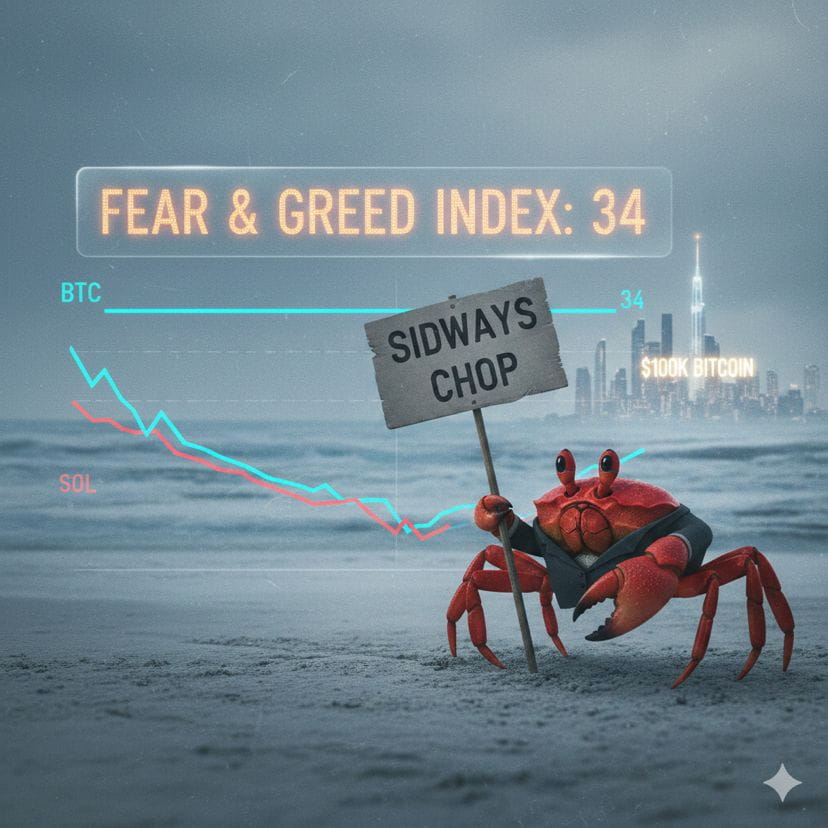

Binance Square fam, let's talk about the current market sentiment. The Fear & Greed Index is firmly in the Fear (34) zone, and frankly, it feels earned.

While we saw some macro relief post-Davos, Bitcoin is struggling to reclaim $90k, showing weakness around the $89.5k mark. Meanwhile, Solana has taken a significant hit, down -11% this week alone, putting its recent bull run under serious pressure.

This isn't a "bear market" yet, but it's a classic "crab market" where sideways action and sharp corrections can liquidate the over-leveraged.

Key takeaways for your trading strategy:

• BTC: Watch for a strong close above $90k for any bullish continuation. A drop below $88k could see us retesting $85k support quickly.

• Alts (like SOL): Be cautious with new positions. Look for consolidation and volume confirmation before jumping in. DCA on dips might be a safer play.

• De-risking: It seems capital is flowing out of both crypto and traditional risk assets. Are you holding stablecoins, or looking for specific narratives?

Question for the community: What specific altcoins are you keeping an eye on for potential bounces after this consolidation phase? Share your charts and reasoning! 👇

#BTC #sol #BinanceSquare #cryptotrading #MarketAnalysis