Vanar Chain ($VANRY): The AI‑Native Blockchain Fueling Web3’s Intelligent Future

In the rapidly evolving landscape of cryptocurrencies and decentralized infrastructure, Vanar Chain and its native token $VANRY have emerged as a compelling narrative blending blockchain performance, AI integration, and real‑world utility. Originally evolving from the Virtua ecosystem and undergoing a one‑to‑one $TVK → $VANRY token swap, the project now aims to recalibrate the expectations of what a Layer‑1 blockchain can deliver in 2026 and beyond.

Core Philosophy & Unique Positioning

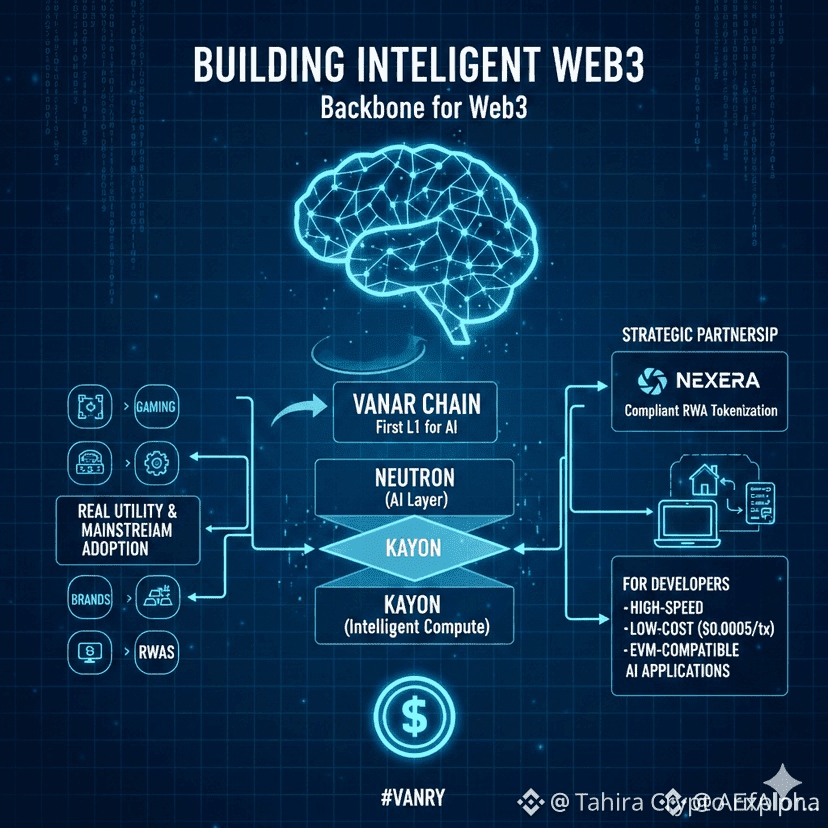

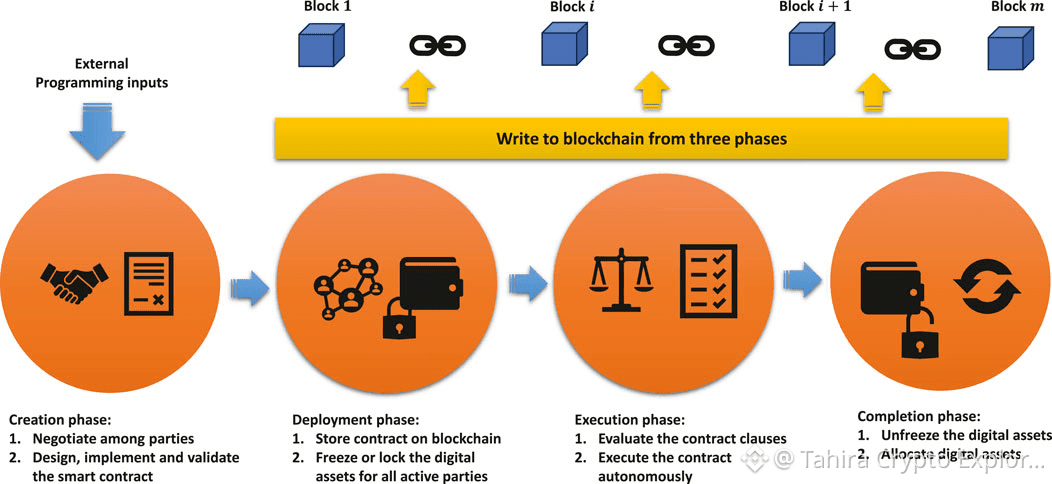

At its core, Vanar Chain isn’t just a transaction ledger — it is marketed as an AI‑native, intelligent Layer‑1 blockchain that embeds machine learning and semantic reasoning directly into the protocol layer. This differentiates it from conventional blockchains that treat AI as an external add‑on. The network’s stack includes AI compression with Neutron and a decentralized reasoning engine called Kayon, enabling real‑time, AI‑assisted data handling on chain.

This architecture is designed for intelligent automation, adaptive contracts, and real‑world finance applications, such as digital payments, tokenized real‑world assets (RWA), and Web3‑native services that require contextual logic instead of pure transaction speed.

Features & Technical Highlights

AI‑Native Infrastructure

Unlike blockchains that bolt AI onto conventional execution layers, Vanar integrates AI deeply, partly through:

Semantic on‑chain data storage: Complex files (documents, media, analytics) are compressed and stored using the Neutron layer at up to 500:1 efficiency.

Kayon reasoning engine: Decentralized intelligence capable of interpreting stored data with real‑time logic — enabling automated contract behavior beyond simple conditionals.

Pilot Agent interaction: Natural‑language on‑chain commands simplify user interactions with wallets and contracts.

These elements collectively support an ecosystem where AI isn’t an external module but part of the blockchain’s cognitive layer.

Consensus & Architecture

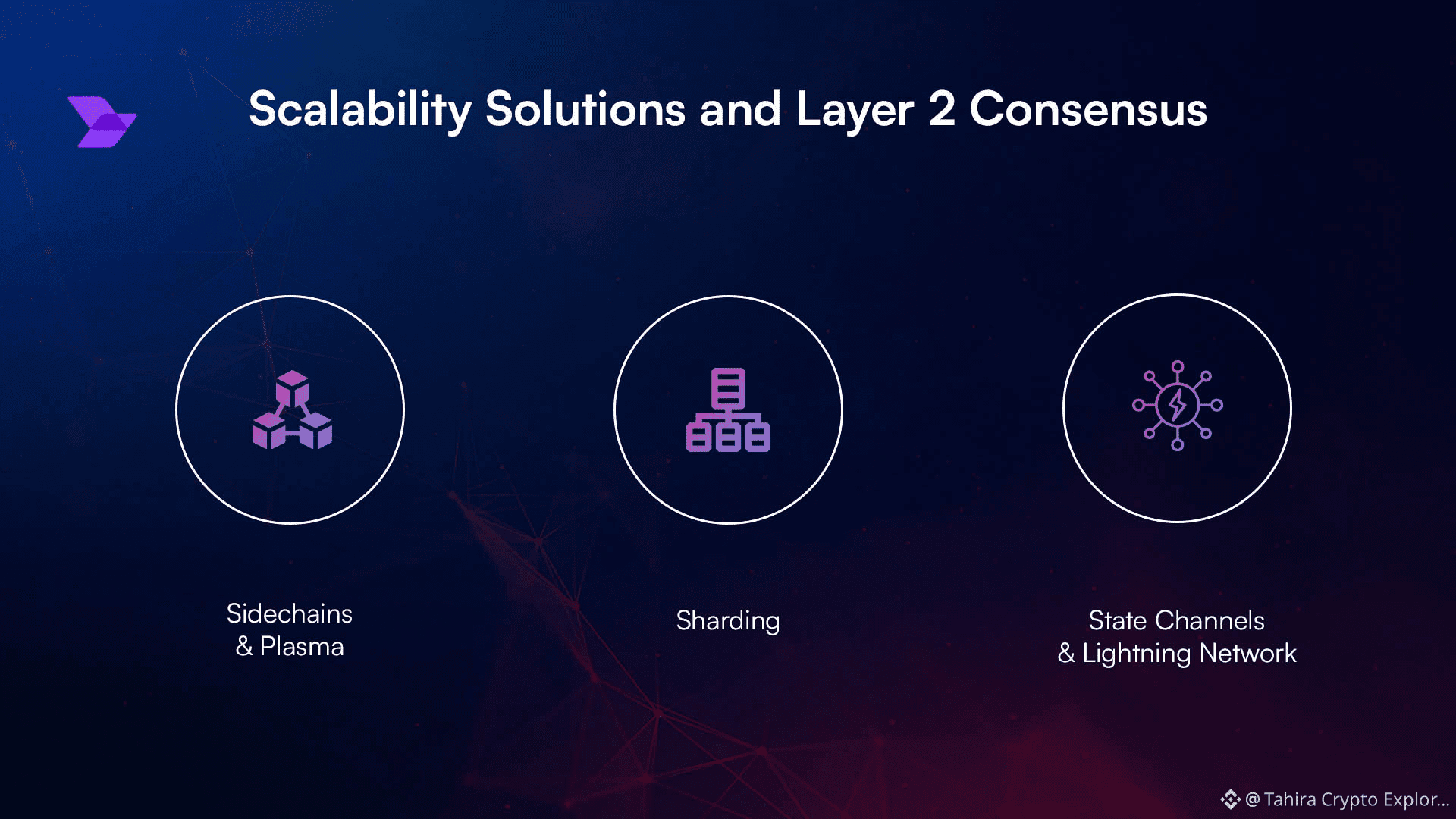

Vanar’s architecture blends performance, decentralization, and governance inclusivity:

Hybrid consensus model: Combines Proof of Reputation (PoR) with Delegated Proof‑of‑Stake (DPoS) and elements of Proof of Authority (PoA) to balance speed with validator credibility.

Ethereum Virtual Machine (EVM) compatibility: Developers familiar with Solidity and Ethereum tooling can deploy existing dApps with minimal friction.

Fast finality & low fees: 3‑second block times and ultra‑low transaction costs (≈ $0.0005) support microtransactions, gaming ecosystems, and DeFi operations.

Eco‑friendly integration: Partnerships with cloud and renewable energy providers aim to reduce carbon footprint while sustaining high throughput.

coinengineer.net

This architectural combination supports fast, cheap, secure interactions while preparing the network for real‑world enterprise and consumer usage.

VANRY Token Dynamics

Utility and Mechanics

The $VANRY token is the economic core of the Vanar ecosystem. Its primary utilities include:

Gas for transactions and smart contracts: $VANRY is required to pay network fees. �

Vanar Documentation

Staking & validator participation: Token holders can stake or delegate towards network security and earn rewards. �

Vanar Documentation

Access to platform features: Many AI tools and ecosystem services require $VANRY for usage, creating recurring demand. �

Deflationary mechanisms: Activity‑linked token burns — e.g., for AI subscriptions — reduce supply, theoretically tightening tokenomics over time. �

The token supply is capped at 2.4 billion units, with roughly 1.66–1.96 billion in circulation depending on the metric source. �

CoinMarketCap +1

Unique Use Cases Driving Real Utility

AI Services & Monetization Engine

Vanar’s AI stack isn’t theoretical; real products like myNeutron AI have launched subscription models in late 2025 where:

Payments convert into $VANRY

Portions of revenue are burned

Other segments fund community rewards and infrastructure growth. �

This represents a novel mechanism where token utility is tied directly to paid product usage — an important step beyond speculative demand.

Gaming, Metaverse, and PayFi

Vanar has extended its ecosystem to embrace real‑time gaming (e.g., VGN network) and immersive experiences via Virtua Metaverse. These platforms facilitate in‑game transactions and microtransactions with virtually no fee friction, attracting developers and users alike. �

Gate.com

On the financial front, low‑fee, instant PayFi mechanisms allow global payments and settlement without traditional banking intermediaries. �

pp.one

Market Impact and Technical Analysis

Recent Developments

In early 2026, the network went live with its AI stack, giving real utility signals to markets and developers. Price movements have reflected this narrative, with technical indicators like MACD crossovers and rising volumes suggesting a tentative recovery from prior declines. �

CoinMarketCap

Volatility & Risks

Despite innovation, VANRY remains highly volatile relative to major tokens. Recent forecasts highlight liquidity constraints, regulatory uncertainty around gaming/metaverse sectors, and competitive pressure from established Layer‑1 blockchains. �

Gate.com

Ecosystem and Future Potential

Vanar’s roadmap through 2026 continues emphasizing ecosystem expansion — cross‑chain Neutron adoption, Kayon mainnet enhancements, and developer growth initiatives like hackathons and fellowship programs. �

CoinMarketCap

If these components mature along with increasing real‑world engagement, Vanar’s AI‑centric design could set it apart from more traditional Layer‑1 platforms.

Conclusion

$VANRY and the Vanar Chain represent an ambitious experiment at the intersection of blockchain and AI, blending advanced protocol design with real‑world product adoption. With its hybrid consensus, EVM compatibility, low‑fee execution, and AI‑native architecture, the network tackles several longstanding challenges in decentralized infrastructure. However, its future will be shaped by adoption, developer traction, and market conditions — not just narrative alone.

In an ecosystem crowded with Layer‑1 competitors, Vanar’s distinctive blend of intelligent automation and real usage models make $VANRY one to watch amid 2026’s continued evolution of Web3.