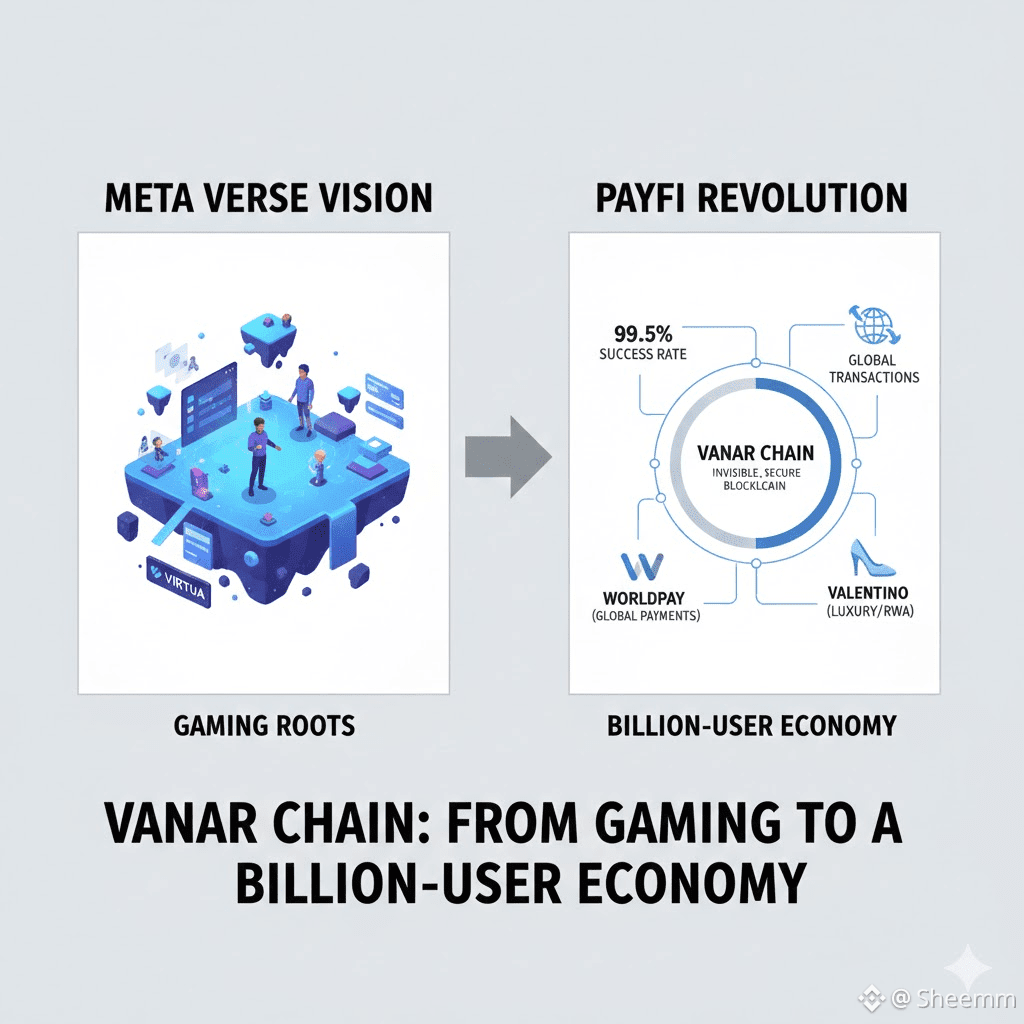

The blockchain landscape is littered with projects that struggled to find mainstream adoption often trapped in the "crypto echo chamber." But what if a project originally known for its immersive metaverse experiences quietly pivoted to build the invisible infrastructure for a billion-user market? Enter Vanar Chain (formerly Virtua), a project that has strategically evolved from its gaming-centric roots to become a powerhouse in the PayFi (Payment Finance) sector, seamlessly integrating Web3 utility into everyday transactions.

This isn't just a rebrand; it's a fundamental reimagining of purpose. Vanar Chain's 2026 trajectory reveals a deliberate shift leveraging its robust underlying technology to solve real-world payment friction and onboard users without them ever needing to understand private keys or gas fees.

THE GENESIS: A METAVERSE VISION (VIRTUAL)

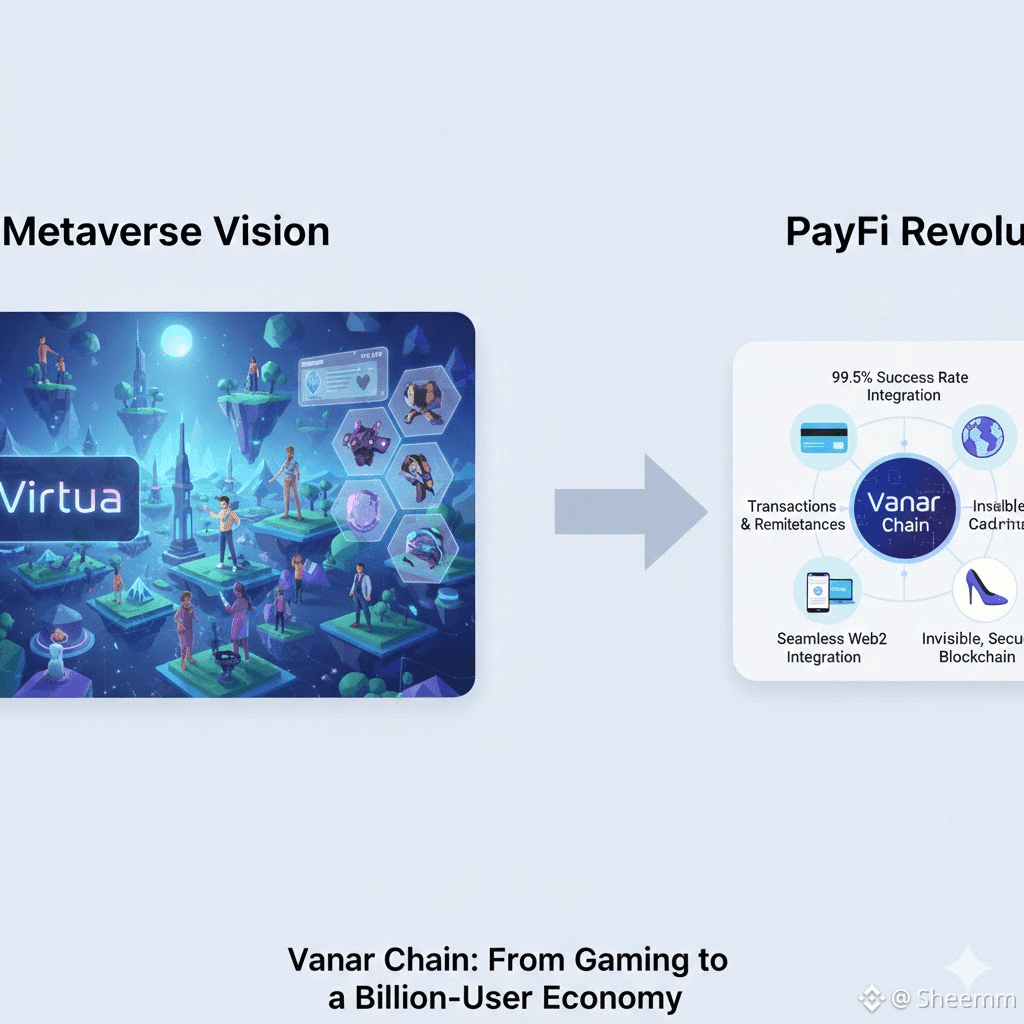

Before its metamorphosis Vanar was known as Virtua, a promising metaverse platform. It aimed to create an interactive digital world where users could own virtual land collectibles, and engage in social experiences. This era was crucial for Vanar's technological development pushing the boundaries of on-chain asset ownership and high-fidelity digital rendering. While the vision was grand the broader market for metaverse adoption remained nascent hinting at the need for a more immediate impactful application of its underlying tech.

THE PIVOT: IDENTIFYING THE "BILLION-USER PROBLEM"

Vanar's leadership recognized a critical bottleneck in Web3 adoption: complexity. For blockchain to reach a billion users it couldn't demand a change in user behavior. It needed to integrate seamlessly into existing financial rails making the underlying technology invisible. The most ubiquitous "killer app" in the world? Payments.

This realization catalyzed the pivot. Vanar began re-architecting its focus to address the pain points of modern payment systems: high fees, slow settlement, and the fragmented nature of global transactions. Their goal: leverage blockchain's efficiency and transparency to create a more robust, cost-effective and user-friendly payment infrastructure.

THE INVISIBLE INFRASTRUCTURE: POWERING PayFi

Vanar's strategy in PayFi is not to replace traditional payment providers but to enhance and optimize them. By integrating directly with established financial networks, Vanar offers a powerful backend solution that improves efficiency without requiring users to interact with crypto directly.

* CREDIT CARD INTEGRATION (99.5% SUCCESS RATE): One of Vanar's most significant achievements is its near-perfect success rate in integrating with traditional credit card processing. This means consumers can make purchases using their existing credit cards while Vanar's blockchain handles the settlement, reconciliation and value transfer more efficiently behind the scenes. For the end-user it's just a normal transaction; for businesses it means lower costs and faster access to funds.

* GLOBAL TRANSACTION EFFICIENCY: Traditional cross-border payments are notoriously slow and expensive. Vanar's blockchain, with its high-speed and low-cost transaction capabilities, offers a compelling alternative for international remittances and business-to-business payments. By streamlining these processes, Vanar significantly reduces friction and costs, especially in emerging markets where efficient payment rails are critical for economic growth.

* SEAMLESS WEB2 INTEGRATION: The key to reaching a billion users is eliminating the Web3 learning curve. Vanar focuses on providing APIs and SDKs that allow existing Web2 applications and services to tap into its blockchain functionality effortlessly. This "invisible blockchain" approach means that a user completing an online purchase, paying a utility bill, or sending money to a friend could be leveraging Vanar's technology without even realizing it.

STRATEGIC PARTNERSHIPS: THE VALIDATOR NETWORK

Vanar's move into PayFi is underscored by its growing network of strategic validators which include major players like Worldpay and luxury brands like Valentino.

* WORLDPAY: As a global leader in payment processing, Worldpay's involvement as a validator on the Vanar Chain is a monumental endorsement. It signifies that Vanar's technology meets the stringent requirements for security, scalability, and reliability demanded by enterprise-level payment solutions. This partnership opens the door for Vanar to integrate its efficient blockchain settlement into countless transactions processed by Worldpay daily.

* VALENTINO: While seemingly disparate from payments, a luxury brand like Valentino as a validator highlights another critical aspect of Vanar's utility: REAL-WORLD ASSETS (RWA) TOKENIZATION AND SUPPLY CHAIN INTEGRITY. By leveraging Vanar, brands can tokenized high-value goods, ensuring authenticity, tracking provenance, and combating counterfeiting. This also extends to payments within luxury ecosystems, where secure and verifiable transactions are paramount.