Imagine standing on the edge of a new financial frontier. Behind you is a world of slow settlement cycles, opaque intermediaries, and financial systems that groan under the weight of centuries‑old legacy. Ahead of you is a horizon bright with potential — where markets settle instantly, privacy isn’t a luxury but a right, and regulated finance isn’t an obstacle but a canvas for innovation.

This is the audacious vision that Dusk — the privacy‑centric, regulation‑aware blockchain born in 2018 — set out to realize, and in 2026, that vision is no longer some distant foreshadowing. It’s real, it’s live, and it’s starting to rewrite how we think about money, markets, and trust.

At the heart of Dusk is a simple yet electrifying idea: what if you could build a blockchain that’s not just decentralized, not just fast, not just programmable — but compliant with real financial laws, and private by design? Meant for regulated markets, designed around institutional standards, and fueled by deep cryptographic innovation, Dusk has always been different. It wasn’t chasing fleeting trends; it was building a new financial infrastructure — one that could actually serve the backbone of global finance. �

DOCUMENTATION

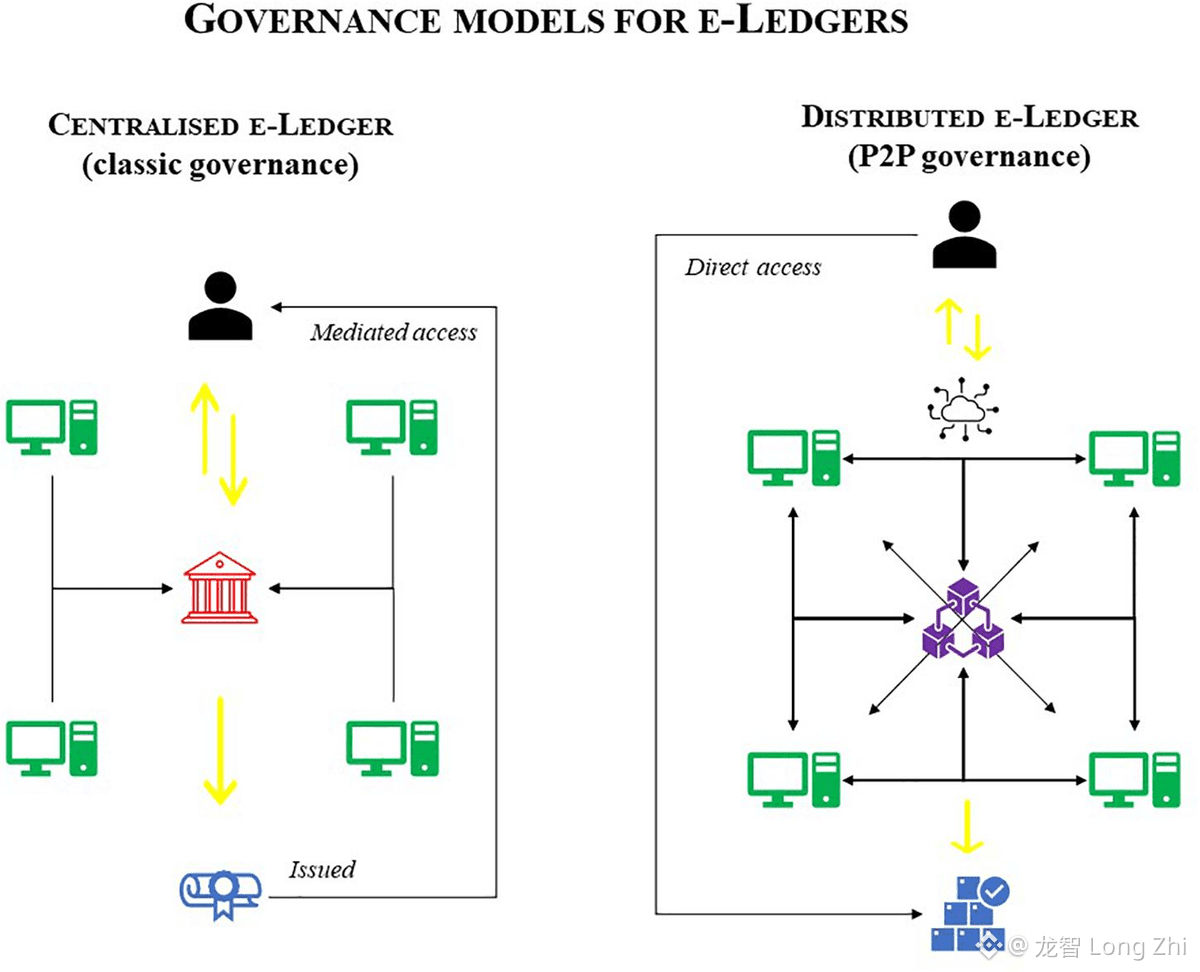

For years, most blockchains fell into one of two camps: permissionless chaos with privacy but no compliance, or regulated systems with compliance but no transparency or decentralization. Dusk chose neither of these extremes. Instead, it carved a third path — one that threaded privacy, compliance, and real‑world utility into a unified tapestry. Simply put, Dusk is a Layer 1 blockchain built for regulated financial markets, where institutions can issue, trade, settle, and manage tokenized assets within a framework that answers the legal world’s toughest questions. �

DOCUMENTATION

The journey to that point was anything but linear.

In the earliest chapters, the Dusk team quietly built and tested core technologies that would eventually become the backbone of the system. They released testnets like DayBreak, letting developers and curious observers interact with a blockchain that supported privacy‑preserving smart contracts, fast settlement, and compliance‑ready workflows — long before most of the industry had even recognized these needs as critical. These weren’t flashy launches aimed at headlines; they were practical milestones in a long‑distance race. �

Dusk Network

Those early systems laid the groundwork for more than just functionality; they established a belief system. Dusk was telling the world, “We aren’t here to disrupt finance recklessly. We’re here to rebuild it thoughtfully.” And this ethos carried through every line of code, every architectural decision, and every strategic partnership.

The first transformative moment came when Dusk announced that it would launch a mainnet capable of supporting regulated financial infrastructure — not just crypto speculation. After years of iteration, testing, retooling, and even rebuilding large parts of the protocol to satisfy evolving regulatory demands, the day finally arrived: the Dusk mainnet officially went live, signaling a seismic shift in what blockchain could accomplish. �

Dusk Network

But launching wasn’t the end. In fact, it was just the beginning. The mainnet launch — scheduled for September 20th — wasn’t merely about producing blocks. It was about unlocking a living, breathing ecosystem that could finally deliver on the audacious promise of a privacy‑first, compliance‑ready financial infrastructure. This launch included not only a decentralized wallet and network explorer but also the ability for third‑party developers to build applications on a network that marries cryptographic privacy with legal accountability. �

Dusk Network

Imagine that for a moment: on one blockchain, you can issue a token representing a real share of a European bond, trade it with counterparty privacy intact, and settle the transaction instantly — all while staying within the boundaries of real financial law. That’s not science fiction. That’s what Dusk is architected to do.

From the very moment the mainnet began producing immutable blocks, a new chapter — the post‑mainnet era — began to unfold, and with it, the roadmap accelerated into full motion. Now, instead of developmental promises, there were deliverables with real economic impact.

Among the first of these was Hyperstaking — a truly novel concept where smart contracts themselves can participate in staking. Traditionally, staking has been something only wallets or validators could do. But with Hyperstaking, you can embed complex logic into staking — imagine pools that distribute rewards based on referral programs, or automated strategies that dynamically reinvest. This transforms staking from a passive activity into a programmable financial primitive. �

Dusk Network +1

Then came Zedger Beta — the first public version of Dusk’s asset protocol designed not just for token issuance but for privacy‑preserving, compliant tokenization of real‑world assets like stocks, bonds, and even real estate. This isn’t about minting memecoins. This is about digitizing entire financial markets in a way that respects privacy and regulatory standards. �

Dusk Network

As if that wasn’t enough to stir the imagination, Dusk also unveiled Lightspeed — a fully EVM‑compatible Layer 2 network that settles on Dusk’s Layer 1. What does that mean in plain language? It means developers from across the Ethereum ecosystem can build familiar smart contracts that run with the privacy, compliance, and performance advantages of Dusk’s base layer beneath them. This is interoperability, not as a buzzword, but as a practical bridge between two worlds. �

Dusk Network

And then there is Dusk Pay, a payment circuit built with electronic money tokens (EMTs) that enables regulatory‑compliant transactions for businesses and individuals alike. It’s a glimpse into a future where digital payments are not just fast and cheap, but also fully compliant with laws like MiCA — something traditional stablecoins and payment networks still struggle to achieve. �

Dusk Network

Let’s pause here, because this is where the narrative becomes genuinely thrilling. What once was a theoretical attempt to bring privacy and compliance together is now an unfolding reality where entire financial ecosystems can be built, traded, and settled on‑chain with unprecedented flexibility and legal safety. For developers, institutions, and end users — it’s like being handed the first set of tools for a digital financial renaissance.

Beyond raw technology, Dusk’s journey is also a story of strategic ecosystem building. Partnerships with licensed entities such as NPEX — a regulated Dutch multilateral trading facility — signal that this network isn’t just about code; it’s about real markets, real assets, and real legal frameworks. These collaborations anchor Dusk’s ambitions in the tangible world of regulated finance, bridging the gulf between traditional markets and decentralized technologies. �

CoinMarketCap

But perhaps the most fascinating part of this entire journey is something less tangible: the shift in mindset. For years, blockchain was synonymous with decentralization alone. But Dusk asks a different question: What if you could have decentralization without sacrificing privacy, without risking regulatory backlash, and without forcing institutions to choose between legality and innovation? In answering this question, Dusk is not just building software — it’s pioneering a new philosophy of digital finance.

As you look ahead into 2026 and beyond, the roadmap before Dusk is not just a list of technical milestones. It’s a story of transformation — of real markets moving on‑chain, of privacy and compliance no longer being enemies, and of financial infrastructure being remade for a new age. The destination may still hold surprises, but one thing is certain: the journey of Dusk is no longer a quiet experiment. It’s a thrilling, unfolding adventure — one that may very well define the next chapter in how we think about money, trust, and technology.@Dusk #dusk #Dusk $DUSK