I keep realizing I’m applying the wrong instincts to Walrus. The same ones I used early in other infrastructure trades waiting for the market to acknowledge relevance. A clean breakout. A surge in volume. Some narrative hook that confirms I’m not early anymore. But storage doesn’t wait for validation, and demand for it doesn’t express itself through hype cycles. When I look back at 2025 mainnet in March, Red Stuff midyear, more than 50 petabytes live before December it’s obvious the inflection already happened. The market just misclassified it. It assumed storage growth behaves like user growth. That assumption is flawed.

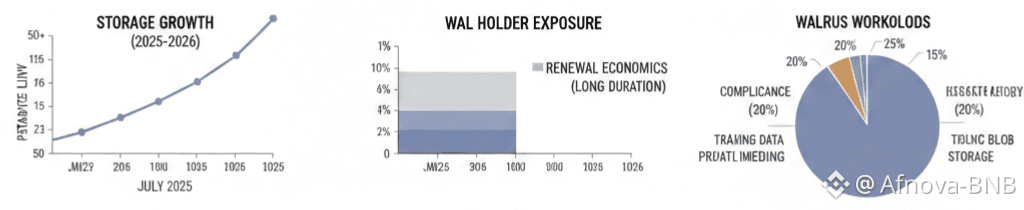

The first thing that keeps bothering me is how little WAL reacted during broader rotations that punished almost everything else. No panic selling, no cascade tied to governance noise, no sudden liquidity vacuum. Wallet concentration barely shifted. Normally that would worry me. But here, it starts to make sense once I remember what large WAL holders are actually exposed to. They’re not betting on activity metrics. They’re underwriting renewal economics. They’re long duration. If you’re responsible for data that can’t be recreated, governance stops being performative and becomes part of your risk model. That changes how capital behaves under stress.

Red Stuff is where my initial read broke down. I treated it like a routine optimization cheaper encoding, improved redundancy, better efficiency curves. Useful, but incremental. Then I watched what happened after July. Storage growth didn’t just continue it accelerated. That’s when it clicked Red Stuff didn’t merely reduce cost it reduced uncertainty. Once operators could forecast long-term storage overhead with confidence, provisioning shifted from cautious to assertive. That’s not a UX upgrade. That’s a balance-sheet unlock. And markets are terrible at pricing balance-sheet unlocks while they’re happening.

The real mental shift comes when I study the 2026 roadmap more closely. “Privacy by default” isn’t branding it’s a reclassification of what Walrus actually is. Public blob storage is niche. Private, permissioned, time-scoped access changes everything. Seal Access Control quietly resolves the enterprise objection that rarely gets airtime: selective visibility. The moment data can be shared with specific wallets for defined durations, storage stops being archival and starts becoming operational. And operational systems behave very differently once they’re under load.

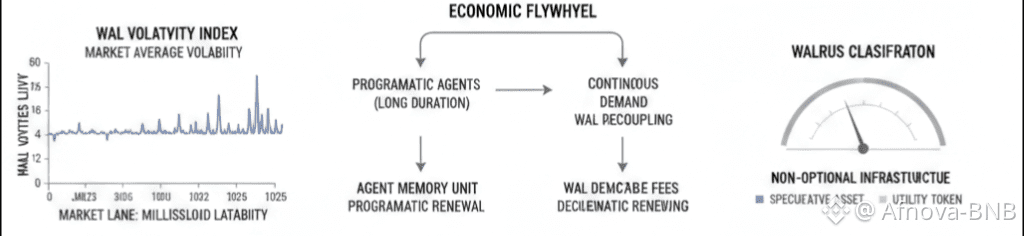

That’s why the Fast Lane details matter more than most people realize. Millisecond latency isn’t about flexing benchmarks it’s about relevance to streaming use cases. Gaming, interactive media, real-time services. Once data retrieval is fast enough for those environments, storage demand stops arriving in bursts and starts flowing continuously. Continuous demand reshapes fee predictability. Predictable fees reshape liquidity behavior. At that point, WAL isn’t reacting to macro cycles it’s tracking usage curves.

I keep resisting the AWS S3 comparison because it feels irresponsible to make it. But the more I test it, the more uncomfortable the parallel becomes. Walrus doesn’t need to replace centralized storage. It only needs to capture workloads that can’t tolerate mutable history or single-point failure. That’s a small segment until it suddenly isn’t. Training data, agent memory, compliance archives don’t care about branding or UX polish. They care about permanence and verifiability. Walrus solves problems centralized providers actively avoid solving.

The economic flywheel finally snaps into focus when I stop thinking about users and start thinking about agents. Humans respond emotionally to costs. Machines don’t. An agent that needs storage, renews automatically, and pays fees programmatically creates demand that’s detached from sentiment. When that happens, WAL demand decouples from narratives altogether. Volatility compresses not because interest disappears, but because discretionary selling does. Markets misread that every time. Then they overcorrect.

What unsettles me is how little of this appears in the usual dashboards. Petabytes don’t trend. Renewal rates don’t spike charts. Governance participation doesn’t excite retail. But liquidity always follows necessity eventually. When storage becomes non-optional infrastructure, WAL stops acting like a speculative asset and starts behaving like a toll token. Tolls don’t explode weekly they siphon value quietly from everything that needs to pass through them.

By the time I arrive at the question everyone else keeps asking Is Walrus undervalued? it already feels outdated. The more relevant question is whether the market understands that data doesn’t rotate. It accumulates. It settles. And once it settles somewhere reliably, value stops flowing around it and starts pooling inside it.

That’s usually when I stop staring at the chart.

And start watching the chain instead.