Plasma was developed with a well-defined economic goal: offering stablecoin transfers in a scalable manner, offering zero fee complexity for end-users, and sustaining a safe and sustainable Layer-1. Plasma does not aim at eliminating any costs for end-users at the protocol layer. Instead, Plasma achieves this by rethinking the way we think about fee payments and verifications so that we can have zero-fee stablecoins for end-users while offering a healthy and safe Layer-1. Plasma is neither an abstract concept nor just a set of models. Instead, $XPL Secures Transactional Execution. XPL Funds Network Incentives. XPL Secures Network Sustainability.

Plasma relies on XPL as the native asset that under collateralizes network security and enforcement integrity. The plasma separates user-facing fee experience from the protocol-level economics to allow stablecoin transfers, like USD₮, to get executed without requiring the users to hold or manage gas tokens. For this, Plasma structures gas abstraction at the protocol level while internally settling execution costs in XPL. That way, Plasma makes sure that even when users pay zero fees, every transaction is priced, verified, and economically accounted for deep inside the system.

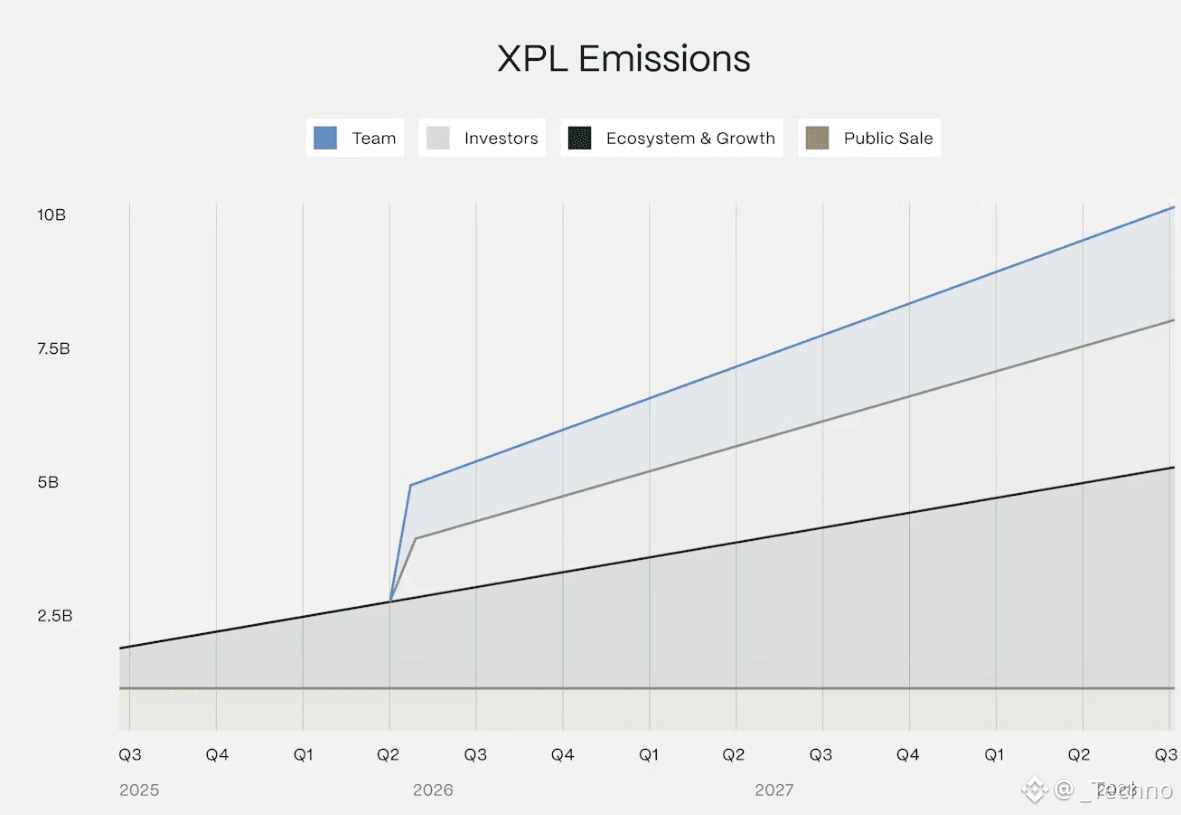

Plasma mints an initial supply of 10 billion XPL when it launches its mainnet beta, and the emissions are designed to activate when external validators and delegation are live. Plasma aims to avoid premature inflation, or inflation due to speculative measures, as it activates emissions in response to network participation as opposed to speculative measures. Plasma starts validator rewards at 5 percent inflation per annum, gradually moving down to 3 percent long-term as inflation, after which it stabilizes. Plasma adds to incentives and rewards as it burns its base fees, offsetting them at the protocol level.

Plasma structures XPL's distribution to manage incentives across its ecosystem. Plasma's allocation structure shares its supply to ecosystem growth, contributors, financiers, and public participants with specific vesting periods to safeguard against supply shocks. Plasma’s allocation structure ensures that locked allocations cannot be secured to participate in staking rewards until they are released, helping active contributors in its ecosystem from supply shocks arising from non-active contributors' tokens. The structure of XPL’s allocation into its ecosystem is designed to be transparent in its nature in order to maintain predictability on its supplies.

Plasma poses XPL as the economic foundation which enables the existence of gasless stable coin transactions, alleging the stable abstraction away from hidden subsidies or incentives by means of abstraction. Within the Plasma domain, user rewards are not minted for individual transactions, nor are they reimbursed in a backward manner, for executing costs are taken care of through the sponsoring time, which enables the abstraction to gas to remain deterministic, observable, and bounded, with sponsoring restricted to specific use cases like stable coin transfer in a singular manner.

Plasma directly ties XPL utility to network activity rather than speculative features. Plasma uses XPL to secure execution, compensate validators, and anchor long-term network reliability. Plasma ensures that demand for execution security and validator participation scales proportionally with the growth in stablecoin usage. Without artificial demand mechanisms, the value of XPL remains only as complexly linked to the underlying assurance of transaction finality, censorship resistance, and correctness of execution.

Plasma designs validator incentives around real execution workload rather than abstract staking yield. Plasma incentivizes validators to sign blocks, order transactions correctly, and maintain uptime in high-throughput conditions. Plasma ensures validator economics stay competitive for a globally sharded set of professional operators while still prioritizing efficiency over excessive reward issuance. Stake delegation will be implemented in Plasma to allow $XPL holders to participate in securing the network without operating infrastructure, further aligning ownership with network health.

Plasma embeds its burn mechanism to offset inflation as utilization increases. Plasma perpetually burns base fees paid for execution, which decreases the pressure on net supply over time. Plasma ensures that the increased volume of transactions strengthens the economic model rather than weakening it. Plasma's burn design reinforces long-term alignment between users, validators, and token holders by linking network growth to supply discipline.

Plasma differentiates its tokenomics through a detailed focus on stablecoin flows as the key base driver of economic activity. Plasma realizes that for such high-frequency, low-value transfers, execution costs need to be predictable with a minimum amount of friction. In this respect, Plasma employs XPL in order to secure this execution layer without creating the need for users to interact with complex gas mechanics. The model allows for applications like payments, remittances, commerce, and micropayments to operate free from fee anxiety while still transparently settling costs at the protocol layer.

Plasma helps make zero-fee mean anything but zero accountability. Plasma enforces rate limits, verification checks, and constraints on usage to avoid spam and abuse. Plasma tightly scopes gas abstraction to keep sponsored execution sustainable and measurable. Plasma considers zero-fee stablecoin transfers a core feature of the network, rather than a temporary incentive, reinforcing trust in long-term availability.

Plasma aligns XPL tokenomics with its broader mission of building programmable money infrastructure. Plasma doesn't rely on short-term yield extraction or promotional mechanics to drive the adoption curve. Instead, Plasma focuses on creating such a system where the reliability of execution, economic clarity, and simplicity for users actually tuck into and reinforce one another. Plasma positions $XPL as a foundational asset whose utility scales with real usage rather than hype cycles.

Plasma ultimately proves that zero-fee Stablecoin infrastructure is achievable without compromising security and economic sanity. Plasma uses XPL, which enables a seamless experience at the user layer, absorbing execution layer complexity. Plasma tokenomics describe how a Level 1 network can facilitate mass-scale flows by using incentives, emissions, and tying everything together with execution integrity.