@Dusk Value in crypto does not travel directly from one wallet to another in isolation. Instead, it passes through exchanges, lending protocols, custody solutions, collateral frameworks, tokenized instruments, and settlement systems that must track ownership, apply rules, and arrive at balances the market can rely on. As digital assets have matured, these pathways have begun to resemble traditional financial infrastructure rather than open social platforms. Institutional trading, stablecoin circulation, large transfers, and tokenized securities all rely on systems that can move value while protecting sensitive information and still remaining auditable. Public blockchains, by design, expose everything. While this radical transparency has benefits, it clashes with the realities of regulated finance, where confidentiality, oversight, and compliance must coexist.

Dusk was created to address this gap. Launched in 2018, Dusk is a layer-1 blockchain purpose-built for privacy-aware, regulated financial use cases. Unlike general-purpose networks that later attempted to bolt on privacy or compliance features, Dusk starts from the premise that real financial activity requires discretion for participants alongside verifiable data for regulators and counterparties. Its architecture is tailored for institutional finance, compliant decentralized applications, and tokenized real-world assets, all operating within a single network where privacy and auditability are foundational rather than optional.

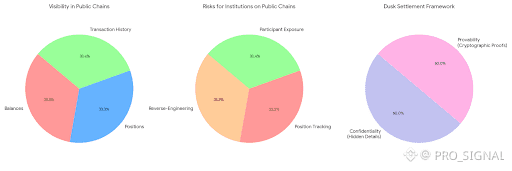

In financial markets, settlement is where transactions become final and enforceable. A trade only truly exists once it is validated, recorded, and locked into a shared system of record. On most public chains, settlement is fully visible, exposing balances, positions, and transaction histories to anyone. While this may be tolerable for small-scale retail activity, it poses serious risks for funds, issuers, and market makers. Strategies can be reverse-engineered, positions tracked, and large participants exposed. Dusk takes a different approach by treating settlement as both confidential and provable. Sensitive details can remain hidden while cryptographic proofs ensure that transactions are valid and rules have been followed.

This capability comes from Dusk’s modular design. Execution, privacy, and verification are separated into distinct layers rather than tightly coupled into a single process. Financial applications can therefore execute trades or transfers privately, while the blockchain maintains a public, verifiable record that supports auditing and compliance. For regulated DeFi and tokenized assets, this separation is critical. Asset issuers can define who may hold or trade an instrument. Regulators can access information when required. Market participants can transact without broadcasting their exposure to the entire network.

The modular structure also enables a wider range of financial products to coexist on the same chain. Not every asset has the same regulatory or privacy requirements. A tokenized bond, for instance, operates under very different constraints than a retail utility token. Dusk allows these variations without fragmenting settlement or compromising the integrity of the shared ledger. Different compliance models can operate on top of the same underlying financial rail.

From a market-structure perspective, this positions Dusk as infrastructure rather than a social ledger. Identity, value transfer, and compliance are integrated into the same system. When ownership changes or a trade settles, the network can verify that the transfer was legitimate and that the recipient meets the necessary conditions, without revealing more information than necessary. This mirrors traditional financial systems, where banks, clearinghouses, and regulators have visibility, but internal positions are not exposed to the public.

Trust in this model is anchored in two places. Cryptography ensures that private transactions are mathematically sound and resistant to manipulation. At the same time, the public blockchain provides ordering, finality, and immutability. Together, these elements create trust through proof rather than disclosure. For institutions, this balance is essential: privacy without verification is insufficient, and transparency without confidentiality is impractical at scale.

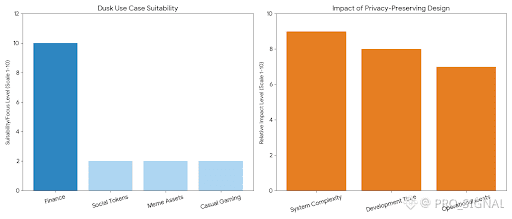

There are trade-offs. Privacy-preserving systems introduce additional complexity compared to fully transparent ledgers. They rely on advanced cryptographic techniques and more careful system design, which can slow development and increase operational costs. As a result, Dusk is not designed for every use case. Social tokens, speculative meme assets, or casual gaming applications do not require regulated privacy. Dusk’s focus on finance narrows its scope, but it also sharpens its purpose.9

Adoption is another challenge. Financial infrastructure only becomes meaningful when it is widely used. For Dusk’s model to have impact, exchanges, issuers, and developers must choose to build on it. The network can provide the rails, but real economic activity is what gives them value.

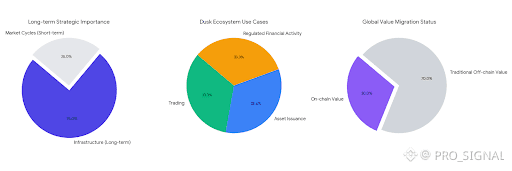

Even with these challenges, Dusk occupies an important structural role. The crypto ecosystem is moving toward tokenized securities, regulated stablecoins, on-chain investment vehicles, and compliant DeFi. All of these demand infrastructure that supports confidentiality alongside oversight. Purely transparent chains struggle to support large-scale finance, while fully opaque systems fail regulatory requirements. Dusk operates between these extremes, offering a controlled, verifiable settlement layer designed for serious financial use.

Over the long term, this type of infrastructure matters more than short-term market cycles. As increasing amounts of value move on-chain, the demand for robust financial rails will grow. Dusk is positioned as one of those rails, enabling trading, asset issuance, and regulated financial activity to take place on a blockchain without undermining the rules and safeguards that real capital depends on.