Markets have a short memory, but infrastructure doesn’t. If you’ve traded crypto long enough, you’ve watched “hot” narratives burn bright and then disappear the moment liquidity moves on. That’s why the projects that survive usually look boring at first. They pick one problem, they grind for a year or two, and they only start getting credit when the rest of the market realizes the plumbing matters. Plasma is getting pulled into that conversation right now, and it’s mostly because it’s playing the long game: stablecoin rails, not the next meme cycle.

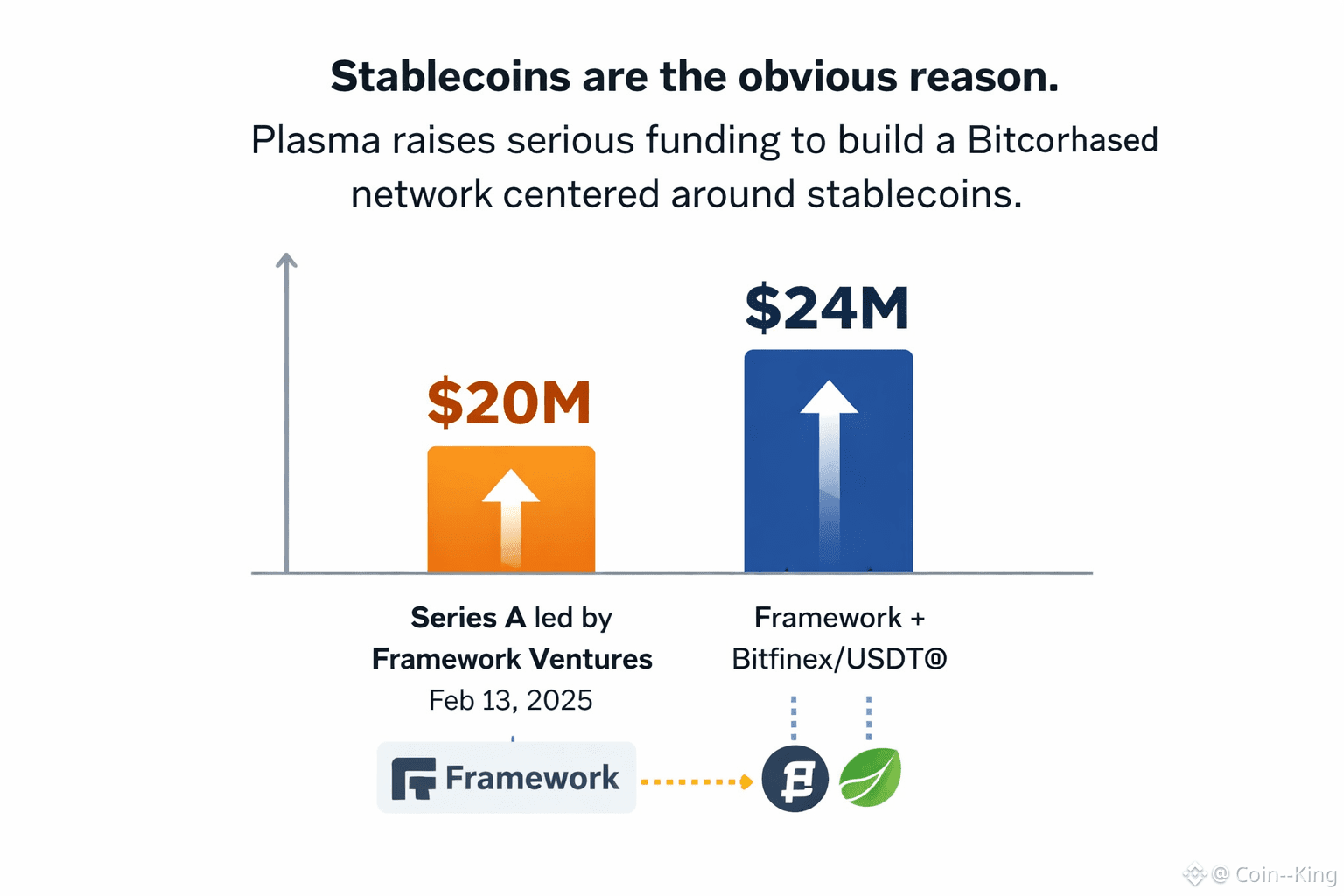

Stablecoins are the obvious reason. By February 13, 2025, Plasma was already raising serious money to build a Bitcoin-based network designed around stablecoins, with reporting at the time showing a $20 million Series A led by Framework Ventures. Plasma’s own later write-up describes a $24 million raise led by Framework and Bitfinex/USD₮0, which tells you two things: there’s been enough momentum to round up more support, and the backers care about distribution and settlement, not just token charts.

If you’re newer, it helps to unpack the jargon. A “Layer 1” is a base blockchain that processes transactions directly. A “sidechain” is a separate chain that connects to a major chain (in this case, Bitcoin) to borrow some of its security or settlement story while running faster, more flexible execution. Plasma’s pitch has been essentially: keep the “Bitcoin as settlement” vibe, but add Ethereum-like programmability (smart contracts) so stablecoins can move and be used inside apps without the usual friction.

The progress markers matter more than slogans. Plasma’s public testnet went live on July 15, 2025, positioned as the first public release of the core protocol and a step toward mainnet beta. Then, in September 2025, multiple outlets reported Plasma planned to launch its mainnet beta on September 25 alongside its native token, XPL, and that the team was talking about starting liquidity in the “over $2 billion in stablecoin TVL” range at launch. Whether you take that number as a target, an arranged liquidity plan, or marketing, it signals they’re thinking in institutional-size pipes, not weekend volume spikes.

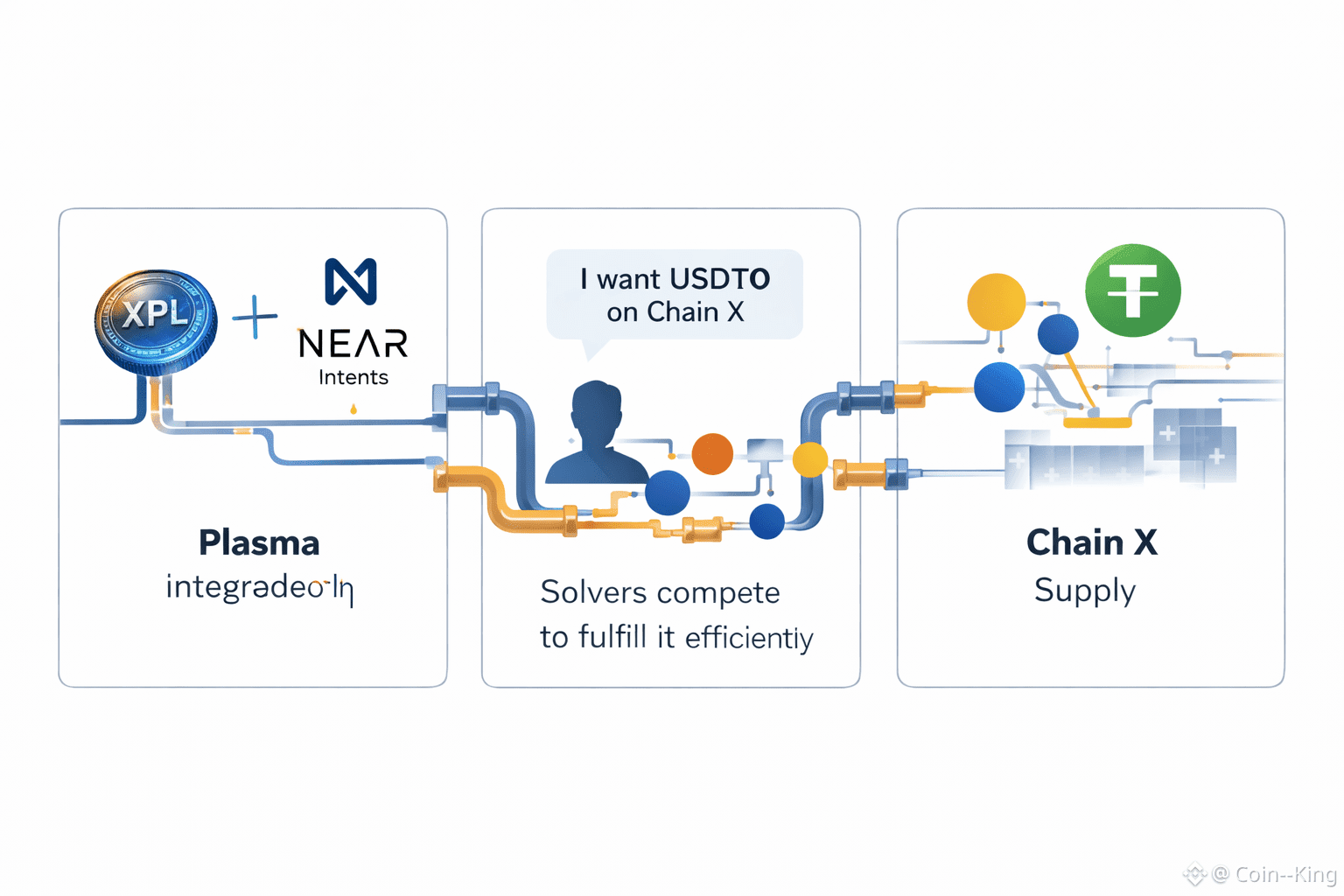

What’s made it trend again into late January 2026 is that the “pipes” are starting to connect to other pipes. On January 23, 2026, Plasma integrated with NEAR Intents for large-volume cross-chain stablecoin settlements and swaps. “Intents” can sound abstract, but the simple version is this: instead of you manually bridging, swapping, and routing, you express what you want (for example, “I want USDT0 on chain X”), and a network of solvers competes to fulfill it efficiently. When traders see that kind of integration, they read it as a push toward smoother flows and deeper liquidity paths across ecosystems.

There’s also a practical distribution angle. Bitfinex announced support for deposits and withdrawals of USDT0 on Plasma around late September 2025, describing USDT0 as an omnichain ready bridged version of Tether’s USDt. That’s not a small detail. Stablecoin networks live or die on on/off ramps, liquidity, and how easily traders can actually use the asset they’re supposed to be moving. When an exchange integration shows up early, it’s usually because the project is optimizing for usage, not just “community.”

The macro backdrop is what makes all of this feel timely. Stablecoins have been framed as the “killer app” of crypto, with the stablecoin economy already exceeding $160 billion in commitments as of early 2025, and mainstream payment networks watching the space closely. When big rails start reacting, that’s a clue the trade is shifting from “who has the loudest narrative” to “who can handle real volume without surprises.” As a trader, I don’t treat that as a reason to blindly ape anything. I treat it as a filter. Projects that keep shipping through dead markets tend to be the ones still standing when the next risk-on window opens. Plasma’s story, so far, is less about fireworks and more about survival and in crypto, that’s often the real edge.