In 2026, blockchain networks are no longer judged solely by token price or hype. The real measure lies in how effectively they connect digital innovation with real-world financial systems. Dusk has positioned itself at this intersection, designing a Layer 1 blockchain that isn’t just about cryptography or smart contracts—it’s about enabling tokenized real-world assets (RWAs) to move, settle, and interact under a compliant and privacy-conscious framework.

The journey from mainnet deployment to operational financial markets is deceptively complex. Many blockchain projects claim readiness for institutional adoption, yet stumble when faced with regulatory frameworks, reporting requirements, or the subtleties of investor trust. Dusk approaches this differently. Its mainnet isn’t a flashy launch event; it’s a meticulously structured foundation for real-world applications. Each layer, from the consensus protocol to the smart contract environment, is calibrated to meet both technical and regulatory rigor.

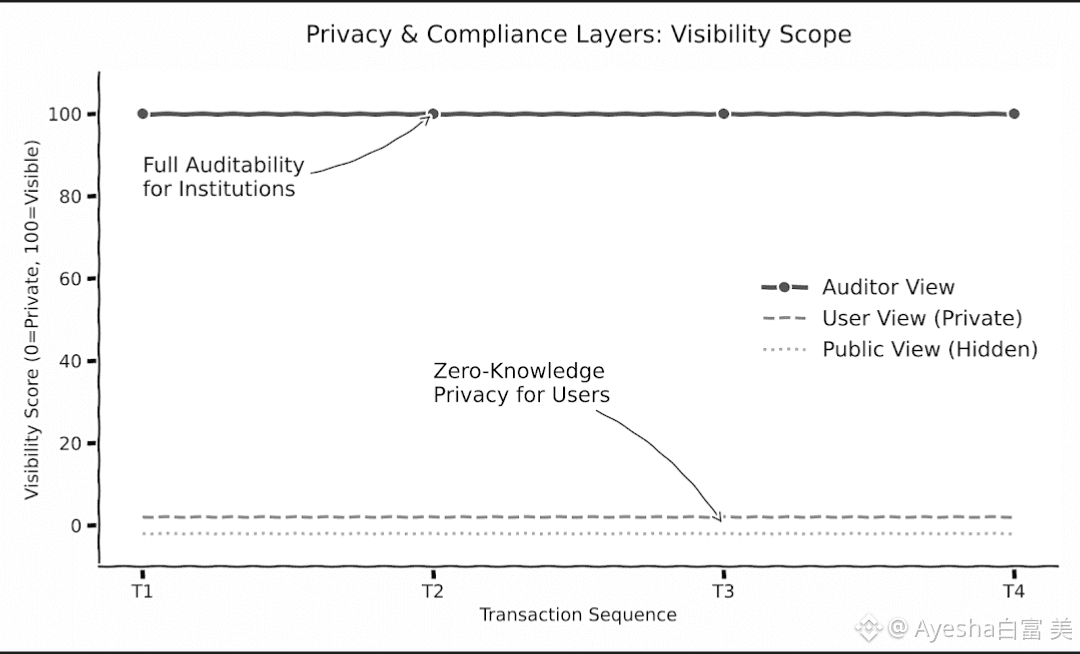

Developers entering Dusk immediately notice the difference. Familiar Solidity tooling is available through DuskEVM, yet every contract execution inherits the network’s privacy-first, auditable architecture. This allows applications to be built on-chain without exposing sensitive financial information to the broader public. Unlike conventional DeFi platforms where transparency can become a liability, Dusk ensures that privacy and auditability coexist naturally. Developers do not need to choose between speed, security, and compliance—they are designed to be synergistic.

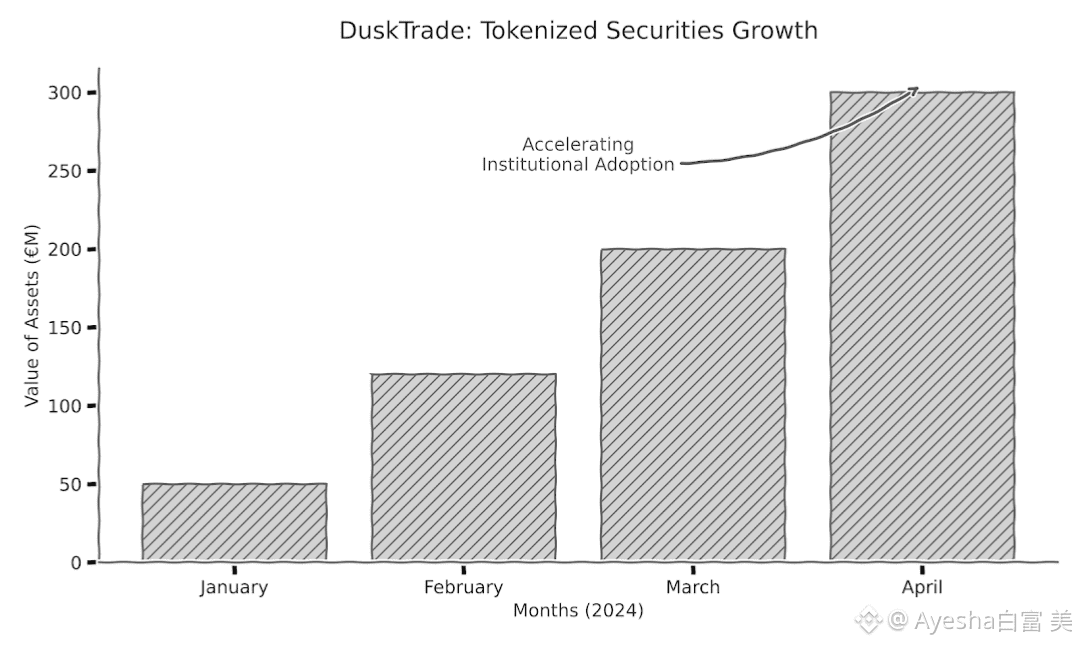

Consider DuskTrade, Dusk’s first real-world asset platform. Partnering with NPEX, a regulated Dutch exchange with MTF, Broker, and ECSP licenses, DuskTrade represents more than a technical achievement; it is a practical bridge between traditional markets and blockchain innovation. With over €300 million in tokenized securities planned for on-chain issuance, the platform demonstrates how RWAs can exist in a digital, programmable form without compromising compliance or investor confidence.

The implications for institutional finance are significant. Traditionally, institutions avoid blockchain due to risks around settlement, transparency, and regulatory compliance. Dusk changes this narrative by providing deterministic finality, modular architecture, and contextual privacy. Every transaction, whether part of a tokenized bond or a derivative, is legally defensible, auditable, and compliant, yet invisible to unauthorized parties. This creates an environment where developers, investors, and institutions can interact confidently, knowing that blockchain innovation does not equate to operational risk.

This careful balancing act is evident in the modularity of Dusk’s architecture. Each component is designed for a specific purpose: settlement, smart contract execution, or privacy-preserving computation. DuskEVM allows developers to deploy standard contracts without needing to re-architect for privacy, while Hedger ensures that transactions retain confidentiality without sacrificing verifiability. The combination empowers a new class of compliant DeFi and RWA applications, bridging traditional finance with programmable finance.

The design also subtly guides behavior. Developers are encouraged to internalize compliance and privacy considerations into their workflow, instead of treating them as external constraints. By embedding these principles into the chain’s architecture, Dusk ensures that innovations are not only technically robust but also operationally and legally coherent. This is essential when scaling RWAs, as each tokenized instrument represents a real-world obligation with real-world consequences.

As Dusk continues to mature, the focus shifts from simply being a blockchain to becoming a reliable infrastructure provider for financial ecosystems. The network is not about speculation; it is about creating repeatable, defensible workflows for digital financial instruments. By prioritizing deterministic behavior, auditability, and privacy, Dusk lays the groundwork for scalable, institution-grade applications that can coexist with legacy financial systems.

Institutional adoption depends on predictability and trust. Dusk’s approach—combining modular technical design, regulatory alignment, and privacy-preserving smart contracts—creates an environment where users don’t have to question the integrity of the network. For investors, auditors, and regulators, Dusk offers the transparency and accountability needed to support large-scale tokenized securities and other digital assets without exposing sensitive operational data.

The vision is clear: a blockchain where real-world assets move fluidly, yet securely, under programmable rules that respect both law and privacy. Dusk demonstrates that institutional-grade innovation doesn’t have to be flashy or noisy; it can be quiet, systemic, and profoundly practical.

By bridging mainnet deployment with tangible market activity, Dusk is proving that blockchain technology can enhance traditional finance rather than disrupt it recklessly. Every module, every transaction, and every developer interaction reinforces the chain’s mission: turning Layer 1 innovation into a platform where RWAs thrive under real-world conditions.