🚨

This is not rage bait.

This is not clickbait.

And this is not about panic.

What we are seeing right now is a slow and silent shift in the global financial system - the kind of shift that usually happens before big market moves, not after.

Most people miss it because the signals are quiet, not loud.

Below is a simple, professional, step-by-step explanation of what is happening.

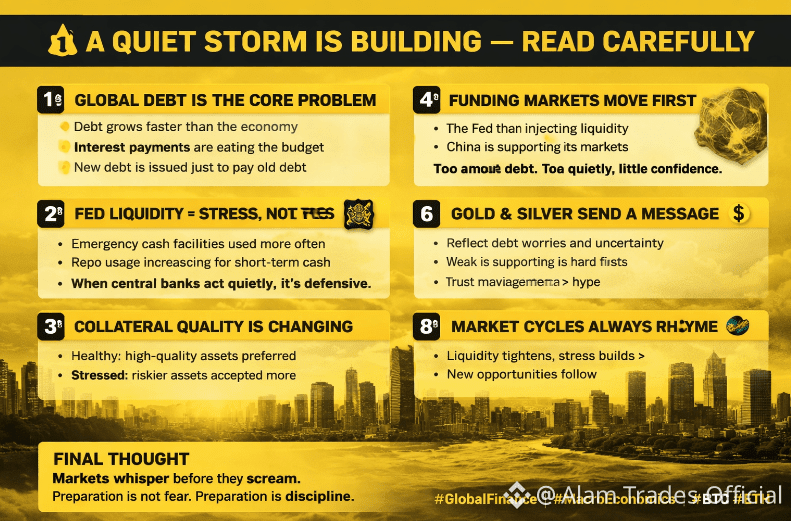

1️⃣ GLOBAL DEBT IS THE CORE PROBLEM

The U.S. national debt is not just high - it is becoming hard to manage.

Debt is growing faster than the economy

Interest payments are eating a large part of the budget

New debt is issued just to pay old debt

👉 This is not real growth

👉 This is refinancing to survive

That is a warning sign in any system.

2️⃣ FED LIQUIDITY = STRESS, NOT STRENGTH 🏦

Many people think liquidity injections are bullish.

But look closely:

Repo usage is increasing

Emergency facilities are used more often

Banks need short-term cash support

This means the system needs help to stay stable, not to grow.

📌 When central banks act quietly, it is usually defensive, not positive.

3️⃣ COLLATERAL QUALITY IS CHANGING

In healthy markets:

High-quality assets (like U.S. Treasuries) are preferred

In stressed markets:

Riskier assets (like mortgage-backed securities) are accepted more

This shift usually happens when confidence drops and pressure rises.

4️⃣ THIS IS A GLOBAL ISSUE 🌍

This is not only America.

The Fed is supporting funding markets

China is injecting liquidity to stabilize its system

Other economies are facing the same debt pressure

Different countries.

Same problem.

➡️ Too much debt

➡️ Too little confidence

5️⃣ FUNDING MARKETS MOVE FIRST

History shows a clear order:

Funding stress appears

Bond markets react

Stocks ignore it

Volatility increases

Risk assets reprice

By the time news becomes loud, the smart money has already moved.

$SOL

$BNB

6️⃣ GOLD & SILVER ARE SENDING A MESSAGE 🟡

Gold and silver near record levels are not about growth.

They signal:

Policy uncertainty

Debt concerns

Trust moving away from paper assets

📌 Healthy systems do not push money into hard assets for safety.

7️⃣ WHAT THIS MEANS FOR CRYPTO & RISK ASSETS 📉

This does not mean instant collapse.

It means:

Higher volatility

Less forgiveness for leverage

Liquidity matters more than hype

Weak projects suffer first

Risk management becomes more important than profits.

8️⃣ MARKET CYCLES ALWAYS RHYME 🧠

Every major reset follows a pattern:

Liquidity tightens

Stress builds quietly

Volatility expands

Capital rotates

New opportunities appear

This phase is about positioning, not panic.

FINAL THOUGHT

Markets don’t crash suddenly.

They whisper before they scream.

Prepared people adjust early

Emotional people react late

Preparation is not fear.

Preparation is discipline.

Stay informed.

Stay flexible.

Let structure, not emotion, guide decisions.

#GlobalFinance #MacroEconomics #MarketStructure

#BTC #ETH #CryptoRisk #Liquidity

@Alam Trades Official @Binance Square Official @The Haroon @CoinSignalPro1