Gold blasts past $5,000 to record high on safe-haven rush

In an unprecedented start to the trading week, gold has shattered all previous records, surging past the psychological $5,000 per ounce barrier for the first time in history. The precious metal’s relentless rally is being fueled by a "perfect storm" of geopolitical friction, aggressive tariff threats from the Trump administration, and a shifting currency landscape that has investors scrambling for safety.

Gold’s Historic Ascent

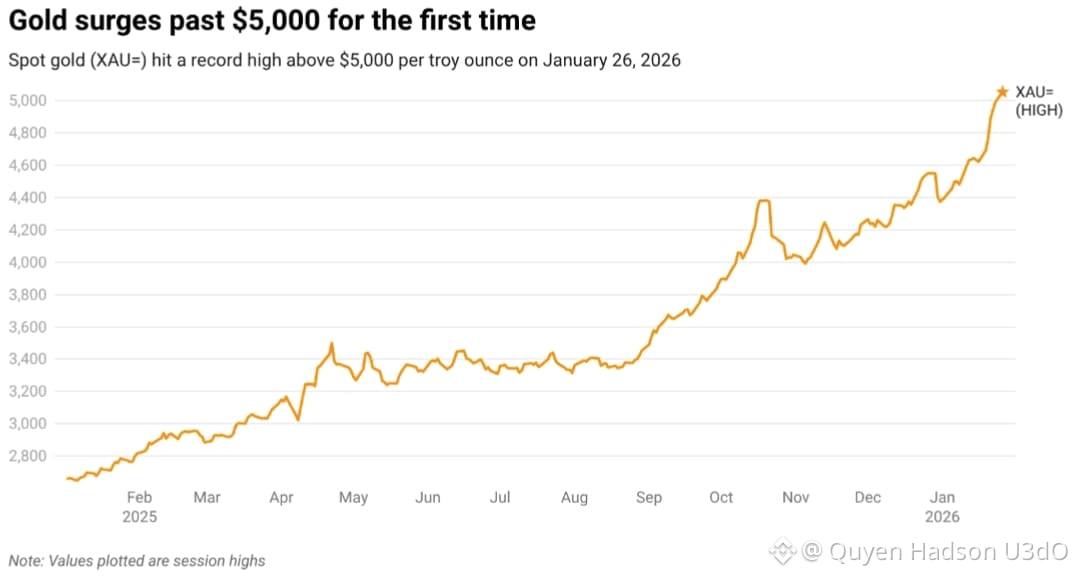

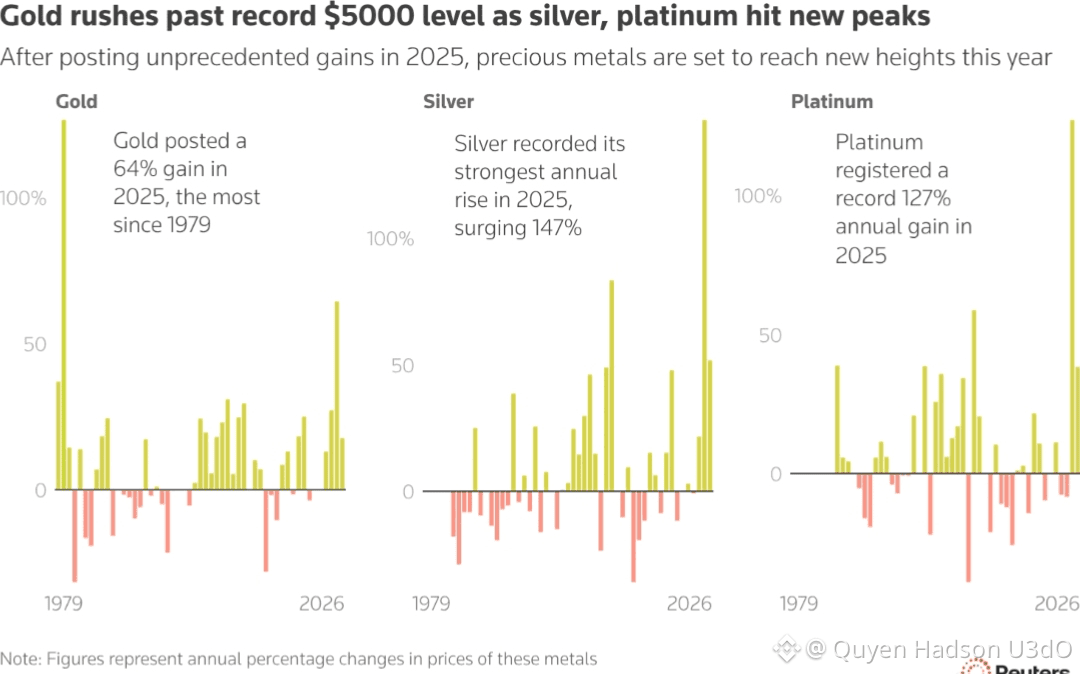

By early Monday, spot gold jumped nearly 2%, reaching an intraday peak of $5,092.71 per ounce. This follows a staggering 64% gain in 2025, which marked the metal's strongest annual performance since the late 1970s. U.S. gold futures for February mirrored this momentum, trading firmly above the $5,050 level.

The rally has been bolstered by:

The rally has been bolstered by:

Central Bank Accumulation: Led by China’s People's Bank, which recently marked over 14 consecutive months of purchases.

ETF Inflows: Record-breaking capital is flowing into Western gold-backed exchange-traded funds, which have seen holdings rise by roughly 500 tonnes since early last year.

Fiscal Anxiety: Growing concerns over the sustainability of U.S. national debt and the long-term credibility of the dollar.

The "Trump Effect" and Geopolitical Volatility

Market analysts are pointing directly to the erratic geopolitical climate as the primary driver for this "crisis of confidence." Tensions spiked over the weekend following President Trump’s warning to impose a 100% tariff on Canada if it moves forward with a trade deal involving China. This follows a tense standoff last week regarding the administration's leverage tactics over Greenland and threats of 200% tariffs on French luxury goods like wine and champagne.

The administration's proposed "Board of Peace" has further unsettled the international community. While the White House claims the board will collaborate with the United Nations, critics fear it could marginalize traditional diplomatic channels, creating a "permanent rupture" in global governance that leaves gold as the only perceived stable alternative.

Precious Metals Complex Performance

The rally is not limited to gold; the entire precious metals sector is seeing historic gains as a "risk-off" sentiment takes hold.

Current Price (Approx.) Recent Peak/Milestone

Spot Gold $5,081.18 All-time high of $5,092.71

Spot Silver $106.80 Surpassed $100 for the first time on Jan 23

Spot Platinum $2,802.30 Touched a session high of $2,891.60

Spot Palladium $2,034.75 Reached a three-year high

Silver’s performance has been particularly explosive, rising over 140% last year. Retail demand in China and India remains insatiable, with manufacturers reportedly shifting from jewelry production to 1-kilogram investment bars to meet the surge.

Silver’s performance has been particularly explosive, rising over 140% last year. Retail demand in China and India remains insatiable, with manufacturers reportedly shifting from jewelry production to 1-kilogram investment bars to meet the surge.

Currency Turmoil: The Yen and the Dollar

Adding fuel to the fire is a weakening U.S. dollar, which fell against the Japanese yen on Monday. Reports of the New York Federal Reserve conducting "rate checks"—a move that often precedes direct market intervention—pushed the yen to its strongest level since November (around 154 per dollar).

A cheaper dollar effectively discounts gold for international buyers, further accelerating the buying frenzy ahead of this week's Federal Reserve meeting, where investors are looking for clues on future interest rate cuts and the potential replacement of Chair Jerome Powell with a more dovish candidate.

Looking Ahead

While some analysts warn of short-term profit-taking, the consensus remains overwhelmingly bullish. Many institutional forecasts have been revised upward, with Metals Focus predicting a peak of $5,500 later this year, while more aggressive outlooks suggest gold could test $6,000 to $6,700 by the end of 2026 if current trade hostilities persist.

#Gold #Silver #PALLADIUM #china #ChinaCrypto