DeFi started out like a public experiment. And honestly, that was the magic. You could look at the chain and see everything: the trades, the liquidations, the whale moves, the weird exploits, the brilliant ideas—right there in the open. No closed doors, no “trust us,” no hidden accounting.

But the more DeFi grew up, the more that radical transparency started behaving like a flaw.

Because finance isn’t a reality show. And when everyone can watch every move you make, some people stop being “observers” and start being predators.

That’s the real reason private DeFi is catching fire again. Not because the industry suddenly wants secrecy for fun, but because DeFi is learning a hard lesson: if you force everything into public view, you create a system where the smartest players don’t just compete—they extract. And regular users pay the bill.

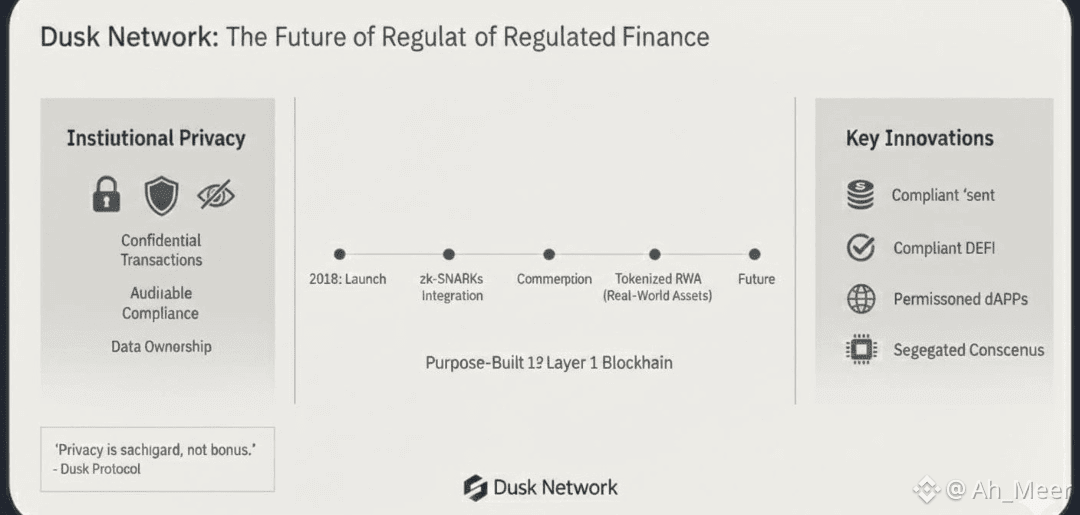

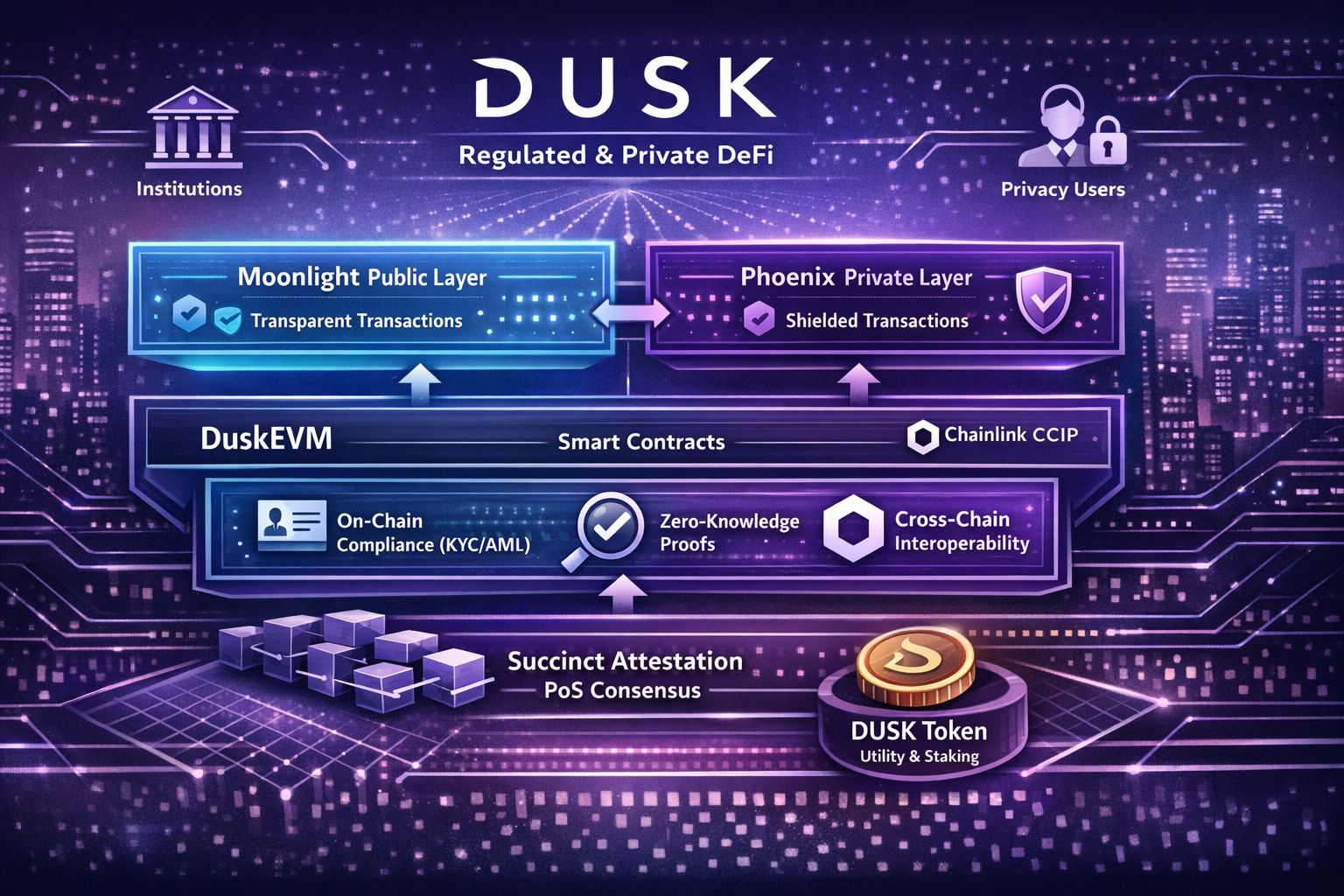

This is where Dusk comes into the picture. A lot of projects talk about privacy. Dusk is one of the ones built around the idea that privacy should actually work inside DeFi itself—inside contracts, inside markets, inside the stuff that matters—not just as an optional “shielded transfer” on the side.

Why privacy is becoming a real DeFi requirement (not a luxury)

People hear “private DeFi” and their brain jumps straight to: hiding transactions. That’s not wrong, but it’s incomplete. The bigger story is that transparency is expensive now.

Here’s how it shows up in real life:

If your trade is visible, someone can trade against you

In many DeFi setups, your intention leaks. You’re trying to swap a decent size position? Others can see it and position themselves to profit off your move. You’re about to do something that’ll shift liquidity? People can anticipate it. That’s why MEV exists—because the system gives people a preview of your action, and the fastest or most connected actors can get in front of you.

Privacy, even partial privacy, closes that “preview window.” It changes the economics. It turns extraction strategies into harder, riskier games instead of easy money.

If your position is visible, your weakness is visible

Lending protocols are a perfect example. If the world can see your collateral, your debt, your health factor, and your liquidation point, you basically become a target. You’re not just managing your own risk; you’re managing other people’s behavior around your risk.

Private state—where sensitive position details aren’t broadcast—doesn’t break risk rules. It just stops you from being hunted.

If your wallet is visible, you’re permanently trackable

Even if you don’t care about “privacy” in the abstract, it gets old fast when:

your trading history becomes your identity,

your holdings can be mapped,

your profit becomes a magnet for copy-traders,

your losses become a signal for liquidation bots.

This is the part people don’t say out loud: transparent ledgers can be psychologically exhausting. You feel watched, even when no one is actively watching.

Institutions can’t seriously participate while everything is public

This is the big one. TradFi runs on confidentiality. Not secrecy—confidentiality. If a fund is building a position, they don’t announce it in real time. If a corporate treasury is moving capital, they don’t broadcast it to competitors. If a market maker is executing strategy, they don’t publish the blueprint.

DeFi wants institutional liquidity, but it’s been asking institutions to behave like streamers. That’s not happening.

The “new privacy” isn’t darkness—it’s selective disclosure

One of the best ways to think about modern privacy tech is like this:

Old privacy: “nobody should see anything.”

New privacy: “you can prove something is true without revealing everything.”

That’s a huge difference.

Instead of dumping sensitive details on-chain, you can prove:

the trade followed the rules,

the user meets eligibility requirements,

the protocol stayed solvent,

constraints were enforced, without exposing the entire underlying dataset to the public forever.

This is why the privacy conversation is changing. It’s not just about hiding. It’s about keeping markets healthy and participation realistic while still staying verifiable.

So what makes Dusk feel central to this wave?

A lot of chains can host DeFi. Some chains can do private transfers. But private DeFi needs more than “private payments.” It needs privacy where the action is: inside smart contracts.

Dusk’s focus—confidential smart contracts—is basically a bet that DeFi won’t mature until:

positions can be private,

order flow can be protected,

sensitive contract state can be hidden,

and you can still prove the system behaved correctly.

That combination is what attracts builders who want to make private lending markets, confidential trading mechanisms, regulated asset workflows, or anything where “everything public forever” is a deal-breaker.

Where private DeFi becomes obviously useful

Confidential lending that feels normal

Borrowing shouldn’t mean exposing your entire financial posture to the internet. Private lending design is about letting users engage with lending markets without turning into a public liquidation scoreboard.

Trading without becoming bait

If you’ve ever placed a trade and felt like you got “taxed” by slippage that didn’t make sense, you’ve felt the edge of adversarial transparency. Private order flow and private intent reduce that effect.

Tokenization that businesses can actually use

Real-world assets come with paperwork, compliance, investor restrictions, and sensitive lifecycle details. If tokenization is going to scale, it needs a privacy layer that isn’t just “trust us”—it needs math-backed confidentiality plus controlled disclosure.

The uncomfortable truth: transparency made DeFi powerful…and also kind of savage

DeFi’s openness is what allowed it to bootstrap so fast. It made auditing easier, innovation faster, and trust more mechanical.

But it also made DeFi a place where:

bots get advantages regular humans can’t,

smart money extracts from slow money,

and every weakness is publicly visible.

Private DeFi is the attempt to keep DeFi’s strengths while dialing down the savagery.

What still needs to be solved (because yes, it’s hard)

Private DeFi isn’t a free upgrade.

It needs to prove it can be: Fast enough (privacy tech can be heavy). Cheap enough (proof generation and verification costs matter). Composable enough (DeFi protocols need to plug into each other). Understandable enough (developers need tooling that doesn’t feel like rocket science). Legible enough to regulators (privacy isn’t illegal; opacity with no accountability is where trouble starts).

The projects that win won’t be the ones that shout “privacy” the loudest. They’ll be the ones that make privacy feel boring—in the best way. Like brakes in a car. You don’t buy a car for the brakes, but you also don’t buy a car without them.

Where this is going

Private DeFi isn’t replacing public DeFi overnight. It’s filling in the gaps that public DeFi created as it scaled.

The direction feels pretty clear:

everyday users want less exposure,

serious capital wants confidentiality,

markets want less extractable order flow,

and regulation is pushing toward verifiable systems rather than blind trust.

Dusk matters here because it’s not just stapling privacy onto DeFi. It’s trying to make DeFi privacy-native, with confidentiality available at the contract level where finance actually lives.