Why Blockchain Gaming Still Hasn’t Found Product–Market Fit — And Whether VANAR Can

Blockchain gaming has promised a revolution for almost seven years now. Ownership of digital assets. Player-driven economies. Interoperable worlds. Studios free from platform rent-seeking. Players finally paid for their time. On paper, it sounded inevitable. In practice, it has been mostly a graveyard of half-built games, mercenary users, and tokens that spike on launch and bleed slowly afterward. The uncomfortable truth is that blockchain gaming hasn’t failed because the tech is weak. It has failed because it misunderstood what players actually want, and because most projects designed their economies for speculation first and gameplay second. The real question isn’t whether gaming will move on-chain. It’s whether any blockchain gaming infrastructure can escape the structural traps that killed the first generation. VANAR positions itself as an answer. Whether it actually is remains an open—and risky—question.

Traditional gaming is brutally competitive and deeply conservative. Players do not switch platforms lightly, and they abandon games fast if the fun isn’t immediate. Fortnite, Roblox, Minecraft, and Call of Duty didn’t win because of revolutionary monetization. They won because the gameplay loop was sticky, social, and frictionless. Blockchain gaming tried to invert that formula. It led with tokens, wallets, NFTs, and whitepapers. Fun was deferred. Complexity was immediate. The result was predictable: users arrived to farm, not to play, and left the moment incentives dried up. This is not a moral failure of users. It is a design failure of the industry.

The clearest evidence of this failure is retention data. DappRadar’s 2022–2024 reports consistently showed that over 80 percent of blockchain games failed to retain even 10 percent of users after 30 days. Axie Infinity, often cited as the category’s success story, collapsed not because people stopped believing in NFTs, but because its economy could not survive once new entrants slowed. When Axie’s token rewards exceeded the real demand for gameplay, inflation became terminal. This wasn’t an edge case. It was the base case for play-to-earn as a model. VANAR is entering an industry that already knows how this movie ends.

Another structural problem is the mismatch between gamer psychology and crypto psychology. Gamers value immersion, fairness, and progression. Crypto users value liquidity, upside, and exit options. When these incentives collide inside a single product, one side usually dominates. In most blockchain games, it was the traders. Bots replaced players. Guilds replaced communities. Gameplay became an obstacle between users and rewards. The moment rewards dropped, engagement collapsed. Product–market fit never existed; it was subsidized attention. Any chain claiming to fix blockchain gaming has to explain how it prevents this incentive hijacking. VANAR claims its answer lies in infrastructure rather than token rewards.

VANAR positions itself not as a single game, but as a gaming-focused Layer 1 optimized for performance, asset streaming, and immersive experiences. This is a smart reframing. The first wave of blockchain gaming failed partly because every studio had to reinvent infrastructure while also building a game. VANAR argues that if you solve latency, cost, scalability, and asset delivery at the base layer, developers can focus on gameplay instead of blockchain plumbing. In theory, this aligns with how successful gaming ecosystems actually form: engines first, hits later. Unreal Engine did not succeed because Epic promised monetization. It succeeded because it removed friction for developers.

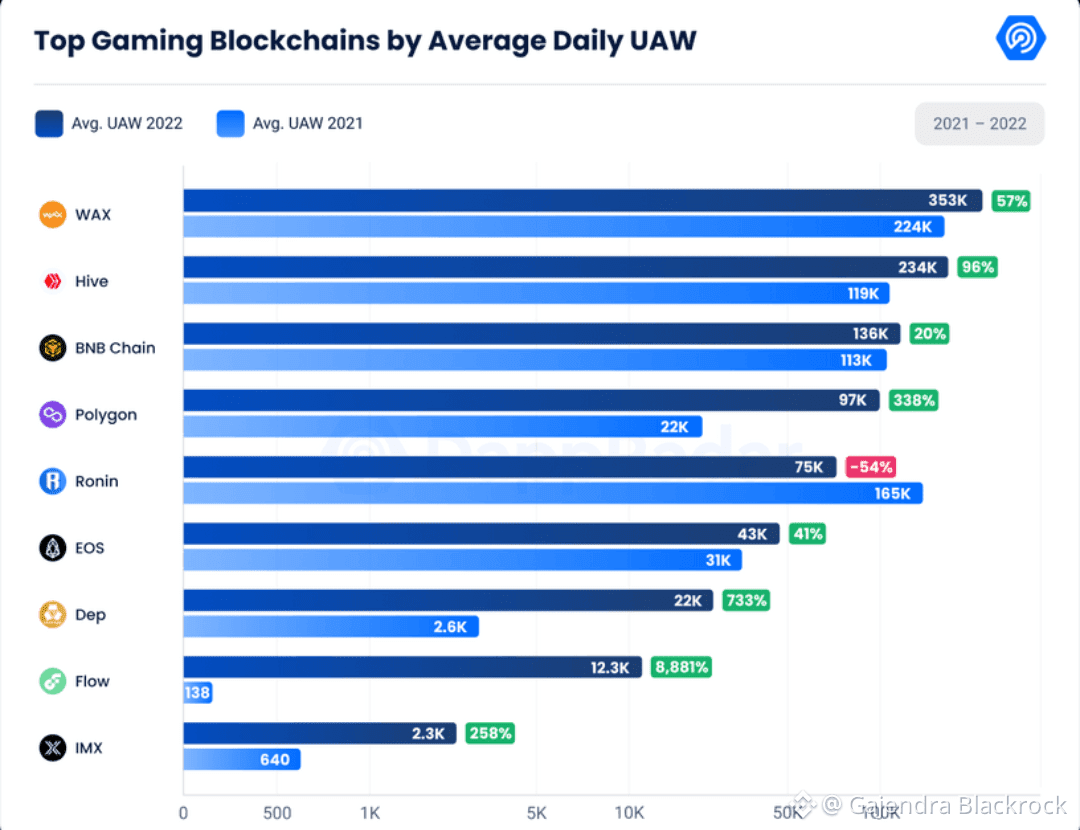

However, infrastructure alone does not guarantee adoption. History is brutal on this point. EOS raised billions promising high-performance dApps and gaming use cases. Flow partnered with the NBA and launched with enormous fanfare. Immutable X positioned itself as the home of Web3 gaming with zero gas fees. All three solved technical problems. None unlocked mass-market blockchain gaming. The bottleneck was not throughput. It was demand. VANAR risks repeating this mistake if it assumes that better rails automatically create better games.

The real-world case study that matters most here is Roblox. Roblox is not blockchain-based, but it accidentally solved many of the problems blockchain gaming claims to address. It offers user-generated content, a creator economy, digital asset ownership within a closed system, and a currency that actually circulates. Roblox’s Robux works because it is tightly controlled, sinks are real, and speculation is discouraged. You cannot freely trade Robux on open markets. This is precisely what makes it stable. Blockchain gaming did the opposite: it maximized liquidity and minimized control. VANAR must confront this contradiction head-on. True player economies often require limits, not freedom.

Token design is where most blockchain gaming projects quietly die. A gaming token has three enemies: low demand, high velocity, and weak sinks. VANAR’s token narrative emphasizes ecosystem usage, developer adoption, and in-game transactions. But usage does not automatically translate into sustainable demand. If the token is primarily a gas or settlement asset, its velocity will be high and its value capture thin. If players earn tokens faster than they need to spend them, sell pressure becomes structural. This is not theory. It is observable across nearly every gaming token launched since 2020.

For VANAR to break this pattern, token demand must come from non-speculative sources that scale with genuine activity. That means developers needing VANAR tokens in ways they cannot easily bypass, and players spending tokens for experiences they actually value, not just to flip later. Cosmetic ownership, access rights, mod marketplaces, and creator monetization are more promising than play-to-earn rewards. But this also means accepting slower growth and less hype. The uncomfortable truth is that the healthiest gaming economies look boring to crypto traders.

A meaningful comparison here is with Immutable X. Immutable focused heavily on developer tooling and partnered with established studios, but its token still struggled to reflect ecosystem growth. Why? Because the value accrued more to games than to the chain. If VANAR succeeds in attracting high-quality games, it may face the same paradox: the better the games, the less visible the chain. From a user’s perspective, that is success. From a token holder’s perspective, it is a problem. VANAR must decide whether it is optimizing for gamers or for token price. Trying to do both often breaks both.

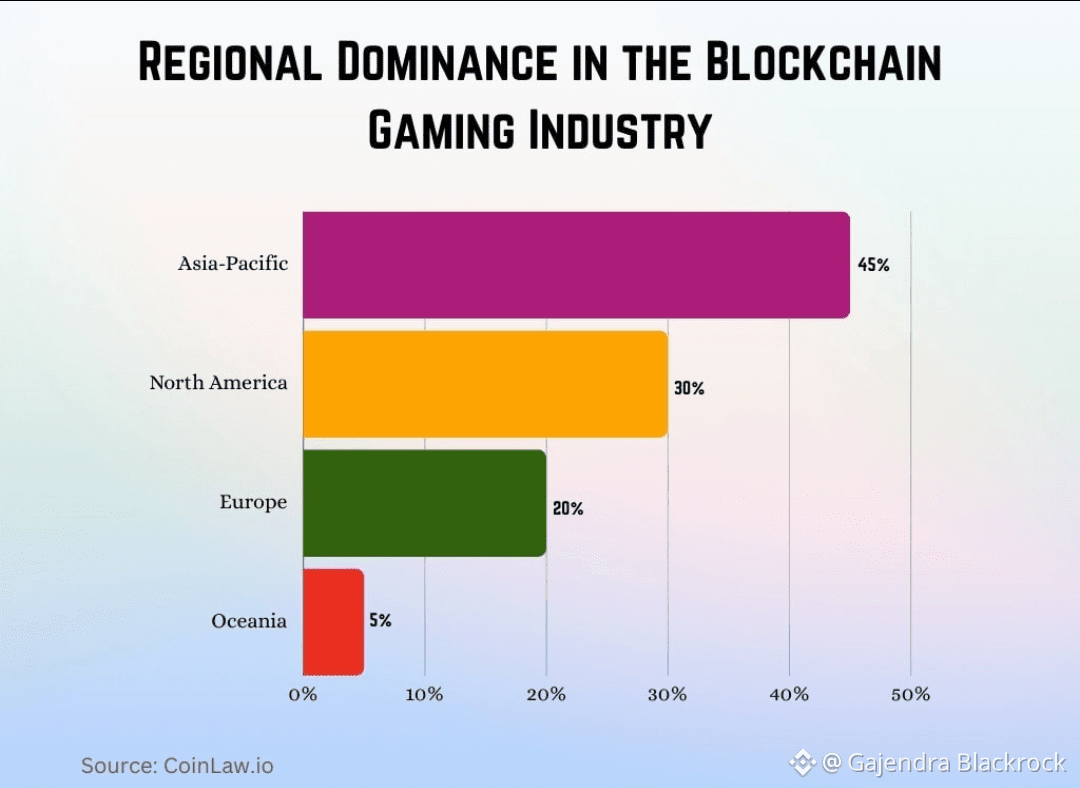

Regulation adds another layer of friction. Gaming regulators already scrutinize loot boxes and in-game currencies. Introducing blockchain tokens that trade freely on exchanges invites financial regulation into what used to be entertainment. South Korea’s ban on play-to-earn mechanics was a wake-up call for the industry. Games were forced to remove token rewards or exit the market entirely. VANAR’s long-term viability depends not just on tech, but on whether its ecosystem can adapt to regional regulatory constraints without collapsing its economic model.

One under-discussed risk is abstraction. For blockchain gaming to reach mainstream users, wallets, gas fees, and chains must disappear into the background. VANAR claims to support this through seamless UX and asset streaming. This is necessary, but it also reduces the visibility of the token itself. If players don’t know they’re using VANAR, they won’t emotionally attach to it. This again shifts value away from the base layer and toward applications. VANAR may succeed as invisible infrastructure and still disappoint speculative expectations.

There is also a timing problem. The broader gaming industry is not waiting for blockchain. Studios are experimenting with AI-generated content, cloud streaming, and cross-platform play. Blockchain is competing for mindshare against technologies that directly improve gameplay today. VANAR’s pitch must resonate with developers who already have alternatives that do not involve token volatility or regulatory uncertainty. That is a high bar, especially for mid-sized studios operating on thin margins.

Despite these risks, VANAR’s approach is not naive. By focusing on performance and immersive asset delivery, it is at least addressing real developer pain points rather than chasing yield narratives. Its success will depend less on marketing and more on whether a small number of genuinely good games choose it and stay. One breakout title that players love without caring about tokens would do more for VANAR than ten speculative launches. But that outcome is rare and unpredictable, and it cannot be engineered by infrastructure alone.

From a value capture perspective, the most realistic long-term scenario is modest, not explosive. If VANAR becomes a niche but respected gaming chain, token demand could stabilize through steady developer usage rather than hype cycles. Velocity would need to be controlled through sinks that feel natural, not forced. Any attempt to accelerate this through aggressive incentives would likely recreate the very problems VANAR claims to solve.

Two real visuals would materially strengthen this analysis. The first should be a chart using DappRadar or Footprint Analytics data showing 30-day retention rates of top blockchain games from 2021 to 2024, highlighting the systemic drop-off across cycles. The second should be a comparative table using public data comparing token velocity and user growth for Axie Infinity, Immutable X, and Roblox’s Robux economy, clearly showing how controlled circulation correlates with sustainability. These are not decorative visuals; they expose the structural differences that matter.

Blockchain gaming hasn’t failed because gamers hate ownership or because blockchains are slow. It failed because it tried to financialize fun before earning trust. VANAR has a chance—not a guarantee—to avoid that mistake by staying boring, disciplined, and developer-first. Whether it can resist the gravitational pull of speculation will decide not just its product–market fit, but the honesty of its vision.

@Vanarchain #vanar #Vanar $VANRY