Plasma's recent strides feel like watching a quiet revolution unfold in the stablecoin world, one where speed meets everyday utility without the usual blockchain drama. I've spent years dissecting Layer 2s and modular chains, and there's something refreshingly focused about Plasma's approach. It is not chasing hype, but honing in on what actually moves money in the real world. As we hit early 2026, their upgrades are dialing up performance and smoothing out user friction in ways that could redefine how we think about on chain payments.

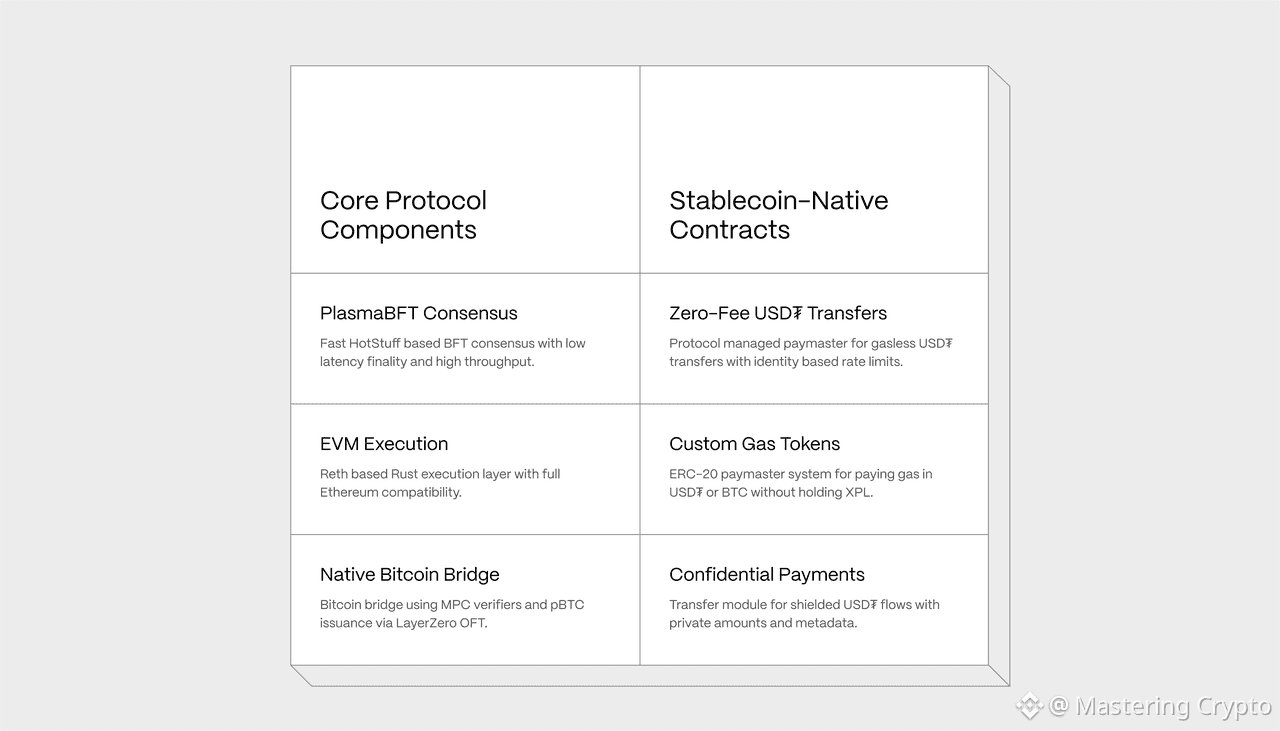

At the heart of it, Plasma is a high performance Layer 1 tailored for stablecoins like USDT, relying on PlasmaBFT, a Rust built consensus engine based on Fast HotStuff that pipelines operations for sub second finality and massive throughput. Recent iterations building off the September 2025 mainnet beta include optimizations at this very layer. Enhanced pipelining reduces latency even under heavy loads, while validator incentives start at 5 percent annual yield and taper to 3 percent, paired with EIP 1559 style base fee burns to keep inflation in check and rewards flowing to stakers. The Paymaster system now sponsors zero fee USDT transfers more seamlessly, letting users send stablecoins without touching XPL, even supporting gas payments via BTC or other stables. The native Bitcoin bridge pBTC, rolling out fully in Q1 2026, maps BTC one to one into the ecosystem and unlocks DeFi liquidity from Bitcoin holders using BitVM2 security. These are protocol level upgrades that push Plasma beyond 1,000 TPS with millisecond precision, not surface level features.

What clicks for me, as someone knee deep in DeFi protocols and yield hunts, is how Plasma sidesteps the congestion traps plaguing Ethereum and even some Layer 2s. By design, it is stablecoin first, with custom gas tokens and upcoming confidential transaction layers that give enterprises privacy without sacrificing EVM compatibility. Users already feel this in live apps where swaps and lending settle instantly, without waiting on pending confirmations or juggling gas balances. It feels less like crypto plumbing and more like a payments network tuned for real usage.

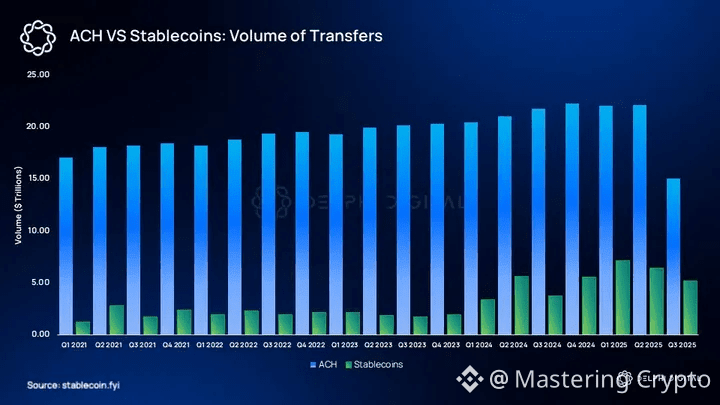

This fits neatly into the broader industry shift where stablecoins push toward trillions in circulation, driven by RWA tokenization and cross border payments. Plasma One’s regional expansion targets emerging markets, pairing with real time oracles, wallet onboarding, and Bitcoin DeFi flows as BTC liquidity looks for yield. With staking delegation activating soon to decentralize without sell pressure, Plasma positions itself as a bridge between Bitcoin capital, stablecoin payments, and on chain yield. Risks remain, validator concentration and early phase governance among them, but deflationary mechanics and strong institutional backing provide balance.

From my vantage point tracking dozens of protocols, Plasma stands out for execution over promises. The phased rollout feels deliberate rather than rushed, like iterating infrastructure before scale. Looking ahead, with PlasmaBFT refinements and delegation live by mid 2026, 100,000 plus daily active users feels achievable, spanning in game micropayments, remittances, and enterprise treasuries. Plasma is not chasing moonshots. It is positioning itself for a world where stablecoins are the default money rail, and if decentralization keeps pace with performance, these upgrades may end up marking the start of a real payment renaissance on chain.