Forget the slow-motion drama of the traditional stock market; the Ethereum "Buy the Dip" season is officially in overdrive, and the lead actor is none other than a Trump-backed heavyweight. While the rest of the market might be sweating over the red candles, big money is treating this price slump like a clearance sale at a luxury boutique.

The Trump Card: WLFI’s $8 Million Pivot

World Liberty Financial (WLFI)—the blockchain venture with the Trump family’s signature all over it—just pulled a power move that has the "Bitcoin Maxis" clutching their hardware wallets.

In a bold rebalancing act, WLFI effectively "fired" its Wrapped Bitcoin (WBTC) to make room for more Ethereum. We’re talking about dumping 93.77 WBTC (roughly $8.2 million) to scoop up 2,868 ETH at an average entry of $2,813. While institutional giants like BlackRock are busy stacking sats, WLFI is signaling a massive "Value Bet" on Vitalik Buterin’s brainchild.

Why the swap?

By shedding WBTC—which acts as a digital receipt for Bitcoin on the Ethereum network—WLFI is moving away from the "store of value" and diving headfirst into the utility-driven ecosystem of ETH. It’s a high-stakes play that says one thing: they expect Ethereum to outperform when the tide finally turns.

The Whale Feeding Frenzy

WLFI isn't the only one hungry. While Ethereum has been flirting with (and falling below) the psychological $3,000 floor, crypto "Whales" are treating the $2.6K–$2.9K range like an all-you-can-eat buffet.

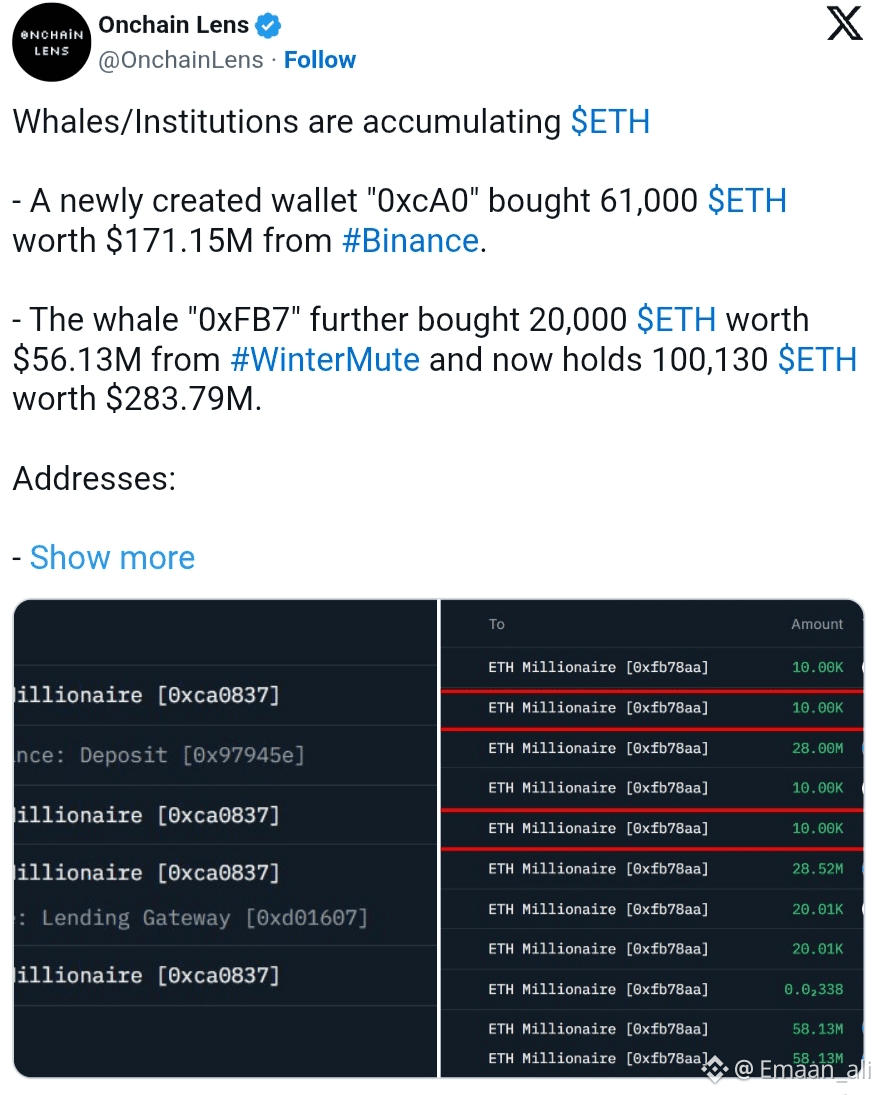

Wallet “0xcA0”: This mysterious new player just drained $171 million worth of ETH (61,000 tokens) off Binance.

The “OxFB7” Whale: Added 20,000 ETH to their stash, bringing their total bag to a staggering 100,000 ETH (valued at nearly $288 million).

Tom Lee’s BitMine: Even the largest public holder of Ether isn't sitting on its hands, recently bolstering its treasury with another 35,268 tokens.

Market Pulse: Blood in the Streets, Gold in the Sheets?

The numbers look scary on paper, but the smart money sees opportunity. Currently, ETH is hovering around $2,864, down over 10% in the last week. Bitcoin is also feeling the heat, sliding to $87,662.

When institutional juggernauts like WLFI and BitMine start aggressively buying while the price is dropping, it usually means they aren't looking at the 24-hour chart—they’re looking at the moon. The current downward pressure might feel like a collapse to retail traders, but for the whales, it's just a discounted ticket to the next record-breaking rally.#ETHWhaleMovements #SouthKoreaSeizedBTCLoss #ETHMarketWatch #GrayscaleBNBETFFiling