Regulated financial markets are not just “money moving.” They are living systems built on rules, responsibility, proof, and protection. Every day banks, brokers, funds, exchanges, custodians, and payment institutions operate inside a strict framework where trust is not a feeling, it is enforced. Identity must be verified. Risk must be managed. Reporting must be accurate. Audits must be possible. Client data must remain confidential. And yet, the world keeps demanding more speed, more access, more efficiency, and fewer middle layers that slow everything down.

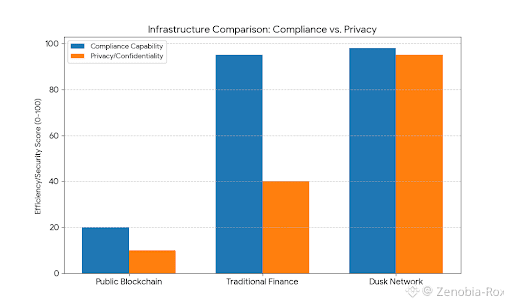

This is the exact tension that makes regulated markets hard to bring on-chain. Many blockchains look powerful from the outside because they are transparent and global. But regulated finance does not work on “everything visible to everyone.” In many cases, full transparency is not a feature, it is a deal breaker. A pension fund cannot reveal its entire trading strategy in public. A bank cannot expose client-level transaction details to the whole world. A tokenized bond or equity cannot be transferred freely to any address without checks, restrictions, and legal accountability. Even when everything is fully legal, the data itself can still be sensitive and harmful if exposed.

That is why $DUSK is built differently. The heart of Dusk’s idea is simple but deep: regulation is not something you bolt on later. If you want real institutions and real markets to use a blockchain, the blockchain must be designed from day one to handle compliance and privacy together. It must be able to enforce rules without making the entire market naked. It must be able to provide accountability without destroying confidentiality. It must be able to settle fast without creating legal chaos. Dusk is built for regulated financial markets because it tries to solve this full puzzle instead of solving only one piece.

To understand why this matters, look at how traditional finance works today. The system is powerful, but it is also heavy. There are many intermediaries because intermediaries create controlled environments where regulations can be enforced. The downside is cost and delay. Reconciliation between institutions takes time. Settlement cycles create counterparty risk. Compliance checks can be slow and manual. Data sits in separate databases, and even when everything is correct, everyone still spends time proving it is correct. The world accepts this because the alternative has always been worse: faster systems without safeguards can create fraud, instability, or non-compliance.

Blockchains promise a shared source of truth, but the public transparency model of many chains does not fit regulated markets. In regulated finance, transparency must be selective. The right people must be able to verify the right things at the right time, without exposing everything to everyone. That is not a small requirement. It is one of the biggest requirements.

This is where Dusk’s core direction matters. Dusk focuses on privacy-preserving verification. Instead of forcing markets to choose between “private but unverified” and “verified but fully exposed,” the network aims for a third path: you can keep details confidential while still proving compliance and correctness. This changes the entire shape of what regulated markets can do on-chain.

When we say privacy in regulated markets, we do not mean secrecy for wrongdoing. We mean confidentiality for legitimate activity. Markets need privacy to function. Corporate treasuries need privacy. Institutional trade execution needs privacy. Private placements need privacy. The identity of investors in certain contexts needs privacy. The size and timing of orders needs privacy. But regulators also need oversight. Auditors need evidence. Courts need enforceability. The system needs guardrails.

Dusk is built around the belief that cryptographic proofs can replace raw exposure. If a participant needs to prove they are eligible, the system should not require them to publicly reveal their full identity to every observer on the network. If an asset has transfer restrictions, the chain should enforce them without leaking personal information. If an exchange needs to show it followed market rules, it should be able to generate verifiable evidence without publishing the entire book of sensitive data to the public. This is why Dusk’s approach is naturally aligned with regulated markets: it treats privacy as a way to protect compliant users, and treats compliance as something that must still be verifiable.

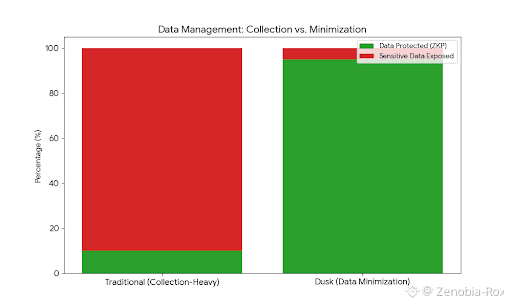

Confidential smart contracts are an important part of this story. Regulated finance is filled with contracts that contain conditions. A tokenized security may require that only verified investors can hold it. It may need jurisdiction checks. It may include lock-up periods. It may need corporate actions like dividends or voting. It may require controlled disclosure. It may require that only certain parties can participate at certain times. If smart contracts cannot handle this reality, then regulated finance cannot move on-chain in a meaningful way.

Confidential smart contracts make that reality possible because they allow logic to execute while keeping sensitive data protected. This is not only about hiding values. It is about allowing real business logic to run on-chain without turning every input, rule, and participant detail into public information. That matters deeply for institutions. Institutions want programmability, but they cannot accept a model where their compliance and operational details become publicly visible by default.

Another reason Dusk is built for regulated markets is its focus on automated compliance. Traditional compliance is expensive because it is fragmented. Different institutions do the same checks in different systems. Paperwork moves between departments. Risk teams review transactions. Systems generate reports. Investigations require pulling data from many sources. Even when people do everything correctly, the cost remains high because enforcement is often “after the fact.” Something happens, then the system verifies whether it should have happened.

Dusk aims for a model where compliance can be enforced at the moment of transaction execution. In a properly designed compliance-aware environment, a non-compliant transfer should not be able to finalize. That does not eliminate regulation. It strengthens it. It turns regulation from a reactive burden into an embedded rule system. That is the direction regulated markets actually want, because it reduces operational risk, reduces human error, and reduces the cost of repeating the same checks across multiple layers.

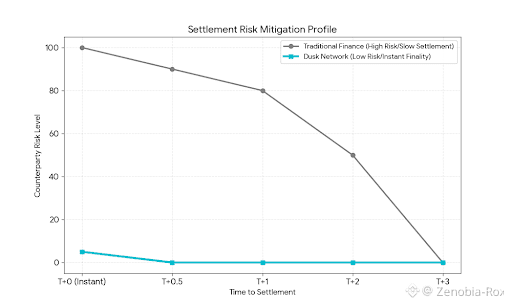

Now let’s talk about settlement, because settlement is where regulated finance feels the pain most clearly. Settlement speed is not just about convenience. It is about risk. When settlement is slow, counterparty risk exists between the time of trade and final transfer. Capital gets tied up. Margin requirements increase. Operational risk increases. Disputes become more likely. The system adds buffers and intermediaries to manage these risks, and those buffers cost money.

Instant or near-instant settlement is a major upgrade for regulated markets, but it only becomes meaningful if it still fits legal and compliance requirements. Speed without rules is not finance, it is chaos. Dusk aims to provide fast finality while still being designed for regulated workflows. That means settlement is not treated like a crypto flex. It is treated like a way to reduce market risk while preserving oversight.

Custody and liability are also central in regulated markets. Institutions often carry heavy legal responsibilities when holding client assets. Custody frameworks exist because the law needs clear accountability. But custody structures also create costs and points of failure. If a blockchain can support structures where users retain self-custody while institutions can still interact with assets in a compliant way, that can reduce liability and reduce friction. Dusk’s narrative supports a direction where users can access financial assets directly from wallets while keeping compliance requirements intact. That is exactly the kind of bridge regulated markets need: user empowerment without removing controls.

Liquidity fragmentation is another reason the regulated world cares about a compliant chain. Today liquidity is split across venues, regions, and systems. Even when two institutions trade the same asset, they may settle through different paths and reconcile later. The existence of multiple “truths” creates inefficiency. A single shared source of truth can reduce reconciliation and reduce disputes, but again, only if it can support the real rules that govern market participation.

Dusk’s idea of a shared, compliant, privacy-preserving environment aims to reduce that fragmentation. If issuers can launch regulated assets on a network that enforces their rules, if venues can trade those assets while keeping sensitive details protected, and if settlement can occur quickly while remaining auditable, then liquidity can be consolidated in a more natural way. This is not just about better technology. It is about better market structure.

From the issuer’s perspective, Dusk is attractive because issuers do not want to choose between global distribution and regulatory safety. Issuers want a way to tokenize assets that still behave like real financial instruments. They want restrictions that are enforceable. They want governance processes. They want compliance. They want privacy. They want settlement and lifecycle management that reduces operational cost. Dusk is built for regulated markets because it aims to make issuance and lifecycle processes possible without forcing issuers into a transparent-by-default environment that exposes their investors and workflows.

From the trading venue perspective, the needs are very specific. A regulated exchange or platform must protect market integrity, prevent manipulation, manage surveillance, enforce eligibility, and remain auditable. But it also needs confidentiality to protect its participants and to prevent predatory behavior like front-running based on visible order flow. Public blockchains can struggle here because complete transparency can become a weapon. Confidential execution and selective disclosure can reduce this risk while still enabling verification and oversight. That is why the Dusk direction matches regulated venues more naturally.

From the institution perspective, adoption is about risk, not hype. Institutions will not adopt a system that increases legal uncertainty, exposes confidential data, or makes compliance harder. They will adopt systems that reduce cost while preserving safety. Dusk is built for regulated markets because its story is not “ignore regulation.” Its story is “build with regulation.” That lowers the barrier for serious adoption.

From the user perspective, the value is also real. Regulated markets often feel closed. Access requires accounts, intermediaries, and permissioned environments. Yet users still want ownership, self-custody, and global participation. A network that supports compliance while still being decentralized and privacy-preserving can help bring users closer to real financial products without stripping away their control. In that sense, Dusk’s direction is not only institutional. It is also human. It aims for a world where being compliant does not mean being powerless.

It is important to be honest about the reality: regulated market adoption is never instant. Laws differ by jurisdiction. Compliance standards evolve. Identity frameworks must be integrated. Governance of disclosure must be carefully designed. Institutions move slowly. Even if the technology is ready, the rollout often happens through pilots, partnerships, and gradual scaling. But this does not reduce the importance of Dusk’s design. In fact, it increases it. If you know adoption will be slow and careful, then the foundation must be built right from the beginning. Dusk is built for regulated financial markets because it tries to start with the right foundation rather than trying to patch it later.

In the end, the reason DUSK is built for regulated financial markets comes down to one truth: regulated finance needs a system that can prove compliance without exposing everything. It needs a system that can enforce rules without relying on endless intermediaries. It needs privacy not as darkness, but as protection. It needs auditability not as surveillance of everyone, but as verifiable accountability. It needs settlement that is fast, but also final and legally meaningful. It needs a bridge between traditional financial structures and a new digital infrastructure that does not break the law to gain efficiency.

That is the lane Dusk is choosing. Not the easy lane of pure openness. Not the fake lane of “private but unverifiable.” But the hard lane where privacy and compliance are designed together, where institutions and users can both exist, and where the future of regulated on-chain finance can actually be built without pretending regulation does not exist.