I keep flipping between the order book and on-chain data, and the same conclusion keeps surfacing @Dusk Network isn’t obviously undervalued it’s incorrectly framed. The flows don’t resemble speculative Layer-1 behavior. They linger. They renew. They feel more like positions being maintained than bets being placed. That alone tells me retail narratives aren’t driving this. Markets tend to murmur before they move, and what I hear here sounds institutional.

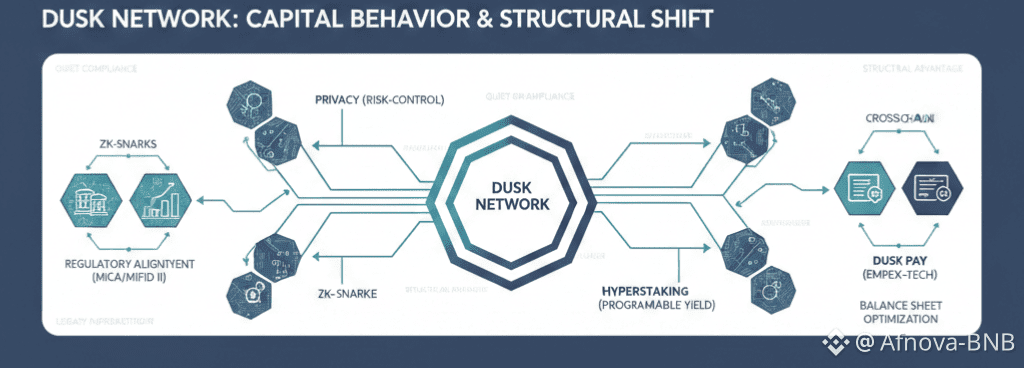

The shift happens when I stop treating privacy as a product feature and start viewing it as a risk-control mechanism. Monero solved anonymity elegantly, but in doing so, it shut itself out of regulated liquidity. Absolute opacity collapses once compliance enters the room. Dusk isn’t trying to win the secrecy arms race it’s designing a version of privacy that can survive oversight. That design space is narrow, difficult, and disproportionately valuable.

I instinctively compare it to Secret Network, and that’s where discomfort sets in. Trusted hardware has always felt like a hidden fault line to me invisible until it fails. Markets hate deferred fragility. Dusk’s ZK-first approach feels slower, heavier, almost conservative by comparison. But that conservatism is precisely what makes it socially scalable. Institutions don’t optimize for elegance; they optimize for audit durability. Suddenly, the muted price action makes sense.

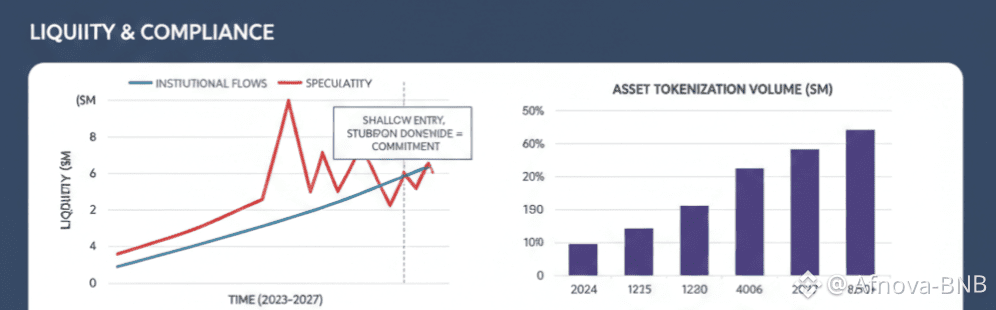

Liquidity patterns reinforce the point. Chains that promise “compliance later” attract capital that exits just as quickly. Dusk’s liquidity curve behaves differently shallow on entry, stubborn on the downside. That isn’t enthusiasm it’s commitment. It resembles desks building exposure they can justify internally. When compliance teams move from obstacle to enabler, capital changes its posture.

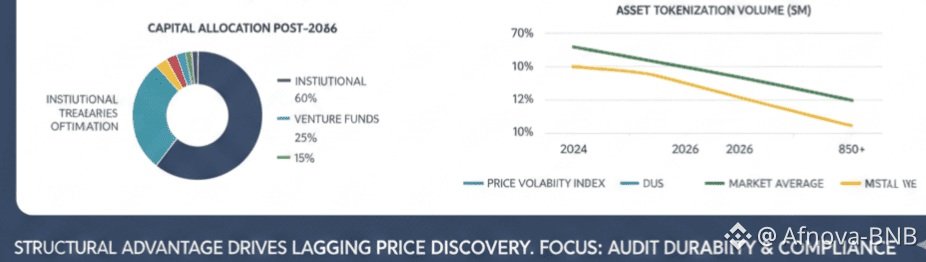

Polymesh comes to mind here. Identity alone never solved the problem. Identity without confidentiality still leaks intent. Strategy leakage is a nonstarter for real desks. Dusk seems to grasp that institutions don’t just need to be compliant they need to comply without revealing how. That nuance doesn’t headline whitepapers, but it shows up clearly in capital behavior.

The 2025 mainnet launch was meant to be the turning point. It wasn’t. The real shift appears after the 2026 NPEX partnership. That’s when activity stops looking exploratory and starts looking operational. SMEs don’t tokenize assets for fun they do it to restructure financing and manage survival. Watching those flows, I stop caring about TVL and start thinking in balance-sheet terms.

DuskTrade’s scaling forces my trader instincts to slow down. Hundreds of millions in tokenized equities and bonds isn’t hype math it’s regulated capital doing regulated things. That kind of money doesn’t chase yield; it settles. If the infrastructure holds, liquidity doesn’t explode it compresses. And compression is often what precedes violent repricing.

Hyperstaking introduces another layer of unease the productive kind. When staking logic becomes programmable through smart contracts, yield stops being speculative and starts looking like fixed-income infrastructure. That’s not DeFi exuberance that’s traditional finance logic bleeding on-chain. Markets consistently misprice slow structural invasions.

Cross-chain design usually sets off alarms, but Dusk’s quantum-resistant framing changes the risk profile. This isn’t about fast bridges it’s about settlement that survives regulatory review and cryptographic longevity. If RWAs are going to move, they’ll move where finality ages well. That’s a long-duration option most models ignore.

Payments are typically where crypto narratives collapse, yet Dusk Pay feels different because regulatory alignment is embedded, not bolted on. MiCA-awareness isn’t a marketing angle here it’s an architectural constraint. When I look at the Dusk Foundation, I don’t see evangelism. I see engineers obsessed with not becoming obsolete or outlawed. That mindset shows up in protocol decisions, not social media.

Zooming out, the realization becomes unavoidable Dusk isn’t trying to outcompete other blockchains. It’s competing with legacy financial infrastructure operating under MiCA and MiFID II. That’s why decentralization here looks restrained rather than maximalist permissionless, but defensible.

I stop refreshing the chart. Price can lag. Structure can’t. Dusk has quietly shifted privacy from ideology to infrastructure. Markets are always late to that kind of transition. When they finally respond, it won’t be because of excitement it’ll be because liquidity refuses to move.