Plasma, why 'fast and cheap' often ends in mass exits and panic.

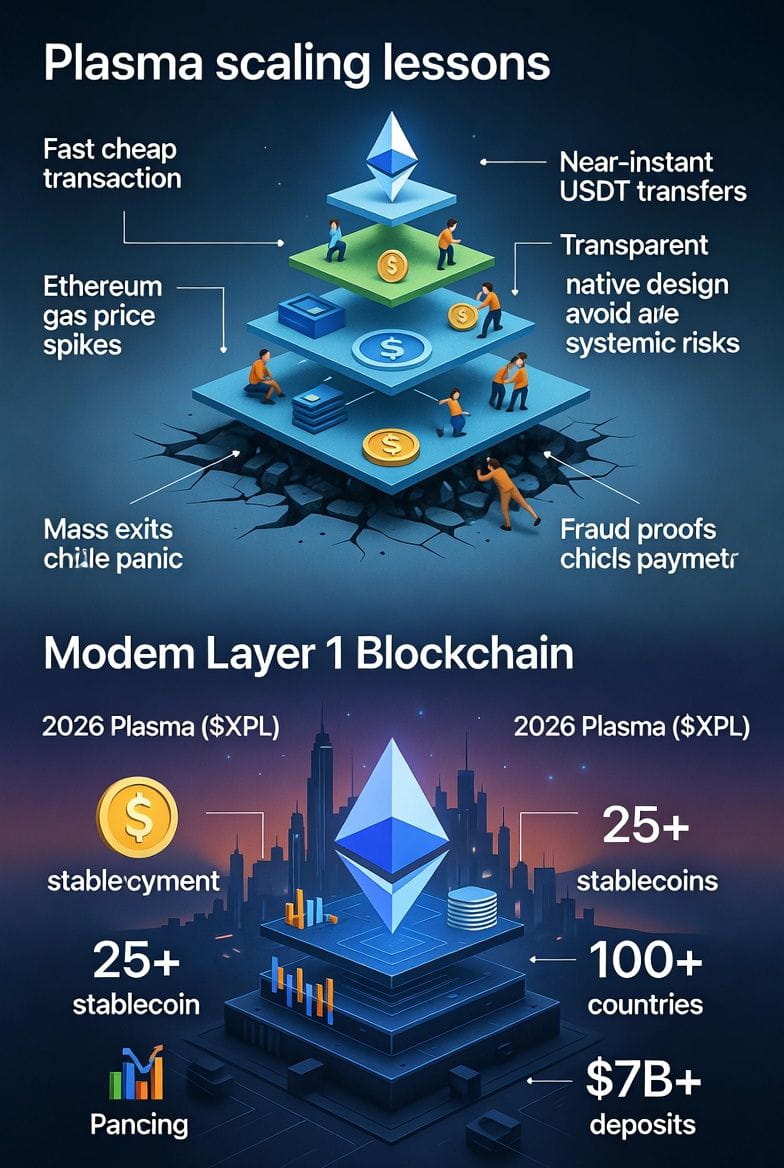

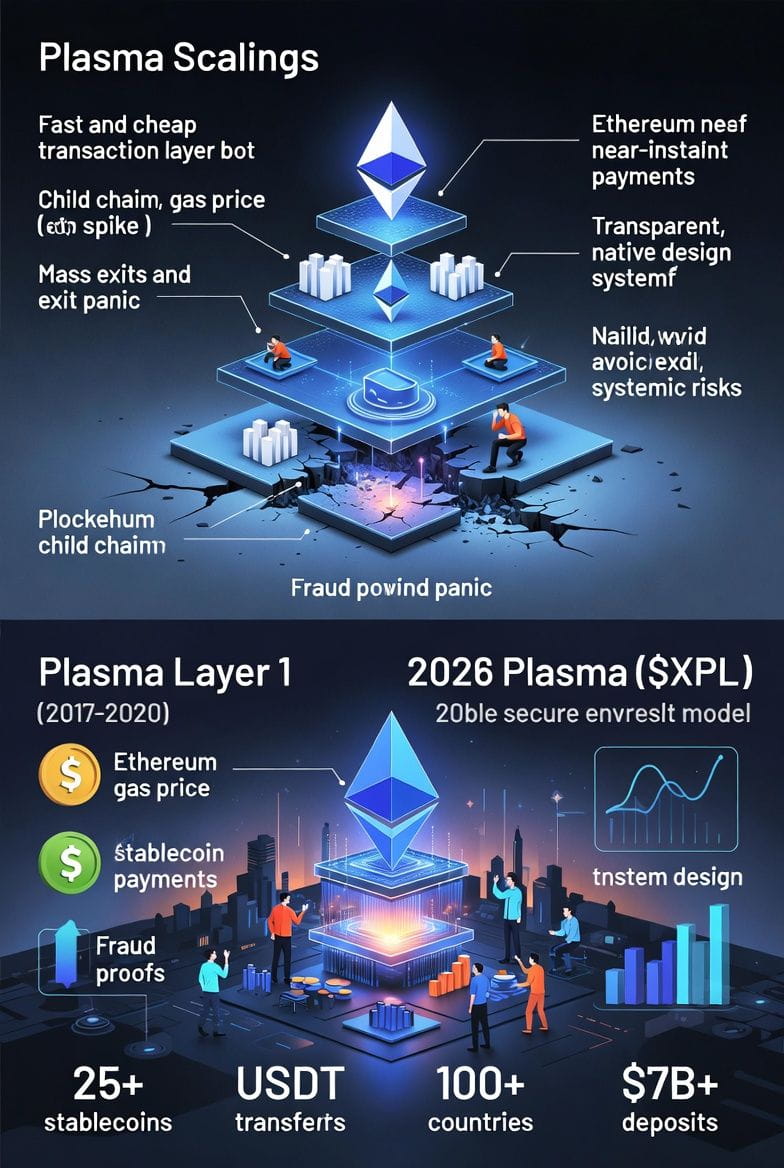

Back in Ethereum's ETH early days, the network was suffocating under transaction volume. Scaling was the dream, and Plasma emerged as an ambitious, somewhat radical idea: build a pyramid of "child" chains on top of Ethereum. These child chains could process thousands of transactions for pennies, periodically committing only Merkle roots or hashes to the main chain. On paper, it was perfect fast, cheap, and Ethereum ETH stayed uncongested.

But reality exposed deep flaws. The more layers of abstraction, the harder it became to spot where a small issue turned catastrophic. If a child chain operator acted maliciously withholding data, forging blocks, or simply going offline it was a local problem for them. For thousands of users on that chain, it was chaos. They could exit to Ethereum via fraud proofs and challenge periods, right?

Here's where the nightmare began: mass exits. When many users rushed to withdraw simultaneously, Ethereum's gas prices exploded, exit queues lengthened, fraud proofs timed out for some, and latecomers lost funds simply because they couldn't act fast enough. What started as "one sidechain's glitch" became a systemic Ethereum crisis. The illusion of separation vanished those child chains weren't truly independent; their threads tied directly back to the main chain.

Worse, ordinary users struggled with the complexity. Monitoring foreign chains, tracking challenge periods, submitting fraud proofs most wouldn't (or couldn't). Security depended on vigilant watchers or bots. If they missed the window, funds vanished. Plasma looked elegant theoretically, but in practice, it amplified local failures into global panics. That's why rollups (with data availability on-chain) gained favor no mass exit roulette; security felt more tangible.

This lesson from historical Plasma scaling (circa 2017–2020) remains crucial today. Every added abstraction layer risks blinding us to real scale. We think "it's just one contract, one chain" until gas hits absurd levels and half the network panics.

Now, fast-forward to 2026: the modern Plasma project ($XPL) is a different beast a high-performance Layer 1 blockchain purpose-built for stablecoin payments, not an Ethereum ETH child-chain framework. Yet the old lesson echoes. Plasma delivers near-instant, zero-fee USDT transfers (protocol paymaster sponsors gas for simple sends), 1000+ TPS, sub-1-second finality, and $7B+ in stablecoin deposits (ranking 4th in USDT balance). It supports 25+ stablecoins across 100+ countries with 200+ payment methods, backed by Tether and partners like Aave/Ethena.

$XPL (total supply 10B, current price ~$0.119–$0.120 as of January 26, 2026) powers staking, delegation rewards, and gas for complex tx creating a flywheel where real usage drives value without relying on fragile layered exits.

In Peshawar and beyond, where remittances mean survival, "fast and cheap" without hidden systemic risks matters. Plasma's L1 design avoids the old mass-exit trap by keeping everything native and transparent no pyramid of child chains to hide cracks.

The deeper question isn't just "how to make it faster and cheaper," but "how to ensure small cracks don't shatter the whole structure tomorrow?" In blockchain and in finance, tech, or society more abstraction often means less visibility. We must pause and ask: If it breaks, who feels it first, and how?

What do you think has the original Plasma saga taught us enough to build safer systems today? Does modern Plasma ($XPL) avoid those pitfalls with its stablecoin focus? Share your views below!