I keep asking myself the same thing while watching Vanar trade what actually drives demand here? It’s not announcements. It’s not partnerships. It’s not even usage spikes. When I scan wallet behavior, I don’t see churn I see deliberateness. That’s unusual. Most chains optimize for throughput; Vanar feels like it’s optimizing for judgment. And in markets, judgment alters risk far more than speed ever does.

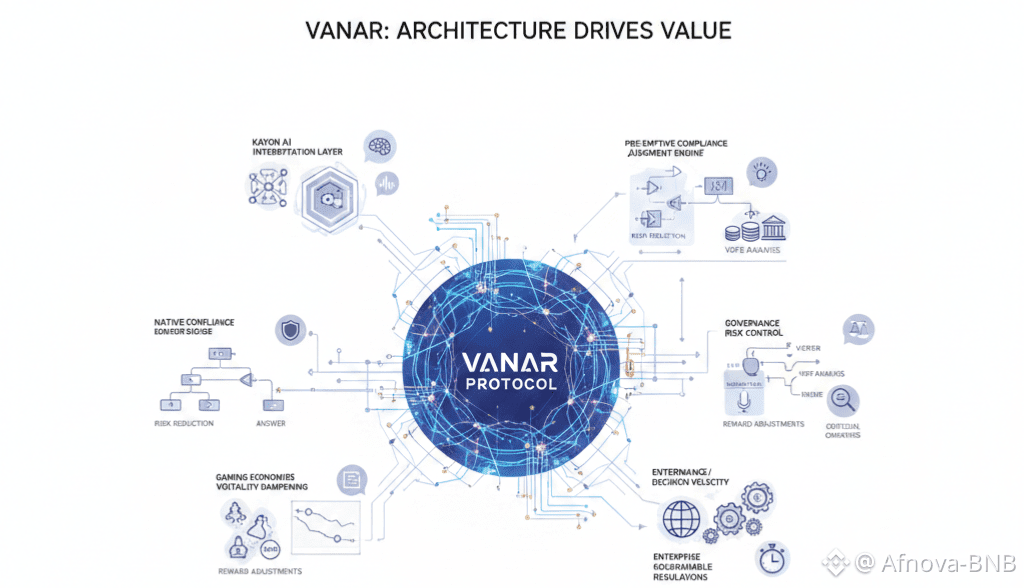

The first real shift in my thinking comes when I stop treating Kayon as an add-on and start treating it as gravity. Embedding AI directly into validator infrastructure doesn’t just reduce latency it removes the gap between state and interpretation. On most chains, data exists first and meaning is derived later, usually off-chain. Vanar collapses that sequence. Meaning is computed where consensus already happens. That’s not analytics; that’s architectural intent.

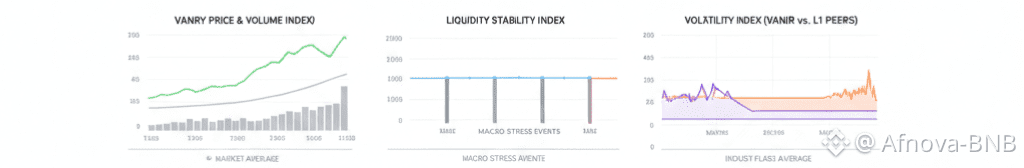

I start thinking about what that does to capital behavior. If certain transactions can be flagged before they propagate not after settlement then compliance becomes pre-emptive rather than punitive. That changes how institutions size exposure. It quietly lowers the risk premium. You don’t see that in flashy metrics; you see it in calmer liquidity, fewer emergency exits, and less violent reactions during macro stress. Traders feel that before they can articulate it.

Natural-language querying was the next thing I underestimated. Everyone advertises AI insights now, so it blends into noise. But this isn’t a dashboard problem. This is intent mapping. Asking the chain questions like “Which wallets consistently bridge size before volatility?” isn’t observation it’s foresight. And when that capability is native to the protocol instead of outsourced to indexers, it becomes composable. Systems can respond to behavior in real time, not just record it.

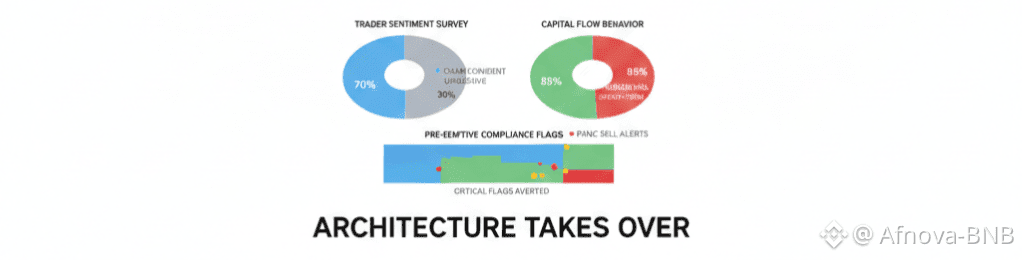

That’s where the model really breaks for me. Vanar isn’t just reducing friction it’s reducing uncertainty. And uncertainty is the cost markets misprice most consistently. If governance participants can surface voting behavior patterns before decisions finalize, governance stops being performative and starts functioning like risk control. That feeds directly into valuation, even if charts lag the logic.

Gaming economies make the implications unavoidable. Player churn isn’t just a UX problem it’s future sell pressure. NFTs don’t represent engagement; they represent latent liquidity events. If Kayon can identify exit-prone wallets statistically, then reward schedules, emissions, and fee structures can adjust before a cascade forms. That’s reflexivity engineered to dampen volatility instead of amplify it. Most chains do the opposite by accident.

I also can’t ignore the enterprise angle, even though traders love to discount it. When compliance rules across dozens of jurisdictions become programmable, capital stops waiting on legal clearance. It moves with confidence. That doesn’t make transactions faster it makes decisions shorter. And capital that moves without hesitation behaves very differently under stress. It doesn’t panic sell.

Eventually I realize I’m no longer evaluating Vanar as a Layer 1 at all. I’m evaluating it as a control system. Validators don’t just attest they interpret. The chain doesn’t just execute it reasons. That’s why VANRY refuses to sit neatly in a single category. It isn’t purely infra, purely AI, purely gaming, or purely compliance. It collapses those buckets, which is why the market keeps mispricing it in both directions.

That oscillation itself becomes a signal. Assets that fit clean narratives get efficiently valued. Assets that blur categories take longer to digest but when they move, they reprice structurally, not emotionally. Watching Vanar in live markets, I see fewer reflexive spikes and more delayed adjustments. That tells me information is being processed unevenly, not ignored.

The most uncomfortable conclusion is also the clearest Vanar isn’t designed for traders like me. It’s designed for systems that persist after traders rotate away. That doesn’t eliminate opportunity it changes its shape. The upside isn’t driven by hype; it emerges as intelligence becomes an assumed layer of infrastructure. Once chains start interpreting context, blind blockspace becomes obsolete.

I don’t know exactly when the market internalizes that. But I know how it starts: quieter charts, stickier liquidity, fewer surprises and a protocol that answers questions before the market realizes it should be asking them.

That’s usually when narratives stop working.

And architecture takes over.