Privacy in crypto has always sounded like freedom. The idea that you could move money without anyone watching felt powerful to many people especially those who came into this market early. But after watching many projects grow struggle and even disappear a deeper truth is now hard to ignore. In real financial systems proof matters more than disappearing completely from view. And this shift is exactly where Dusk is quietly placing itself.

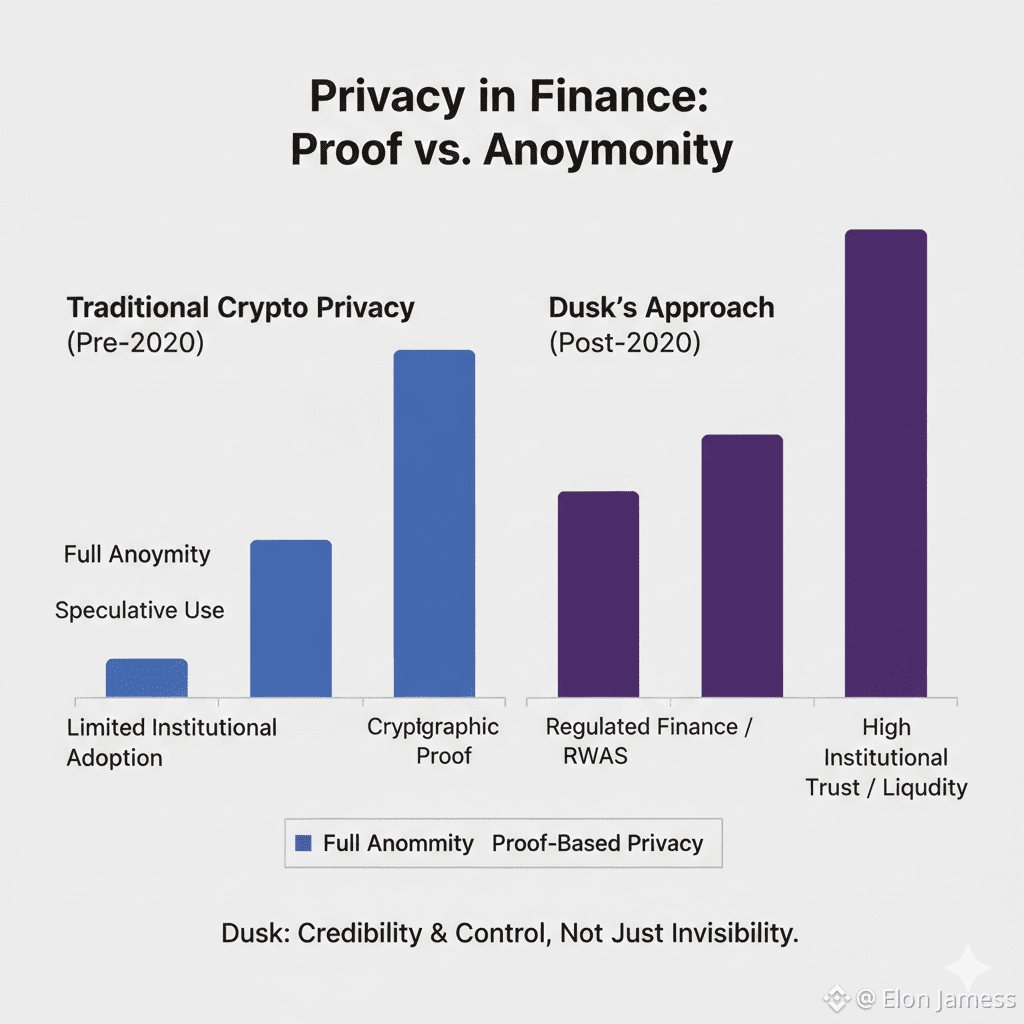

Most blockchains began with the belief that transparency was enough. Every transaction could be seen every balance could be traced. For speculation this worked well. People could watch wallets and follow trades and that served short term trading activity. But for real finance this approach did not work. Institutions funds and serious long term investors do not want their positions strategies or counterparties exposed on a public ledger for all to see.

At the same time regulators are not willing to accept systems that cannot show basic legality and legitimacy. This is where many privacy focused chains hit a wall. Complete anonymity may sound ideal until it stops people from joining. When a network cannot prove that transactions follow legal and financial rules without showing sensitive data exchanges become cautious institutions stay away and liquidity remains limited. Over time users drift away not because the technology is bad but because the ecosystem never grows up and this is a retention problem that many privacy chains rarely talk about.

Dusk approaches privacy in a different way. Instead of trying to hide everything forever it focuses on cryptographic proof. Transactions remain confidential but the system can still show that rules are followed and that the transactions are valid. This detail may sound small but it changes everything. With zero knowledge proofs built into the core design Dusk lets someone demonstrate that a transaction is correct compliant and properly structured without exposing who is involved or the financial details.

This matters more than many traders realize. Markets are not just charts and price action. They are networks of trust. Liquidity comes from participants who feel safe operating at scale. When funds asset issuers and financial institutions look at a blockchain they ask one question first. Can this system protect sensitive data while still standing up to audits and regulation? Dusk was built to answer yes.

The technical architecture supports this idea. Privacy is not something added later. It is part of the base layer. Dusk has confidential smart contracts private asset issuance and selective disclosure all built into its core. Instead of forcing users to choose between privacy and legitimacy Dusk treats proof as the bridge between the two.

A simple real life comparison helps explain it. Imagine two marketplaces. In the first no one knows who anyone is and there is no way to verify whether trades are legal. Activity may increase early on but serious participants eventually leave. In the second participants remain private but the system can prove that trades meet standards when required. Over time the second marketplace attracts deeper capital more stable activity and long term users. Dusk is building the second type.

Recent developments in the network reinforce this direction. The ecosystem has been moving toward real world financial use cases rather than speculative novelty. Privacy preserving asset issuance regulated trading frameworks and compliance friendly infrastructure are no longer theoretical goals. They are actively being built and tested. This shows long term involvement rather than short term hype.

From an investor perspective this design choice reduces risk in a way that is easy to overlook. Networks that depend on absolute anonymity face constant uncertainty around access listings and legal pressure. Networks built around proof can adjust to the rules. They can work with traditional finance without giving up their core values. That ability to adapt is often what determines which projects survive many market cycles.

There is also an emotional side to this shift. Many early crypto users connect regulation with control and loss of freedom. That fear is understandable. But proof does not mean surrender. It means maturity. It means building systems that protect individuals while allowing the broader economy to interact safely. Dusk does not reject privacy ideals. It refines them into something sustainable.

Retention is where this difference becomes clear. Users stay where there is liquidity development and relevance. Developers build where there is clarity and capital flows where risk is understood. Privacy chains that ignore this reality struggle to keep momentum. Dusk emphasis on proof creates an environment where users can remain private without isolating themselves from the financial world.

The broader trend is clear. Markets are moving toward privacy with accountability. Traders may not see it in daily price charts but it shows up in who is building who is partnering and who is willing to commit long term resources. Dusk sits in that transition zone not chasing extremes but solving the problem many projects avoid.

If you are evaluating privacy focused assets it is worth looking beyond surface stories. Ask how privacy is achieved. Ask whether the system can prove compliance without exposing users. Ask whether institutions could realistically operate there five years from now. These questions matter more than slogans.

Dusk approach suggests a future where privacy is not about hiding from the world but participating in it on your own terms. That difference may not move prices overnight but it is exactly the kind of foundation that lasts through many market cycles. In a space where many projects promise invisibility Dusk quietly focuses on credibility. And in real financial systems credibility is what keeps people coming back.