Nobody wants to talk about this 🤐

Because once you see it, you can’t unsee it 👀

The U.S. is facing a debt problem so massive that it will mechanically drain liquidity from the global financial system.

Not maybe.

Not someday.

⚙️ By design.

If you hold Bitcoin, stocks, crypto, gold, or any risk asset — this matters more than any trending narrative on CT 🧠📊

🔢 THE NUMBER THAT CHANGES EVERYTHING

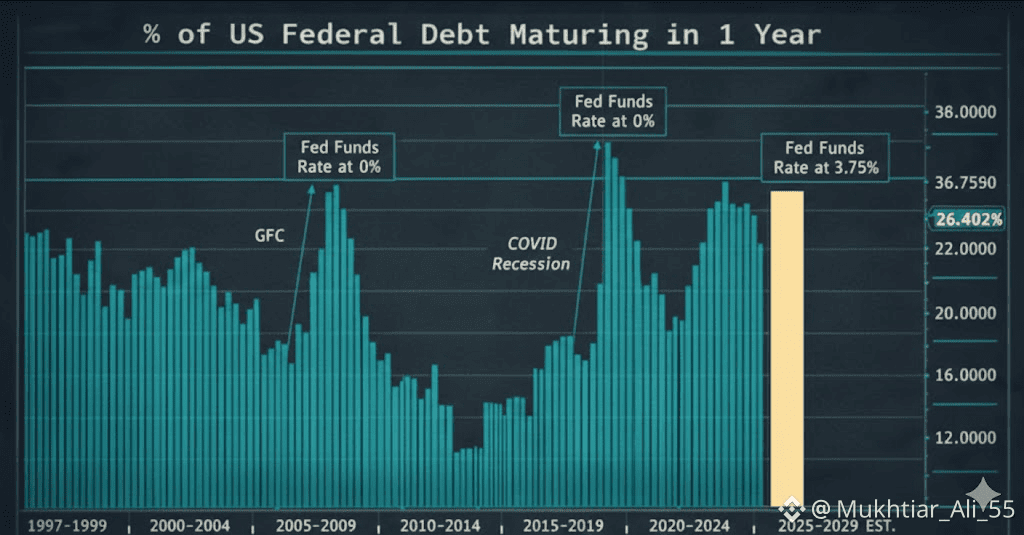

⚠️ Over 25% of total U.S. debt matures in the next 12 months

This is not normal 🚨

💥 It’s the largest refinancing wall in modern U.S. history

💰 Over $10 TRILLION must be rolled over

❌ No delay

❌ No workaround

➡️ It has to be refinanced

⏪ WHY THIS WASN’T A PROBLEM IN 2020

Back then, refinancing was painless 😌

✔️ Rates near 0%

✔️ Money was basically free

✔️ Liquidity everywhere 🌊

✔️ The Fed backstopped everything

📊 At the peak, ~29% of U.S. debt was short-term — but costs were negligible.

⏩ WHY IT’S A PROBLEM NOW

Fast forward to today ⏳

🔺 Policy rate: ~3.75%

🔺 Borrowing costs much higher

🔺 Bond buyers demand real yield

🔺 Liquidity already tight

⚠️ The same debt structure has turned toxic ☠️

🏦 WHAT ACTUALLY HAPPENS NEXT

The Treasury has no choice.

To refinance, it must:

📌 Issue massive amounts of new bonds

That means:

• 🌊 Flooding markets with Treasuries

• ⚔️ Competing with every asset for capital

• 🧲 Pulling liquidity out of the system

This isn’t a theory 📚

This is how bond markets work.

Every dollar buying Treasuries =

❌ Not going into:

📉 Stocks

📉 Crypto

📉 Risk assets

📉 Metals

📉 Private credit

📉 Emerging markets

❌ “RATE CUTS WILL FIX IT” — NOPE

Markets expect 2–3 rate cuts ✂️

That doesn’t solve this problem.

Even with cuts:

• Refinancing costs stay far above 2020 levels

• The debt volume is enormous

• Bond supply is unavoidable

🩹 Rate cuts may slow the bleed —

🚫 They don’t stop the drain.

🌊 THIS IS A LIQUIDITY EVENT (NOT A RECESSION CALL)

This is where most people get it wrong 👇

The danger isn’t an instant collapse 💥

It’s a slow, sustained liquidity vacuum 🕳️

When liquidity drains:

• 📉 Valuations compress

• ⚡ Volatility spikes

• 🔗 Correlations go to 1

• 🧨 Speculative assets break first

Sound familiar? 👀

That’s how bull markets quietly die 🐂➡️⚰️

🪙 WHY CRYPTO & RISK ASSETS ARE MOST EXPOSED

Crypto runs on excess liquidity 💸

When money is cheap:

🚀 Bitcoin

🚀 Altcoins

🚀 Memes

🚀 Leverage

🚀 Speculation

When liquidity is pulled:

📉 Leverage unwinds

📉 Weak hands get flushed

📉 Volatility explodes

📉 Only the strongest survive

This isn’t bearish propaganda 😐

It’s macro mechanics ⚙️

⏳ THE 12–24 MONTH WINDOW THAT MATTERS

This refinancing wall doesn’t vanish overnight.

Over the next 1–2 years, the U.S. must:

• 🔁 Continuously roll debt

• 🧾 Continuously issue bonds

• 🧲 Continuously absorb liquidity

Result?

📉 Persistent pressure on global markets

Not a one-day crash.

🪨 A grinding adjustment.

🤫 THE PART NOBODY TALKS ABOUT

The U.S. can’t escape this without pain.

Options are limited:

• 📊 Issue more debt → drain liquidity

• 💵 Monetize debt → weaken the dollar

• 🧱 Financial repression → distort markets

None of these are bullish short-term 🚫📈

Every path hurts somewhere.

🎯 WHAT THIS MEANS FOR INVESTORS

This isn’t a panic call 🚨

It’s a reality check 🧠

Markets are entering a phase where:

• 🌊 Liquidity > narratives

• 🌍 Macro > micro

• 🛡️ Risk management > hopium

The next big winners won’t be the loudest 📣

They’ll be the ones who understand when liquidity leaves — and when it comes back 👑📊