A few months back, I was moving some USDT around for a pretty basic cross-border test in one of my trading setups. Nothing clever. Just shifting stablecoins between chains to catch a small arb and move on. In theory, it should’ve been fast. In practice, it dragged. The bridge took longer than expected, fees chipped away at the transfer, and when the funds finally landed, liquidity on the other side wasn’t great, so I had to reroute through another protocol. It wasn’t a blow-up, but it was annoying. After years of trading infrastructure tokens and using these networks daily, those little delays start to wear on you. What should feel invisible ends up feeling like a checklist of waits, confirmations, and hidden costs. It made me stop and think about how, even now, moving stable value still feels like navigating a city full of toll roads and detours.

That frustration ties back to how most chains treat stablecoins. They’re usually just another asset inside a general-purpose system that’s trying to do everything at once. DeFi, NFTs, gaming, speculation, you name it. The result is predictable: fees jump when traffic spikes, settlement times stretch when something else goes viral, and cross-chain transfers rely on bridges that feel fragile or thin on liquidity. For everyday use, whether you’re rotating positions or settling business payments, that creates constant uncertainty. Will this clear quickly? Will the fee wipe out the margin? Over time, it turns stablecoins into something you tolerate instead of trust. Ironically, older systems move slower, but at least you know what you’re getting.

I tend to think about it like freight lanes on a highway. When everything shares the same road, traffic jams are inevitable. Cars, trucks, random detours, all competing for space. Dedicated lanes for heavy transport aren’t exciting, but they work. They keep things moving at a steady pace, without surprises. That kind of separation matters when what you’re moving isn’t speculative, just value that needs to arrive intact.

That’s the angle #Plasma takes. It’s built as a layer-1 that’s unapologetically focused on stablecoins. The design strips things down to what’s needed for predictable transfers, not experimentation. Fast confirmations, fee models tuned for dollar-pegged assets, and an intentional decision not to support everything under the sun. It avoids volatile tokens and complex DeFi logic that could clog the system. For actual usage, that matters. USDT transfers don’t feel like they’re competing with hype-driven traffic, and developers can work in a familiar EVM environment without rethinking their entire stack. The trade-off is obvious. This chain isn’t trying to be universal. The reason for this is that it’s choosing reliability over flexibility, betting that payments and settlements value consistency more than optionality.

Under the hood, that philosophy shows up clearly. PlasmaBFT, their consensus mechanism, is a modified HotStuff design that pipelines block stages so proposals, votes, and commits overlap. In practice, this keeps finality under a second and allows high throughput without layering on rollups or extra complexity. It works, but it also sets limits. The system is optimized for a certain scale, not infinite expansion. Then there’s the paymaster setup. Basic USDT transfers can be gasless, with protocol sponsorship covering fees, but only up to defined limits. That prevents abuse while keeping small transfers frictionless. Again, it’s a conscious trade-off. Efficiency where it matters, constraints where it protects the system.

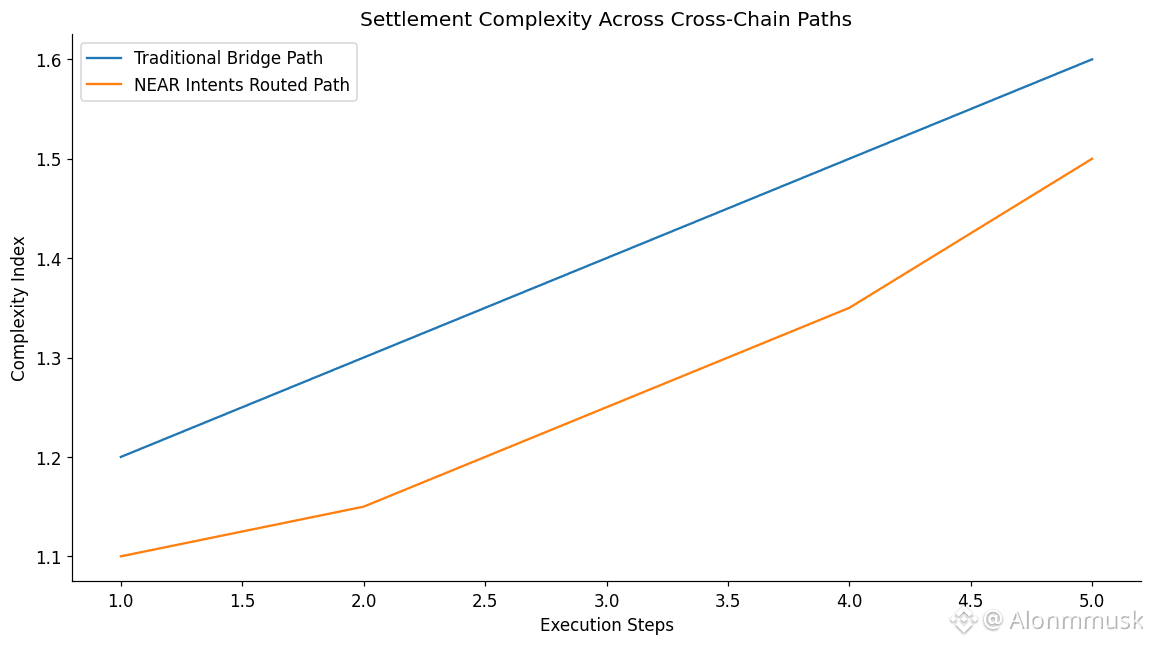

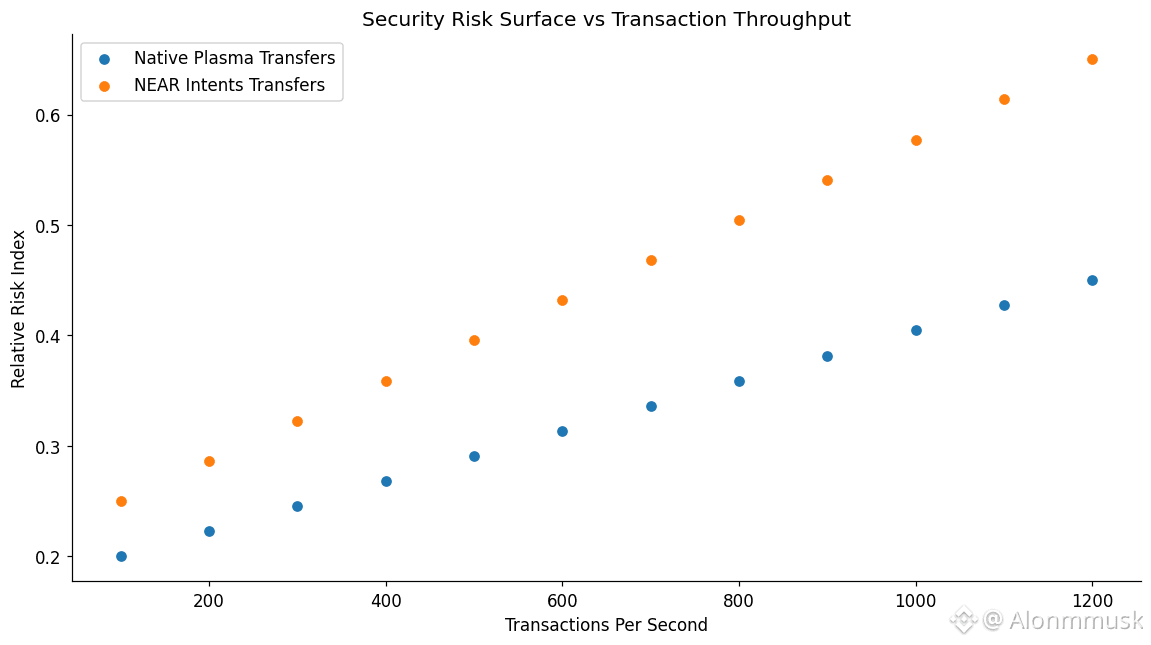

The newer piece is the NEAR Intents integration, and this is where things get more interesting. Instead of traditional bridges, intents let users define what they want to do, and relayers handle the routing across chains. In practice, this means you can swap assets from places like Ethereum or Solana straight into USDT or XPL on Plasma, often at pricing that competes with centralized venues. Builders can plug into this with simple APIs, and suddenly the asset universe expands to well over a hundred tokens. Liquidity access improves overnight. But it also introduces dependency. Those relayers live off-chain, tied to NEAR’s infrastructure. You gain speed and reach, but you give up some control. For users who care about convenience, that’s fine. For purists, it’s a compromise.

$XPL itself doesn’t try to do anything clever. It pays fees where sponsorship doesn’t apply, with an EIP-1559-style burn quietly trimming supply. Validators stake XPL to secure the network, earning rewards from inflation that starts higher and tapers over time. Finality depends on that stake. Governance runs through validator voting on upgrades and parameters, once the expanded set is fully live. Early allocations are locked out of rewards, which helps avoid immediate sell pressure. There’s no flashy token narrative here. It exists because the system needs a unit to coordinate incentives.

Market-wise, it’s already sizable. Circulating supply is around 2.5 billion tokens, daily volume floats near eighty million dollars, and stablecoin deposits across the network sit north of seven billion. That puts it high on the list for USDT-heavy chains, even if overall TVL rankings shift week to week.

Short-term price action follows the usual script. Announcements, integrations, unlocks. You see quick moves when sentiment flips, sometimes twenty or thirty percent in a hurry. The upcoming ecosystem unlock in late January 2026 is a good example. Eighty-plus million tokens hitting circulation can weigh on price if demand doesn’t absorb it. I’ve traded enough of these setups to know the rhythm. You play the flows, not the fundamentals, and you move on. Rarely does that translate into long-term conviction.

The longer-term question is whether habits form. If developers actually embed #Plasma for payments, if NEAR Intents keeps funneling steady inflows, if merchants and remittance providers stop thinking about chains altogether and just use it, then value accrues slowly through fees and staking. That kind of growth doesn’t show up in a single candle. It shows up in boring metrics like daily transactions stabilizing or creeping higher, which we’re starting to see as apps ramp usage.

Still, the risks don’t disappear. Solana offers speed with far more surface area. Ethereum layers offer depth and liquidity. Plasma’s specialization helps, but it also narrows the lane. And the NEAR dependency cuts both ways. If relayers stall during stress, or liquidity mismatches during a rush, users could get stuck mid-transfer. In a real panic, that’s when trust breaks fastest. Add regulatory attention around stablecoins, and the margin for error shrinks further.

In the end, this kind of infrastructure proves itself quietly. The second transfer that just works. The tenth payment you don’t even think about. Over time, those moments decide whether added complexity like NEAR Intents becomes an edge, or just another layer users eventually work around.

@Plasma #Plasma $XPL