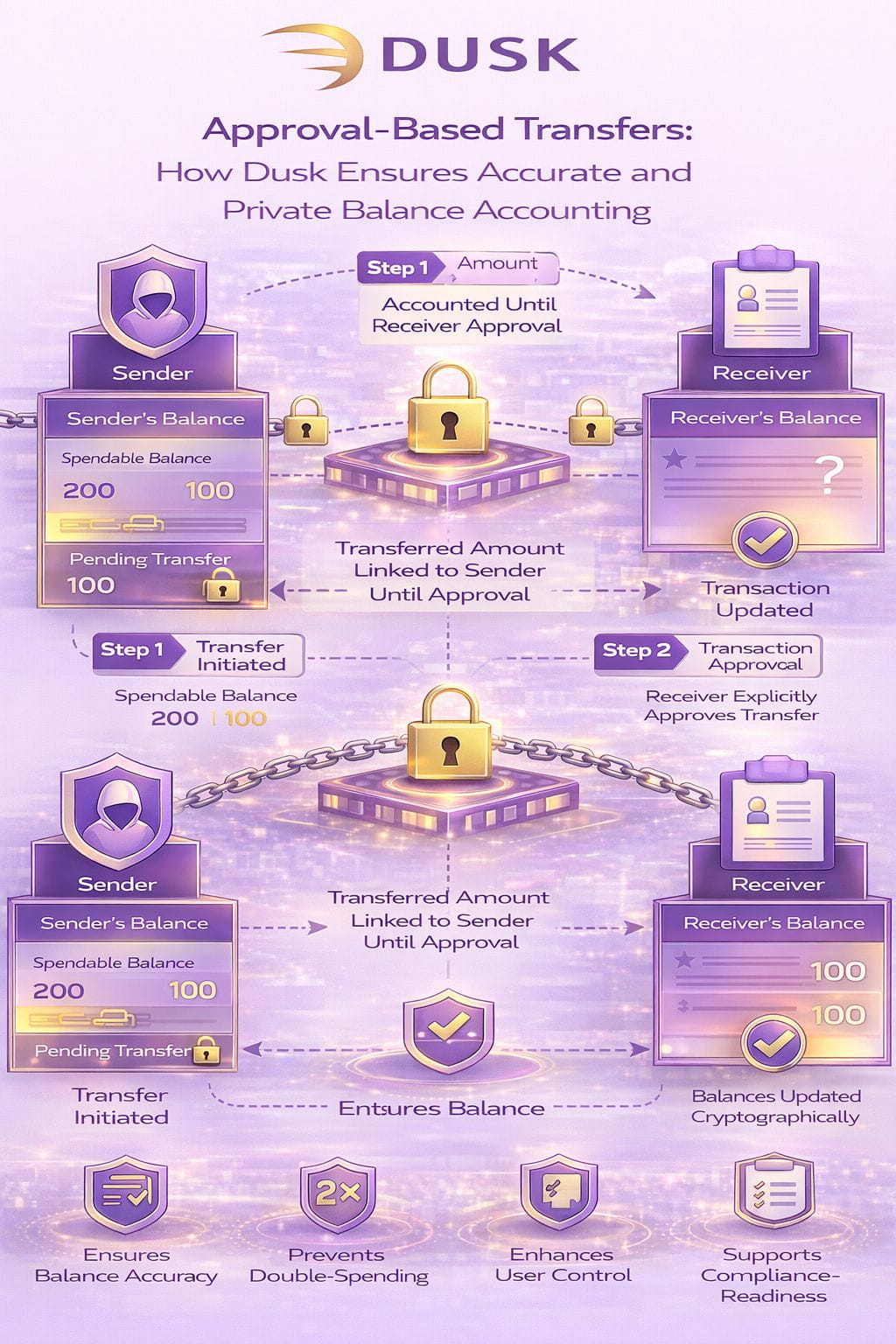

Dusk Network introduces an approval-based transfer mechanism to solve a critical problem in privacy-preserving finance: how to move assets securely without breaking balance integrity or exposing sensitive information. Instead of instantly finalizing transfers the moment they are initiated, Dusk ensures that transferred assets remain properly accounted for in the sender’s balance until the receiver explicitly approves the transaction.

This design prevents ambiguity in balance tracking while maintaining strong confidentiality. When a sender initiates a transfer, the asset amount is temporarily locked and marked as pending rather than being immediately deducted or publicly reassigned. From an accounting perspective, the sender’s balance still reflects ownership of the funds, ensuring that no value disappears into an unconfirmed state.

The receiver plays an active role in final settlement. Only after the receiver approves the transaction does the ownership officially change. This approval step finalizes the transfer, updates balances on both sides, and completes the state transition. Until then, the network treats the transaction as incomplete, protecting both participants from unintended loss, race conditions, or malicious manipulation.

Privacy is preserved throughout this process. Transaction details such as sender identity, receiver identity, and transferred amount remain confidential using zero-knowledge proofs. Observers can verify that balances remain consistent and that no double-spending occurs, without learning any sensitive financial data.

This approval-based model also strengthens user control. Receivers are never forced to accept assets blindly, which is especially important for regulated environments, institutional use cases, and compliance-sensitive workflows. It aligns well with real-world financial settlement systems, where transfers often require acknowledgment before becoming final.

By combining approval-based settlement with cryptographic privacy guarantees, Dusk achieves accurate balance accounting without sacrificing confidentiality. This approach ensures that value is always tracked correctly, users remain in control of their funds, and the network maintains trustless verification, making Dusk uniquely suited for secure, private, and regulation-ready digital finance.