In the fast-evolving world of blockchain and real-world assets (RWAs), most projects chase visibility through bold announcements, speculative tokenomics, or viral marketing. DuskTrade takes the opposite approach. It focuses on building robust, compliant financial infrastructure that integrates seamlessly with existing regulated markets—prioritizing privacy, auditability, legal enforceability, and institutional usability over short-term hype.

DuskTrade is not merely another DeFi platform rebranding assets as “tokenized.” It is purpose-built to bring legally recognized securities—equities, bonds, funds, ETFs, money market funds, and structured products—onto a blockchain without sacrificing the safeguards that traditional finance demands. By partnering with NPEX, a fully licensed Dutch exchange operating as a Multilateral Trading Facility (MTF), Broker, and European Crowdfunding Service Provider (ECSP), DuskTrade creates a genuine bridge. NPEX manages over €300 million in assets under management (AUM), and the collaboration aims to move a significant portion of these onto the Dusk blockchain in 2026, enabling compliant on-chain issuance, trading, settlement, and secondary markets.

This is regulated finance meeting blockchain-native efficiency head-on. Transactions settle quickly and deterministically, compliance checks are automated at the protocol level, and sensitive data remains protected. The result is infrastructure that reduces operational friction for institutions, developers, and regulators alike, allowing focus on strategic value rather than procedural overhead.

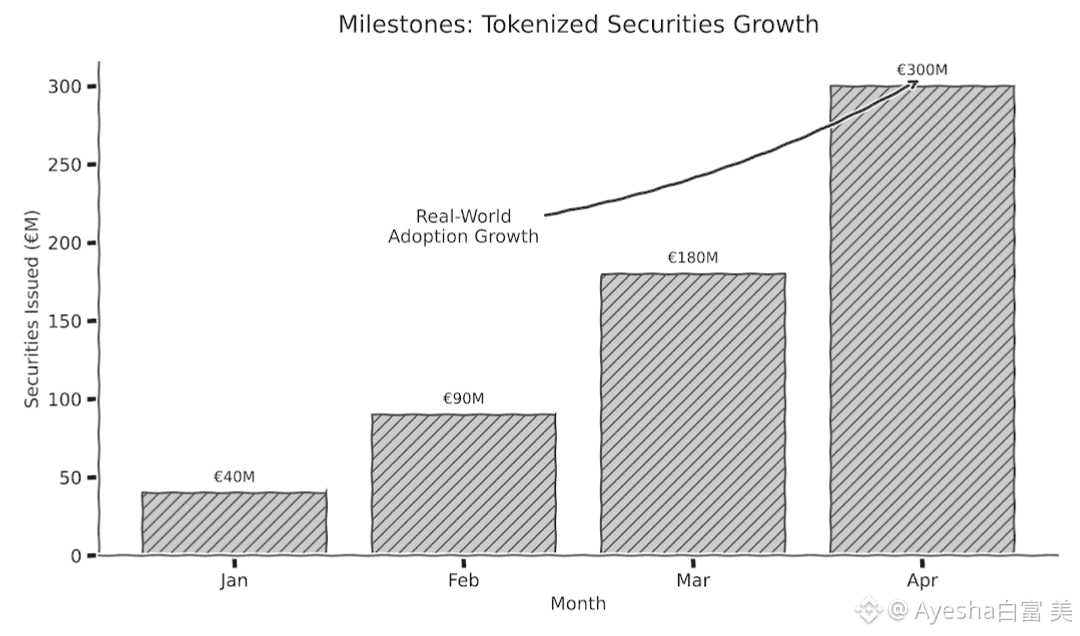

Current Milestones and Momentum (as of January 2026)

The DuskTrade journey is accelerating:

The waitlist is now open at trade.dusk.network, inviting early participants to join for priority access, platform updates, and potential incentives (including chances to engage with tokenized RWAs early).

The platform targets tokenizing and listing over €300 million in securities from NPEX's ecosystem during 2026, starting with equities, bonds, and funds.

Dusk Network's roadmap includes a Q1 2026 mainnet upgrade to support the NPEX dApp deployment, enhancing scalability and privacy features.

Integration with Chainlink—using CCIP for canonical cross-chain interoperability, Data Streams for reliable market data, and DataLink for secure off-chain connectivity—ensures tokenized assets can move compliantly across ecosystems while maintaining institutional-grade standards.

These steps mark real progress toward Europe’s first fully blockchain-powered, regulated securities exchange environment.

Why Privacy and Compliance Are Non-Negotiable

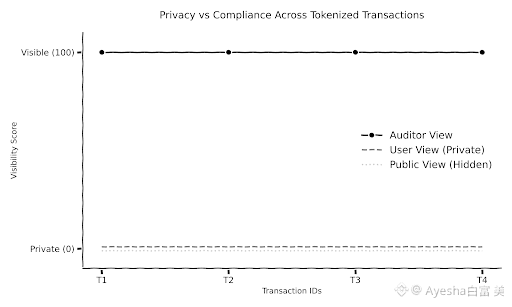

Traditional blockchains expose transaction details publicly, creating insurmountable barriers for institutions handling sensitive positions, client data, or proprietary strategies. DuskTrade solves this at the foundational layer.

Hedger enables privacy-preserving execution through zero-knowledge techniques. Trades and settlements remain confidential to unauthorized parties, yet regulators, auditors, and authorized custodians retain verifiable access to proofs and metadata.

The Phoenix transaction model provides fast, deterministic finality with embedded compliance logic—no need for off-chain workarounds.

Confidential Security Contracts (XSC standard) allow issuance of privacy-enabled tokenized securities that comply with strict financial regulations while remaining programmable.

DuskEVM offers full Solidity compatibility, so developers can deploy and interact with smart contracts using familiar tools, without forgoing Layer 1 security or privacy defaults.

This architecture means institutions no longer choose between speed, confidentiality, regulatory alignment, or interoperability—they get all four as standard.

A Real-World Use Case: Tokenized Corporate Bonds in Action

Imagine an institutional investor—say, a pension fund—holding tokenized corporate bonds originally issued and listed via NPEX. In the legacy system, transferring or settling these might involve multiple intermediaries, manual reconciliations, delayed settlement (T+2 or longer), and high costs.

On DuskTrade:

The investor initiates a compliant on-chain transfer or structured product issuance via a privacy-enabled smart contract.

Hedger ensures position sizes, counterparty identities, and pricing details stay confidential.

The transaction settles in minutes with deterministic finality, automated KYC/AML checks, and full on-chain audit trails.

Regulators access necessary verification data without exposing the full transaction graph.

Chainlink oracles provide real-time market data for accurate pricing and risk management.

Legal enforceability remains intact—the tokenized bond retains its status as a regulated security under Dutch/EU law.

The outcome: faster liquidity, reduced counterparty risk, lower operational costs, and preserved privacy—all while meeting GDPR, MiFID II, and other regulatory requirements.

Developer Perspective: Responsible Innovation in a Compliant Sandbox

For developers, DuskTrade offers a refreshing design philosophy. Every module aligns technical flexibility with regulatory expectations. Solidity devs can build compliant applications—tokenized debt instruments, yield-bearing products, structured notes—without reinventing privacy or compliance layers.

The platform encourages “responsible innovation”: balancing programmable possibilities with operational realities. No more retrofitting public chains for institutional use or sacrificing auditability for speed. Instead, builders inherit tools where privacy, modularity, and legal defensibility are defaults. This lowers barriers for fintech teams, asset managers, and exchanges seeking to experiment with on-chain securities in a safe, scalable environment.

Contrasting with the Broader RWA Landscape

Many RWA projects focus on synthetic representations, retail speculation, or permissionless issuance of tokenized treasuries/yield products. While innovative, they often sidestep the hardest problems:

Full regulatory defensibility for primary issuances.

Secondary market liquidity under licensed frameworks.

Privacy for institutional flows.

DuskTrade addresses these head-on. It digitizes existing, legally recognized securities from regulated issuers like NPEX, creating genuine liquidity in private markets, enabling fractional ownership for qualified investors, and opening secondary trading without compromising compliance. Partnerships with custodians like Cordial Systems further streamline institutional onboarding.

The Bigger Picture: A Template for Global Adoption

Blockchain’s promise in regulated finance has always hinged on trust: can distributed ledgers deliver transparency where needed, privacy where required, and enforceability that courts recognize?

DuskTrade quietly demonstrates that the answer is yes—when architecture is designed with purpose rather than spectacle. By embedding privacy (Hedger/XSC), interoperability (Chainlink), developer accessibility (DuskEVM), and compliance (NPEX licensing + Phoenix), it provides a scalable template.

As global regulators clarify tokenized asset frameworks (e.g., EU’s MiCA, potential U.S. developments), platforms like DuskTrade will serve as models for bridging old and new financial systems. Growth is measured in adoption metrics, operational efficiency, and institutional confidence—not token price volatility or social media buzz.

DuskTrade proves that transformative change can happen quietly—methodically, reliably, and with long-term utility in mind.