If you've ever seen a trading tool, a game, or some analytics dashboard just quietly stop working—maybe because a dataset vanished or got too pricey to keep online—you know the awkward reality of crypto infrastructure. People don’t quit in some big dramatic exit. They drift away when things feel unreliable, when costs swing around, or when the system acts differently every time they use it. That slow, steady loss of users? That’s the real retention problem. And honestly, tokens only matter if they actually help fix it.

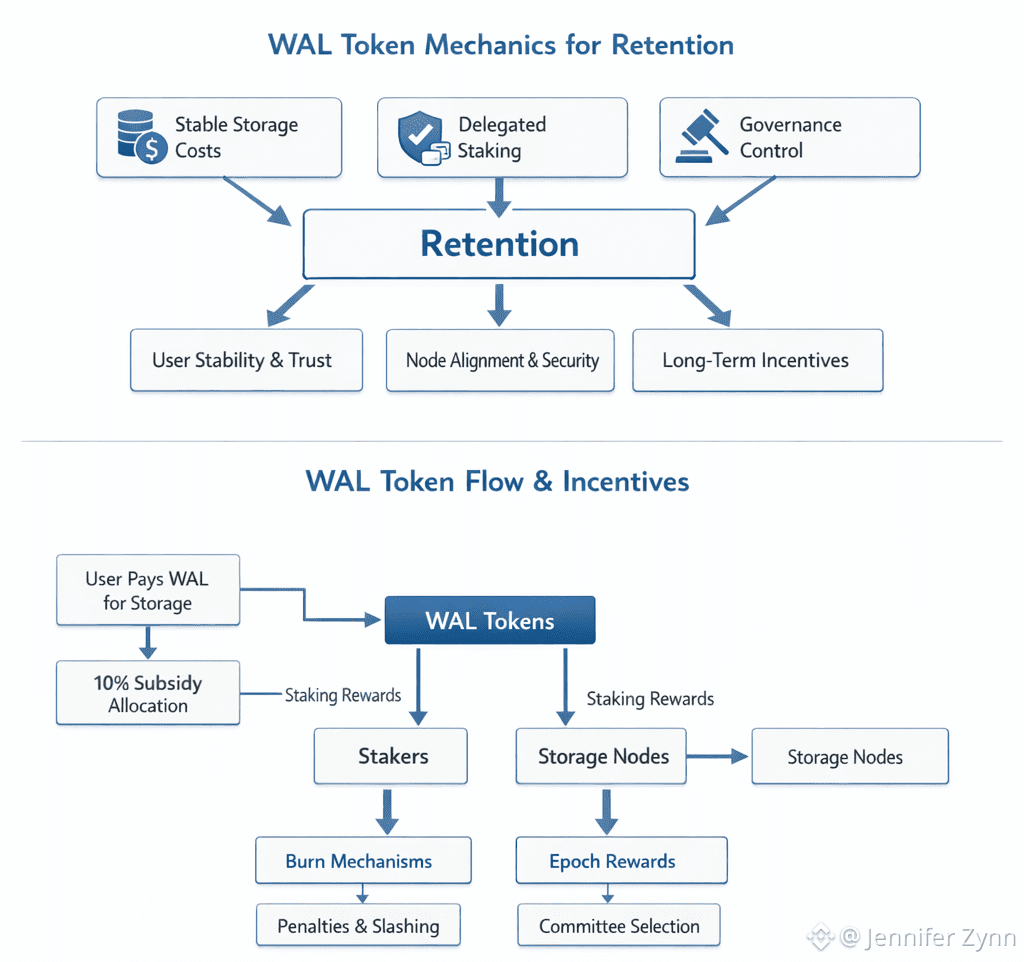

Walrus treats WAL as a utility token before anything else—not just some narrative. The mechanics focus on three things: making storage payments feel stable for users, staking to keep node operators aligned with data safety, and governance so the network can adjust incentives without breaking everything. For traders and investors, forget the catchphrases. What really matters is how these mechanics aim to keep users, node operators, and long-term stakers from slipping away.

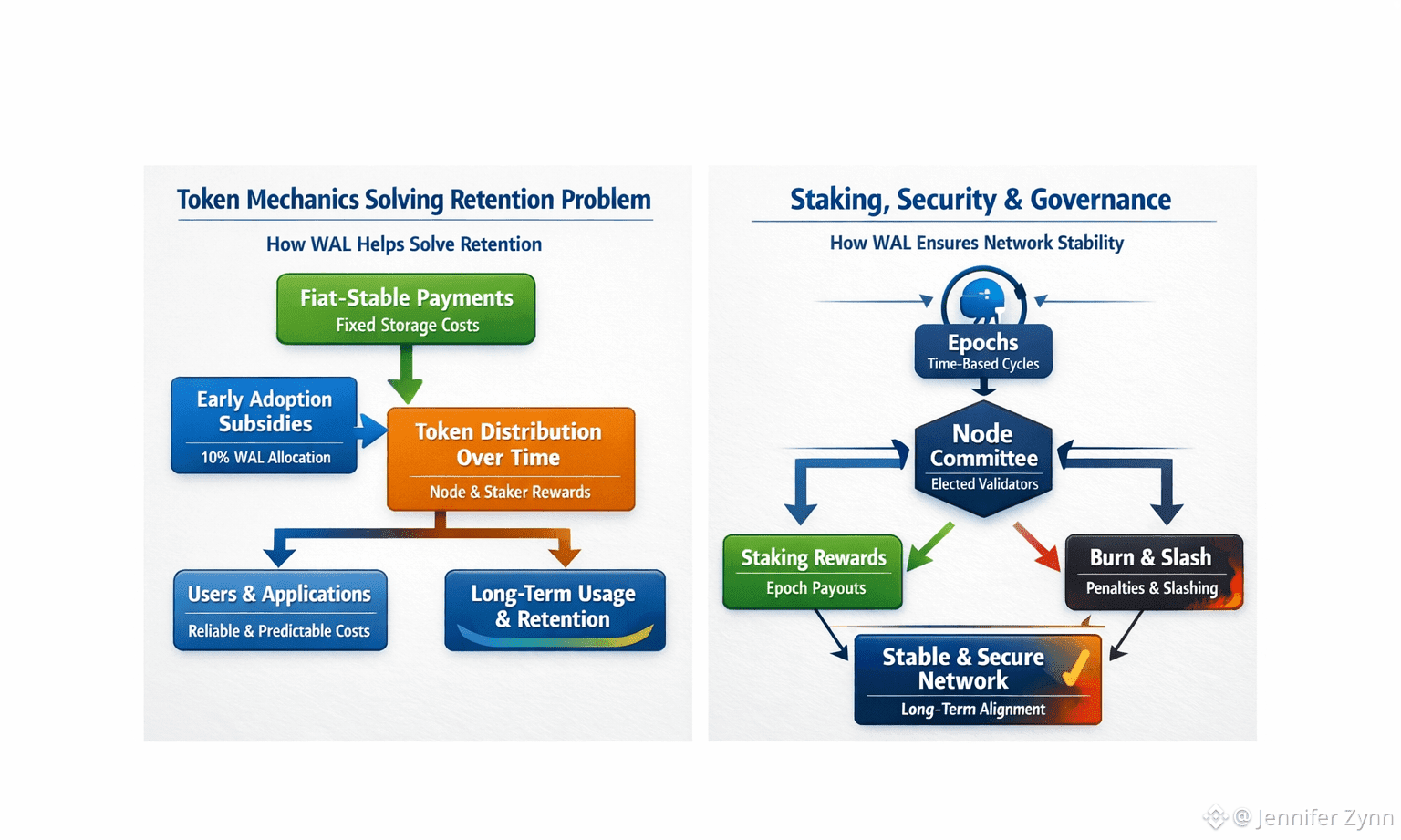

Let’s talk payments, because that’s usually where retention falls apart. Walrus calls WAL the payment token for storage, with a system built to keep storage costs steady in fiat terms. The goal is to shield users from wild swings in WAL’s price over time. So, when someone pays for storage, they pay upfront for a set period. That WAL gets spread out over time, rewarding storage nodes and stakers. Why does this matter? Because it tries to separate the user’s decision from the daily ups and downs of the token. For a team building an app, that’s a big deal—it’s the difference between seeing storage as a basic operating cost or a risky bet.

Walrus takes a pretty hands-on approach to getting people on board early. It’s not shy about using subsidies—setting aside 10% of WAL just for this. That lets users pay less for storage than they’d find elsewhere, and at the same time, helps storage nodes keep their businesses afloat. For investors, though, these subsidies aren’t just some free ticket to growth. They’re a way to keep people around—especially builders who might otherwise bail before the network really takes off.

Now, don’t get lost in the numbers before you know what the token is actually trying to do. Once you’ve wrapped your head around that, here’s where things stand: as of January 26, 2026, CoinMarketCap lists WAL at about $0.1188 with around $24.6 million traded in 24 hours. That’s a 7.07% drop in a day. The market cap sits at roughly $187.3 million, with 1.577 billion tokens out in circulation and a max supply of 5 billion. These stats won’t tell you if Walrus will make it big, but they do show there’s plenty of liquidity for traders, and the token’s size means how they design incentives really matters.

Staking is the second big piece, and this is where security and keeping users actually overlap. Walrus says delegated staking is the backbone of their security. Anyone can stake WAL, whether or not they run storage nodes themselves. Nodes try to attract more stake, and that stake decides how much data comes their way. Both nodes and those who delegate earn rewards based on their actions, and once it’s up and running, slashing will keep everyone honest. The idea is pretty straightforward, but the effect is clear: staking isn’t just about chasing yield. It’s a signal. The more the market trusts a node, the more responsibility—and opportunity—it gets.

The docs lay it out pretty clearly: Walrus runs on a committee of storage nodes, and that committee changes every epoch. WAL is the token you use to delegate stake to these nodes. The more stake a node has, the more likely it gets picked for the committee. Then, at the end of each epoch, the system hands out rewards—for selecting nodes, storing data, and serving blobs—through smart contracts on Sui.

If you're an investor, don't brush off epochs and committee selection as just technical background noise. They're actually the heartbeat of the system. They set the pace for when performance gets tracked and when rewards get paid out.

Now, here's the real challenge with staking: capital doesn't like sitting still. Delegators often chase quick yield spikes or the latest reputation bump, and that shuffling costs the network in both money and stability. Walrus tackles this with a deflationary model and two burning mechanics. First, there's a penalty fee if you move your stake too quickly—some of that gets burned, and some goes to people who stick around. Second, once slashing goes live, they'll burn tokens from low-performing nodes. Whether you see burning as a way to hold up value or just a tool to keep people honest, the goal is simple: stop the kind of noisy stake movements that make the network worse for real users.

Walrus has another angle on retention. Stake rewards start out low and only ramp up as the network grows. That means the people who hang in there early get rewarded later, and the economics stay healthy for operators. It's a bet on patience. High rewards too soon attract mercenaries, not real believers. Sure, low rewards at the start can be annoying, but they also weed out folks who aren't in it for the long haul.

Let’s make this concrete. On January 21, 2026, Walrus announced Team Liquid moved 250TB of match footage and brand content onto their network. They wanted global access, no single points of failure, and true long-term storage. You don’t have to care about esports to get the point: Big datasets are the hardest to keep. Switching costs are huge, and if you mess up, your reputation takes a hit. If a storage network can’t keep users like that happy over time, no amount of token hype will save it.

For traders, WAL’s real-world mechanics boil down to a few sharp questions. Is storage demand actually growing, or is it just token games? Are stakes sticking with solid nodes, or bouncing all over? Once penalty and slashing rules kick in, are they pushing people towards reliability, or just squeezing out quick profits? These signals matter way more than whatever the price does this week.

If you’re thinking about WAL, treat it like a real infrastructure play—not just another slogan. Dig into how the token works, learn how payments aim for fiat stability, and figure out how staking changes data assignment and security. Decide your angle: trade the volatility if that’s your thing, or stake only if you’re ready to track node performance and think in terms of epochs, not hours. The best move, whether you’re bullish or skeptical, is to do the work nobody brags about: watch how people use it, follow the incentives, and pay attention to retention. That’s where WAL either proves itself or fades away.

@Walrus 🦭/acc $WAL #Walrus