I want to talk today about Dusk Network, and I’ll start by saying this is not a project I understood in one read. I had to sit with it, read the docs slowly, and think about how real money actually moves. In my research, I noticed Dusk is not trying to impress anyone with speed claims or loud marketing. From the first layer of its design, it feels like they are thinking about institutions, balance sheets, and settlement risk, not hype cycles. That alone made me look twice.

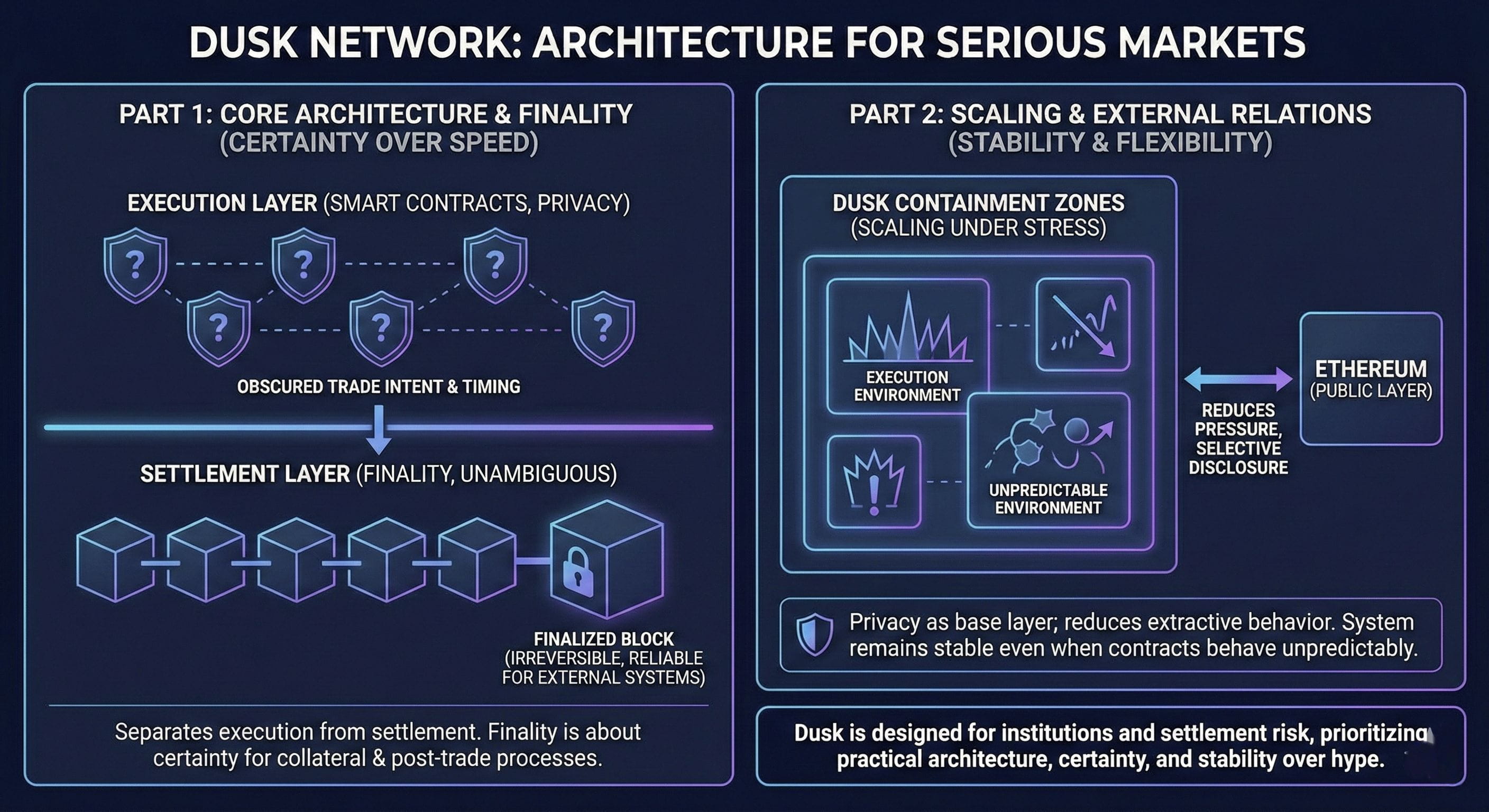

When I look at Dusk, I see a network that treats architecture as something practical. We often hear people say “tech doesn’t matter, adoption does,” but in my experience, architecture decides who is even allowed to participate. Dusk separates execution from settlement, and in simple terms, that means once something is finalized, it stays finalized. There is no guessing game. For traders and funds, this is not a technical detail. This is how risk is priced. I tell you honestly, big capital does not trust promises, it trusts structure.

We read a lot about finality, but most chains treat it like a speed contest. From what I understand, Dusk’s finality is about certainty, not bragging rights. When a block becomes final in seconds and cannot be rolled back, external systems can rely on it. That matters for things like collateral management and post-trade processes. In my knowledge, this is where many blockchains quietly fail. They work fine when markets are calm, then fall apart when timing really matters.

As I studied more, I noticed how Dusk thinks about scaling. They are not trying to push everything faster and louder. Instead, they try to contain problems. If activity spikes or smart contracts behave badly, settlement keeps moving. This sounds boring, but boring is good when money is involved. From a professional point of view, this is how real infrastructure is built. You want systems that stay calm when everyone else is panicking.

I also want to talk about privacy, because here the tone changes a bit. Many people think privacy is about hiding or ideology. That’s not how I see it on Dusk. I see privacy as efficiency. When trades don’t broadcast size, timing, and intent to the whole world, markets behave better. We’ve all watched how visible mempools create unfair advantages. From what I researched, Dusk makes privacy part of the base layer, not an add-on. That changes who is willing to trade and how much they are willing to show.

Another thing I found interesting is how Dusk approaches Ethereum. They are not trying to replace it or steal attention from it. Instead, they reduce pressure on it. With Dusk’s EVM support, contracts can choose what to reveal and what to keep private. In real markets, that is normal behavior. We disclose what settles and protect what trades. I tell you honestly, this kind of flexibility is rare on-chain, and it fits how professional desks already operate.

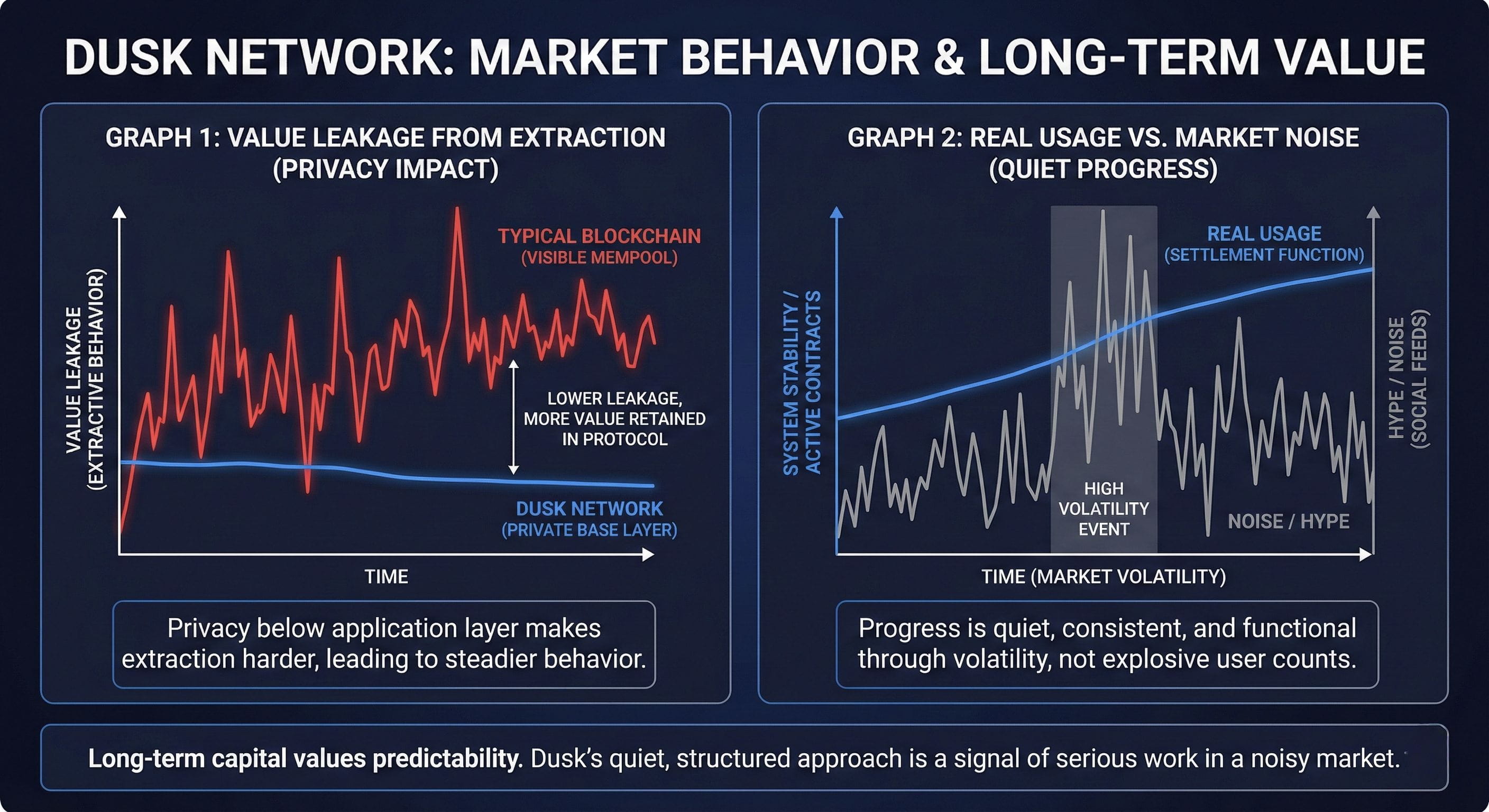

When privacy sits below the application level, the whole game changes quietly. Searchers still exist, but extraction becomes harder and more competitive. Over time, value flows back to the protocol instead of leaking out through aggressive strategies. From my point of view, this makes revenues steadier and easier to model. And that is what long-term capital actually wants, even if it never tweets about it.

What really stands out to me is how this network signals progress. It’s not loud. You won’t see explosive user numbers or flashy campaigns. Instead, you’ll see contracts that stay active, liquidity that doesn’t run at the first sign of stress, and settlement that keeps working during volatility. In my experience, this is how real usage looks. It’s quiet, consistent, and easy to miss if you’re only watching social media.

Looking ahead, I believe systems like Dusk benefit from where regulation and capital are slowly moving. There is growing demand for privacy that still works with compliance, not against it. Dusk does not feel built for screenshots and excitement. It feels built for teams that care about reliability more than noise. If that group keeps growing, adoption will not announce itself. It will simply show up as capital that stops leaking elsewhere.

We read many stories in this market, but sometimes the strongest signal is silence. From what I’ve researched and understood, Dusk Network seems comfortable with that silence. And in my experience, that’s usually where the most serious work is happening.