Stablecoins have quietly become one of the most important use cases in crypto. While speculation often dominates headlines, the largest real-world transaction volumes today move through assets like USDT. Yet most blockchains were never designed with stablecoins as their primary function. Plasma changes that premise entirely.

Plasma (XPL) is a next-generation Layer-1 blockchain designed from the ground up for stablecoins. Rather than treating stable assets as just another token type, Plasma places them at the center of its architecture. Its core mission is to make stablecoin transfers feel as seamless as traditional payments while retaining the transparency and programmability of blockchain infrastructure.

With fee-free USDT transfers, high-speed settlement, deep liquidity integration, and strong institutional traction ahead of its mainnet launch, Plasma positions itself as a foundational payments and settlement layer for the stablecoin economy.

The Vision Behind Plasma

Most existing blockchains aim to be general-purpose platforms. They support many use cases but often struggle to optimize for any single one. Plasma takes a different approach. It focuses on one specific and rapidly growing demand: stablecoin payments and settlement at global scale.

Plasma was designed to answer a simple but critical question: What would a blockchain look like if stablecoins were the primary asset, not an afterthought?

By narrowing its scope, Plasma is able to optimize performance, costs, and security around stablecoin flows. The result is a network tailored for real-world payments, treasury movements, DeFi liquidity, and cross-border settlement, all without the friction commonly associated with gas fees or slow confirmation times.

What Is the Plasma Blockchain?

Plasma is a high-performance Layer-1 blockchain launched with strong alignment to Tether and the USDT ecosystem. It is purpose-built to support stablecoin transfers, decentralized finance applications, and payment infrastructure with a focus on speed, cost efficiency, and reliability.

Unlike traditional networks where transaction fees fluctuate based on network congestion, Plasma enables zero-fee USDT transfers. This design choice makes it especially attractive for high-frequency payments, remittances, and enterprise-scale settlement use cases.

Plasma is not a scaling layer or sidechain. It is a fully independent blockchain with its own validator set, consensus mechanism, and native token, XPL.

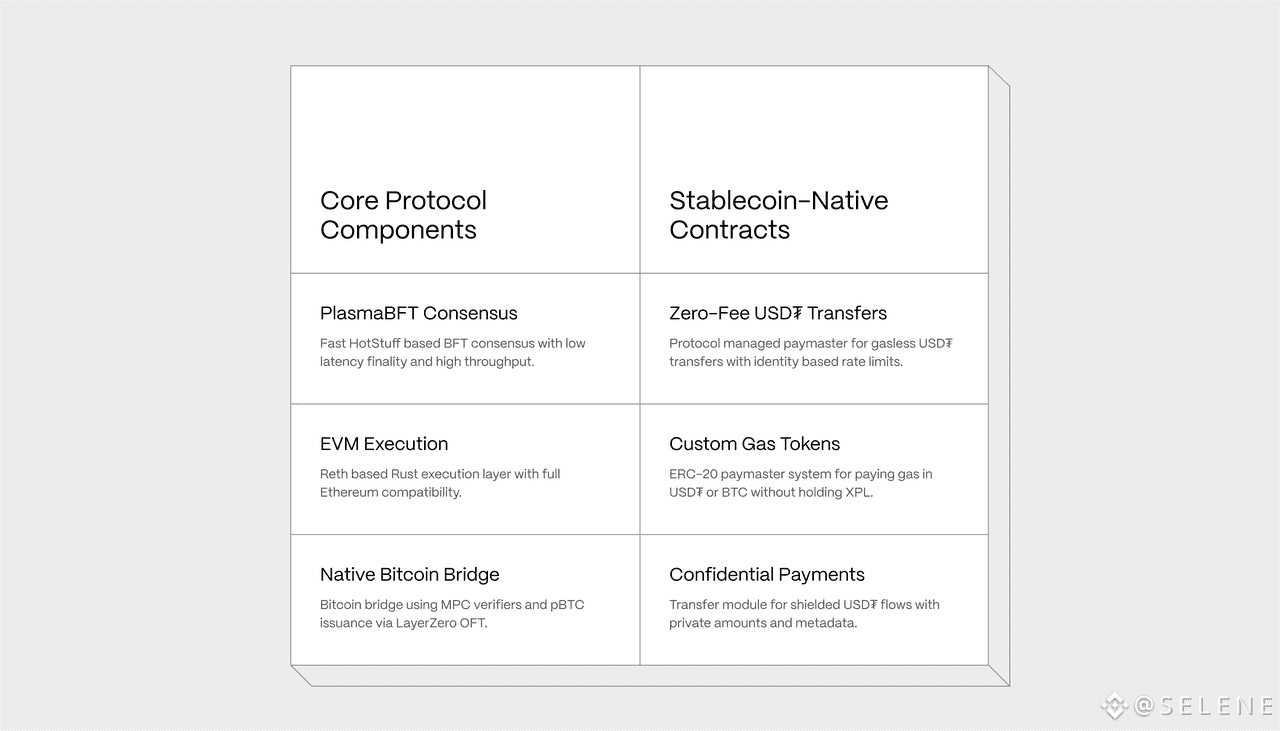

How Plasma Works

At the core of Plasma is a blockchain architecture optimized for stable asset flows. Its design prioritizes fast block times, predictable execution, and low operational overhead for users and applications.

Zero-Fee USDT Transfers

One of Plasma’s defining features is the removal of transaction fees for USDT transfers. This eliminates a major barrier for everyday usage, particularly in regions where even small fees can significantly impact affordability.

High-Speed Settlement

Plasma is engineered for rapid finality. Transactions settle in seconds, making it suitable for point-of-sale payments, treasury operations, and real-time financial applications.

Stablecoin-Centric Architecture

Rather than supporting all assets equally, Plasma optimizes its execution layer for stablecoins. This allows for higher throughput and more efficient state management when compared to general-purpose chains.

EVM Compatibility

Plasma supports EVM-compatible smart contracts, allowing developers to deploy existing Ethereum-based applications with minimal modification. This ensures access to a mature tooling ecosystem while benefiting from Plasma’s performance advantages.

What Is XPL?

XPL is the native token of the Plasma blockchain. While USDT is the primary transactional asset on the network, XPL plays a critical role in maintaining security, governance, and long-term sustainability.

Key Functions of XPL

Transaction Operations

While USDT transfers are fee-free, XPL is used for non-stablecoin transactions, smart contract interactions, and advanced network operations.

Validator Incentives

Validators who secure the network are rewarded in XPL. This aligns network security with token economics and ensures long-term decentralization.

Ecosystem Growth

XPL is used to fund ecosystem incentives, developer grants, and liquidity programs that expand Plasma’s application layer.

Governance

Token holders participate in governance decisions, influencing protocol upgrades, parameter changes, and ecosystem initiatives.

XPL is designed to support the network without interfering with the primary goal of frictionless stablecoin usage.

Mainnet Launch and Token Generation Event (TGE)

Plasma’s mainnet launch is accompanied by the Token Generation Event (TGE) for XPL. This milestone transitions the network from early testing and pre-deposit phases into full production.

The TGE introduces XPL into circulation, enabling staking, validator participation, governance, and ecosystem incentives. It also establishes the economic foundation required to sustain the network as it scales.

Rather than relying solely on speculative demand, Plasma’s token economics are closely tied to actual network usage and institutional participation.

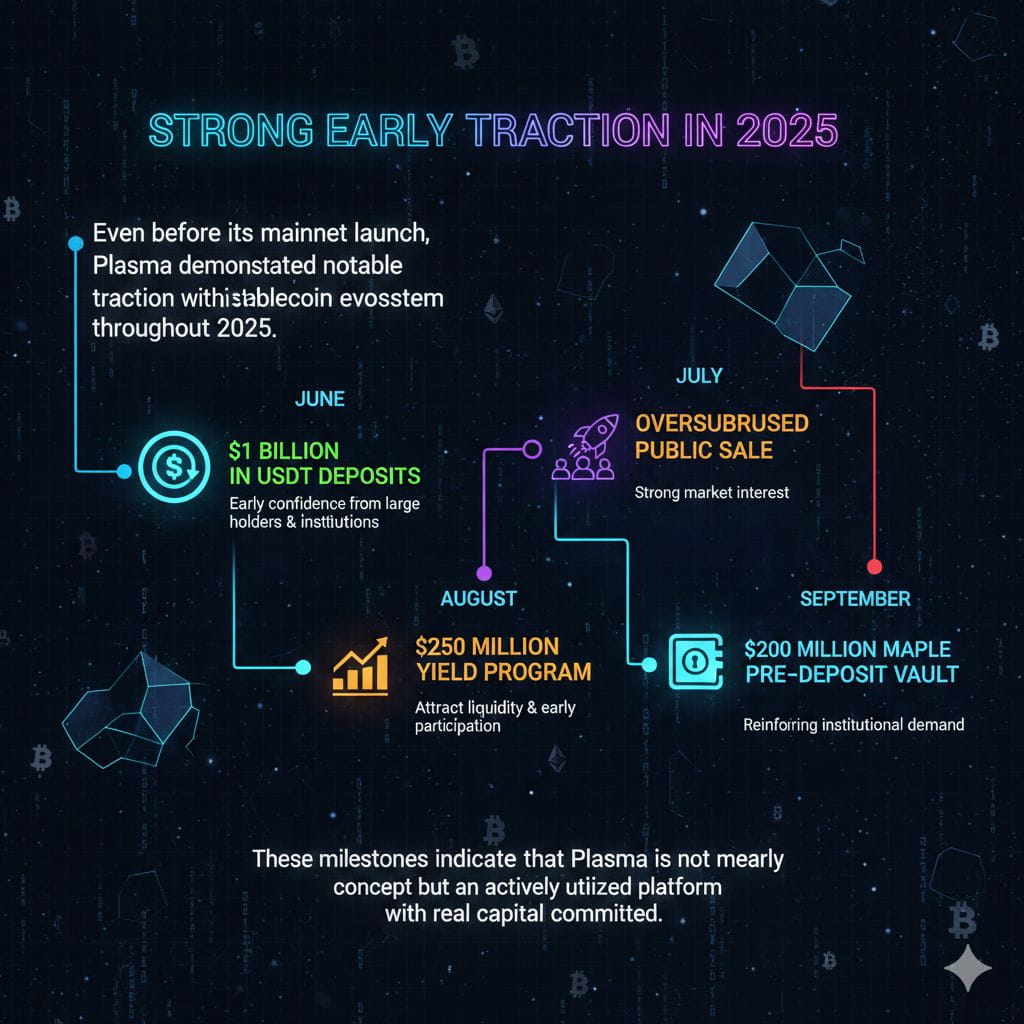

Strong Early Traction in 2025

Even before its mainnet launch, Plasma demonstrated notable traction within the stablecoin ecosystem throughout 2025.

$1 Billion in USDT Deposits

In June, Plasma recorded $1 billion in USDT deposits, signaling early confidence from large holders and institutions.

Oversubscribed Public Sale

Plasma’s public sale in July was oversubscribed, reflecting strong market interest in a stablecoin-focused blockchain.

$250 Million Yield Program

In August, Plasma launched a yield program totaling $250 million, designed to attract liquidity and encourage early participation.

$200 Million Maple Pre-Deposit Vault

In September, Maple contributed a $200 million pre-deposit vault, further reinforcing institutional demand for Plasma’s infrastructure.

These milestones indicate that Plasma is not merely a concept but an actively utilized platform with real capital committed.

Plasma and Stablecoin Payments

Stablecoin payments are one of Plasma’s core use cases. By removing fees and reducing settlement times, Plasma enables payment experiences closer to traditional financial systems while retaining blockchain transparency.

This makes Plasma suitable for:

Peer-to-peer transfers

Merchant payments

Payroll distribution

Cross-border

Treasury settlement for businesses

By focusing on reliability and simplicity, Plasma lowers the barrier for both individual users and enterprises to adopt blockchain-based payments.

Plasma in DeFi

Plasma also serves as a foundation for stablecoin-centric DeFi. Many DeFi protocols rely heavily on stable assets for lending, liquidity provision, and yield generation.

Plasma’s design benefits DeFi applications by offering:

Predictable transaction costs

High liquidity concentration

Fast execution

Reduced operational friction

This environment is especially attractive for institutions and protocols that require stable pricing and consistent settlement conditions.

Institutional Alignment and Compliance

A key differentiator for Plasma is its alignment with institutional requirements. Stablecoins are increasingly used by regulated entities, payment providers, and financial platforms.

Plasma’s focus on USDT, its transparent infrastructure, and its predictable execution model make it easier to integrate with compliance frameworks and reporting standards.

Rather than positioning itself against regulation, Plasma is designed to coexist with real-world financial systems.

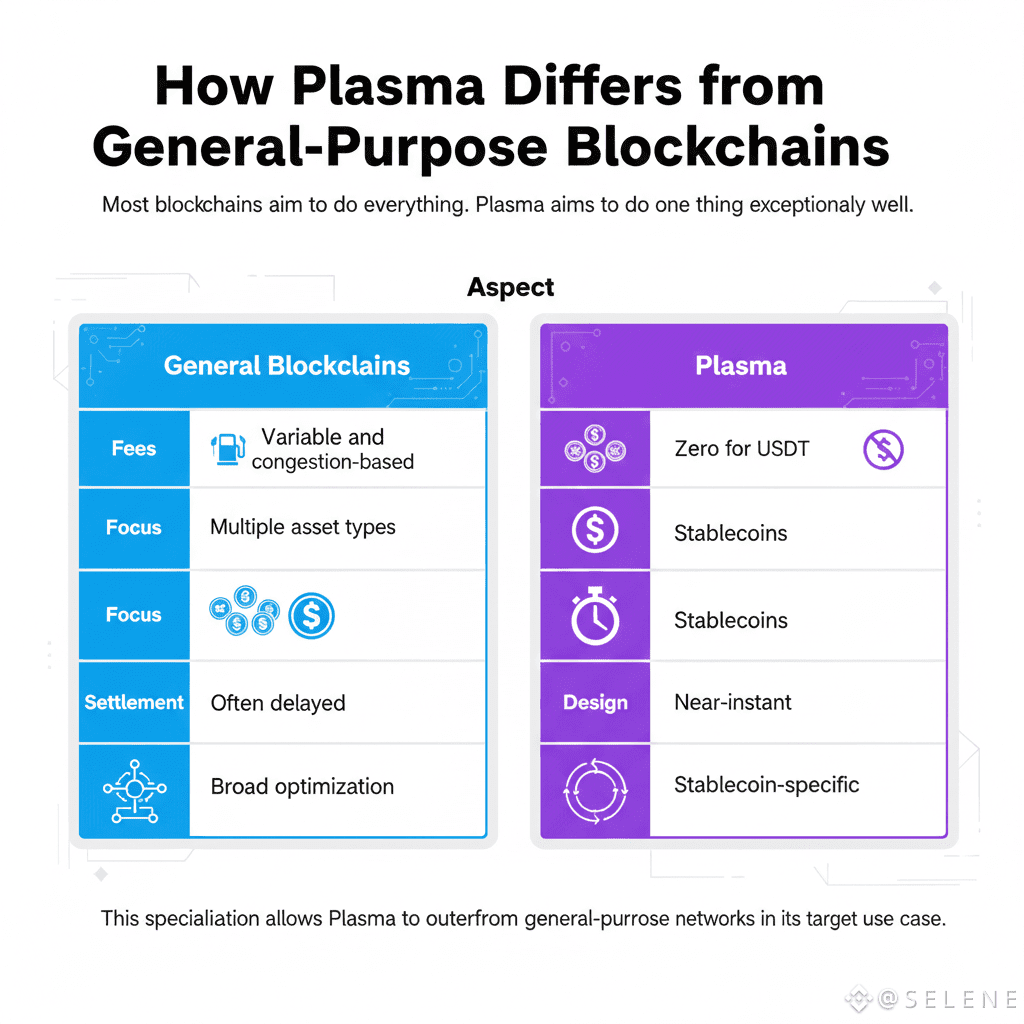

How Plasma Differs from General-Purpose Blockchains

Most blockchains aim to do everything. Plasma aims to do one thing exceptionally well.

AspectGeneral BlockchainsPlasmaFeesVariable and congestion-basedZero for USDTFocusMultiple asset typesStablecoinsSettlementOften delayedNear-instantDesignBroad optimizationStablecoin-specific

This specialization allows Plasma to outperform general-purpose networks in its target use case.

Long-Term Outlook for Plasma

As stablecoins continue to grow in adoption, the need for specialized infrastructure becomes increasingly clear. Payment networks, financial institutions, and decentralized applications require predictable, efficient settlement layers.

Plasma positions itself as that layer.

By focusing on stablecoins, aligning with major liquidity providers, and designing around real-world usage rather than speculation, Plasma aims to become a foundational component of the global digital payments stack.

Conclusion

Plasma (XPL) represents a shift in blockchain design philosophy. Instead of building for every possible use case, it focuses on the most widely used digital asset category in crypto today: stablecoins.

With fee-free USDT transfers, high-speed settlement, institutional traction, and a purpose-built architecture, Plasma offers a compelling vision for the future of stablecoin infrastructure. The XPL token supports this ecosystem by securing the network, enabling governance, and funding growth without compromising usability.

As stablecoins continue to bridge traditional finance and decentralized systems, Plasma stands out as a blockchain designed not for hype, but for function, scale, and long-term relevance.