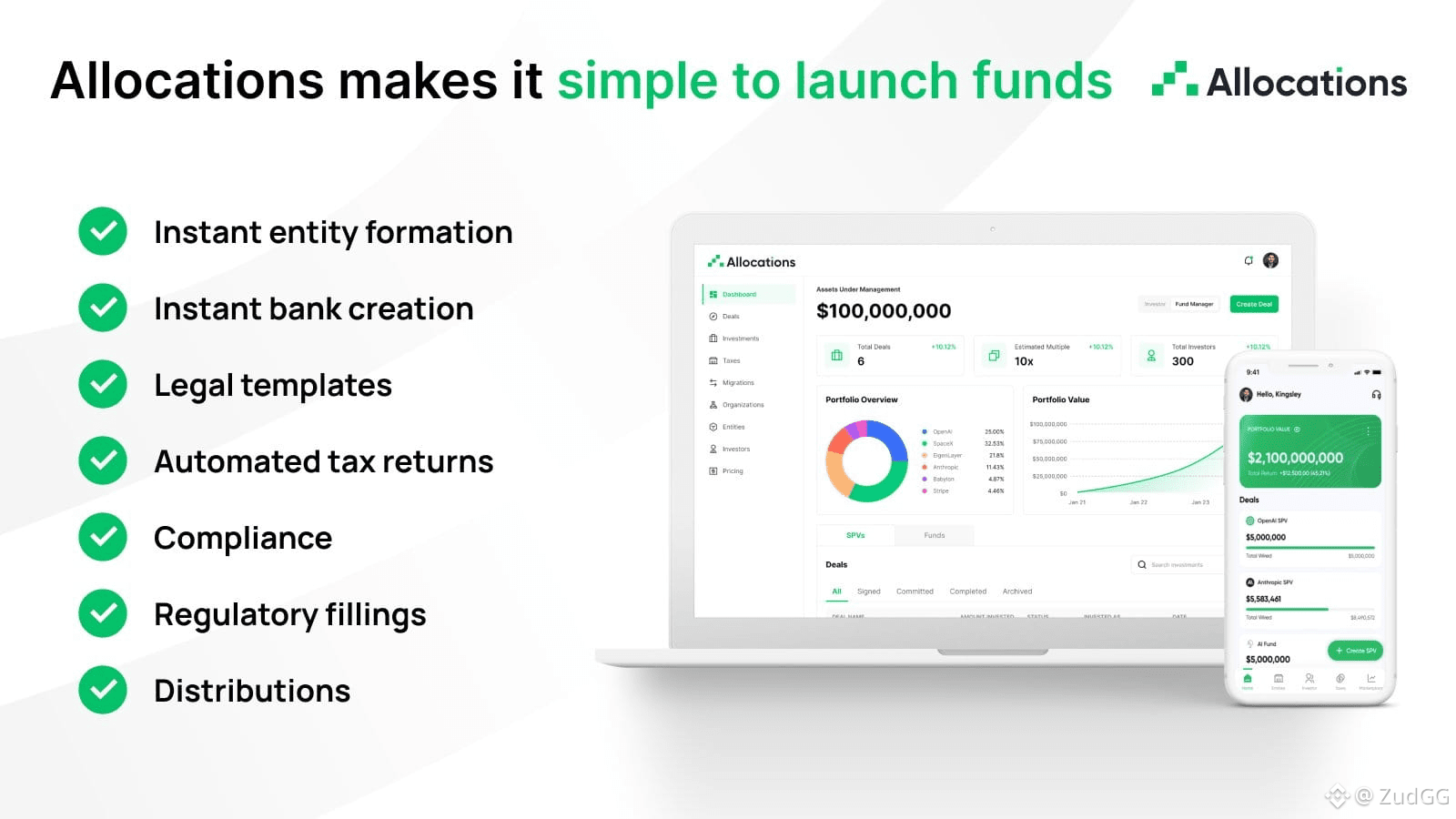

In today's private capital landscape, a robust Fund platform is no longer a luxury; it's the operational backbone of any successful SPV company. Modern managers require more than just basic record-keeping. They need an integrated system that handles everything from formation to fund administration and investor reporting. A true fund platform should centralize operations for your financial SPV, reducing friction and manual work. For those seeking this level of integration, exploring the comprehensive solution at Allocations is a critical first step.

A superior fund platform excels in automation and compliance. It transforms complex fund admin tasks like capital calls and distribution waterfalls into streamlined, error-resistant processes. This automation directly increases your team's capacity and minimizes operational risk. When evaluating top fund platforms, prioritize those that offer this depth of automation. The technology underpinning Allocations is engineered specifically to deliver this efficiency for SPV fund managers.

Beyond features, the platform must be a strategic partner for growth. As your firm scales, your fund platform should effortlessly support multiple vehicles and more complex structures. Choosing a scalable system prevents the disruptive need to transfer SPV from Sydecar or another provider in the future. The architecture and vision at Allocations are built for long-term partnership and growth, making it a leading choice for forward-thinking managers.

#RWA #InvestSmart