In crypto, governance is often sold as momentum. More votes, more proposals, more knobs to turn. Communities are told that participation itself creates growth, that constant decision-making keeps a protocol alive and evolving. Plasma takes a very different view, and it’s one that can feel almost uncomfortable if you’re used to governance being treated like a feature rather than a limitation.

In crypto, governance is often sold as momentum. More votes, more proposals, more knobs to turn. Communities are told that participation itself creates growth, that constant decision-making keeps a protocol alive and evolving. Plasma takes a very different view, and it’s one that can feel almost uncomfortable if you’re used to governance being treated like a feature rather than a limitation.

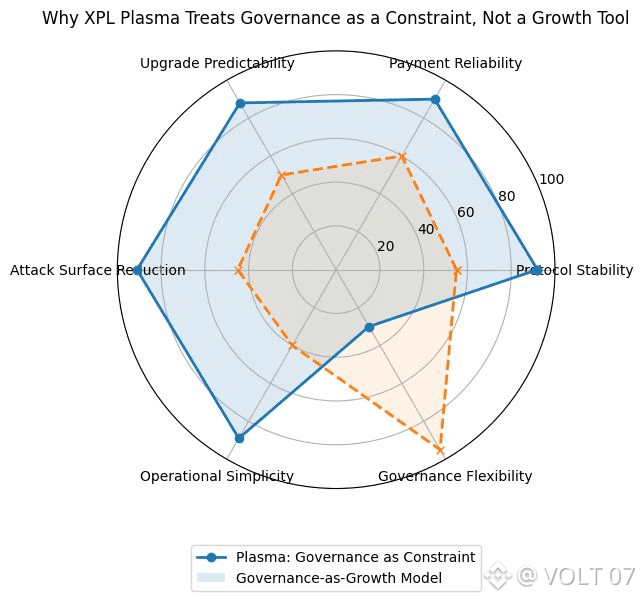

At the center of this approach is Plasma’s belief that some systems work best when they change less, not more. Plasma wasn’t built to be shaped daily by sentiment or short-term incentives. It was built around a narrow promise: move stable value quickly, predictably, and without drama. Once you commit to that promise, governance stops being a lever for expansion and starts becoming a boundary that protects the system from itself.

The problem with governance-as-growth is that it assumes more choice always leads to better outcomes. In practice, frequent governance changes introduce uncertainty. Parameters shift. Rules evolve. What worked last month may not work next month, not because the system improved, but because collective mood changed. That kind of flexibility can be healthy for experimental platforms, but it’s poison for infrastructure meant to feel boring and reliable.

Plasma’s design reflects an understanding that payment systems are trust machines. People don’t want to wonder whether fees, settlement behavior, or execution rules might change because a proposal passed. They want consistency. They want to know that the rules they learned yesterday still apply tomorrow. By treating governance as a constraint, Plasma limits how much the system can be reshaped by short-term pressure, even when that pressure comes from well-intentioned participants.

This doesn’t mean governance disappears. It means governance is scoped. Decisions exist, but they are deliberate and slow. The system resists the urge to optimize for engagement metrics or token-holder excitement. Instead of asking, “What can governance add next?” Plasma tends to ask, “What should governance never be allowed to break?” That inversion changes everything. Growth becomes a function of usage and integration, not proposal velocity.

There’s also a subtle economic reason for this restraint. Governance tokens often become speculative instruments when decision-making feels powerful. People accumulate them not because they care about the system, but because they believe influence itself will be valuable. Over time, this distorts incentives. Decisions start optimizing for token narratives rather than system integrity. Plasma avoids this trap by making governance less expressive. Influence exists, but it’s bounded. You can’t vote the network into a different personality.

What results is a system that feels less democratic on the surface, but more dependable in practice. Plasma doesn’t ask its users to constantly participate in steering it. It asks them to trust that the core constraints won’t move underneath their feet. For a payments-focused chain, that trust is more valuable than any burst of governance-driven excitement.

In a space that often equates activity with progress, Plasma’s stance can look conservative. But infrastructure isn’t supposed to feel alive in the same way social platforms do. It’s supposed to feel stable. Governance, in this context, is not a growth engine. It’s a safety rail. It defines what the system is allowed to be and just as importantly, what it is not allowed to become.

That may limit how fast narratives form around XPL, but it also limits how easily the protocol can drift away from its purpose. Plasma treats governance the way engineers treat constraints in good design: not as obstacles, but as the reason the system holds together under stress.