A few months back, late 2025, I was testing a small tokenized asset position. Nothing fancy. Just moving a slice of a real-world asset fund across a bridge to see if I could get better yield without putting every detail on display. At first, it worked the way you’d expect. Then the friction showed up. The chain I was using exposed more transaction detail than I was comfortable with, and once I tried adding privacy tooling, compliance checks kicked in and dragged settlement out for hours. That’s what bothered me. Not that it was slow, but that it felt unpredictable. If this stuff is supposed to work for real finance, why does it still feel like it’s one edge case away from breaking?

That experience stuck with me because it points to a bigger problem across crypto infrastructure. Privacy is almost always an afterthought. Most networks force you to choose between two bad options. Either everything is transparent, which means strategies, positions, and flows are visible to anyone watching closely, or everything is hidden, which immediately creates problems for institutions that have to answer to regulators. The middle ground is messy. UX degrades. Fees jump when audits or checks happen. Tools don’t integrate cleanly. For anything serious, like settling trades or managing tokenized securities, that friction adds up quickly. Developers hesitate to commit. Users fall back to centralized systems, not because they love them, but because at least they know what to expect.

It’s a bit like working with sensitive documents in a shared office. Everyone uses the same filing cabinet because it’s convenient, but without proper locks, your papers are exposed to anyone walking past. Add locks after the fact, and suddenly every retrieval takes longer, needs approvals, and interrupts workflow. Unless the system was designed for selective access from the start, efficiency and confidentiality keep fighting each other.

That’s where @Dusk approach starts to feel different. It’s built as a layer-1 where privacy isn’t bolted on later. Zero-knowledge proofs are part of execution itself, so transactions are private by default, but still verifiable when auditors or regulators need visibility. The focus is narrow, and that seems intentional. Instead of chasing NFTs, meme cycles, or high-frequency retail activity, it’s aimed at financial use cases like securities, payments, and RWAs. Since the January 2026 mainnet launch, the network has shown sub-second finality in controlled environments, though real usage is still early. That restraint matters. Less unrelated traffic means more predictable behavior for things like the NPEX deployment in Q1 2026, which is targeting more than €300 million in tokenized assets without turning compliance into a workaround.

Under the hood, the design choices line up with that focus. The consensus mechanism, Secure Block Agreement or SBA, is leaderless and Byzantine fault tolerant. No single validator decides block production. Agreement happens in pipelined stages, pushing throughput toward the 100 TPS range without sharding for now. The December 2025 DuskDS L1 upgrade improved data availability to support this. Block propagation uses Kadcast, which routes data through a Kademlia-style network instead of brute-force broadcasting. It’s not built to win speed contests. It’s built to stay reliable under confidential workloads. Combined with PLONK-based proofs in DuskEVM, launched late 2025, this setup avoids choking during private execution, which matters when assets move across the two-way bridge that went live back in May 2025.

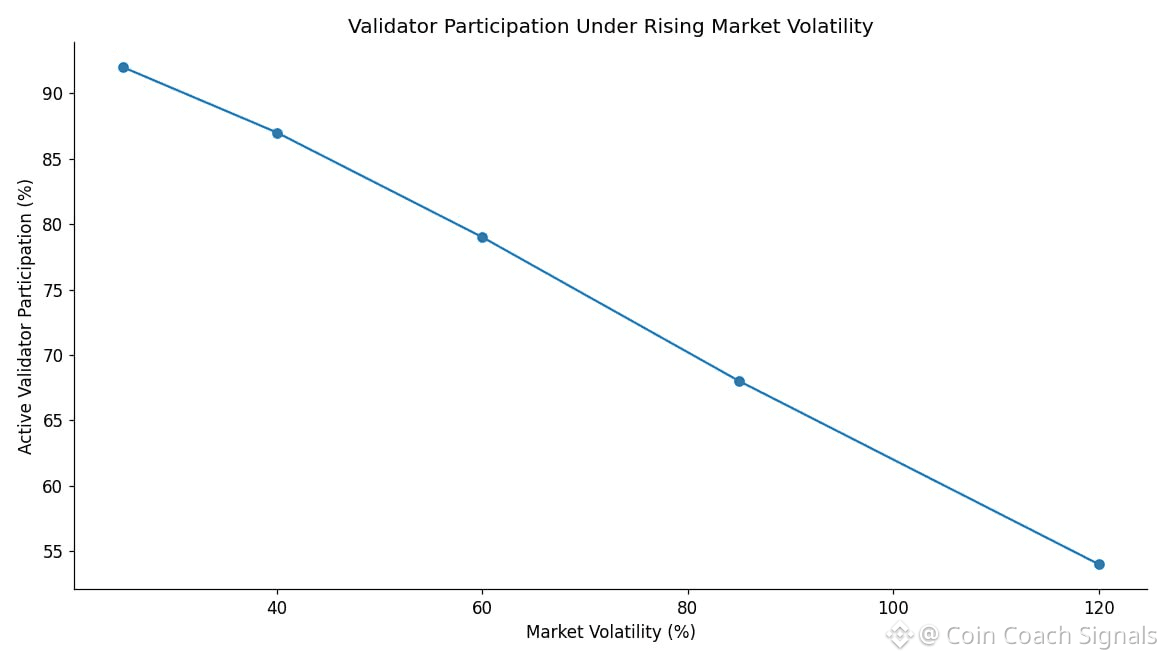

#Dusk as a token is intentionally plain. It pays for gas on confidential transactions, with part of the fee burned to introduce some supply pressure over time. Staking secures the network. Structurally, validators and delegators lock DUSK to participate in block production and earn rewards tied to uptime and participation. The reason for this tends to be that governance flows through staked voting on protocol upgrades, like the layer-1 changes rolled out in early 2026. The reason for this is that slashing exists to punish misbehavior such as double-signing, tying security directly to economic risk. There’s no heavy incentive theater here. It’s meant to function as infrastructure, not entertainment.

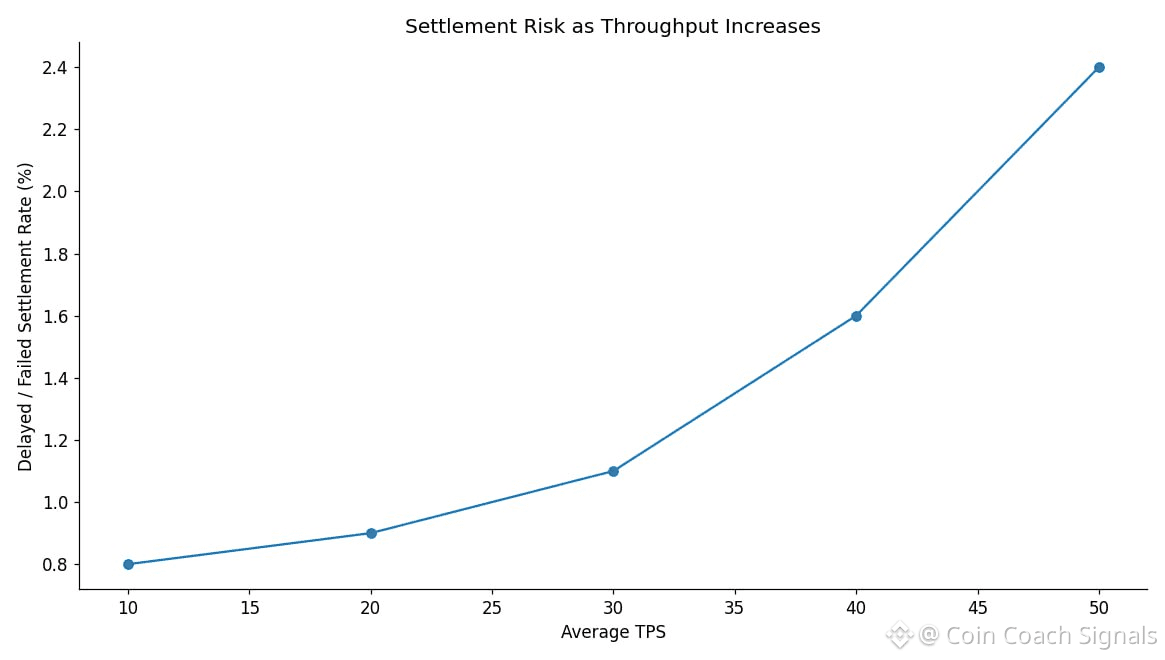

Right now, the numbers reflect that early phase. Circulating supply is around 464 million tokens, with market cap hovering near $75 million at recent prices. Daily volume has been averaging about $20 million following mainnet. On-chain activity is still ramping. Roughly 10,000 unique addresses have interacted with the network since January 2026, but average throughput remains under 50 TPS as applications like Dusk Trade’s waitlist, opened January 22, begin onboarding users.

From a trading angle, short-term price action is still narrative-driven. Structurally, the privacy rotation in mid-January 2026 sent DUSK sharply higher, helped by exchange listings on HTX and Binance US late last year. This works because partnerships spark bursts of attention, like the Chainlink integration announced in November 2025, or today’s January 26 news around the Quantoz EURQ MiCA-compliant token. The behavior is predictable. These events pull in retail momentum and quick trades. They also fade. Unlocks, broader market pullbacks, or simple attention shifts tend to unwind gains just as fast.

Longer term, the real question is whether habits form. If institutional flows stick, demand for $DUSK comes from staking and fees, not speculation. Hedger’s confidential transactions added in June 2025, the multilayer evolution that followed, and platforms like NPEX targeting €300 million in RWAs all point in that direction. But infrastructure value doesn’t show up quickly. It compounds slowly through repeated, uneventful transactions. Second settlements. Third trades. Routine operations that work without drama.

The risks are still obvious. Competition is intense. Monero and Zcash dominate retail privacy narratives. Ethereum L2s are rolling out ZK solutions that may satisfy institutions without asking them to move ecosystems. Regulatory uncertainty remains, especially with MiCA reshaping Europe. And there are real technical failure modes. A surge in RWA issuance during market stress could overwhelm proof generation, leading to settlement delays or temporary halts. Even short disruptions could damage trust if institutions are involved.

There’s also a narrative risk. If retail hype dominates while institutional usage lags, volatility increases and builders hesitate. Dusk’s value proposition depends on being boring in the right way. Predictable. Compliant. Quiet.

In the end, networks like this are decided over long stretches of time. Not by launch weeks or announcement candles, but by whether people come back and use them again. The second transaction matters more than the first. If that trust compounds, Dusk finds its place. If not, it becomes another technically sound idea that never fully escaped the adoption gap.

@Dusk