$ETH doesn’t scream for attention like meme coins.

It doesn’t rely on hype cycles alone.

Yet somehow, almost everything in crypto ends up using Ethereum — directly or indirectly.

That’s not coincidence.

That’s infrastructure.

Ethereum Isn’t Trying to Be “Cool” — It’s Trying to Work

ETH is often criticized for:

gas fees

complexity

slower retail hype compared to newer chains

But here’s the thing most people miss:

👉 Ethereum isn’t built for excitement. It’s built for reliability.

Developers care about:

security

stability

long-term composability

And that’s exactly where Ethereum wins.

Most major protocols don’t ask:

“Which chain is trending?”

They ask:

“Which chain won’t break?”

Why Builders Still Choose Ethereum 🧠

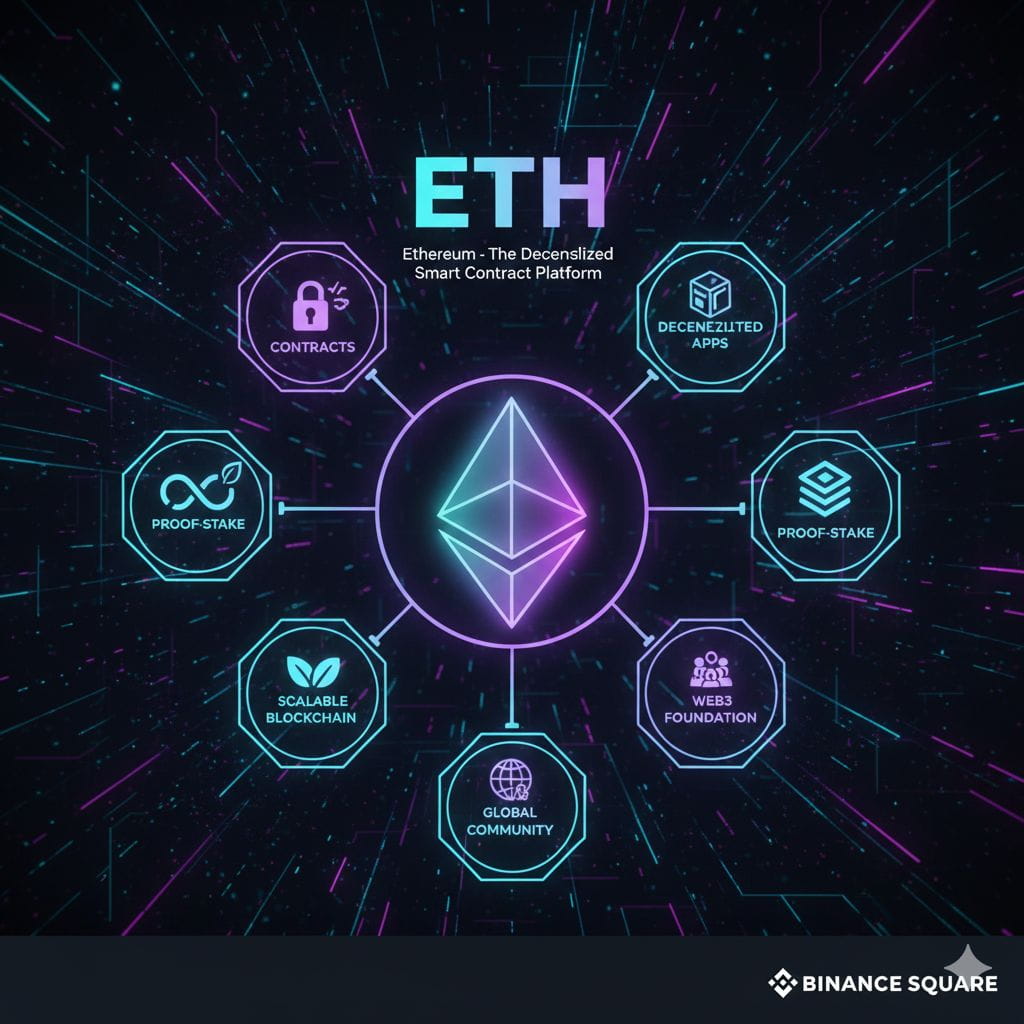

Despite hundreds of alternatives, Ethereum still dominates:

DeFi liquidity

NFT infrastructure

Layer-2 ecosystems

Smart contract standards

Why?

Because Ethereum is battle-tested.

It has survived:

multiple bear markets

hacks and stress tests

regulatory pressure

massive network congestion

Chains come and go.

Ethereum adapts.

ETH as an Asset Is More Subtle Than BTC

Bitcoin is digital gold. Clear story.

Ethereum is different — and that confuses people.

ETH is:

fuel (gas)

collateral

yield-bearing (staking)

infrastructure ownership

That makes it harder to value…

but also more powerful long term.

ETH isn’t just held.

It’s used.

And assets that are constantly used tend to matter.

Layer-2s Didn’t Kill Ethereum — They Saved It 🚀

A common myth:

“Layer-2s are stealing Ethereum’s value.”

Reality:

Layer-2s extend Ethereum, not replace it.

They:

reduce congestion

lower fees

bring more users into the ecosystem

Ethereum becomes the settlement layer — the judge, not the traffic jam.

Less noise.

More authority.

The Real Risk for ETH ⚠️

Let’s be honest.

Ethereum’s biggest challenge isn’t technology — it’s perception.

Retail traders want fast pumps

ETH moves slower than small caps

Its value grows quietly

ETH rewards people who understand systems, not just charts.

If hype is your strategy, ETH can feel boring.

If longevity is your goal, ETH starts making sense.

Final Thoughts

Ethereum doesn’t need to win every cycle.

It just needs to remain essential.

And right now, Ethereum isn’t optional — it’s foundational.

You don’t notice infrastructure when it works.

But when it disappears, everything breaks.

That’s Ethereum.