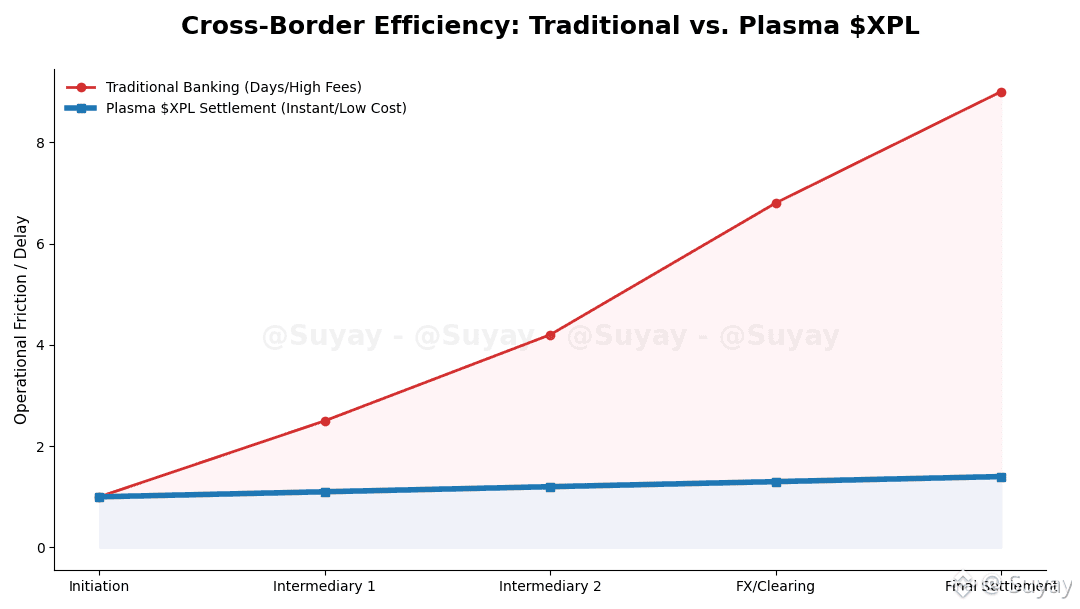

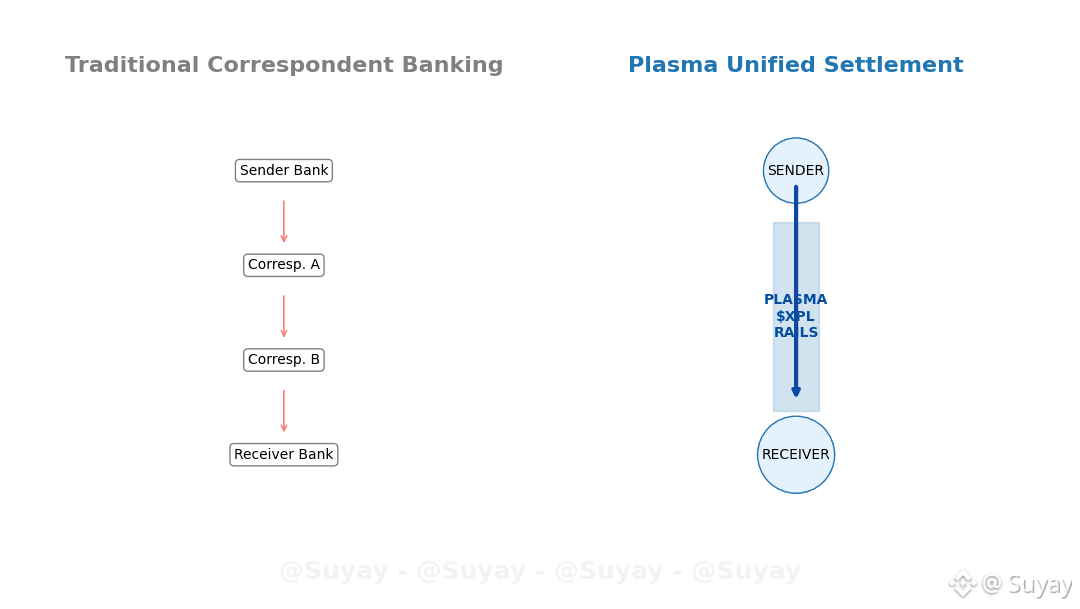

Cross-border payments remain one of the clearest examples of financial infrastructure failing real users. International transfers are still slow, expensive, opaque, and fragmented. Money often moves through multiple intermediaries, settlement layers, and compliance systems before reaching its destination. Each step adds delay, cost, and operational risk. Plasma approaches this problem not as a messaging issue, but as a settlement problem — redesigning how stablecoins move, clear, and finalize across borders.

Most blockchains focus on enabling transactions. Plasma focuses on enabling payment systems. That distinction matters. A transaction moves value between addresses. A payment system coordinates liquidity, execution, confirmation, and finality between economic actors operating across jurisdictions.

Why cross-border payments break traditional rails

International payments today rely on correspondent banking networks, prefunded accounts, batch settlement, and manual reconciliation. Even when front-end tools improve, the underlying structure remains inefficient. Funds take days to settle. Fees accumulate across the route. FX conversion introduces friction. Tracking and compliance slow everything further.

Stablecoins remove one layer of complexity by representing value directly on-chain. But without payment-oriented infrastructure, they still inherit limitations of general-purpose networks: unpredictable fees, limited settlement tooling, and architecture optimized for apps rather than financial flows.

Plasma starts from a different premise: if stablecoins are used as money, the chain itself must behave like financial infrastructure.

Stablecoin settlement as a native function

Plasma treats stablecoins as first-class settlement assets. Instead of being generic tokens deployed on top of a neutral chain, stablecoins on Plasma are supported by protocol-level contracts built specifically for payment execution. This enables predictable transfers, low operational overhead, and architecture aligned with high-frequency, cross-border value movement.

For international payments, this unlocks several advantages:

Near-instant settlement without intermediary layers.

Reduced counterparty risk through on-chain finality.

Continuous operation across time zones.

Direct programmable flows between users and services.

Instead of bridging fragmented ecosystems, Plasma enables cross-border payments within a unified settlement environment.

From transfers to financial flows

Cross-border payments are rarely isolated events. They are recurring flows: remittances, supplier payments, payroll, treasury movements, and platform settlements. Plasma’s payment layer is designed to support these patterns natively.

This means enabling not only transfers, but structured operations: batching, routing, automation, conditional releases, and system-level observability. Stablecoins become programmable settlement units that can move across borders while remaining integrated into financial processes.

By focusing on flows rather than transactions, Plasma aligns blockchain infrastructure with how international finance actually operates.

Risk, cost, and operational efficiency

Traditional cross-border systems concentrate risk in intermediaries. Delays expose participants to volatility. Opaque routing complicates reconciliation. Plasma reduces these pressures by anchoring settlement directly on-chain, where finality, balances, and execution logic are unified.

Fees become predictable. Settlement becomes continuous. Liquidity coordination becomes programmable. For institutions and payment providers, this translates into lower operational overhead and more resilient settlement pipelines.

Strategic positioning of Plasma

Plasma positions itself not as an app ecosystem, but as a financial substrate for global payments. It is designed to sit underneath wallets, fintech platforms, merchant processors, and remittance services — providing the settlement engine rather than the interface.

This infrastructure-first approach allows Plasma to realistically address cross-border use cases by restructuring rails around stablecoins and programmable settlement.

Conclusion

Cross-border payments expose the weaknesses of today’s financial infrastructure. By designing directly for stablecoin settlement and payment flows, Plasma reframes how international value movement can function.

It shifts the focus from faster transfers to functional payment systems. From isolated transactions to coordinated financial activity.

In that context, @Plasma $XPL #plasma represent an attempt to rebuild cross-border settlement around how money actually needs to work.