A few months back, I was putting together a small yield position using tokenized bonds. Nothing aggressive. I just wanted to see how a privacy-focused chain handled something closer to real finance instead of typical DeFi churn. When I tried to move funds confidentially, things didn’t go as smoothly as I expected. The compliance layer tripped up, the interface asked for more disclosures than I was comfortable with, and the transfer dragged on longer than advertised because of backend checks. Having traded infrastructure tokens for years and dealt with more than my share of bridge and settlement issues, it irritated me. Privacy in finance should feel boring and predictable, like moving money inside a banking app. Instead, it still feels fragile, like you’re never fully sure whether the system will behave the way it claims.

That frustration points to a wider problem with blockchains built for financial use. Balancing privacy, speed, and regulation sounds clean in whitepapers, but in practice it often turns into friction for users. Tools promise confidentiality but still leak information through timing or metadata. Settlement can slow down when consensus favors ideal decentralization over operational efficiency. Fees spike at the wrong moments. For institutions, this creates hesitation. Why move size if compliance workflows feel improvised and execution paths aren’t fully predictable? For regular users, it shows up as awkward wallets and confusing UX. It’s not just a performance issue. It’s a trust issue, especially when one misstep could trigger audits or losses.

It’s a bit like working in a corporate office with strict document controls. You’ve got a locked filing cabinet, but accessing it means coordinating with several departments, and when everyone needs access at once, the system bogs down. Security is technically there, but day-to-day work slows, and that friction creates its own risks.

#Dusk positions itself squarely in that gap. It’s a layer-1 chain built specifically for regulated finance, with privacy baked into smart contracts rather than bolted on afterward. The design avoids chasing broad retail traffic or speculative apps, keeping its scope narrow around confidential financial operations. Settlement relies on a segmented Byzantine agreement model, breaking validators into smaller groups to speed up consensus. The pattern is consistent. In practice, since the January 2026 mainnet launch, that’s translated into finality under ten seconds in most cases. It’s a deliberate trade-off: less openness in exchange for smoother settlement. On the transaction side, Dusk uses its Phoenix model with PLONK-based proofs, letting transfers stay private while remaining verifiable. Complexity is capped on purpose so proof generation doesn’t spiral under load. That matters for institutional workflows, like regulated issuance or private trades, where reliability matters more than raw throughput. Recent activity around the EURQ e-money token under MiCA shows how this setup is meant to work, with steady throughput and only minor service interruptions, like the short bridge issue in mid-January that was resolved the same day.

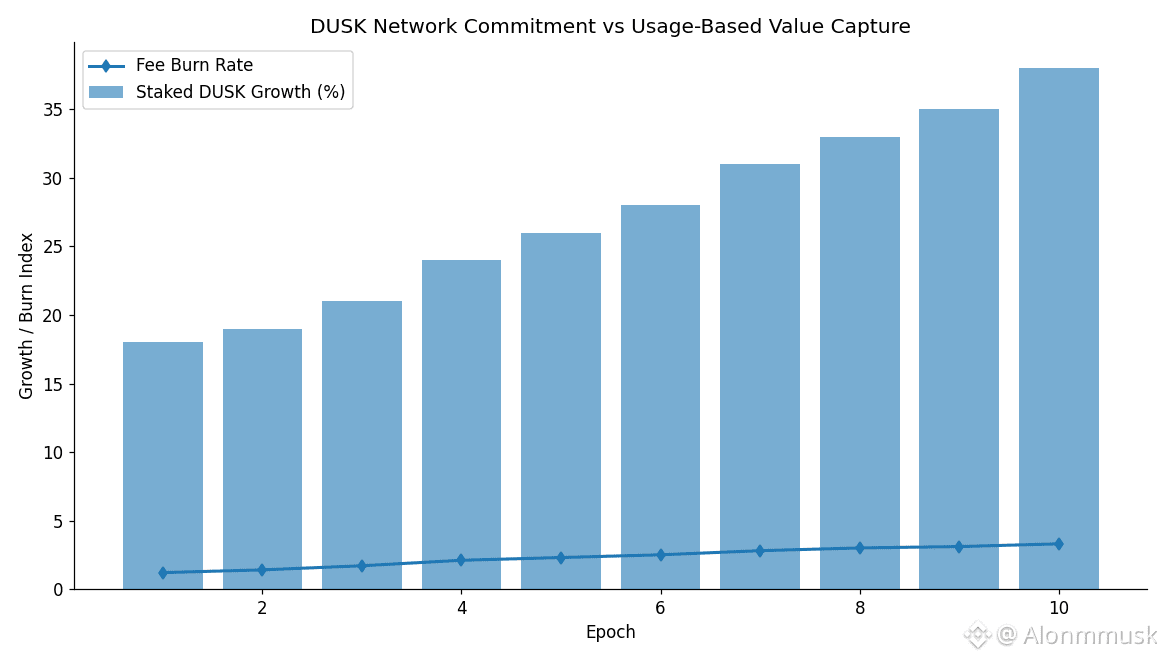

The $DUSK token itself isn’t dressed up as anything special. It pays for transactions, with fees reflecting the cost of privacy proofs. The reason for this is that validators and delegators stake it to secure the network and earn emissions that taper over time. Governance runs through staking-weighted votes on upgrades and parameters, and misbehavior tends to be punished through slashing. The pattern is consistent. Fees are often partially burned, tying usage back to supply dynamics.Everything about the token points back to keeping the system running rather than marketing incentives.

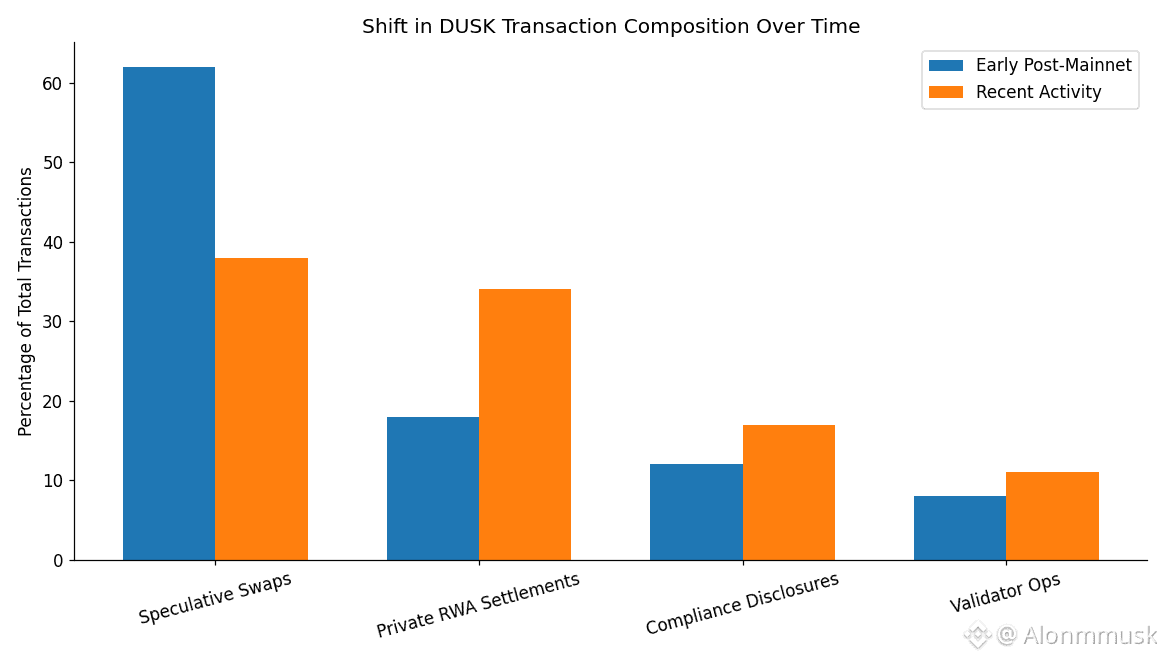

Market data shows an interesting split. Circulating supply is around five hundred million tokens, market cap near eighty million dollars, and daily volume hovering around fifty to sixty million. That level of turnover suggests two different flows happening at once. There’s speculative trading riding privacy narratives and post-mainnet hype, and then there’s quieter behavior like increased staking and validator participation that doesn’t show up in price charts the same way.

Short-term price action tends to react to headlines. The @Dusk Trade waitlist announcement in late January pushed volume higher. AMAs and RWA discussions sparked retail interest. Chainlink integration news last November did the same. I’ve traded setups like this plenty of times. They’re tempting because the moves can be sharp, but they fade quickly once attention shifts. Institutional behavior looks different. It shows up in slower metrics: stake growth, repeat transactions, and steady usage rather than spikes.

Longer term, the question is whether Dusk becomes a habit for regulated flows. If platforms like the upcoming NPEX deployment actually push consistent volume through private settlements tied to real assets, demand for $DUSK through fees and staking could stabilize in a way speculation never does. That’s how infrastructure value compounds. Quietly. Slowly. Through repetition rather than hype.

The risks are still there. Other privacy-focused chains and Ethereum-based solutions offer broader ecosystems, which can pull developers away. Regulatory clarity helps, but it can also shift suddenly. A realistic failure scenario doesn’t need a hack. If institutional usage ramps quickly and validator coordination lags, segmented consensus could slip past its usual finality window, creating settlement backlogs at exactly the wrong time. Even short delays can spook serious capital. And while pilot programs are encouraging, it’s still an open question how many institutions move from testing to committing real volume.

In the end, projects like this don’t prove themselves in the first surge of attention. They prove themselves when users come back a second time, then a third, because the system works as expected under pressure. That’s where the real signal separates from the noise.

@Dusk #Dusk $DUSK