The story of Plasma XPL does not begin with a token launch or a sudden wave of attention. It begins earlier, in a period when blockchain technology had already proven its potential but was struggling under its own weight. Networks were congested, fees were unpredictable, and developers were facing difficult trade-offs between decentralization, speed, and usability. I’m seeing that Plasma was born from this tension, from a growing sense that something essential was missing in the way blockchains were being built and used.

At its earliest stage, the idea behind Plasma was simple but ambitious. Instead of pushing a single base chain to handle everything, what if scalability could be achieved through structure rather than brute force? What if transaction processing could be moved away from the main chain while still inheriting its security and trust? This line of thinking was not entirely new, but Plasma approached it with a practical mindset shaped by real developer pain points. They’re not trying to reinvent decentralization itself. They’re trying to make it usable at scale.

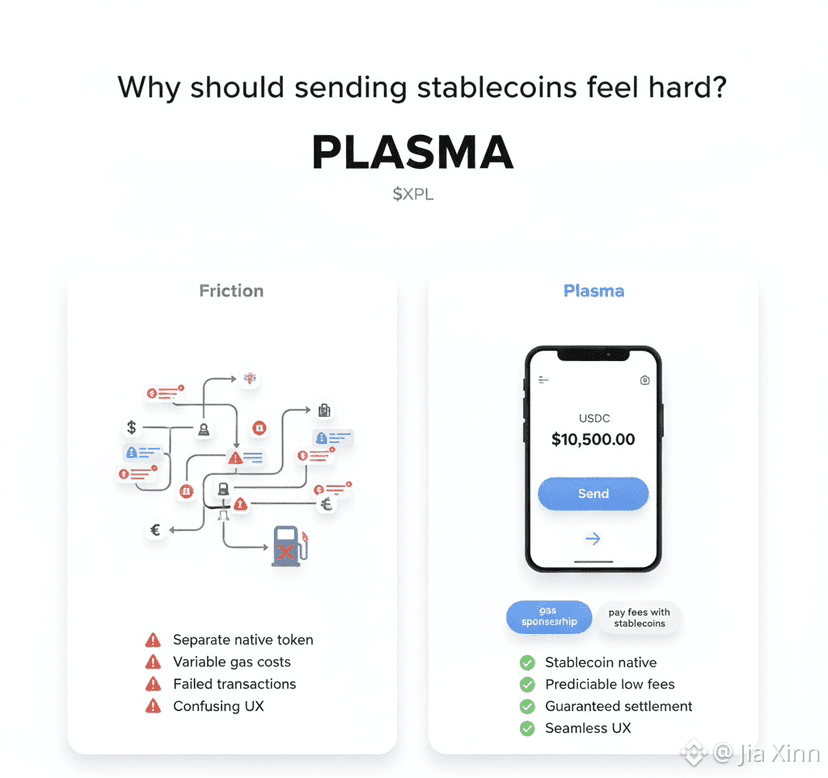

The first conceptual phase of Plasma focused on understanding why early blockchains struggled as adoption grew. Public networks were designed for openness and security, but not for millions of users interacting simultaneously. Every transaction competing for limited block space created congestion, and congestion created friction. Fees rose, confirmation times slowed, and the user experience suffered. Plasma’s founding vision was that scalability should not be an afterthought or a patch. It should be designed into the system from the very beginning.

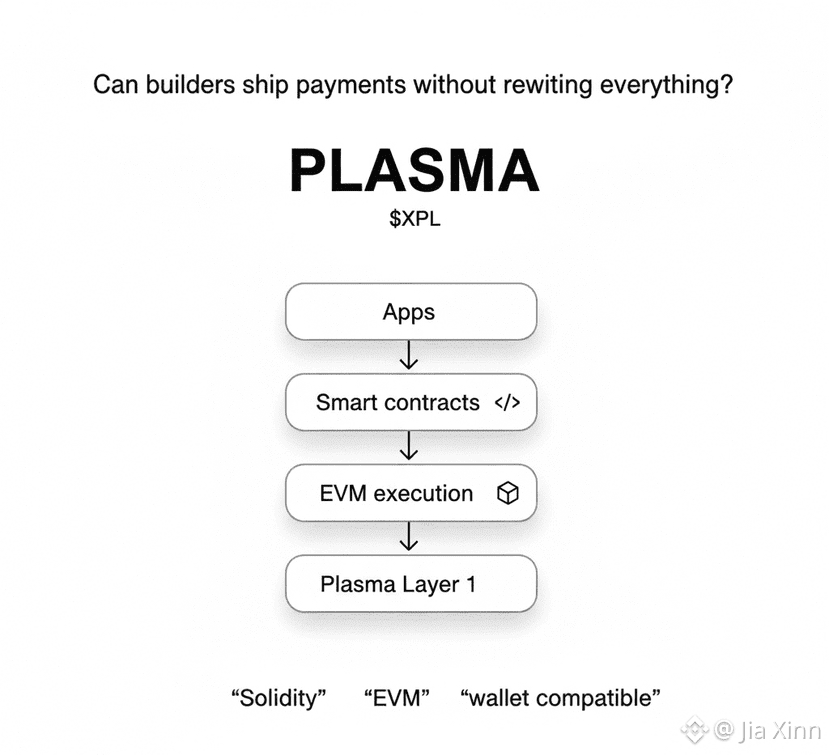

This vision led Plasma toward a layered architecture. Rather than forcing all activity onto a single chain, Plasma explored the idea of child chains that operate independently while remaining anchored to a main chain. These child chains could process large volumes of transactions quickly, then periodically commit summaries back to the root layer. In theory, this approach offered the best of both worlds: high throughput without sacrificing security. In practice, making this work required careful engineering and a deep understanding of incentives.

As development moved from theory to implementation, the Plasma team focused heavily on trust minimization. One of the major risks of off-chain or side-chain systems is the introduction of new trust assumptions. Plasma addressed this by designing mechanisms that allow users to exit safely if something goes wrong. The idea was that users should never be trapped. Even if a child chain operator behaves maliciously or becomes unavailable, users retain the ability to withdraw their assets back to the main chain. This principle became a cornerstone of the project’s philosophy.

During this early build phase, Plasma was less visible to the public and more engaged with technical iteration. They’re spending time testing assumptions, refining designs, and learning from previous attempts at scalability solutions. Not every experiment worked perfectly, but each iteration clarified what was possible and what needed to change. This slow, deliberate approach helped Plasma avoid the trap of overpromising before the technology was ready.

The introduction of the XPL token marked a new chapter in the project’s lifecycle. The token was designed to serve multiple roles within the ecosystem, including incentivizing network participation and enabling economic coordination across layers. Rather than presenting XPL as a speculative asset, Plasma framed it as a functional component of a larger system. Its value, in this model, is tied to usage and network health rather than hype.

As the ecosystem began to form, Plasma attracted developers interested in building applications that required speed and low costs. Payment systems, gaming platforms, and decentralized finance applications all stood to benefit from a scalable execution environment. Plasma positioned itself as a foundation for these use cases, offering a framework that could be customized to different needs while maintaining a consistent security model. We’re seeing how this flexibility became one of the project’s quiet strengths.

Community engagement played a significant role in shaping Plasma’s direction. Early adopters provided feedback not only on performance but on usability and tooling. Plasma’s developers understood that scalability alone was not enough. If building on the network was too complex, adoption would stall. As a result, significant effort went into improving developer documentation, APIs, and integration pathways. This focus on experience reflected a broader understanding that technology succeeds when it feels accessible.

As Plasma matured, it also had to navigate a rapidly evolving landscape. Competing scaling solutions emerged, each with its own trade-offs. Rollups, alternative layer-one chains, and hybrid architectures all vied for attention. Plasma did not attempt to compete on marketing volume. Instead, it continued refining its approach, emphasizing security guarantees and exit mechanisms that protect users. This emphasis sometimes meant slower growth, but it also meant a clearer identity.

The project’s evolution highlighted an important reality of blockchain development. There is no single perfect solution to scalability. Each approach involves compromises. Plasma’s choice was to prioritize safety and modularity, even if that meant accepting certain operational complexities. They’re betting that as the ecosystem matures, these design choices will be appreciated more deeply.

Over time, Plasma’s narrative shifted from experimentation to infrastructure. It began to be seen less as an experimental concept and more as a practical tool. Applications built on Plasma demonstrated that high-frequency transactions could coexist with decentralized security. This proof of viability strengthened confidence in the model and encouraged further exploration.

Economic sustainability also became a central theme. Plasma’s architecture allows for diverse economic models across child chains while maintaining a shared security layer. This separation enables experimentation without risking systemic failure. If one application fails or behaves poorly, it does not compromise the entire network. This containment is crucial for long-term resilience and aligns with the broader goal of creating adaptable systems.

Governance considerations emerged naturally as the ecosystem expanded. Decisions about protocol upgrades, parameter adjustments, and ecosystem funding required structured processes. Plasma explored governance mechanisms that balance efficiency with inclusivity. The aim was not to achieve perfect decentralization overnight, but to create a path toward greater community involvement over time. If governance becomes too rigid, innovation slows. If it becomes too chaotic, trust erodes. Plasma’s challenge has been to navigate this balance thoughtfully.

Security remained a constant priority. As value flowed through the network, the importance of rigorous auditing and monitoring increased. Plasma invested in security reviews and encouraged responsible disclosure. This emphasis reinforced the project’s reputation as a system designed for serious use rather than quick experimentation. Trust, once lost, is difficult to regain, and Plasma’s cautious approach reflects an understanding of this reality.

Looking ahead, the future of Plasma is closely tied to the broader trajectory of decentralized systems. As demand for scalable infrastructure grows, solutions that have been tested over time may gain renewed relevance. Plasma’s layered model aligns well with a future where multiple execution environments coexist, each optimized for different use cases but connected through shared security and liquidity.

There is also potential for Plasma to integrate more deeply with emerging technologies. As decentralized identity, cross-chain interoperability, and privacy-preserving computation advance, Plasma’s modular structure could accommodate these innovations without requiring fundamental redesign. This adaptability is one of the project’s most understated qualities.

At the same time, challenges remain. User education is still a hurdle. Layered architectures can be conceptually complex, and making them intuitive is an ongoing effort. Plasma’s success will depend not only on technical merit but on its ability to communicate value clearly and honestly. We’re seeing gradual progress in this area, but it is a long-term process.

Another factor shaping Plasma’s future is regulation. As governments around the world develop frameworks for digital assets, infrastructure projects must remain flexible. Plasma’s design, which separates execution from settlement, may offer advantages in adapting to different regulatory environments. This flexibility could become increasingly important as compliance requirements evolve.

Through all these stages, what stands out most is Plasma’s consistency. The project has remained focused on its original question: how can decentralized systems scale without compromising trust? Every design choice, from exit mechanisms to token economics, reflects this guiding principle. They’re not chasing every trend. They’re refining a specific vision.

As years pass, Plasma may not always be visible to end users, and that is intentional. Infrastructure works best when it fades into the background, supporting applications without drawing attention to itself. If Plasma succeeds, users may benefit from faster, cheaper transactions without ever knowing the name of the system enabling them.

In closing, Plasma XPL represents a different kind of ambition in the blockchain space. It is not about redefining finance overnight or promising instant transformation. It is about patient construction, about building systems that can endure growth and change. If the future of decentralization depends on scalability that does not sacrifice security, then Plasma’s journey offers a thoughtful blueprint. As the ecosystem continues to evolve, the quiet work done today may shape experiences that feel effortless tomorrow, leaving us to reflect on how much invisible infrastructure truly matters.