A while back, I had some funds staked on a mid-tier chain. Nothing tactical. I wasn’t hunting yield or trying to optimize returns, just letting assets sit while I focused on trading elsewhere. Then the network hit a bump. A few validators dropped offline, confirmations slowed, and rewards dipped slightly. Nothing catastrophic, but enough to make me stop and look closer. I’d delegated to nodes that looked solid on paper, yet when things slipped, it wasn’t obvious who was responsible or why those validators had authority in the first place. After years of trading infrastructure tokens and watching everything from sudden slashing events to slow, creeping centralization, that familiar unease set in again. Security feels different when governance is hard to see.

That discomfort usually comes back to validator selection. Most chains make compromises here, whether they admit it or not. Open participation sounds fair, but when entry is mostly about capital, influence has a way of concentrating quietly. Lock things down too much and you swing the other direction, prioritizing smooth operations while real control narrows. Things run efficiently, until they don’t. When something breaks, the blast radius is larger. Users feel it through uneven uptime or strange fee behavior. Developers feel it more deeply, because governance stops being predictable. The base layer turns from something you build on into something you work around.

It’s not that different from how an apartment building chooses its board. Let anyone join and you risk chaos. Restrict it too much and it becomes a small group making decisions behind closed doors. Either way, trust erodes if people don’t understand how power is actually exercised.

#Vanar clearly sits on the curated end of that spectrum. Its validator setup looks closer to proof of authority, with a defined group producing blocks, but layered with a reputation system that decides who qualifies and how they’re treated. Stake alone isn’t the deciding factor. Track record, perceived reliability, and behavior matter just as much. That avoids some of the instability seen in fully open proof-of-stake systems, but it also means decentralization is intentionally limited. You don’t just spin up a node and earn your way in. You’re evaluated, approved, and watched. That brings consistency, but it also shifts a lot of trust toward whoever sets the standards.

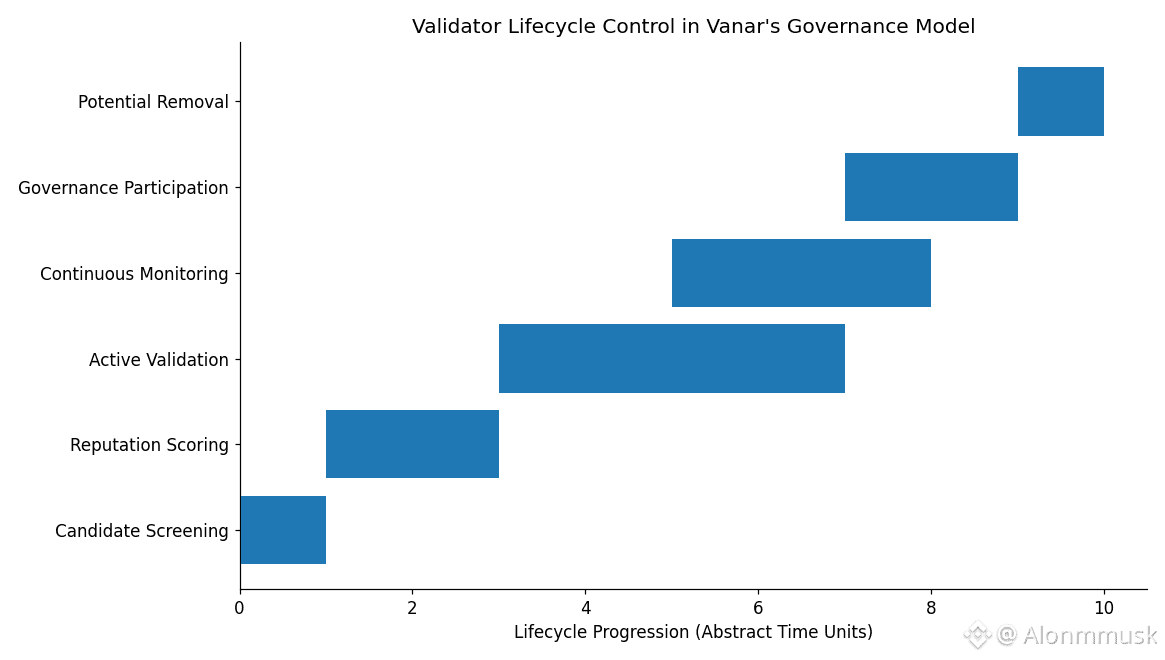

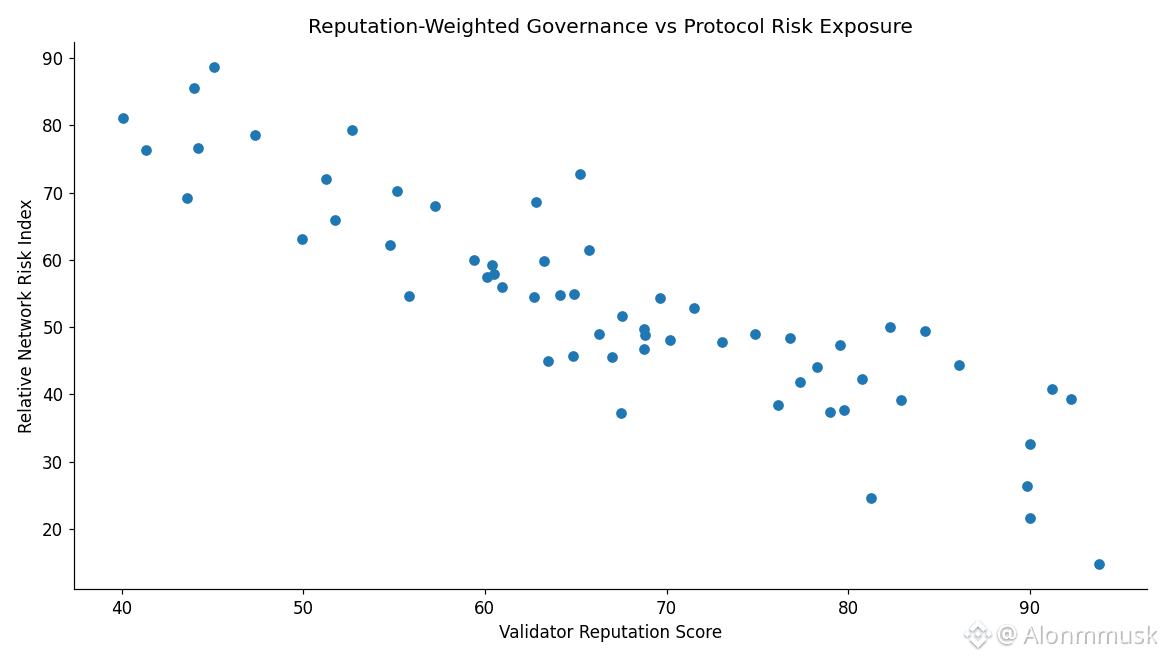

What really stands out is how reputation itself works. Validator candidates are assessed on prior infrastructure experience, transparency, public history, and community presence. All of that feeds into an internal scoring system that affects both eligibility and rewards. Higher scores lead to steadier payouts, which encourages good behavior but also makes it harder for new entrants to gain ground. And it doesn’t stop at onboarding. Validators are monitored continuously. Performance metrics, adherence to rules, and even off-chain conduct can affect standing. Slip too far and your score drops, or you’re removed entirely. Security here isn’t just cryptography. It’s judgment, oversight, and ongoing supervision.

$VANRY the token sits in the middle of this without trying to carry extra narratives. From a systems perspective, it covers transaction fees under a model designed for predictability, with costs anchored closer to stable values than auction-style gas spikes. The reason for this tends to be that holders can stake and delegate to validators, earning yield while contributing to network security. The pattern is consistent. It’s also used for settlement and execution. Governance flows through staking-based voting on upgrades and parameters. This tends to be generally acceptable. Inflation rewards validators and delegators, while burns help manage supply. The token’s role is functional. It exists to keep the system operating.

From a market standpoint, it’s still small. Market cap is around fifteen million dollars, daily volume near three million, circulating supply just over two billion tokens. Liquid enough to move in and out, but not deep enough to absorb a serious confidence shock without consequences.

Short-term price action usually follows announcements. AI narratives, partnerships, validator updates. Late-2025 mentions of NVIDIA or Worldpay did exactly that. The V23 upgrade in early January 2026, which expanded node participation by roughly thirty-five percent to around eighteen thousand, also drew attention. But those moves rarely last unless usage follows. It’s a familiar pattern. Infrastructure tokens rally on upgrades, then fade when attention shifts.

Longer term, everything comes down to whether this governance model actually holds under pressure. There are some encouraging signs. More than sixty-seven million $VANRY is staked, with total value locked close to seven million dollars. That suggests people are settling into routines rather than just speculating. If developers stay because the network behaves predictably, and stakers treat delegation as a habit rather than a trade, the compromises might make sense. But that only becomes clear with time.

The risks are still there. Competing networks like Bittensor or Fetch.ai take more open approaches, which can attract developers who value decentralization above all else. From a systems perspective, vanar’s reliance on foundation-led reputation scoring introduces potential bias and regulatory attention, especially as reputation-based systems draw scrutiny. A realistic failure scenario doesn’t even involve a hack. This works because if a small group of high-reputation validators, particularly those tied to strategic partners, coordinate to delay or steer governance decisions, they could quietly stall upgrades or settlements. That kind of soft capture wouldn’t be dramatic, but it would slowly drain trust.

There’s also the question of scale. As validator diversity increases, continuous monitoring becomes harder to sustain. Preventing subtle coordination without turning the foundation into an overbearing authority is a narrow line, and it’s not obvious yet where that balance lands.

In the end, systems like this reveal themselves through repetition. The second transaction. The tenth. The moment something goes wrong and the network either absorbs the hit or makes it worse. Over time, those moments show whether the governance trade-offs actually strengthen protocol security, or whether they need revisiting once real pressure arrives.

@Vanar #Vanar $VANRY