Executive Summary

Symphony represents a novel approach to DeFi execution infrastructure, positioning itself as an AI-native coordination layer that abstracts cross-chain complexity through intent-based architecture and autonomous agent execution. While the protocol demonstrates strong early traction on Monad mainnet with $185M+ cumulative volume, institutional-grade assessment reveals critical transparency gaps that warrant cautious evaluation. Symphony

Key Investment Thesis: Symphony addresses genuine structural problems in fragmented DeFi liquidity and user experience complexity, but lacks the institutional-grade security disclosures and code transparency typically required for tier-1 investment consideration.

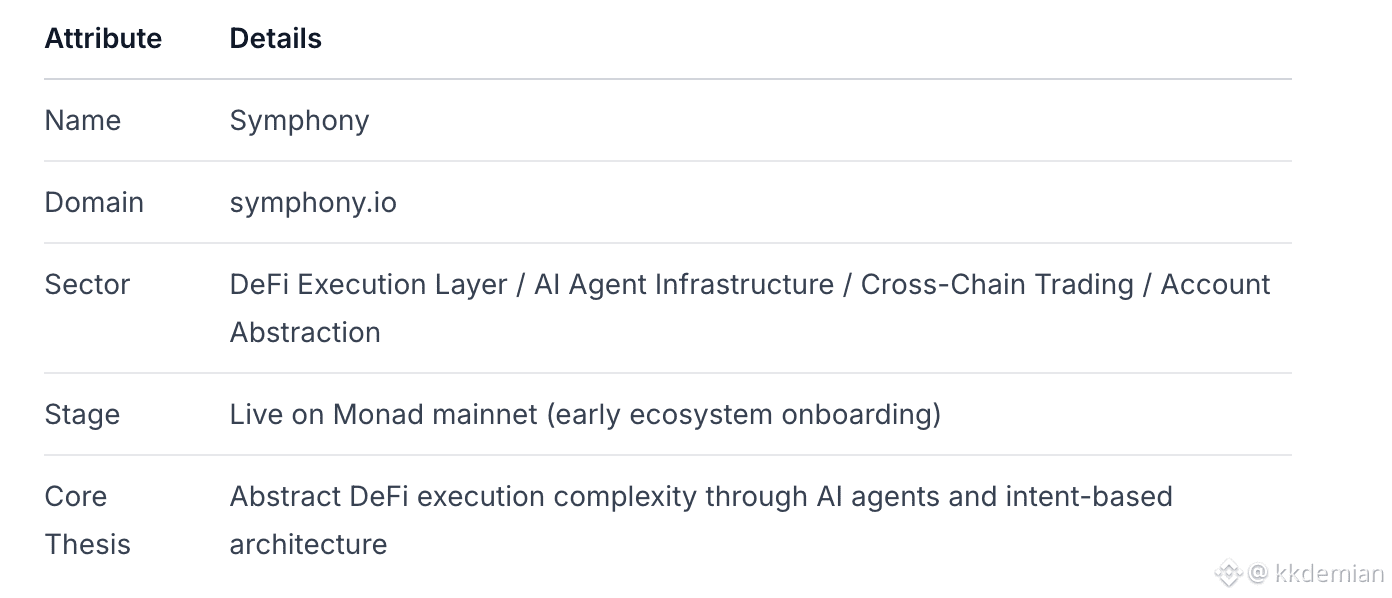

1. Project Overview

Protocol Vision: Symphony aims to unify fragmented DeFi liquidity through a comprehensive execution stack that enables both AI agents and human users to express high-level intents and execute complex, multi-chain strategies non-custodially. Symphony Docs

Team Origins: Led by CEO Vik and CTO Ben, with backgrounds spanning traditional finance institutions (Kava, Celsius, Ankr, Sei). The team transitioned from building Cadence Protocol (a perpetuals protocol on Canto) to developing Symphony's broader execution infrastructure. Symphony About

Classification: Symphony should be categorized as an AI-native coordination layer for on-chain capital rather than a traditional DeFi protocol, given its focus on intent expression, agent orchestration, and execution abstraction.

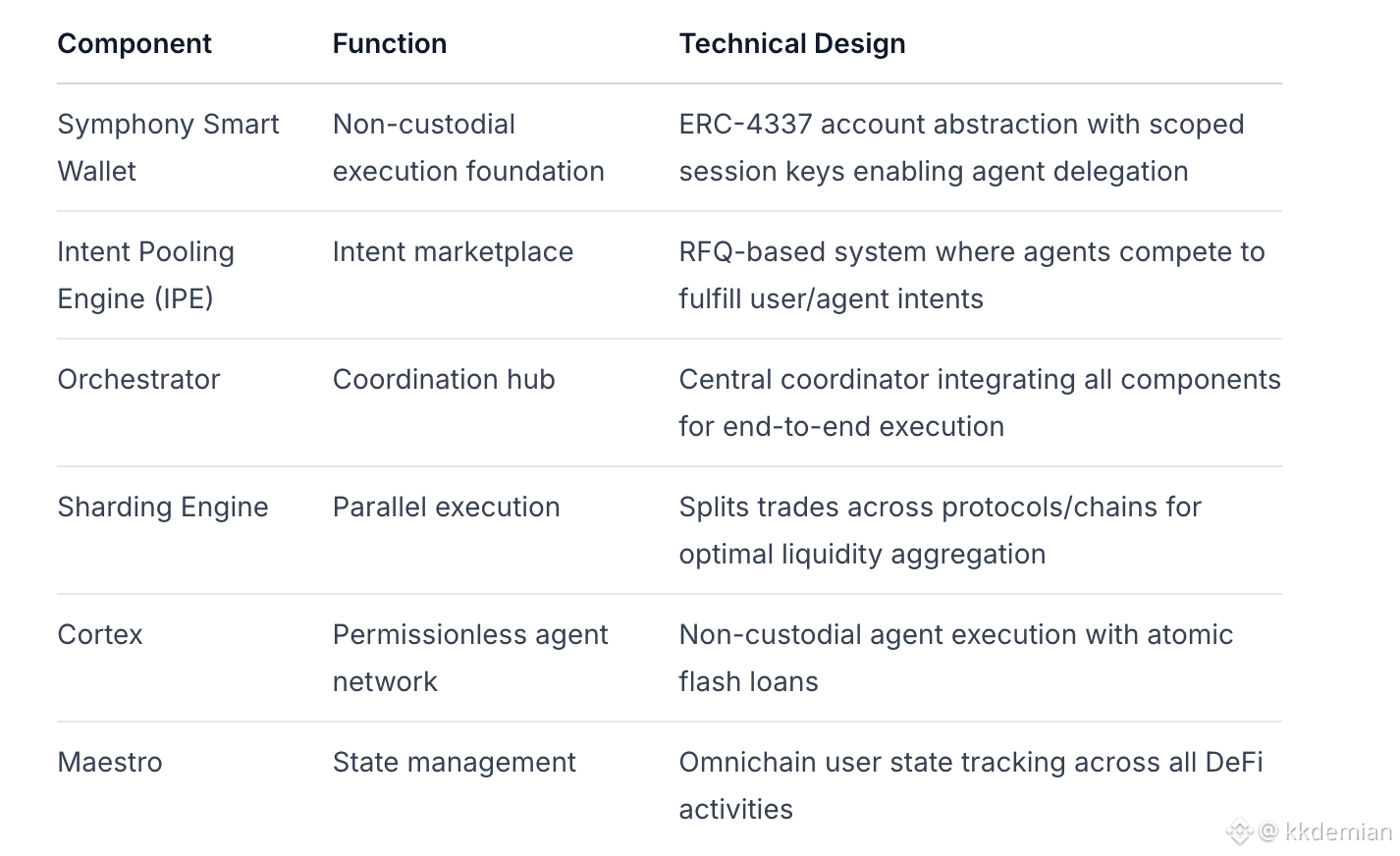

2. System Architecture and Execution Stack

Symphony's architecture comprises six interconnected systems designed for modular, scalable execution:

Core Components

Execution Flow

Intent Submission: Users or agents express high-level outcomes (e.g., "swap 10 ETH for USDC at best rate across any chain")

RFQ Broadcasting: IPE broadcasts request-for-quotes to agent network

Agent Competition: Cortex agents submit optimized execution paths

Path Selection: Orchestrator selects optimal solution based on price, slippage, and execution guarantees

Sharded Execution: Sharding Engine executes across multiple venues/chains in parallel

Settlement: Atomic settlement ensures all-or-nothing execution Symphony RFQ System

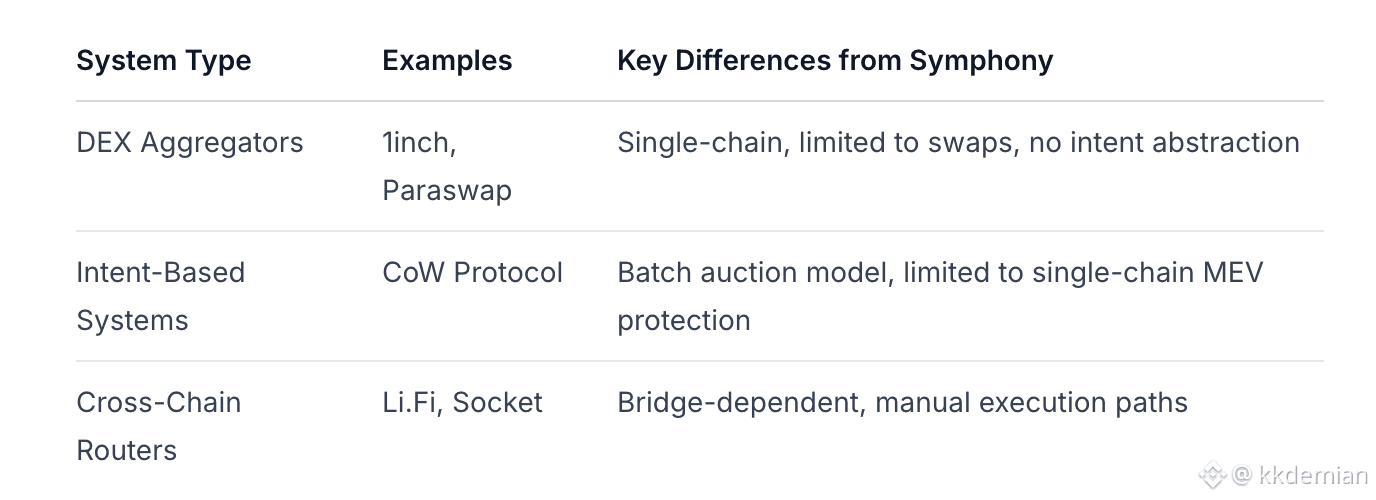

Architectural Classification

Compared to existing systems:

Symphony differentiates through its AI-agent composability, omnichain state management (Maestro), and parallel sharding execution rather than traditional batch auctions or bridge-based routing.

3. Non-Custodial Model and Trust Assumptions

Custody Architecture

Symphony's non-custodial model relies on ERC-4337 account abstraction with scoped permissions:

User Control Preservation:

Users retain ultimate control through smart wallet ownership

Agents operate within predefined execution boundaries via session keys

All transactions require user-signed permission scopes Symphony Smart Wallet

Trust Assumptions:

Reduced Trust: Modular separation isolates execution, state management, and agent coordination

New Dependencies: Orchestrator coordination logic introduces centralization risk during early phase

Agent Network: Cortex agents are incentive-aligned through staking/slashing mechanisms, though specific parameters remain undisclosed

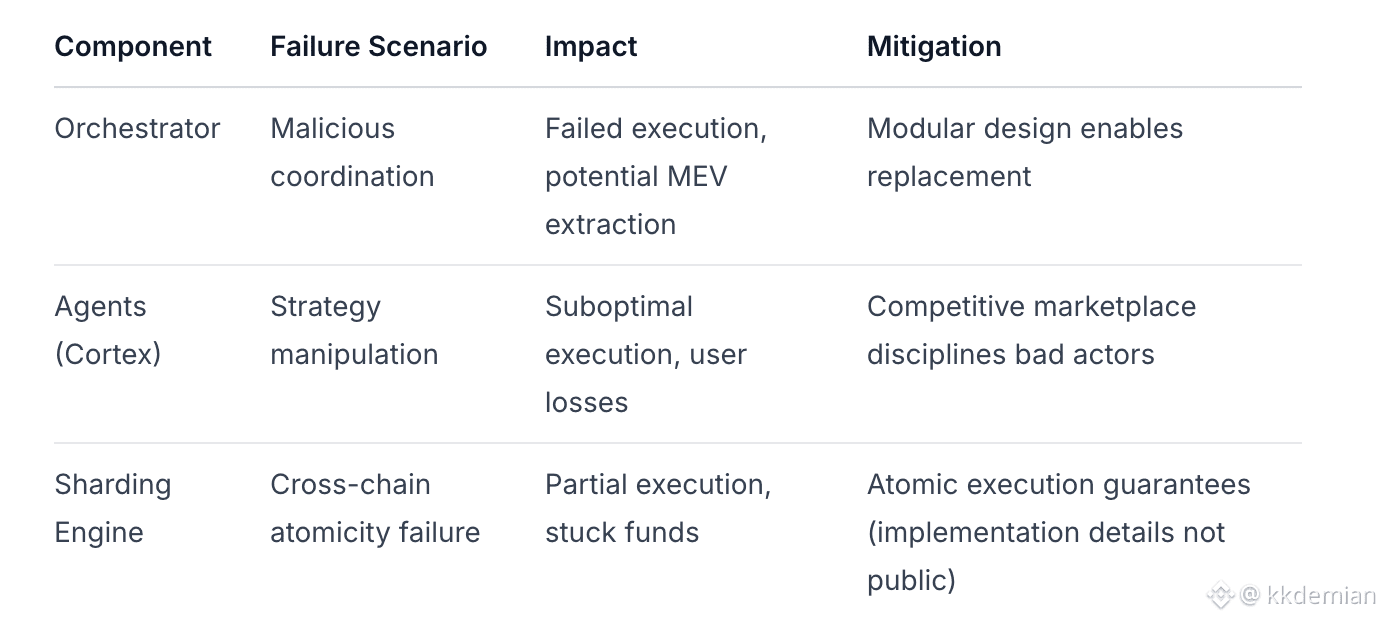

Failure Mode Analysis

Assessment: Symphony reduces trust compared to custodial solutions but introduces new dependencies on agent network integrity and cross-chain coordination mechanisms.

4. Intent Expression and Strategy Execution Logic

Intent Structure

Symphony intents are declarative constraints expressing desired outcomes rather than execution paths:

// Example intent structure (inferred from documentation){ action: "swap", inputAsset: "10 ETH", outputAsset: "USDC", constraints: { minOutput: "39000 USDC", maxSlippage: "0.5%", chains: ["ethereum", "arbitrum", "polygon"], timeframe: "5 minutes" }}

Execution Prioritization

Symphony's execution logic prioritizes:

Capital Efficiency: Sharding across venues for optimal liquidity utilization

Atomicity: All-or-nothing execution prevents partial fills

Price Optimality: Agent competition drives toward best execution

Composability: Multi-step strategies can be chained within single intent Symphony Intent System

Strategy Composability: Advanced users and agents can compose complex multi-protocol strategies (e.g., Pendle PT/YT yield farming) within single execution context.

5. AI Agent Network (Cortex) and Incentive Design

Agent Participation Model

Cortex operates as a permissionless agent network with the following characteristics:

Agent Roles:

Strategy Generation: Agents analyze market conditions and propose execution paths

Execution Proposal: Competitive bidding on user/agent intents via IPE

Settlement: Agents can utilize atomic flash loans for capital-efficient execution

Incentive Structure:

Agents compete in RFQ marketplace for execution fees

Performance-based selection drives quality competition

Specific staking/slashing parameters not publicly disclosed Cortex Network

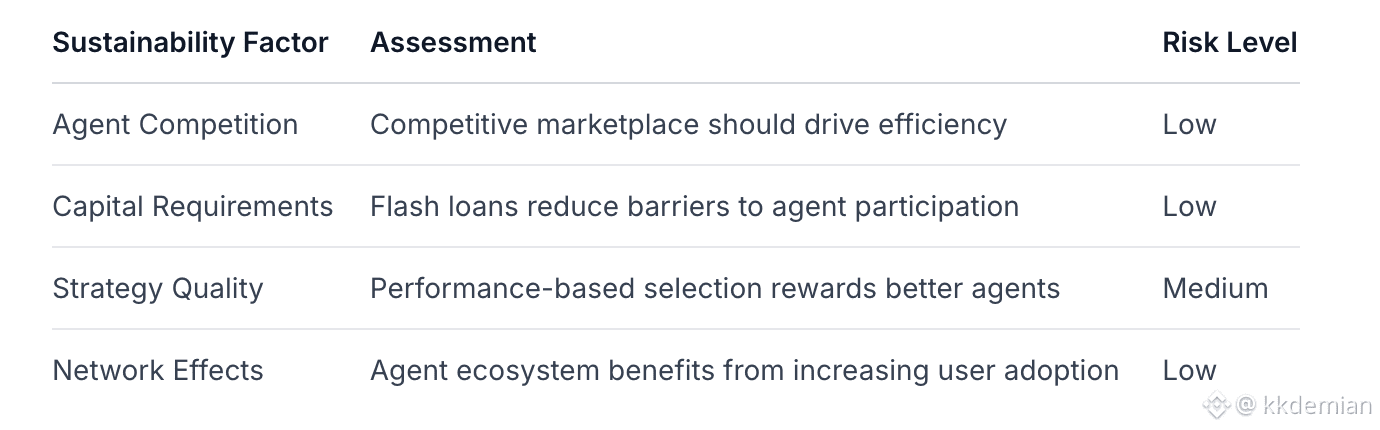

Economic Sustainability Assessment

Vulnerability Assessment: The agent network appears economically self-stabilizing through competition, though agent collusion or strategy spoofing risks exist without disclosed monitoring mechanisms.

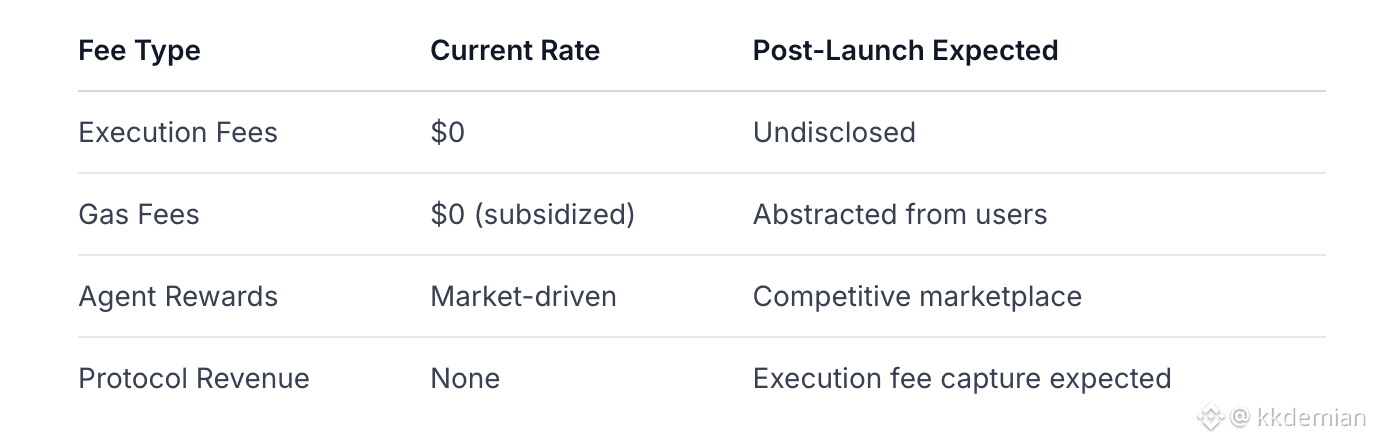

6. Protocol Economics and Monetization

Current Fee Structure

Symphony currently operates with zero protocol fees during promotional phase: Terminal Fees

Token Economics: $CAD to $SMY Migration

Current Status: Token migration remains unimplemented as of January 2026:

$CAD (Cadence Protocol): Original token with no active trading

$SMY (Symphony): Proposed 1:4 migration ratio (1B max supply, no dilution)

Launch Timeline: No confirmed timeline for $SMY launch or trading Medium Announcement

Revenue Sustainability: Protocol economics remain underdeveloped without active token or established fee capture mechanism. Long-term sustainability depends on successful transition from subsidized to fee-generating execution.

7. Governance, Security, and Risk Surface

Current Governance Model

Governance Structure: Team-led development with planned DAO transition

No active token-based governance

Parameter control centralized during early phase

Upgrade mechanisms not publicly documented

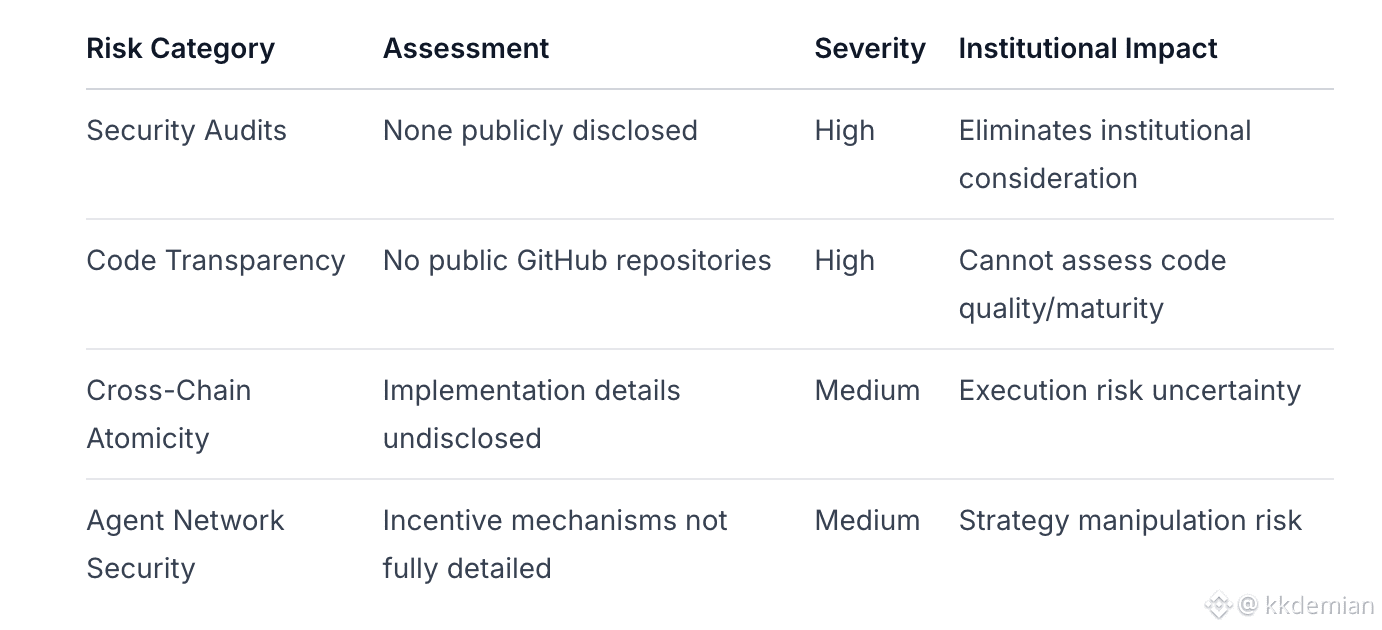

Security Assessment

Critical Risk Factors:

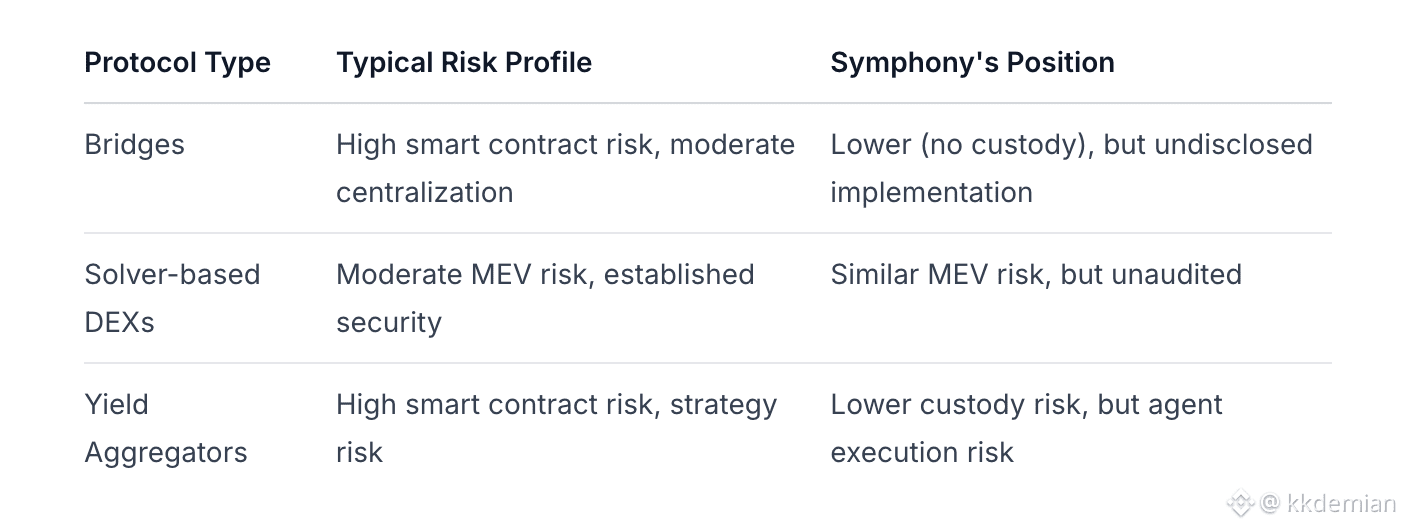

Risk Comparison

Compared to established protocols:

Institutional Assessment: The absence of public security audits represents a critical blocker for institutional investment, regardless of architectural innovation.

8. Adoption Signals and Ecosystem Fit

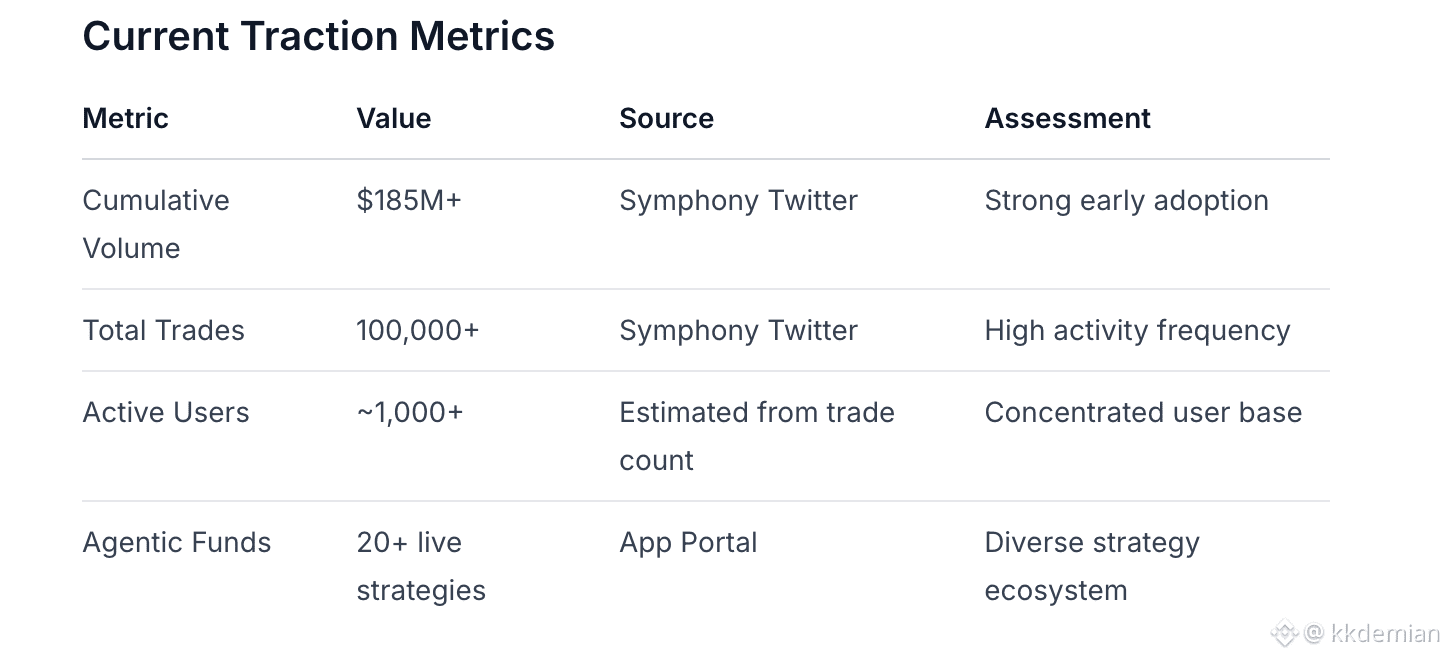

Current Traction Metrics

Strategic Partnerships

Deep Protocol Integrations:

Pendle Finance: Agentic yield strategies for PT/YT tokens, expanding DeFi composability X

Virtuals Protocol: Execution layer for ACP V2, serving 17,000 agents and 180,000 AI agent owners with $1M+ volume in first 24 hours X

Target Market Analysis

Primary User Segments:

Advanced DeFi Traders: Seeking execution optimization and cross-chain coordination

AI Agent Developers: Building autonomous trading strategies

Institutional Users: Requiring non-custodial execution with professional-grade infrastructure

Ecosystem Positioning: Symphony is well-positioned within the AI agent economy and chain abstraction trends, with strong narrative alignment around autonomous execution.

9. Strategic Assessment and Market Fit

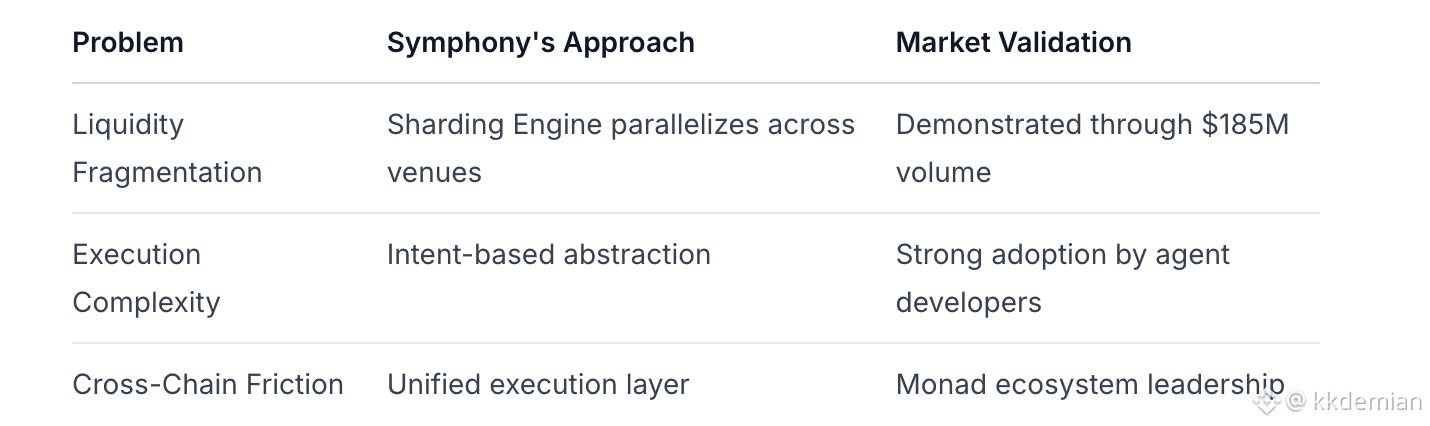

Structural Problem Analysis

Symphony addresses structurally hard problems in DeFi:

Critical Success Milestones (12-24 months)

Security Maturation: Public audit completion and code repository disclosure

Token Launch: Successful $SMY migration and sustainable tokenomics implementation

Multi-Chain Expansion: Expansion beyond Monad to Ethereum mainnet and major L2s

Agent Ecosystem: Growth to 100+ sophisticated trading agents with proven performance

Institutional Integration: Adoption by major DeFi protocols as execution infrastructure

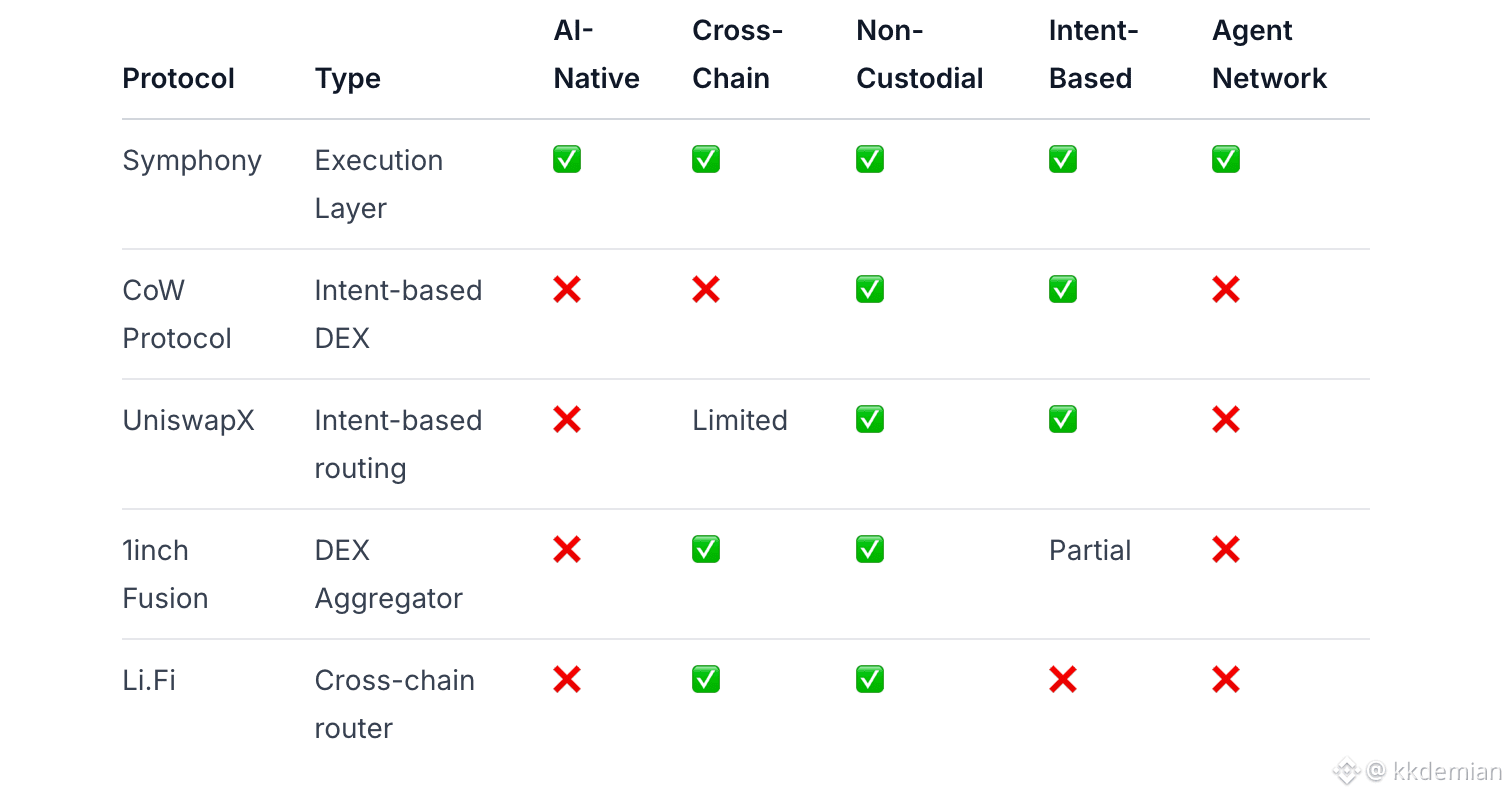

Competitive Positioning

Symphony's Unique Value Proposition:

AI-First Design: Purpose-built for autonomous agent execution

Unified Architecture: Single stack handles intent expression through settlement

Non-Custodial Execution: Maintains user control while enabling agent autonomy

Competitive Threats:

UniswapX/CoW Protocol expansion into AI agent execution

Traditional aggregators adding intent-based features

Chain abstraction solutions with execution capabilities

10. Final Investment Assessment

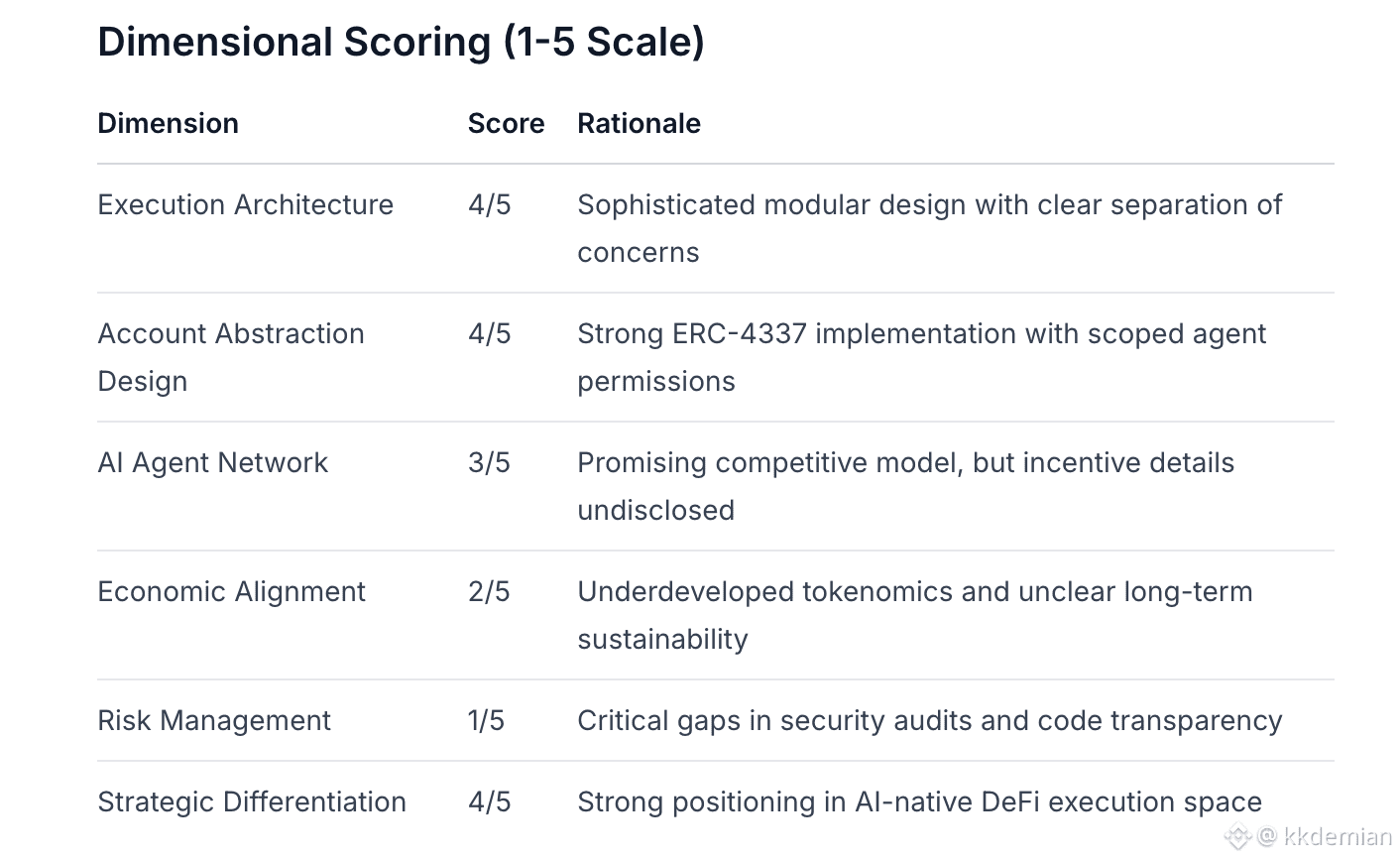

Dimensional Scoring (1-5 Scale)

Overall Score: 3.0/5

Summary Verdict

Investment Recommendation: MONITOR WITH SIGNIFICANT RESERVATIONS

Symphony demonstrates exceptional architectural innovation in AI-native DeFi execution and strong early market validation through its Monad ecosystem leadership. The protocol addresses genuine structural problems in DeFi liquidity fragmentation and user experience complexity.

However, critical institutional-grade deficiencies prevent current investment consideration:

Blocking Factors:

No public security audits from reputable firms

Absent code transparency with no public repositories

Underdeveloped economics with unclear token launch timeline

Limited institutional backing with no disclosed Tier-1 VC investment

Path to Investment Grade:

Complete comprehensive security audits by firms like Trail of Bits or Spearbit

Open-source core protocol components for community review

Launch $SMY token with clear value accrual mechanisms

Expand beyond Monad to demonstrate multi-chain execution reliability

Strategic Recommendation: Symphony warrants close monitoring as the protocol has positioned itself advantageously within the emerging AI agent economy. If the team addresses security and transparency gaps over the next 6-12 months, it could become a compelling investment opportunity in the execution infrastructure space.

Appendix

A. Competitive Comparison Matrix

B. Risk Decomposition: AI-Driven Execution Under Market Stress

High-Stress Scenarios:

Flash Crash Events: Agent coordination may break down under extreme volatility

Cross-Chain Congestion: Atomic execution guarantees may fail during network stress

Agent Manipulation: Coordinated malicious behavior could exploit intent mechanisms

Oracle Failures: Price feed disruptions could cause execution errors

Risk Mitigation Requirements:

Circuit breakers for extreme market conditions

Redundant cross-chain execution paths

Agent reputation systems with slashing mechanisms

Multiple oracle sources with fallback mechanisms

This report represents analysis based on publicly available information as of January 26, 2026. Investment decisions should incorporate additional due diligence and risk assessment.