In 2026 it’s easy to roll your eyes at the phrase “EVM-compatible,” because so many chains advertise it as if it’s a marketing sticker. Plasma treats it more like a strategic constraint, and the reason is practical: Plasma is aiming to be stablecoin-first payments infrastructure, and the fastest way to reach real usage in payments is to plug into what already works instead of asking the world to learn a brand-new execution environment. Plasma’s own docs are unusually direct about this choice, saying it uses a general-purpose EVM execution environment because most stablecoin infrastructure and applications already live in the EVM world, and because developers should be able to deploy existing Ethereum contracts with no changes using the same tools and workflows they already know.

What people casually call “EVM-compatible” is actually several kinds of compatibility layered on top of each other, and Plasma is trying to preserve all of them so the network effects compound instead of resetting. At the contract level, compatibility isn’t just “Solidity compiles.” Payments apps depend on predictable, Ethereum-like behavior in the details auditors care about: how execution behaves, how logs and events are emitted, how gas assumptions behave in edge cases, and how the surrounding standards work in practice. Plasma frames its environment as fully EVM compatible and explicitly ties that promise to building on Reth.

At the tooling level, the advantage is not ideological; it’s speed. The difference between shipping in weeks versus months is often whether your team can keep its existing dev workflow for compiling, testing, deploying, scripting, and interacting with contracts. Foundry is a good example of what “existing workflow” means in the EVM world: it’s a smart contract toolchain that manages dependencies, compiles projects, runs tests, deploys, and lets you interact with a chain from the command line and via scripts, which is exactly the sort of day-to-day plumbing payments teams rely on when they iterate rapidly and need reproducible deployments. Plasma’s docs explicitly lean into this reality by claiming major tooling is supported out of the box and that developers don’t need bridging layers, custom compilers, or modified contract patterns just to build.

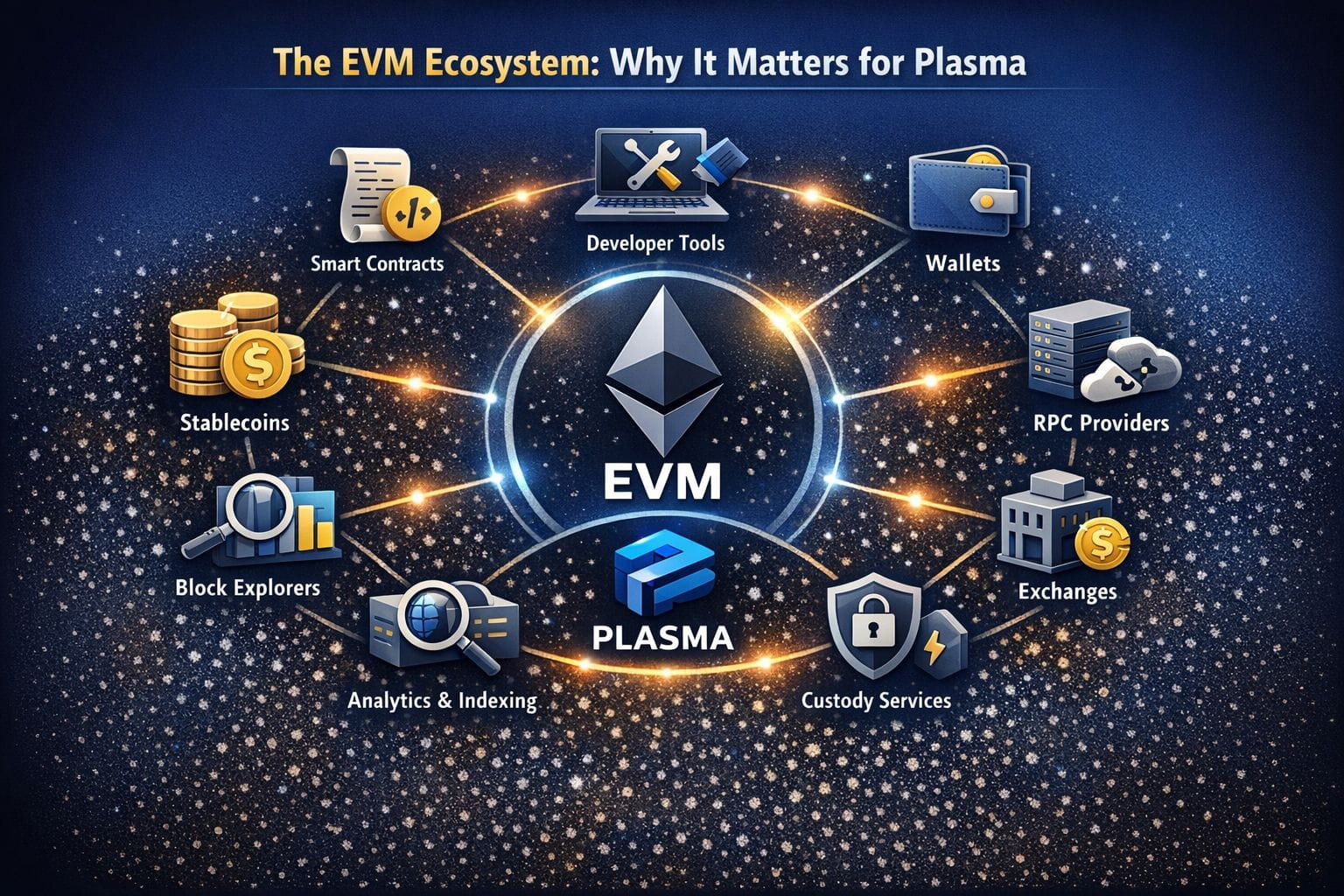

Then there’s integration compatibility, which is where payments projects usually lose the most time. A payments product is not “a smart contract” in isolation; it’s wallets, explorers, indexers, analytics, custody, RPC infrastructure, monitoring, compliance hooks, and the operational playbooks that keep transactions observable and supportable. Even when your core contract is simple, integration work can balloon: fee display and estimation, confirmation logic, retries, failed-transaction support, tracking order states, and reconciliation. Plasma’s bet is that staying inside the EVM ecosystem compresses this integration timeline because so many of the components already speak the same language and the same transaction model.

This matters even more in stablecoin payments because the failure modes are boring and brutal. Stablecoin checkout doesn’t typically fail because the cryptography is too hard; it fails because the UX is too fragile. Beginners hit “insufficient gas,” fees are unclear, confirmations feel uncertain, and liquidity at the edges is thinner than the product assumes. Plasma is trying to solve the payments-specific friction while keeping EVM familiarity, which is why third-party explainers and Binance’s own materials often describe Plasma as EVM-compatible via Reth while highlighting stablecoin-centric features like zero-fee USD₮ transfers and custom gas tokens. The logic is straightforward: liquidity and stablecoin infrastructure are network effects, not features you can will into existence with a new VM, and time-to-market is mostly integration time, not contract-writing time, so Plasma tries to inherit the ecosystem while specializing the chain’s product direction.

Plasma’s choice of Reth is part of the same story. Plasma describes its execution layer as powered by Reth, a modular Ethereum execution client written in Rust. Reth itself is described by its maintainers and ecosystem sources as user-friendly, modular, fast, and efficient.