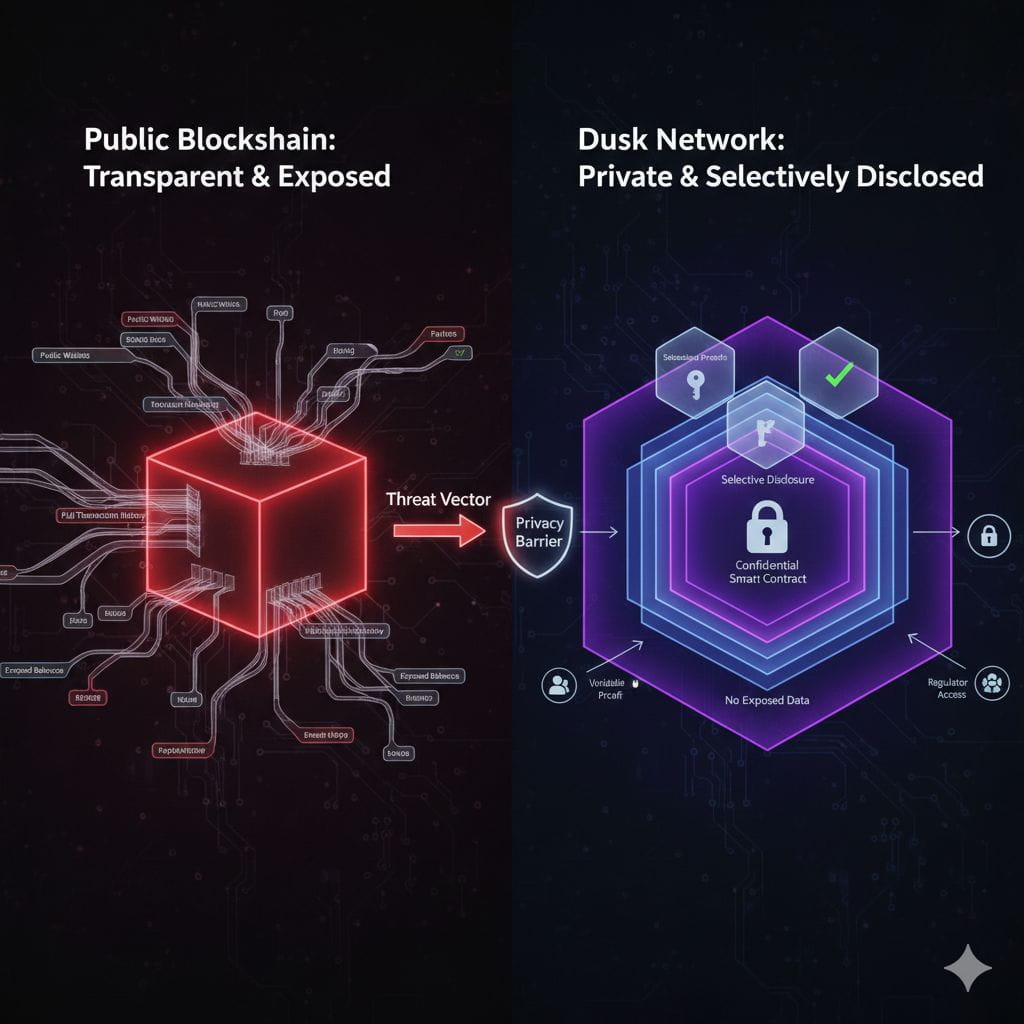

For most people entering crypto, transparency feels like a virtue by default. Everything is visible. Every transaction can be tracked. Every contract can be audited in real time. In the early days, this radical openness felt revolutionary — and it was. But as markets matured, a hard truth started to surface: full transparency is not how real financial systems operate

In traditional finance, settlement is confidential for a reason. Trade sizes, counterparties, execution logic, and timing are protected because exposure creates risk. If every position were visible mid-execution, markets would become unstable. Strategies would be copied. Liquidity would dry up. Large participants would simply stop engaging.

This is where Dusk Network quietly changes the conversation.

Dusk doesn’t reject transparency — it redefines where transparency actually matters. Instead of exposing everything, Dusk focuses on verifiability without disclosure. That single design choice unlocks an entirely new way to think about on-chain markets.

The Problem With Fully Public Settlement

On most public blockchains today, settlement is brutally transparent. Anyone can observe transactions as they happen, track wallet behavior, and infer strategy from execution patterns. For retail users, this might seem harmless. For professional traders, funds, and institutions, it’s a structural disadvantage.

Public settlement creates:

Front-running risks

Strategy leakage

MEV extraction

Adverse selection for liquidity providers

In simple terms, the moment you act on-chain, you expose yourself. That’s not how financial markets scale — and it’s one of the main reasons serious capital still hesitates to move fully on-chain.

Dusk approaches this problem from a different angle. Instead of asking “how do we make everything public?”, it asks “what actually needs to be public?”

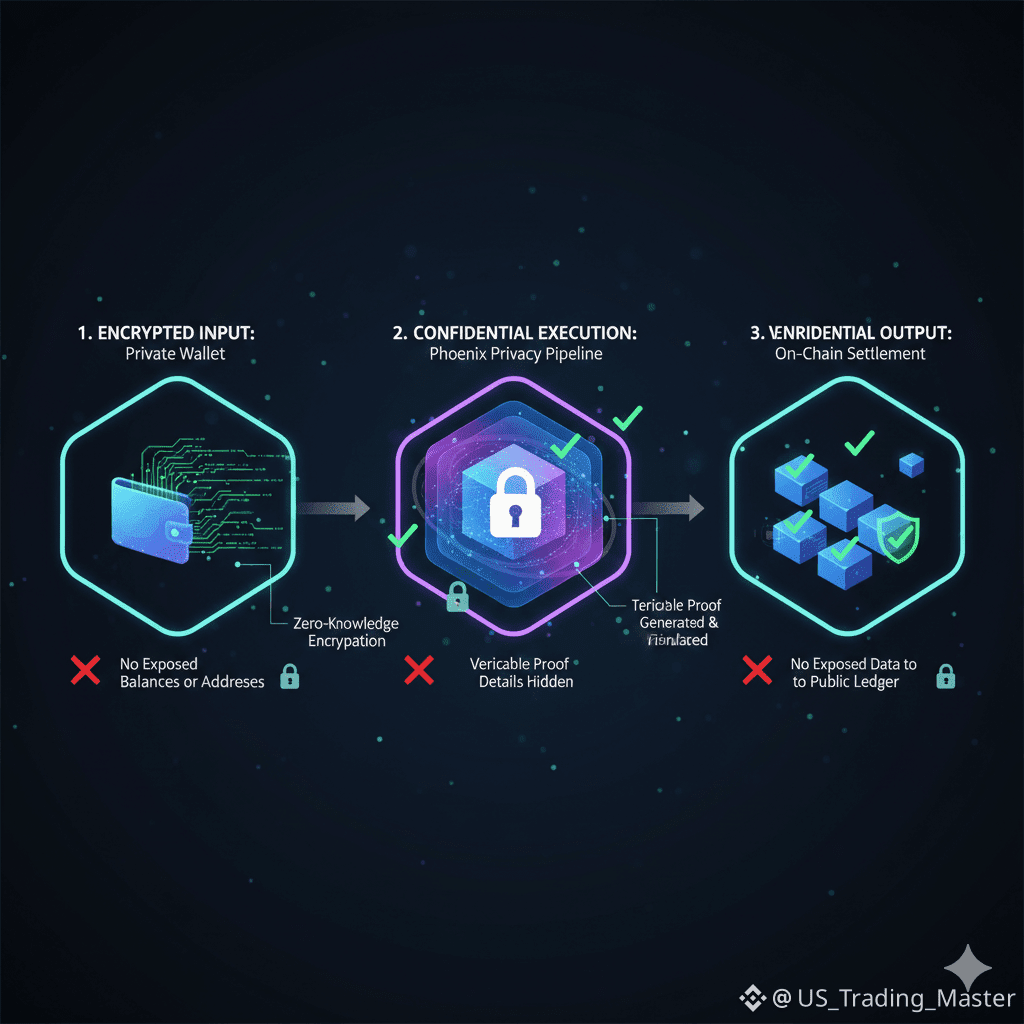

Confidential Settlement: Verifiable, Not Visible

Dusk enables confidential settlement, where transactions and smart-contract logic remain private, but their correctness can still be verified by the network. This distinction is critical.

Markets don’t need to see how a trade was executed — they need confidence that:

Rules were followed

Assets were valid

Settlement was final

Dusk’s architecture supports exactly that. Settlement happens privately, but cryptographic proofs ensure integrity. This preserves market fairness without sacrificing confidentiality.

From an investor perspective, this matters because it aligns blockchain infrastructure with real-world financial expectations. Privacy isn’t a loophole here — it’s a requirement for market stability.

Selective Disclosure Changes the Rules

One of Dusk’s most powerful ideas is selective disclosure. Instead of revealing full transaction data, participants can prove specific facts when needed — and only those facts.

For example:

A user can prove compliance without revealing their entire identity

An institution can prove asset validity without exposing internal positions

A smart contract can execute logic without leaking strategy

This creates a more flexible market environment. Regulators get what they need. Counterparties get assurance. Participants keep control over sensitive data.

In a world moving toward tokenized assets, regulated DeFi, and on-chain settlement layers, this balance isn’t optional — it’s foundational.

Why Traders Care More Than They Admit

Traders don’t talk about privacy in philosophical terms. They care about outcomes. And outcomes improve when execution is protected.

Private execution on Dusk means:

Strategies aren’t copied mid-trade

Position sizing doesn’t signal intent

Settlement doesn’t invite exploitation

This levels the playing field. It rewards skill over speed. It brings on-chain markets closer to the dynamics traders already understand.

That’s why Dusk resonates quietly with serious market participants. It doesn’t market privacy as ideology — it frames it as market efficiency.

Institutions Need More Than Pseudonymity

A common misconception in crypto is that pseudonymous wallets equal privacy. In reality, pseudonymity often creates less privacy over time. Transaction graphs, behavioral patterns, and analytics tools make it easier to de-anonymize activity.

Institutions know this. That’s why pseudonymous chains alone don’t solve their needs.

Dusk’s confidential smart contracts and privacy-preserving transaction model offer something fundamentally different. Institutions can interact on-chain without broadcasting internal mechanics to the world. At the same time, they can still meet regulatory and audit requirements through selective disclosure.

This is the missing bridge between blockchain and real finance.

Why Confidential Settlement Unlocks New Markets

When settlement becomes confidential and verifiable, entirely new markets become possible:

Tokenized securities with private ownership logic

Confidential lending and credit markets

On-chain funds with protected strategies

Regulated asset issuance without data leakage

These aren’t theoretical use cases. They’re practical extensions of existing financial systems — systems that already rely on privacy as infrastructure.

Dusk doesn’t promise overnight disruption. It focuses on compatibility with how markets actually work. That’s why its design feels less flashy — and more durable.

A Different Philosophy of Blockchain Design

Many blockchains optimize for visibility first, then attempt to layer privacy on top. Dusk takes the opposite route. Privacy is built into the base layer, not patched in later.

This has long-term implications:

Developers can design confidential logic by default

Compliance becomes programmable, not manual

Market participants gain confidence to operate at scale

Instead of forcing users to choose between transparency and usability, Dusk creates a framework where both coexist — but in the right places.

Why This Matters for the Next Market Cycle

As crypto matures, the narrative shifts. The next phase isn’t about novelty — it’s about infrastructure. Investors are starting to ask harder questions:

Can this scale under regulation?

Can institutions actually use this?

Does this resemble real financial systems?

Dusk answers those questions quietly but convincingly.

Confidential settlement isn’t a niche feature. It’s the foundation required for serious capital, complex instruments, and long-term market participation. Dusk understands that the future of blockchain isn’t louder transparency — it’s smarter disclosure.

Final Thought

Privacy in finance isn’t about hiding. It’s about protecting function. Dusk recognizes this at a protocol level. By enabling confidential settlement with verifiable integrity, it brings blockchain closer to how markets truly operate.

For traders, it means fairer execution.

For institutions, it means usable infrastructure.

For the ecosystem, it means maturity.

And that’s why Dusk feels less like a trend — and more like a long-term market layer waiting to be fully understood.