Plasma ($XPL): Binance Square’s Next‑Gen Stablecoin‑Native Blockchain

In late 2025, the crypto ecosystem witnessed the emergence of Plasma ($XPL) — a Layer‑1, EVM‑compatible blockchain designed to redefine how stablecoins and digital value are transferred, settled, and integrated into decentralized finance (DeFi) infrastructure. With backing from major institutions and broad exchange support, including a prominent launch on Binance and community programs via Binance Square, has $xpl rapidly become one of the most discussed tokens in decentralized finance. �

Binance Academy +1

Core Features and Technical Architecture

At its foundation, Plasma is built for high‑throughput, low‑cost stablecoin transactions, addressing a longstanding bottleneck in legacy blockchain networks where fees and congestion undermine real‑world payments. �

Binance Academy

1. Layer‑1 Blockchain with EVM Compatibility

Plasma operates as a Layer‑1 blockchain fully compatible with the Ethereum Virtual Machine (EVM), enabling developers to deploy Solidity smart contracts and integrate Ethereum‑based tools with minimal friction.

Binance Academy

Execution Layer: Powered by Reth — a Rust‑based Ethereum client — which manages transaction processing and smart contract logic. �

Binance Academy

Consensus Security: Uses PlasmaBFT, an advanced consensus mechanism derived from HotStuff BFT protocols, enhancing transaction finality and validator coordination while maintaining security in adversarial conditions. �

Binance Academy

This combination gives Plasma the flexibility of Ethereum’s ecosystem with bespoke scaling and finality improvements.

2. Zero‑Fee Stablecoin Transfers & Custom Gas Tokens

Plasma’s headline innovation is zero‑fee transfers for USDT (Tether) — the largest stablecoin by market capitalization — enabled by an on‑chain paymaster system. �

Binance Academy

Paymaster System: Sponsored gas for simple USDT moves, letting users send and receive without native token fees. �

Binance Academy

Custom Gas Tokens: Developers can register other ERC‑20 tokens to cover gas, broadening flexibility for users and DApps. �

Binance Academy

This dual‑layer gas model improves onboarding and usage by reducing traditional barriers to trading and remittance.

3. Trust‑Minimized Bitcoin Bridge

A standout piece of Plasma’s infrastructure is its Bitcoin bridge. Rather than relying on custodial wrapped tokens, a network of decentralized validators adjudicates BTC deposits and mints pBTC, a token usable in DeFi and smart contracts. �

Binance Academy

This trust‑minimized approach creates tighter security alignment with the Bitcoin network and expands cross‑chain capital utility without centralized risk.

4. Confidential Payments and Privacy Modules

While still under development late into 2025, Plasma is actively researching Confidential Payments — tools that obscure transaction details (amounts, participants) without sacrificing compatibility with existing wallet infrastructure. �

Binance Academy

This positions $XPL as a platform that could support both traditional compliance and optional privacy features for users.

Token Utility and Economic Design

The $XPL token is central to Plasma’s economic model:

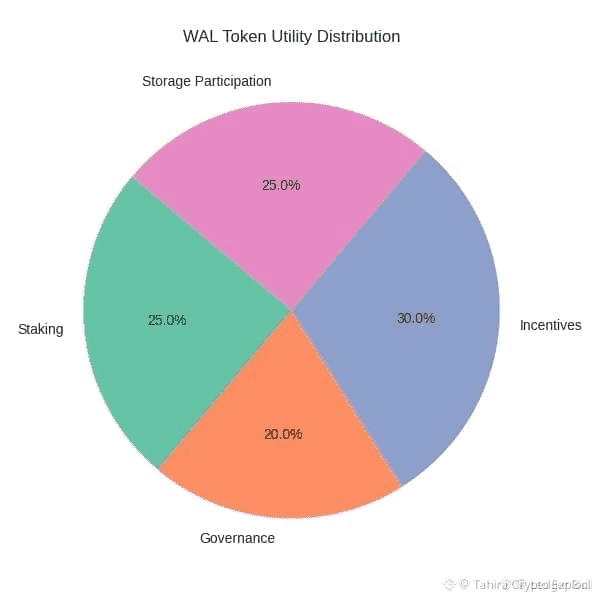

Gas Fees: Required for transactions that go beyond basic USDT transfers. �

Binance Academy

Network Security: Validators stake XPL to participate in consensus and earn rewards. �

Binance Academy

Delegation: Holders can delegate XPL to validators — enabling broader participation without running infrastructure. �

Binance Academy

Governance and Incentives: Planned governance functions and community reward programs help align long‑term stakeholder interests. �

eco.com

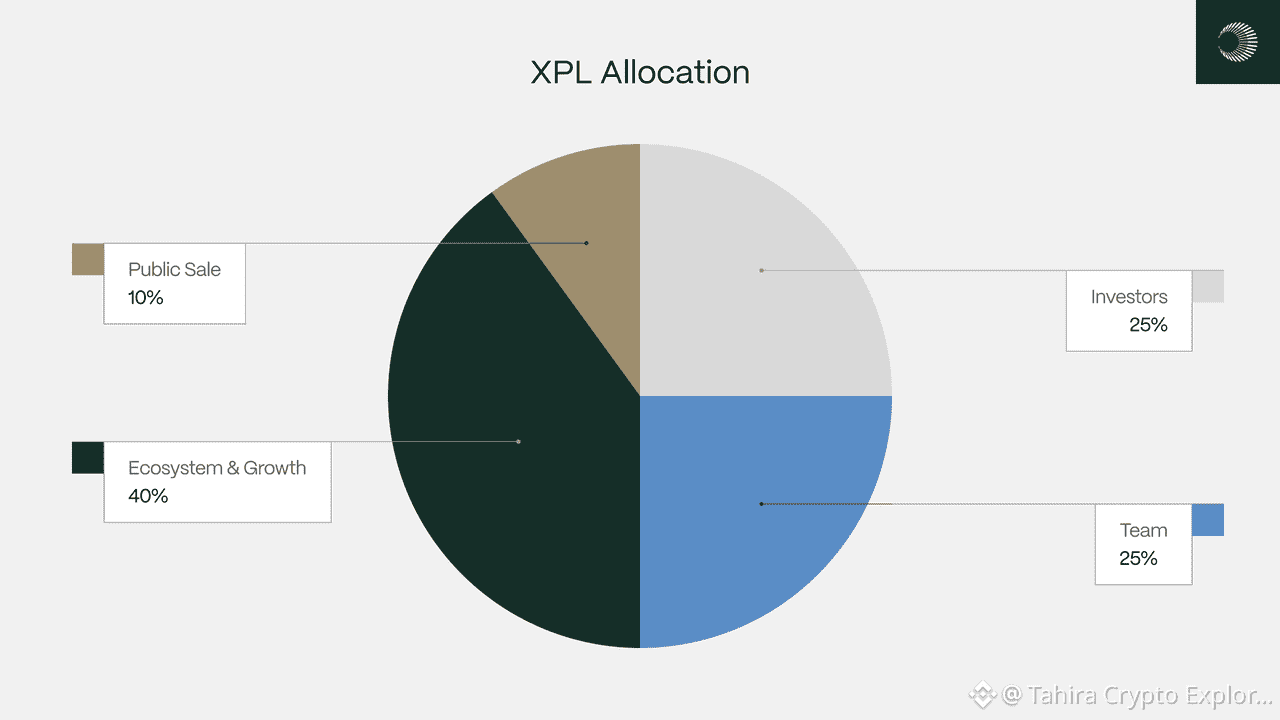

The initial token supply at mainnet launch was 10 billion XPL, with mechanisms like fee burning inspired by EIP‑1559 to introduce deflationary pressure tied to network activity. �

eco.com

Binance Integration and Square Campaigns

Binance played a pivotal role in mainstreaming $XPL via multiple initiatives:

HODLer Airdrop Program: Plasma was selected as the 44th HODLer Airdrop project, distributing 75 million XPL to eligible Binance users, boosting early liquidity and awareness. �

Yatırım Masası

Listing and Trading Pairs: Upon listing, Binance enabled spot and futures trading with pairs such as XPL/USDT, XPL/BNB, USDC, and others, increasing access for retail and institutional traders. �

Coincu

Binance Square CreatorPad Campaign: In early 2026, Binance Square launched an XPL campaign distributing 3.5 million XPL to content creators who produce engaging, high‑quality content — reinforcing community growth and education. �

Traders Union

These programs have enhanced both market participation and organic ecosystem activity.

Market Impact and Technical Adoption

The market response to has $xpl been volatile but notable:

Derivatives Activity: Open interest in XPL derivatives spiked to record highs (~$1.8 billion), indicating strong speculative and hedging interest on major exchanges. �

Coincu

Liquidity & TVL: At launch, Plasma’s total value locked (TVL) exceeded $3 billion in certain products due to strategic integrations, including stablecoin yield products. �

AInvest

Exchange Listings: Beyond Binance, XPL has been listed on multiple centralized platforms like Nexo, enabling purchases via card and inclusion in trading products. �

However, like most emerging ecosystems, has xpl experienced price volatility and speculative swings, reflecting broader market sentiment and adoption pace. �

Gate.com

Real‑World Use Cases and Future Outlook

Plasma’s design supports several impactful applications:

Cross‑Border Payments: Zero‑fee stablecoin transfers enable efficient remittances and cross‑currency settlements. �

Binance Academy

DeFi Integrations: High throughput and customized gas make Plasma attractive for stablecoin‑heavy DeFi protocols and liquidity pools. �

AInvest

Institutional Cash Management: Enterprise treasury operations benefit from predictable, low‑cost stablecoin rails. �

eco.com

Payment Infrastructure: Plasma’s blueprint positions it as a backbone for apps requiring consistent, high‑volume transactions.

Looking forward, continued ecosystem growth — from enhanced privacy modules to wider developer adoption — will determine how Plasma transitions from launch hype to sustained production usage.

Conclusion

Plasma ($XPL) represents a compelling case of focused blockchain engineering: a stablecoin‑optimized Layer‑1 with both institutional and retail backing. By blending EVM compatibility, zero‑fee stablecoin rails, cross‑chain bridges, and strong exchange integration via Binance and Binance Square programs, it has created a multi‑dimensional platform for next‑generation digital finance. Its long‑term success will depend on real‑world adoption, technical execution, and the ability to scale securely within a crowded blockchain landscape.