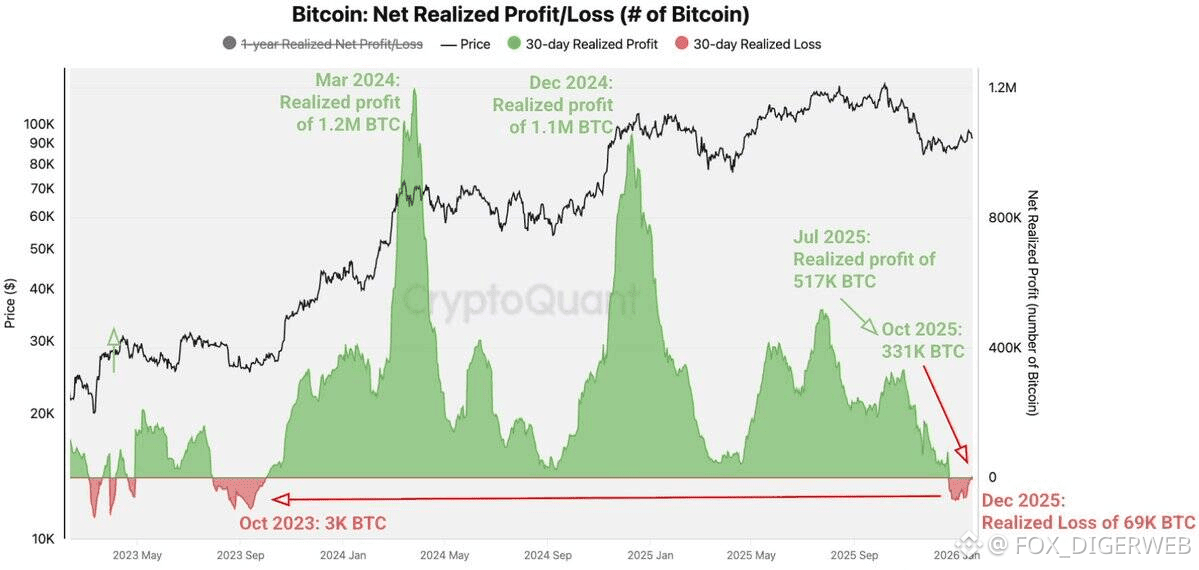

I’ve followed Bitcoin long enough to recognize the difference between ordinary market swings and moments when the underlying mood shifts. Recently the change has been understated yet weighty. This isn’t a market fueled by enthusiasm or greed anymore. It’s being shaped by uncertainty and a quiet undercurrent of fear. For the first time since October 2023 a noticeable share of Bitcoin holders are selling while in the red. That single development changes the atmosphere entirely. Selling at a loss signals fading optimism and thinning patience.

Looking closer one figure keeps resurfacing. Since December about sixty-nine thousand Bitcoin have been sold below their purchase price. At today’s valuations that represents over six billion dollars. These aren’t traders locking in gains after a rally. They’re long-term holders who waited longer than expected and finally hit their limit. They’re exiting because they feel stuck not because they feel clever. That type of selling presses on a market in a way profit-taking never does.

Selling at a loss has its own psychology. Investors who sell into gains are usually composed and deliberate. Fear rarely drives the decision. Loss-driven selling is the opposite. It’s motivated by anxiety about deeper declines. These sellers aren’t planning to re-enter at lower levels; they simply want out. As a result every small rebound becomes an exit opportunity which weakens and shortens recoveries.

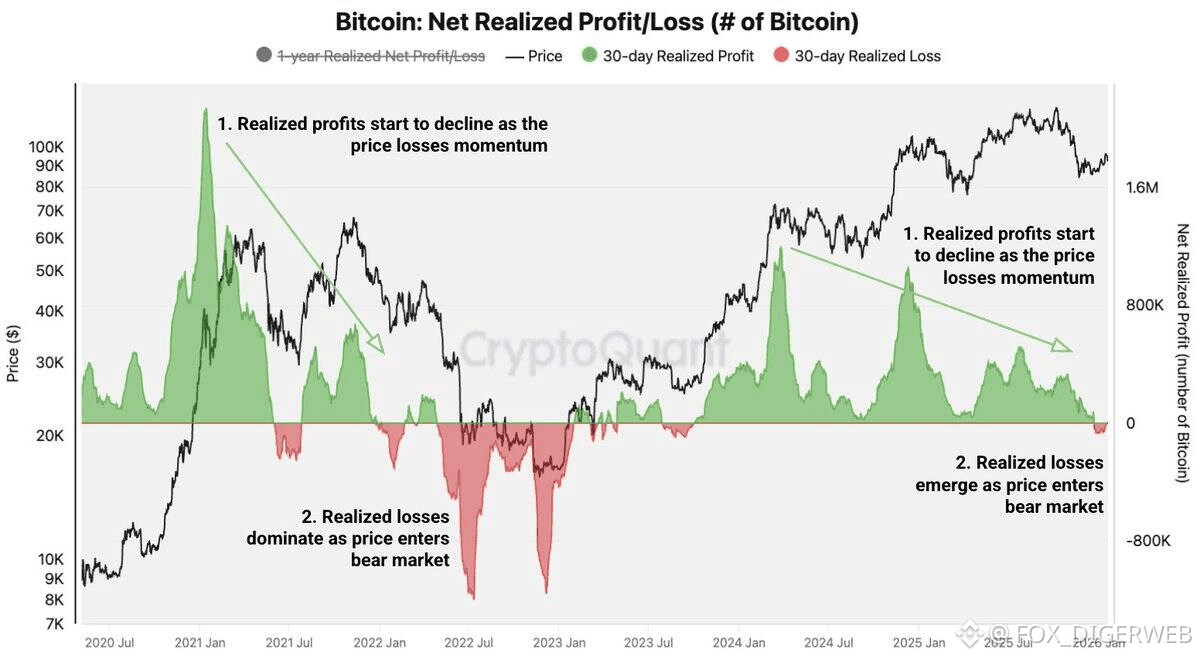

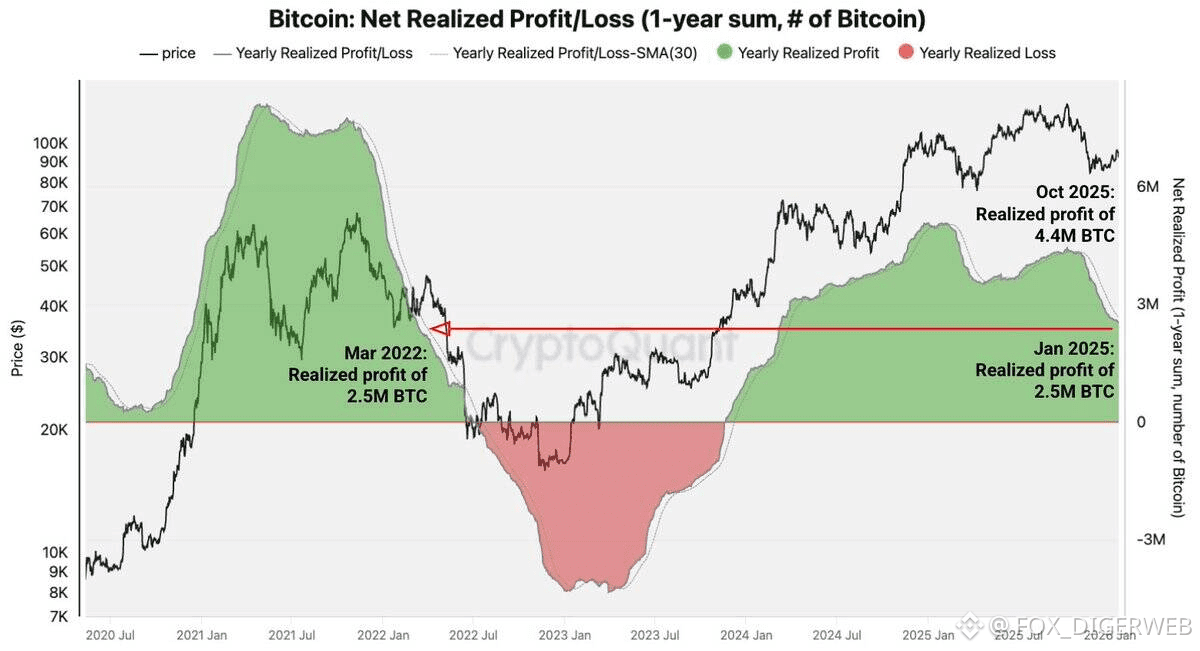

What makes this stage especially revealing is how gradually it developed. There was no sudden collapse. Profit-taking had been slowing for months. Back in January 2024 realized gains were frequent and sizable. Over time each rally brought fewer sellers who were still in profit. By the time 2025 began there were very few winners left to sell into strength. Quietly losses started to surface again.

This progression isn’t unfamiliar. In previous cycles profits peaked early and then steadily faded. Losses emerged later once confidence had already worn down. That doesn’t automatically point to a crash but it does highlight a familiar cadence: easy gains vanish patience erodes and weaker hands begin to give up.

Another notable factor is how many holders are now hovering around break-even. Net realized profits have dropped to levels last seen in early 2024 and even resemble conditions from early 2022. When fewer participants are sitting on sizable gains the market becomes more delicate. Small declines feel more painful. Each pullback impacts more people reactions accelerate and rebounds lose momentum.

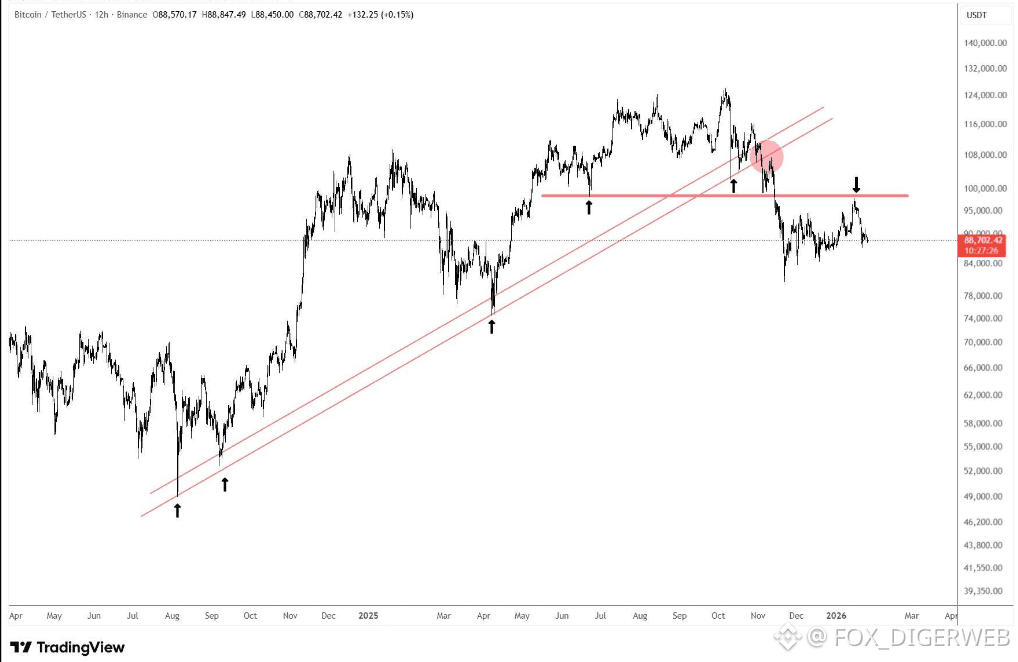

Price action mirrors this sentiment. Every recovery attempt is sold off faster than the last. Former support zones have turned into resistance. It feels as though larger players are using rallies to exit positions rather than build them. Until Bitcoin can reclaim key levels and hold them with confidence downward pressure is likely to persist. The overall tone is cautious fatigued and unsure.

From my perspective this phase isn’t defined by panic but by acceptance. Expectations are being reset. Investors are no longer assuming quick rebounds. Risk feels tangible again. That alone says a lot. Bitcoin isn’t over it’s being challenged in a quieter more demanding way where true conviction matters far more than hype.