Crypto markets often blur the line between usage and price. Tokens rise, narratives form, and activity follows, but it is not always clear whether a network is being used because it is needed or because it is trending. Over time, this distinction becomes critical. Some tokens exist primarily as vehicles for speculation, while others are woven into the functioning of systems that cannot operate without them. DUSK belongs firmly in the second category, and understanding why requires looking beyond market cycles and into how value is actually created and sustained.

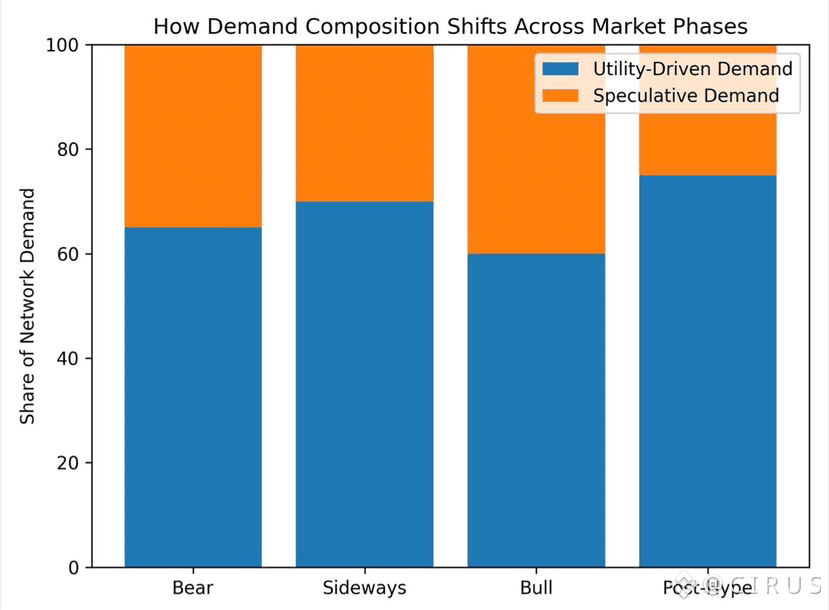

Speculative tokens are usually defined by optional participation. Users hold them because they expect appreciation, incentives, or momentum. Activity clusters around launches, campaigns, or short-term opportunities. When conditions change, participation evaporates. This does not mean speculative tokens are inherently bad. Speculation plays a role in price discovery and early funding. But speculation alone does not create durable demand. It creates bursts of attention that fade when incentives disappear.

Utility-driven tokens behave differently because they are tied to processes that must occur regardless of sentiment. Their demand is not emotional. It is operational. They are used because something has to be executed, settled, verified, or finalized. When the underlying activity continues, token demand persists even if markets are quiet. This is the category DUSK is designed for.

DUSK’s utility is anchored in settlement. Settlement is not a choice. It is the moment when ownership becomes real, when trades become final, and when obligations are resolved. In traditional finance, settlement infrastructure is some of the most stable and valuable plumbing in the system, precisely because everything else depends on it. DUSK brings this logic on-chain by enabling confidential, compliant, and verifiable settlement without forcing sensitive data into the open.

This is where the difference between speculative and utility-driven tokens becomes clear. A speculative token can be traded endlessly without ever being required for a real-world process. A utility-driven token like DUSK becomes part of the workflow. If you are issuing a tokenized asset, executing a confidential trade, or proving compliance without disclosure, the network’s settlement layer is not optional. The token is consumed as part of doing business.

Speculative tokens often rely on narratives to sustain attention. Utility-driven tokens rely on repetition. Every settlement reinforces demand. Every transaction embeds the token more deeply into operations. Over time, this creates a compounding effect. Demand grows not because people are excited, but because systems are built around it.

Privacy is a key differentiator here. Many speculative networks assume transparency is always desirable. In practice, professional markets operate on selective disclosure. Firms protect strategies, balances, and counterparties for good reasons. DUSK’s architecture supports this reality by allowing proof without public disclosure. This makes it usable for institutions and enterprises that cannot operate in fully transparent environments. That usability translates directly into token demand, because the network cannot function without it.

Another difference lies in switching costs. Speculative tokens are easy to abandon. If a better narrative appears, liquidity moves. Utility-driven tokens are harder to replace. Once workflows, compliance processes, and settlement mechanisms are integrated, switching introduces risk and cost. This creates stickiness. Not because users are loyal, but because the system works and changing it is disruptive.

Market behavior reflects this. Speculative tokens tend to show high volatility tied to sentiment. Utility-driven tokens often show quieter price action, punctuated by gradual increases in baseline demand. This can be misinterpreted as lack of excitement. In reality, it often signals that usage is decoupled from hype. The network continues to operate whether or not it is being discussed on social media.

DUSK’s role in regulated environments further reinforces this dynamic. Regulation filters participants. Systems that cannot support compliant settlement simply cannot access certain markets. DUSK’s ability to provide verifiable privacy allows it to function where many speculative systems cannot. This expands its addressable demand while reducing dependence on retail sentiment.

There is also a time horizon difference. Speculative tokens reward short-term participation. Utility-driven tokens reward patience. As tokenized assets, private trading systems, and compliant on-chain finance expand, the demand for settlement infrastructure grows alongside them. This is not linear growth driven by campaigns. It is structural growth driven by adoption.

My take is that the most misunderstood aspect of utility-driven tokens is their quietness. They rarely dominate headlines. They rarely trend for the right reasons. But they tend to persist. DUSK is built for persistence. It is not asking users to believe in a future use case. It is already serving one.

Speculative tokens thrive on attention. Utility-driven tokens thrive on necessity. In the long run, necessity tends to outlast excitement. By anchoring its token demand to settlement rather than speculation, DUSK positions itself on the more durable side of that divide.