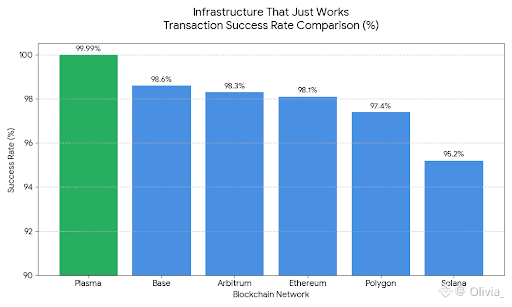

@Plasma exists because most blockchains were never stress-tested for everyday money movement. They work well when activity is low or when users are willing to pay extra for priority, but payments don’t work that way. Payments need consistency. Fees need to stay low even during peak usage, and settlement needs to be predictable. Plasma is built around those assumptions.

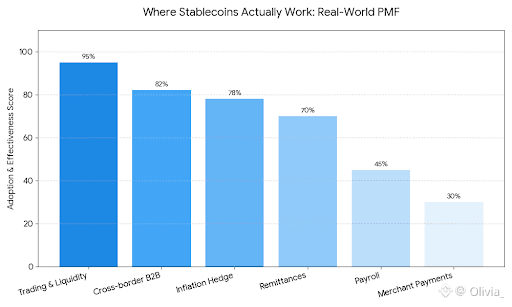

Stablecoins already function as digital cash for millions of people, especially in regions where traditional banking is slow, expensive, or unreliable. Yet the infrastructure behind them often adds friction through congestion and volatile fees. Plasma’s design starts with the idea that stablecoins are not an edge case but the main product. Everything else is secondary.

One of Plasma’s most important choices is focusing on throughput and efficiency rather than feature overload. Payments don’t require complex execution paths or endless customization. They require a system that works the same way every time. By narrowing its scope, Plasma can optimize the parts of the stack that matter most for high-volume transfers.

EVM compatibility plays a quiet but important role here. Developers don’t need to learn a new environment or abandon existing tools. Wallets, payment processors, and applications can integrate Plasma without rebuilding everything from scratch. This lowers friction for adoption while keeping the network flexible enough to support real products.

Another overlooked aspect of payments is trust in the system itself. Users and businesses need confidence that the network won’t degrade under pressure. Plasma’s architecture is designed to stay stable during high demand, avoiding the sudden fee spikes and delays that make blockchain payments unreliable in practice.

The XPL token supports this system by aligning incentives around network health rather than speculation. Its role is tied to validation, security, and long-term sustainability. This keeps the focus on keeping the network functional, not just active.

Plasma is not trying to be the loudest chain in the room. It doesn’t rely on constant announcements or shifting narratives. Its value comes from being useful, especially in situations where reliability matters more than innovation for innovation’s sake.

If stablecoins continue to grow as a neutral form of global money, the infrastructure behind them will matter more than the apps built on top. Plasma is positioning itself as that invisible layer, not something users think about, but something they depend on.

That’s what real financial infrastructure looks like. It works quietly, consistently, and at scale.