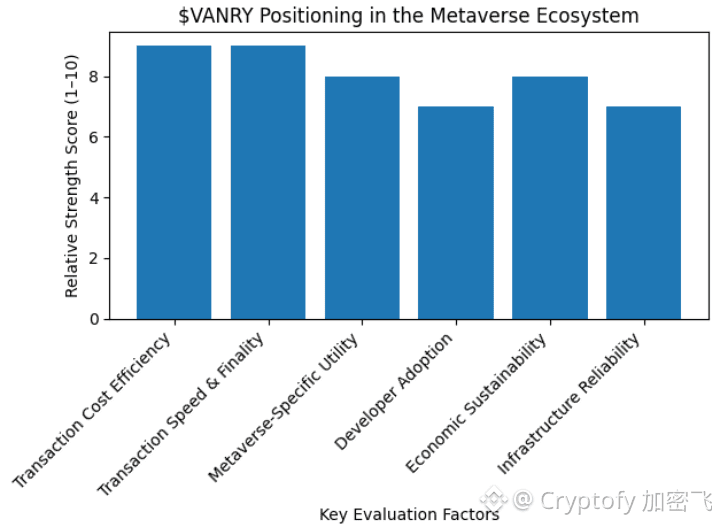

The metaverse infrastructure landscape resembles the early days of mobile app development, when developers had to choose between building native applications for specific platforms or creating cross-platform solutions that sacrificed performance for compatibility. Vanar Chain's $VANRY token has begun attracting attention within this fragmented ecosystem precisely because it addresses a specific pain point that generalist blockchain networks struggle to solve: the economic and technical requirements of persistent virtual worlds. Unlike speculative metaverse tokens tied to single games or platforms, $VANRY functions as the economic rails for an entire blockchain infrastructure designed around the technical demands of 3D environments, real-time interactions, and complex digital asset ownership. The token's growing relevance stems from Vanar Chain's architectural decisions that prioritize transaction throughput and cost predictability over pure decentralization, a tradeoff that makes considerably more sense for metaverse applications where users expect seamless experiences comparable to traditional gaming rather than tolerance for network congestion and variable gas fees. This positioning has attracted partnerships with established gaming studios exploring Web3 integration, entities that require enterprise-grade reliability and cost structures incompatible with Ethereum mainnet economics or even some Layer 2 solutions during peak usage periods. The practical differentiation becomes evident when examining actual use cases: a metaverse platform processing thousands of microtransactions per minute for in-world item transfers, avatar customizations, or virtual real estate modifications cannot function economically on networks where individual transaction costs might exceed the value being transferred. Vanar Chain's sub-cent transaction costs and near-instant finality create an economic environment where these interactions become viable, positioning $VANRY as the medium facilitating this activity rather than merely a speculative asset riding metaverse narratives.

The token's utility framework within metaverse contexts extends beyond simple payment rails into more sophisticated economic mechanisms that mirror how successful gaming economies operate. Metaverse platforms built on Vanar Chain can implement $VANRY-denominated marketplaces where creators sell digital assets, virtual landowners collect rent or admission fees, and players trade resources earned through gameplay, creating circular economic flows that generate consistent token demand independent of speculative trading activity. The staking mechanisms allow metaverse projects to reward long-term participants and community members who contribute to virtual world governance, replicating proven Web2 gaming loyalty systems while adding genuine ownership through blockchain verification. This design philosophy acknowledges a fundamental truth about metaverse economics that many blockchain projects ignore: users care primarily about their virtual world experience and only secondarily about the underlying blockchain, meaning the infrastructure must become nearly invisible while the economic benefits remain tangible. Governance participation through VANARY holdings enables stakeholders across different metaverse projects built on Vanar Chain to influence protocol-level decisions affecting all connected virtual worlds, creating coordination mechanisms more sophisticated than individual project DAOs but more focused than general-purpose blockchain governance. The security model supporting these metaverse economies relies on validator infrastructure designed for consistent uptime and DDoS resistance rather than maximizing decentralization, recognizing that metaverse users experiencing downtime or lag will simply abandon platforms regardless of their philosophical commitment to decentralization principles. This pragmatic approach has resonated with traditional gaming companies evaluating blockchain integration, entities that measure success through user retention metrics and revenue generation rather than ideological alignment with cryptocurrency principles.

Current metrics reveal $Vanary's position as an emerging metaverse infrastructure token rather than an established category leader. Trading volumes fluctuate between several million to occasionally reaching double-digit millions in daily turnover across centralized exchanges, providing adequate liquidity for projects building on Vanar Chain but remaining substantially below major gaming tokens or metaverse platforms with years of operational history. The circulating supply continues expanding through scheduled unlocks, with roughly 40-50% of the 2.7 billion maximum supply currently available, creating ongoing dilution pressure balanced against ecosystem growth and increasing utility. Security considerations for metaverse applications on Vanar Chain involve both protocol-level validator security and application-layer protections against exploits targeting digital asset ownership, smart contract vulnerabilities, or economic manipulation of in-game markets, areas where the team has implemented auditing requirements and developer guidelines. Governance remains relatively centralized during this growth phase, with foundational decisions guided by the core team while community input channels develop alongside the expanding user base. The community surrounding VANRY concentrates heavily within gaming and metaverse development circles rather than broader cryptocurrency investment communities, attracting builders focused on virtual world creation, digital asset designers, and gaming studio personnel exploring blockchain integration possibilities.

Conclusion

The attention $VANRY receives within metaverse development communities stems from Vanar Chain's deliberate optimization for virtual world requirements rather than general-purpose blockchain applications. Whether this focused approach translates into sustained relevance depends entirely on the platform's ability to attract and retain successful metaverse projects that generate genuine user activity beyond initial launches. The token's value proposition rests on a testable hypothesis: that metaverse applications require specialized blockchain infrastructure with different performance characteristics than DeFi protocols or general NFT platforms, and that builders will choose purpose-built solutions over adapting generalist networks. Early traction suggests this thesis resonates with some segment of metaverse developers, though the ultimate verdict requires years of operational data showing whether these virtual worlds achieve the persistent user engagement and economic activity that justify dedicated blockchain infrastructure.