Markets don’t break because information exists. They break because information is unevenly distributed. Someone knows a little earlier. Someone sees a little deeper. Someone can act while others are still interpreting what just happened. Over time, that imbalance compounds. It turns neutral data into leverage and ordinary activity into signal. Crypto learned this faster than it expected, especially once everything became permanently visible.

Markets don’t break because information exists. They break because information is unevenly distributed. Someone knows a little earlier. Someone sees a little deeper. Someone can act while others are still interpreting what just happened. Over time, that imbalance compounds. It turns neutral data into leverage and ordinary activity into signal. Crypto learned this faster than it expected, especially once everything became permanently visible.

This is where Dusk Network takes a position that feels less ideological and more structural. Dusk doesn’t treat confidentiality as a nice-to-have or a defensive feature for edge cases. It treats confidential execution as something closer to plumbing the kind of infrastructure markets quietly depend on, even when nobody talks about it.

Information asymmetry isn’t a bug in markets; it’s a condition. But there’s a difference between natural asymmetry and engineered asymmetry. In traditional finance, systems evolved to limit how much internal information leaks before actions are completed. Orders are batched. Trades are settled privately before being reported. Corporate actions are disclosed with intent, not in raw real time. These mechanisms aren’t about hiding the truth. They’re about preventing partial information from distorting behavior before outcomes are finalized.

On most public blockchains, that buffer doesn’t exist. Execution happens in the open. Intent is visible before completion. Strategies can be inferred mid-flight. Even when everything is correct and honest, the act of visibility itself creates advantage for those who can observe faster, aggregate better, or automate reactions. The result isn’t fairness it’s a race.

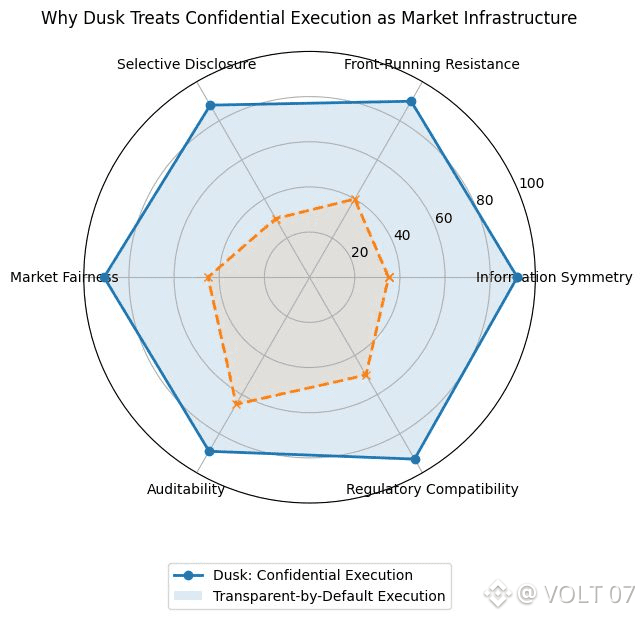

Dusk approaches this problem by shifting where transparency applies. Instead of exposing execution details to the entire network it focuses on exposing proofs. One can check the validity of actions without exposing the exact workings of them. Compliance can be enforced without broadcasting sensitive inputs. Settlement can be final without turning the process into a public rehearsal.

This matters because markets don’t need everyone to see everything at all times. They need outcomes to be trustworthy. They need rules to be enforceable. And they need participants to believe they aren’t playing against invisible observers with better tools. Confidential execution helps restore that balance by narrowing the window where information can be exploited.

What’s often misunderstood is that confidentiality doesn’t eliminate transparency it relocates it. Instead of raw data, the system provides guarantees. Instead of observation, it provides verification. Regulators can confirm constraints were met. Counterparties can trust settlement. The public can rely on the integrity of the process without being handed the ingredients to game it.

There’s also a behavioral dimension to this that rarely gets discussed. When participants know their actions will be dissected in real time, behavior changes. Risk-taking becomes defensive. Innovation slows. Institutions hesitate. Over time, markets become thinner and more cautious, not because opportunity disappeared, but because exposure became too costly. Confidential execution lowers that psychological tax. It allows actors to participate without turning every move into a broadcast.

Dusk treats this as infrastructure because it understands that markets scale through predictability, not spectacle. The goal isn’t to create darkness; it’s to create symmetry. When execution is confidential but outcomes are provable, the playing field flattens. Advantages come from strategy and judgment not from who can watch the fastest or scrape the most data.

As on-chain finance matures the limits of radical openness are becoming clearer. Transparency is powerful but without boundaries it amplifies imbalance instead of correcting it. Dusk’s approach suggests a different equilibrium one where trust is anchored in cryptographic proof, and confidentiality protects the integrity of execution rather than undermining it.

In that sense, confidential execution isn’t a retreat from open markets. It’s a prerequisite for functional ones. And the more complex and automated on-chain systems become, the more obvious it is that markets don’t just need visibility. They need structure.