I have been looking over the token design of a few privacy driven Layer 1s in the recent past and Dusk Network has a token, called $DUSK , that I have found to be going at a slower pace and with longer horizons. As opposed to most projects, which front load emissions or are highly speculative, Dusk directly corresponds the token economics to sustainable network security and actual use. Let's break it down clearly.

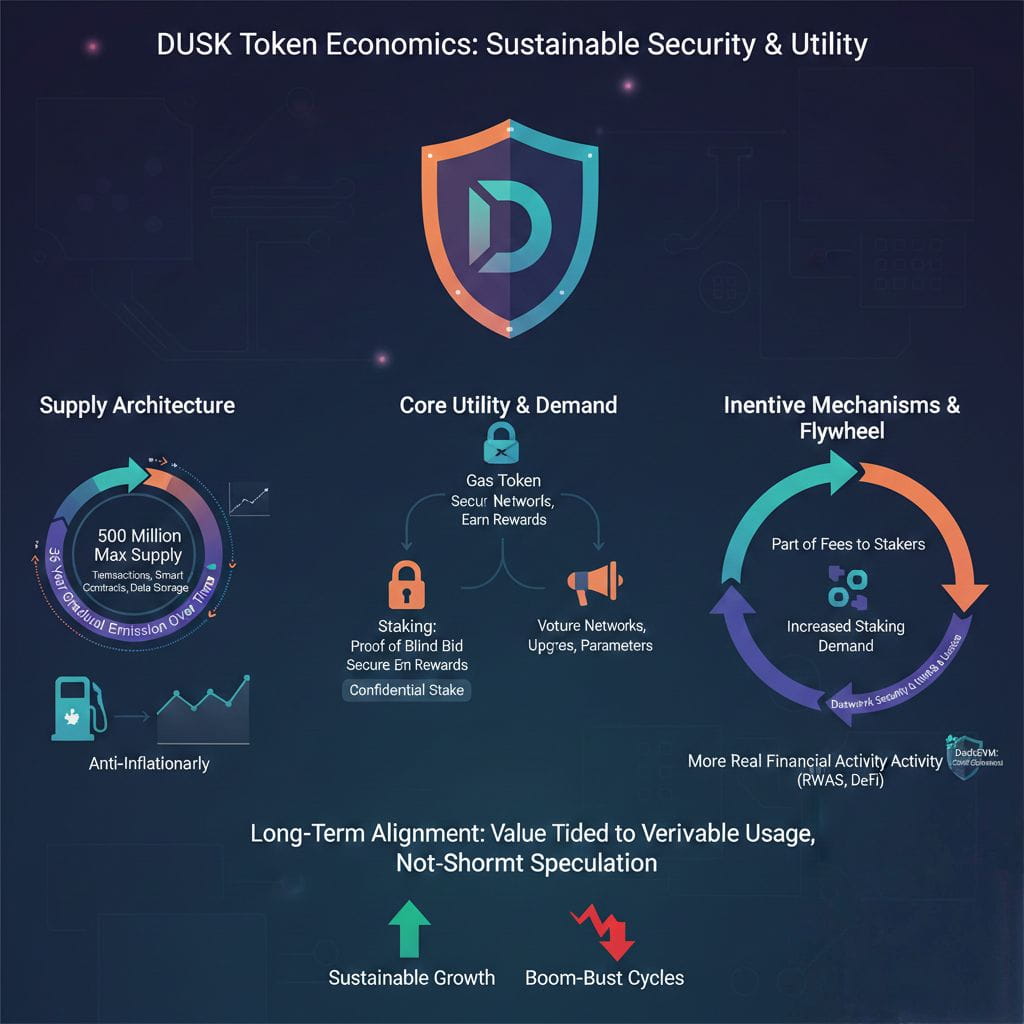

The supply amount of DUSK is set at 500 million tokens. This is the maximum mint that can be done. This supply constraint gives a constant maximum available supply, which matters to long term holders who attach value to scarcity.

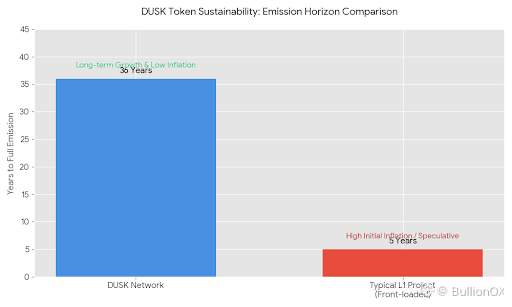

The emission plan is distributed in 36 years with the rewards being less and less rewarded. This gradual issue renders the inflation shocks sharp and the ecosystem ample time to grow before most of the supply is released into circulation. The initial emissions are mostly used to support staking and network security, whereas subsequent stages are largely dependent on transaction fees.

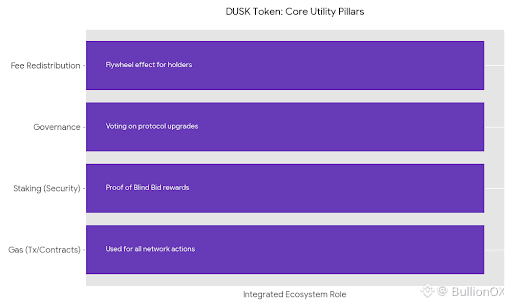

All the activities on the network use DUSK as the native gas token. All actions of transactions, smart contracts calls, and storing data are paid in DUSK. This generates minimum demand depending on real network activity. With more usage of both confidential smart contracts and tokenized RWAs, the number of gas used rises, making the token more useful than staking.

Another fundamental role is staking. DUSK is secured in the Proof of Blind Bid consensus in order to engage in block generation and validation. The two sources of rewards are the emissions that continuously take place and a share of the transaction fees collected by stakers. The zero-knowledge proofs of the blind bid system ensure that the amount of stake is confidential, providing an extra privacy protection layer to the incentive system itself.

One of the major mechanisms of long term alignment is fee redistribution. Part of each gas fee is pushed to stakers producing a flywheel effect. The more real financial activity (e.g. tokenized asset issuance or compliant DeFi) takes place, the higher the fees are, so staking becomes more appealing and more inviting to holders of the tokens to lock them instead of selling.

Another utility vector is governance participation. DUSK holders are able to suggest and vote on protocol upgrades, parameter changes and ecosystem initiatives. This role becomes increasingly important as the network is mature enough, and thus community has a direct influence on future development without necessarily having to be controlled centrally.

Since January 2026, DuskEVM, which is live on mainnet, extends utility to EVM compatible confidential contracts. Application developers that build regulated applications will raise the number of transactions, which will subsequently increase gas usage and fees being paid back to stakers.

The general architecture does not make use of short term incentives heavily. It associates token value instead with verifiable network Usage and security. This system promotes a sustainable ecosystem development in place of boom bust cycles.

What is your opinion of such a model of redistribution of fees and a long emission scheme?

Is it more sustainable to DUSK than faster unlocks in projects?