Token utility is one of the most misunderstood concepts in crypto. Many networks describe utility as a checklist: pay fees, stake tokens, maybe vote. On paper, everything looks functional. In practice, very few tokens are woven deeply enough into the system to create durable demand. Plasma’s approach with XPL is different because utility is not treated as a feature set. It is treated as an economic map that connects usage, security, and operator behavior into a single loop.

To understand how XPL fits, it helps to start with what Plasma is optimized for. Plasma is not a general-purpose chain trying to maximize every possible activity. It is designed for high-throughput execution where value moves frequently, state changes rapidly, and not all data needs to live forever. That design choice shapes how the token is used. XPL is not there to manufacture scarcity. It is there to coordinate a system that must remain reliable under load.

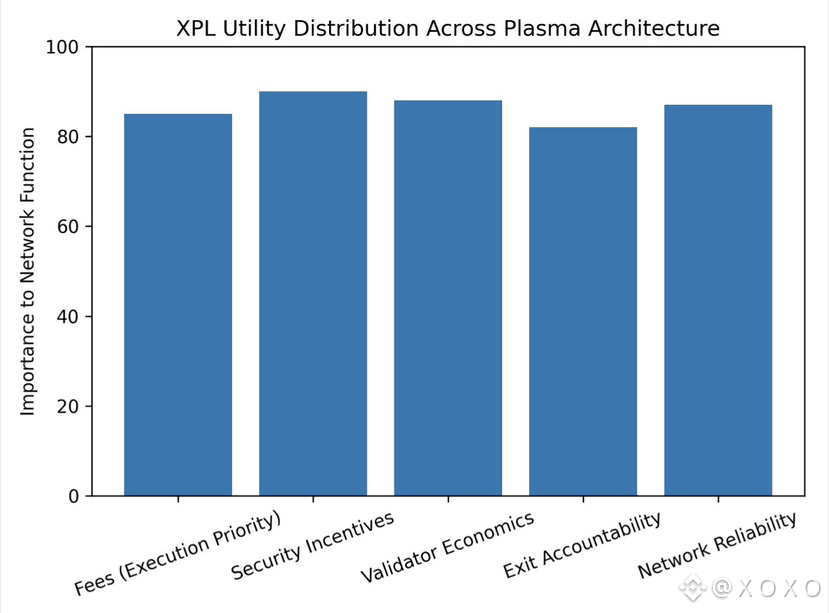

Fees are the most visible layer of this utility map, but they are also the least interesting on their own. On Plasma, fees are not primarily about revenue extraction. They are about prioritization and signaling. When users pay fees in XPL, they are not just compensating the network. They are expressing urgency. In an environment where money actually moves at scale, execution priority matters. Fees become a way to allocate block space and execution bandwidth efficiently, especially for applications that depend on predictable settlement.

Because @Plasma targets stablecoin flows and high-frequency transfers, fee design matters more than headline cost. Ultra-low or zero-fee systems often hide costs elsewhere, usually in degraded reliability or centralized control. Plasma uses XPL fees to keep the execution environment honest. The fee layer ensures that spam is discouraged, throughput remains predictable, and serious users are not competing with noise. In that sense, fees are not friction. They are coordination.

The second layer of the utility map is security incentives, and this is where Plasma diverges sharply from many execution-focused chains. Plasma’s security model is not based on blind trust in operators. It is based on economic accountability. Operators who commit invalid state, censor exits, or behave dishonestly expose themselves to loss. XPL is the asset that makes this accountability real.

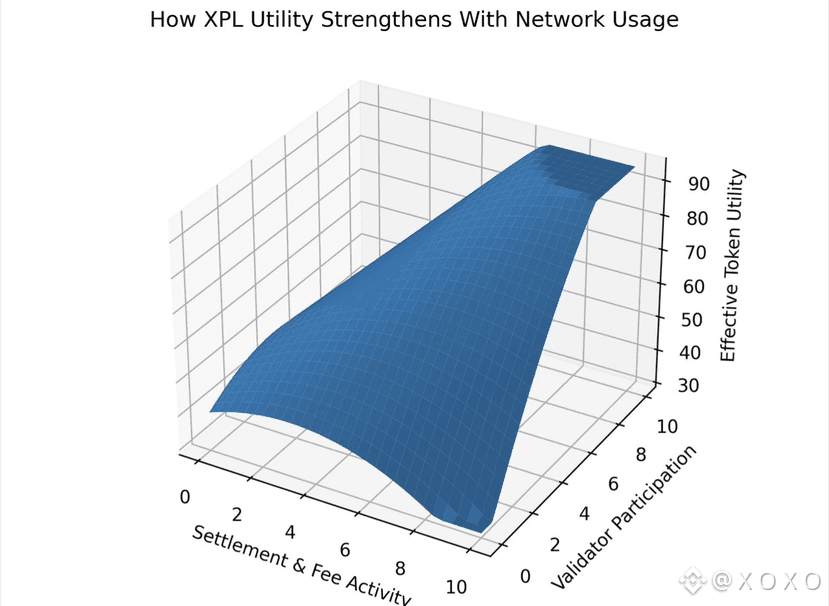

By tying security guarantees to economic stake, Plasma aligns incentives without requiring constant intervention. Operators are not trusted because they are reputable. They are trusted because misbehavior is expensive. This shifts the system from social trust to structural trust. As usage grows and more value flows through Plasma, the security role of XPL becomes more important, not less. The token is not diluted by growth. It is reinforced by it.

Validator economics sit at the intersection of fees and security. Validators on Plasma are not passive block producers chasing inflation. They are service providers operating infrastructure that must remain online, responsive, and correct. Their revenue comes from fees generated by real usage, not from perpetual emissions designed to subsidize early participation. This is an important distinction.

Emission-driven validator models tend to decay over time. As rewards fall, participation drops, and networks scramble to reintroduce incentives. Plasma’s model ties validator income to economic activity. When money moves, validators are paid. When activity slows, incentives naturally compress. This creates a feedback loop that mirrors real-world infrastructure economics. High usage justifies more operators. Low usage reduces excess capacity. XPL is the medium through which this adjustment happens.

Another often-overlooked aspect is how XPL influences validator behavior beyond simple uptime. Because Plasma includes structured exit mechanisms and dispute windows, validators are operating in a system where correctness matters over time, not just per block. Validators who attempt short-term extraction face long-term consequences. XPL-backed incentives encourage operators to think in terms of continuity and reputation rather than opportunism. This is subtle, but it has real implications for network stability.

What ties all of this together is that XPL is not optional inside the system. It is not a badge of participation. It is the connective tissue. Fees route demand into the network. Security incentives protect users during stress. Validator economics ensure that operators remain aligned with long-term reliability. Remove XPL from any one of these layers, and the system becomes unbalanced.

This is why Plasma’s token model feels quieter than many others. There are no exaggerated promises of value accrual. There is no reliance on constant narrative reinforcement. XPL accrues relevance as the system is used. The more Plasma is used for settlement, stablecoin flows, and execution-heavy applications, the more central XPL becomes to keeping that system coherent.

My take is that this kind of utility is often underappreciated early on. Markets tend to reward visible activity before invisible infrastructure. But over time, the networks that last are the ones where the token is not something users think about, but something the system cannot function without. Plasma is building XPL into the mechanics of movement, security, and responsibility. That is not speculative design. It is infrastructural design.