The Definitive Guide to Plasma: How Zero-Fee Architecture and Bitcoin Security Are Redefining Digital Finance in 2026

The cryptocurrency landscape of 2026 is vastly different from the fragmented ecosystem of just a few years ago. Users today demand more than just decentralized promises; they require speed, absolute security, and, perhaps most importantly, an economic model that mirrors the seamlessness of traditional finance. In this rapidly maturing market, one Layer-1 blockchain has surged ahead by solving the industry’s most persistent bottleneck: transaction fees on stablecoins. That blockchain is Plasma.

With the recent activation of key integrations and a skyrocketing Total Value Locked (TVL), Plasma has transitioned from a promising concept to a dominant infrastructure layer. By effectively merging the flexibility of Ethereum’s Virtual Machine (EVM) with the unshakeable security of Bitcoin, @undefined is carving out a unique lane in the Web3 world. This article explores the technological innovations, recent strategic moves, and future roadmap that have positioned Plasma and its native token, $XPL, at the forefront of the 2026 bull market.

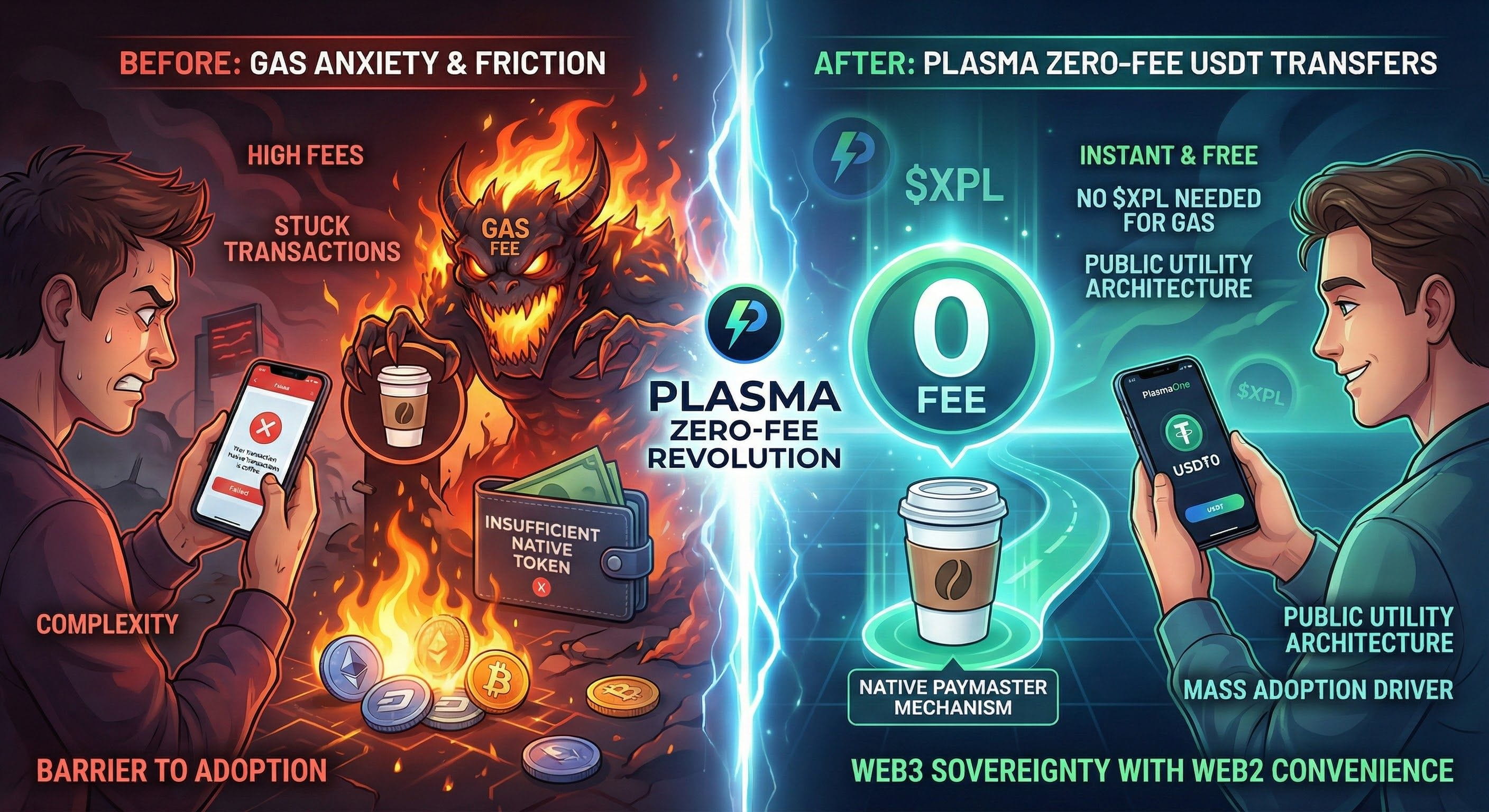

The End of Gas Anxiety: Zero-Fee USDT Transfers

For over a decade, the concept of "gas fees" has been the single largest friction point for onboarding mass users. Imagine trying to buy a coffee with digital currency, only to find the transaction fee costs more than the drink itself, or worse, realizing you are stuck because you lack the specific native token required to pay for the network cost.

Plasma has radically dismantled this barrier through its innovative implementation of a native paymaster mechanism. This system allows users to send and receive USD₮0—the network’s native stablecoin—without ever needing to hold $XPL or any other token for gas. The network abstracts the fee layer entirely for the end-user. This is not just a UI trick; it is a fundamental architectural change. By treating stablecoin transfers as a public utility subsidized by the network’s unique economic design, Plasma has created an environment where digital cash finally behaves like physical cash: instant and free to hand over.

This "Zero-Fee" narrative has been the primary driver behind the network’s explosive adoption since the Mainnet Beta launch in September 2025. For developing nations and high-frequency traders alike, the ability to move value without calculating overhead is a game-changer. It has turned PlasmaOne, the ecosystem’s flagship neobank interface, into a genuine competitor against traditional fintech apps, bridging the gap between Web2 convenience and Web3 sovereignty.

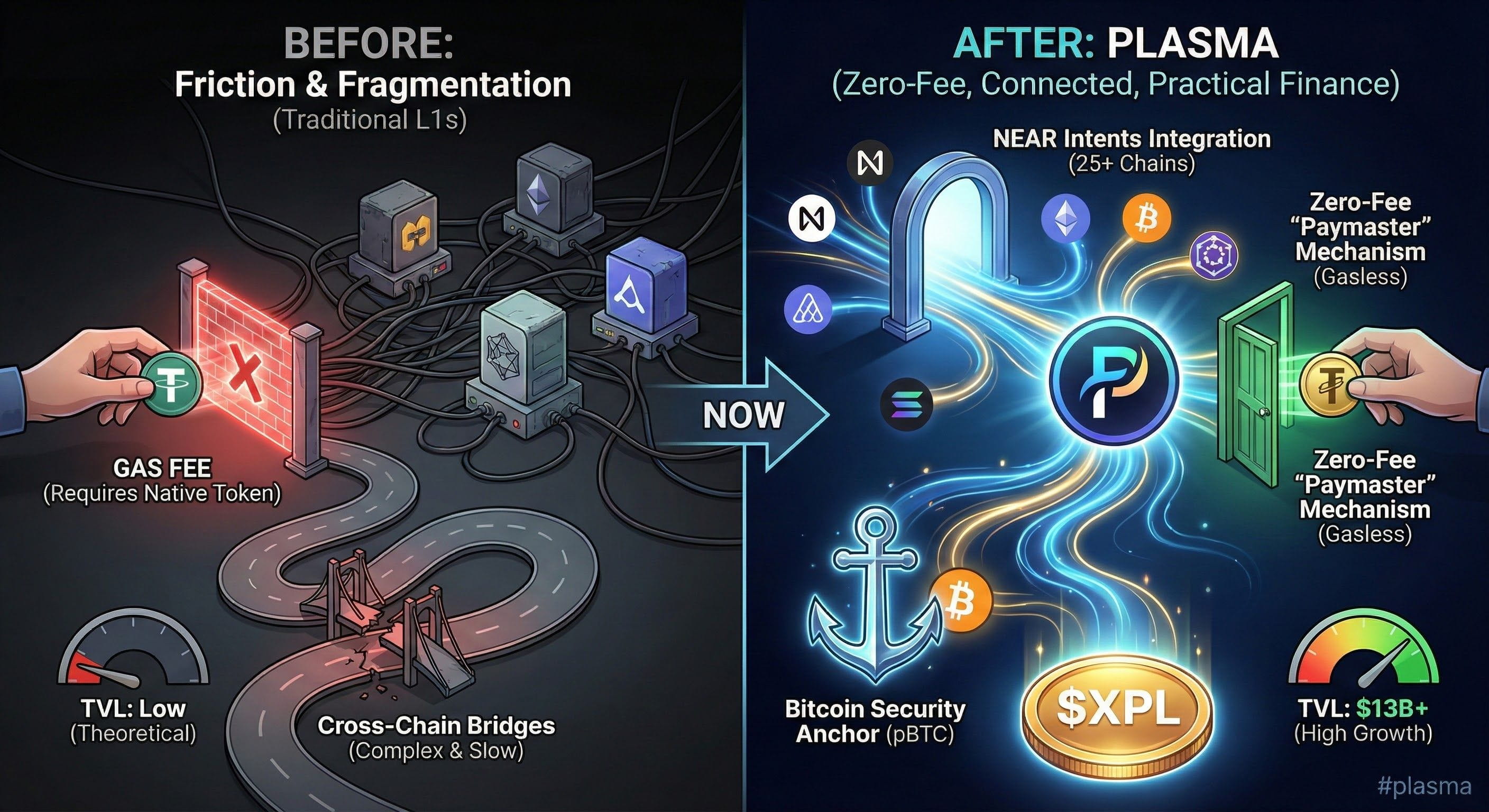

Architecture: Anchoring to Bitcoin While Speaking Ethereum

Historically, blockchains had to choose between security and flexibility. Bitcoin offered the former, while Ethereum offered the latter. Plasma refuses to compromise. The network is fully EVM-compatible, meaning that any application, smart contract, or tool built for Ethereum can be deployed on Plasma with zero code changes. This has allowed a flood of developers to migrate their dApps to Plasma, seeking the user-friendly zero-fee environment.

However, the true engineering marvel lies in how Plasma secures this activity. The network utilizes a trust-minimized bridge to anchor its finality to the Bitcoin blockchain. This allows for the creation of "pBTC" or Programmable Bitcoin. Unlike previous wrapped versions of Bitcoin that relied on centralized custodians, pBTC on Plasma inherits the security properties of the Bitcoin network while gaining the programmable superpowers of smart contracts. This fusion has unlocked billions of dollars in dormant Bitcoin capital, bringing it into the decentralized finance (DeFi) ecosystem to earn yield, collateralize loans, and power payments, all within the Plasma environment.

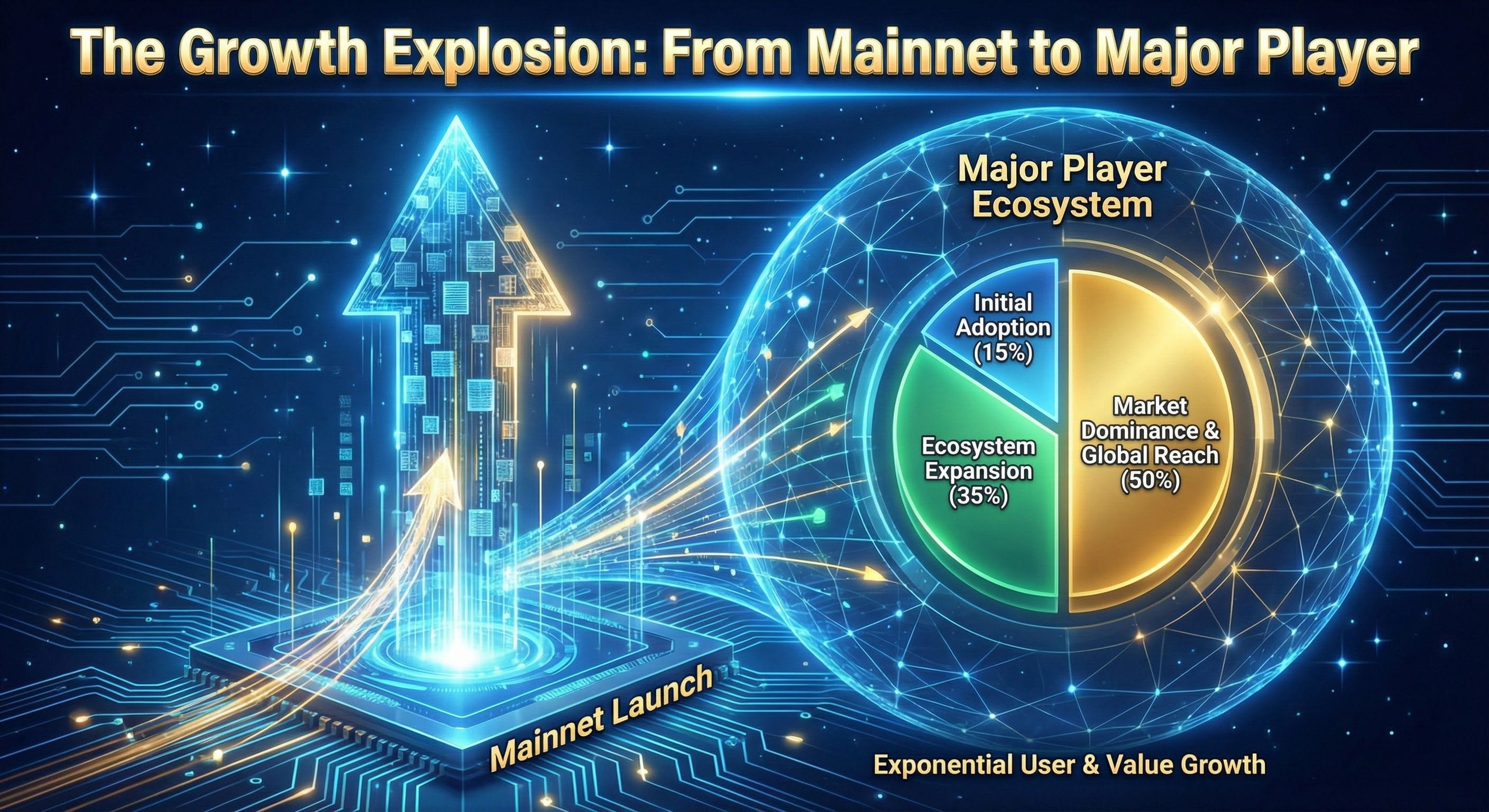

The Growth Explosion: From Mainnet to Major Player

The trajectory of Plasma since late 2025 has been nothing short of historic. When the Mainnet Beta activated the "PlasmaBFT" consensus mechanism in September 2025, the industry watched closely. The results were immediate. The network attracted over two billion dollars in Total Value Locked (TVL) almost instantly.

But the momentum did not stop there. As word spread of the reliable uptime and the cost-saving benefits of the paymaster mechanism, liquidity poured in from other Layer-1s and Layer-2s. By January 2026, the TVL had swelled to over thirteen billion dollars. This metric is significant not just for its size, but for its composition. A massive portion of this value is held in stablecoins, making Plasma one of the top blockchains globally by stablecoin supply. This deep liquidity creates a flywheel effect: deep liquidity attracts traders, traders attract builders, and builders create use cases that attract more users.

Breaking Down Silos: The NEAR Intents Integration

In the modern multi-chain world, isolation is a death sentence. Recognizing this, the Plasma team executed a strategic integration on January 23, 2026, connecting to the NEAR Intents cross-chain network. This was a critical maturity milestone for the ecosystem.

The integration expands Plasma’s reach to over twenty-five different blockchains. It solves the fragmentation issue that plagues many high-performance chains. Now, liquidity can flow seamlessly between Plasma and other major networks without the user needing to navigate complex bridges or worry about wrapped asset de-pegging risks. For holders of XPL and users of USD₮0, this means tighter spreads and better pricing when swapping assets. It effectively turns Plasma into a liquidity hub that is plugged into the wider crypto economy, rather than a walled garden.

Empowering the Community: The Binance CreatorPad Campaign

Technology alone does not build a movement; people do. Understanding this, Plasma launched a massive incentive program on January 16, 2026, via the Binance CreatorPad. The campaign allocated 3.5 million XPL tokens specifically to boost community engagement and content creation.

This initiative has sparked a renaissance of grassroots marketing and education. Creators across Binance Square and other social platforms are now actively producing tutorials, analysis, and guides on how to leverage the Plasma network. This "human layer" of the protocol is essential for translating complex technical achievements like PlasmaBFT into understandable benefits for the average investor. The surge in social volume and engagement metrics for #plasma since the campaign launch indicates that the strategy is working, creating a vibrant, distributed marketing team that is incentivized to see the network succeed.

The Road Ahead: Staking and Supply Dynamics

As investors look toward the rest of 2026, the roadmap for Plasma is packed with high-impact catalysts. The immediate focus for Q1 2026 is the activation of Staking and Delegation. This feature is eagerly anticipated by the community, as it will allow XPL holders to participate directly in network security and earn rewards for doing so. This transition is expected to lock up a significant percentage of the circulating supply, potentially reducing sell pressure while increasing network decentralization.

Further down the line, July 2026 is marked on every analyst’s calendar. It is scheduled for a major token unlock of 2.5 billion tokens for early investors. While token unlocks are often viewed with caution, the Plasma team has been transparent about the schedule, and the market absorption of XPL suggests strong demand that may counterbalance the increased supply. The deep liquidity and high utility of the token as a governance and staking instrument are designed to absorb these shocks, turning potential volatility into distribution opportunities for new entrants.

Conclusion

Plasma represents the maturation of the blockchain promise. It has moved beyond the theoretical discussions of scalability and interoperability to deliver a live, high-value network that solves real user pain points. By eliminating transaction fees for stablecoins, anchoring security to Bitcoin, and aggressively expanding its interoperability through NEAR, Plasma is building a financial railroad for the next generation of the internet.

For users tired of high fees and complexity, Plasma offers a refreshing alternative. For developers, it offers an EVM-compatible playground with a massive, active user base. And for the broader crypto market, the rise of $XPL signals a shift toward utility-driven value. As the network marches toward its staking launch and continues to integrate with global finance, Plasma is not just participating in the 2026 bull run—it is helping to lead it.

Strategic Outlook

The combination of zero-fee mechanics and Bitcoin-grade security positions Plasma uniquely in the Layer-1 wars. As the network evolves through 2026, the activation of staking will be the next major stress test and opportunity for value capture.