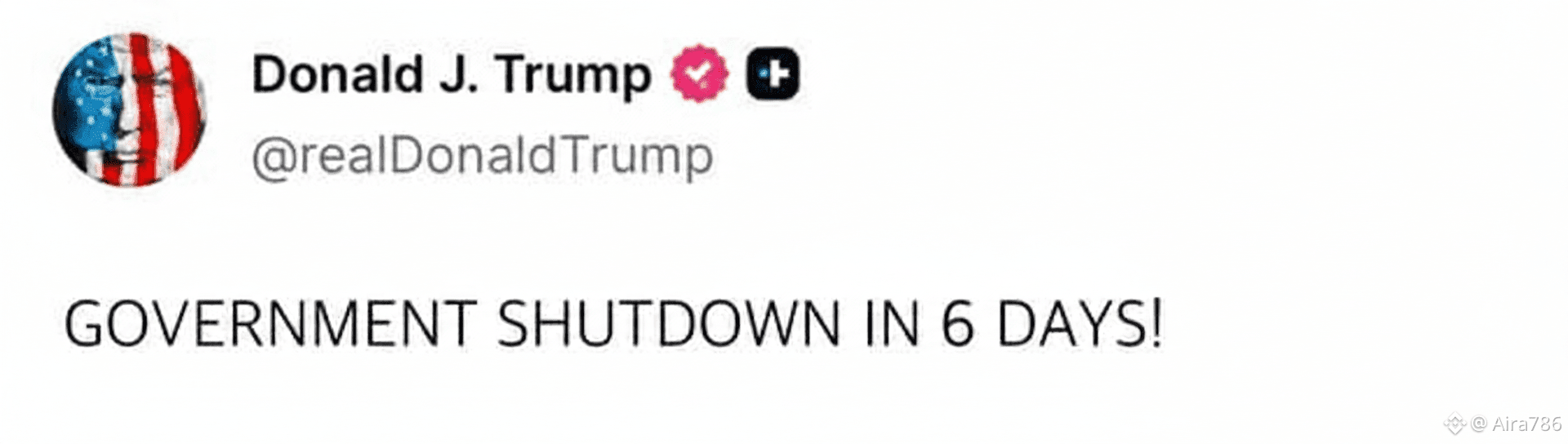

🏛️ Market Alert: Imminent U.S. Government Shutdown & Systemic Risk Analysis

The U.S. government is facing a potential shutdown in just six days. While precious metals like Gold and Silver have historically reached all-time highs during such fiscal instability, holders of equities and high-risk assets should prepare for significant volatility.

We are approaching a period of "Institutional Blindness." Here are the four primary threats to the current financial infrastructure:

1. The Data Blackout

A shutdown halts the release of critical economic indicators, including CPI (Inflation) and Non-Farm Payrolls (Jobs).

The Impact: The Federal Reserve and algorithmic risk models lose their primary data inputs.

The Result: The VIX (Volatility Index) typically reprices higher to account for this sudden lack of transparency.

2. Collateral Shock & Credit Downgrades

Given existing credit warnings, a prolonged shutdown increases the probability of a sovereign credit rating downgrade.

The Impact: Repo margins may spike, tightening the available pool of high-quality collateral.

The Result: A rapid contraction of global liquidity.

3. Liquidity Freeze

With the Reverse Repo (RRP) facility buffer significantly lower than in previous years, the financial "safety net" is thin.

The Impact: If primary dealers begin hoarding cash to protect their own balance sheets, funding markets could seize.

The Result: A sharp increase in borrowing costs across the board.

4. Recessionary Catalysts

Historical data suggests each week of a federal shutdown reduces GDP by approximately 0.2%. In a cooling economy, this friction is often enough to trigger a technical recession.

🔍 Key Metric to Watch: The SOFR–IORB Spread

To gauge real-time stress, monitor the spread between the Secured Overnight Financing Rate (SOFR) and Interest on Reserve Balances (IORB).

If this spread widens significantly (as seen during the March 2020 liquidity crisis), it signals that private markets are starved for cash while liquidity remains locked within the Federal Reserve system.

📊 Performance Snapshot

#MarketUpdate #FederalShutdown #Economy2026 #GoldStandard #LiquidityCrisis