There are moments in technology when something feels bigger than code — when an idea seems to bend toward the way the world should work. Plasma is one of those rare projects. It didn’t emerge merely to chase headlines or mimic another blockchain’s whitepaper. It was born from a simple yet profound recognition: money that is digital should act like money — instant, predictable, inclusive, and seamlessly global. What Plasma has set out to build isn’t just another Layer‑1 chain. It’s a new settlement layer for the stablecoin era, designed with one clear obsession at its core: make dollars on chain as effortless as dollars in your pocket. �

Plasma

To understand why Plasma feels like the beginning of something big, you have to zoom out a bit. Stablecoins like USD₮ aren’t fringe assets anymore. They’ve become the workhorses of the crypto world and increasingly part of mainstream digital finance — used for cross‑border payments, remittances, merchant settlements, and even as a backbone for decentralized finance. But despite their widespread use, stablecoins are still hamstrung by the very platforms they live on. On Ethereum, fees can dwarf the value of small transfers. On legacy chains, settlement is fast but feels fragmented and insecure. Plasma asks a powerful question: what if money had a home built around money’s needs — not around speculation or complex DeFi primitives, but around transferring value quickly, cheaply, and with certainty? �

Plasma Docs +1

From the first line of its architecture, Plasma’s design feels intentional and purposeful. At its heart, it runs a custom consensus called PlasmaBFT — a high‑performance implementation of Fast HotStuff written in Rust. Unlike typical blockchain mechanisms that can lag during congestion or impose unpredictable fees, PlasmaBFT is engineered for sub‑second finality and ultra‑high throughput, able to handle thousands of transactions per second without breaking a sweat. That’s not incremental improvement; that’s next‑generation settlement performance. And beyond raw speed, the engineering here is thoughtful: the consensus layer and the execution layer are cleanly separated yet deeply harmonious, making the network not just fast but reliable. �

Plasma Docs

What really makes Plasma feel revolutionary is how it approaches gas. In older blockchain paradigms, you had to buy a separate token just to pay for transactions. That creates friction — especially for users who only want to send a stable dollar, not play with volatile crypto. Plasma flips this script. It offers zero‑fee USD₮ transfers at the protocol level, and even beyond that, it allows fees to be paid in whitelisted assets like stablecoins or Bitcoin itself. Users don’t need to hold a native token just to use money. They don’t need to think about “gas tokens” or conversions. They just send value as if they were tapping a phone screen. That’s a UX breakthrough — not flashy, not hype, but real friction removed. �

Plasma +1

Behind the scenes, Plasma uses something called a protocol paymaster system to sponsor gas for basic USD₮ transfers, making the network feel almost invisible to the end user. Imagine migrating billions of dollars every day without fees, settlements resolving in a heartbeat, and wallets that look and behave like traditional payments apps — except they’re global, permissionless, and resilient. That experience is closer than most people realize. �

Stablewatch

Yet speed and cost are just the beginning. Plasma also functions as a full EVM‑compatible chain thanks to its use of Reth, a Rust‑based Ethereum execution client that speaks all the familiar Solidity language, tooling, and developer patterns. That means developers don’t have to reinvent the wheel to build on Plasma. They can bring what they already know from Ethereum — MetaMask, Hardhat, contract logic — and deploy it into an environment optimized for massive stablecoin settlement. This isn’t just a technical convenience; it’s a strategic acceleration of adoption. Developers don’t have to learn a new language to tap into tomorrow’s money rails. �

Plasma Docs

Security, too, is a foundational part of Plasma’s promise. In a world where blockchains often trade off speed for decentralization, Plasma strikes a bold hybrid: it anchors its state to the Bitcoin network. By periodically writing cryptographic checkpoints to Bitcoin’s immutable ledger, Plasma draws on Bitcoin’s unmatched security guarantees, effectively giving its settlement history a trusted external guarantee. This isn’t about tying itself to Bitcoin’s chain for convenience — it’s about leveraging the world’s most secure digital money infrastructure to make Plasma’s own ledger tamper‑resistant and censorship‑resilient. For global payments, where disputes and rollback risks matter deeply, this kind of security anchor is more than a feature — it’s peace of mind. �

Gate.com +1

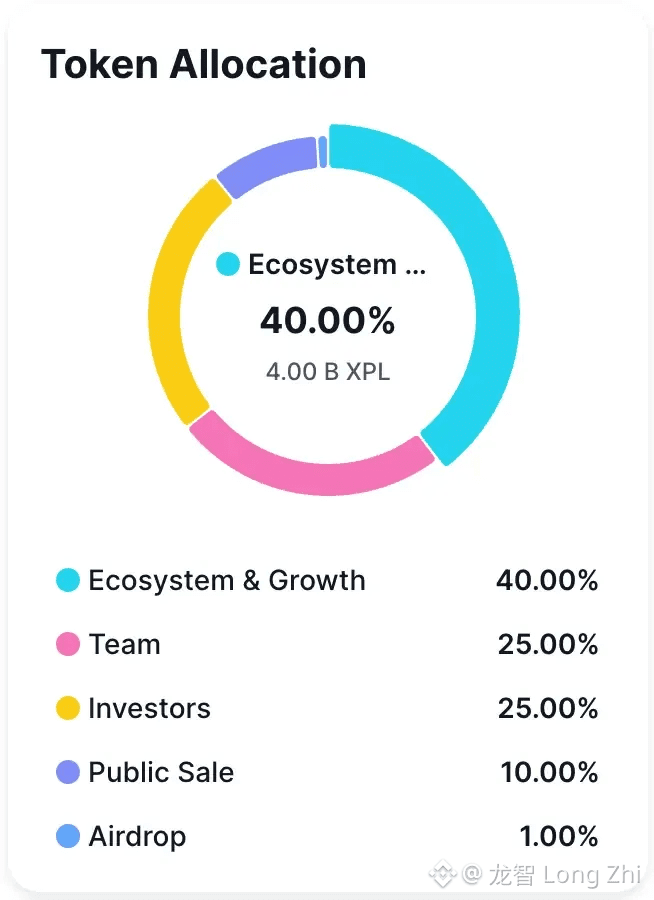

What’s striking is that these features aren’t theoretical — they are actively rolling out and shaping the ecosystem. Plasma launched its mainnet beta in late 2025 with its native token XPL powering the network and a massive liquidity base already integrated across partners. From that launch, it began life with billions in stablecoin deposits, immediately ranking among the leading networks by deposit metrics — a level of entry most new chains only dream of. That’s not luck; that’s the pull of a vision that resonates with experienced builders and capital allocators alike. �

BlockFin

Behind the scenes, major strategic investors and financial heavyweights — including major stablecoin issuers and liquidity providers — have backed Plasma with tens of millions of dollars in funding. This isn’t just developer enthusiasm; it’s capital confidence that the stablecoin economy — already trillions in global transactions — is seeking infrastructure that matches its scale. �

Plasma

And the ecosystem is already moving fast. Plasma isn’t content to be just a settlement chain; it’s becoming a layer where payments, remittances, merchant settlement, cross‑chain liquidity flows, and even neobank experiences can live. Projects like **Plasma One — a USDT‑centric neobank app offering yield and cash‑back — demonstrate how this blockchain is seeping into everyday financial experiences. These aren’t abstract experiments. They are the kinds of real touchpoints that make blockchain money feel like money to real people. �

Yahoo Finance

What lies ahead for Plasma feels like chapters in a fast‑unfolding story. In the near term, the focus is on maturing its confidential payment technologies and evolving its Bitcoin bridge — bridging real BTC into the chain securely for programmability and settlement. Beyond that, Plasma plans to deepen integrations with wallets, fintech rails, merchant tools, and payment aggregators across emerging markets where dollar access and affordability make a world of difference. Imagine micropayments in Africa that don’t cost a fraction of the transfer value, remittances in Latin America that skip expensive corridor fees, or payroll settlements in Asia that land instantly. �

Plasma

Perhaps the most thrilling aspect of Plasma is not its code or its consensus; it’s the implication. For the first time, stablecoins — already outpacing many legacy systems in throughput and adoption — might finally have a home that treats them not as side attractions but as mainstage money. That isn’t a trivial pivot. That’s a rethinking of what blockchain settlement should be. And as Plasma continues to weave together performance, security, seamless usability, and global reach, it feels less like a dream and more like the next fundamental layer of digital money. �