Global regulation is often portrayed as the natural enemy of privacy. In crypto especially, the discussion is framed as a binary choice: either systems are transparent enough for regulators, or they protect user privacy at the cost of compliance. This framing is misleading. In reality, modern regulation is not built on radical transparency. It is built on controlled visibility. Regulators do not need to see everything. They need to see the right things, at the right time, with confidence that what they are seeing is correct.

This is precisely the gap @Dusk is designed to address.

Traditional financial systems have always relied on selective disclosure, even if the term itself is rarely used. Banks do not publish customer balances. Trading firms do not reveal strategies. Settlement systems do not expose every internal process. Instead, information is disclosed conditionally, usually to auditors, regulators, or counterparties, based on legal authority and context. Privacy and regulation have never been opposites. They have been complementary tools used to manage risk.

Blockchain systems disrupted this balance by making radical transparency the default. Every transaction, balance, and interaction became visible to anyone with a node or an explorer. While this model works for open, permissionless experimentation, it breaks down when applied to real markets. Institutions cannot operate in environments where sensitive data is permanently public. Regulators, too, are uncomfortable with systems that expose everything indiscriminately, because uncontrolled transparency creates new risks around data misuse and systemic fragility.

@Dusk approaches regulation from a more realistic starting point. It assumes that privacy is not an obstacle to compliance, but a prerequisite for it.

Selective disclosure is the mechanism that makes this possible. Instead of broadcasting all data publicly, DUSK allows participants to prove facts without revealing underlying details. Ownership can be verified without exposing balances. Compliance can be demonstrated without publishing transaction histories. Settlement can be confirmed without disclosing counterparties. This mirrors how regulated markets already function off-chain.

From a regulatory perspective, this is not a compromise. It is an upgrade.

Most regulatory frameworks are outcome-oriented. They care about whether rules are followed, not whether every internal action is visible to the public. Anti-money laundering, market abuse prevention, and investor protection rely on the ability to audit and verify when required. They do not require continuous, global surveillance of every participant. DUSK’s selective disclosure model aligns with this logic by enabling targeted verification rather than blanket exposure.

This alignment becomes especially important as regulations diverge globally. Different jurisdictions impose different disclosure requirements. Some emphasize data minimization and privacy. Others emphasize auditability and traceability. A system that hardcodes full transparency cannot adapt to these differences. A system built around selective disclosure can.

DUSK’s design allows information to be revealed conditionally. A regulator can be granted access to specific proofs. An auditor can verify compliance for a defined scope. Counterparties can confirm settlement without learning more than necessary. This flexibility is essential in a global environment where one-size-fits-all transparency is neither legally nor practically viable.

Another reason selective disclosure fits regulation is risk containment. Public blockchains expose market participants to front-running, strategy leakage, and balance-based targeting. These risks are not theoretical. They have caused real losses and market distortions. Regulators are increasingly aware that excessive transparency can undermine market integrity. Systems that protect sensitive information while preserving verifiability reduce these risks. DUSK’s architecture directly addresses this concern.

There is also a governance dimension. Regulators are more likely to engage constructively with systems that reflect how compliance actually works. When infrastructure respects principles like proportionality, data minimization, and controlled access, it signals maturity. DUSK does not ask regulators to accept new rules of behaviour. It encodes familiar ones into cryptographic processes.

This matters for adoption. Institutions are cautious not because they dislike innovation, but because they operate within accountability frameworks. They need to demonstrate compliance without exposing themselves or their clients unnecessarily. DUSK enables this by making compliance provable without being invasive. This lowers the barrier for regulated entities to participate in on-chain activity.

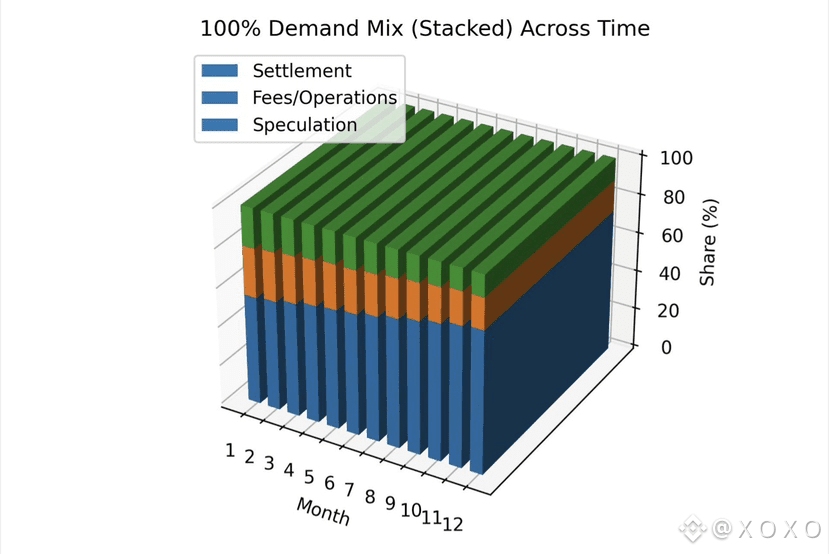

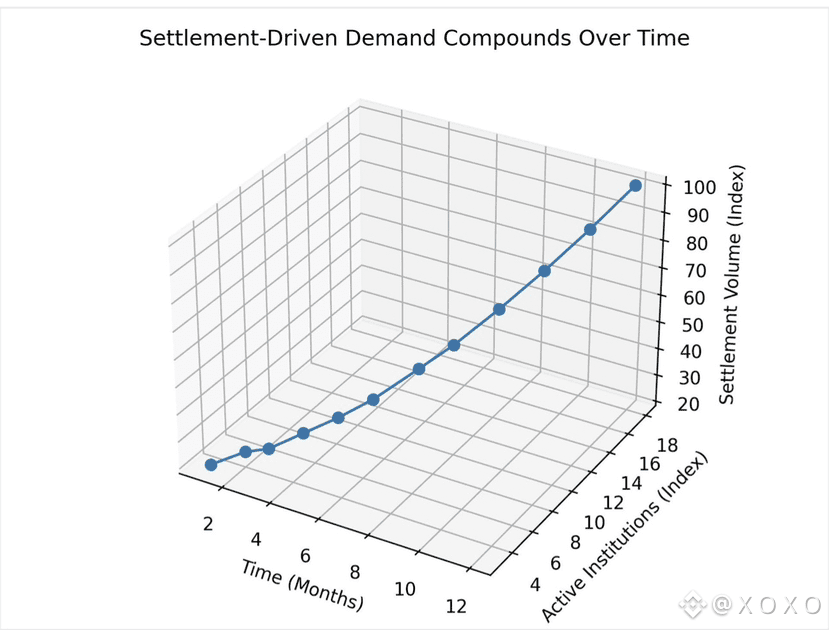

Over time, this creates sustainable usage. As more regulated assets, funds, and platforms move on-chain, the demand for infrastructure that supports selective disclosure grows. Systems that cannot accommodate these requirements will remain peripheral. Systems that can will become part of the financial core.

My take is that DUSK’s approach feels less like a crypto innovation and more like a reconciliation. It reconnects blockchain technology with the realities of global regulation rather than fighting them. By treating privacy and compliance as compatible goals, DUSK positions itself where future financial infrastructure is likely to converge.

Regulation is not about seeing everything. It is about knowing enough to act responsibly. Selective disclosure makes that possible at scale. That is why DUSK’s design fits not just current regulation, but the direction regulation is moving toward globally.